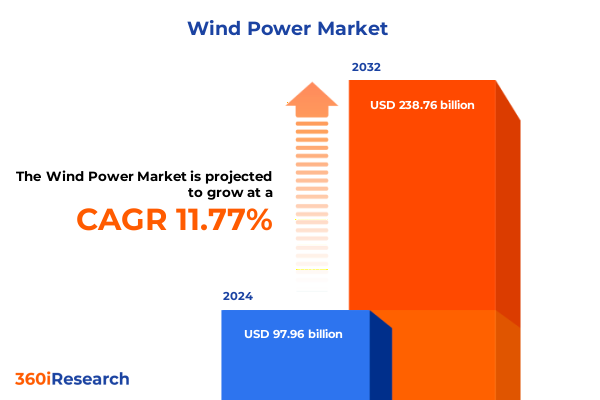

The Wind Power Market size was estimated at USD 109.75 billion in 2025 and expected to reach USD 120.58 billion in 2026, at a CAGR of 11.74% to reach USD 238.76 billion by 2032.

Harnessing the Winds of Change in 2025: Unveiling Critical Dynamics, Emerging Drivers, and Strategic Imperatives for the Wind Energy Sector

The wind power sector is navigating a defining moment shaped by converging forces of policy reform, technological advancement, and shifting market dynamics. As governments around the world set ambitious decarbonization targets, wind energy has emerged as an indispensable pillar of the global clean energy transition, driving a surge in investment and innovation.

The offshore wind segment, poised to add approximately 19 gigawatts of capacity in 2025, exemplifies this momentum, with record lease auctions in Mainland China and significant project pipelines in Europe and North America fueling a resurgence after a slowdown in late 2024. This rebound highlights the increasing strategic importance of offshore installations in balancing energy security and sustainability objectives.

Simultaneously, the industry is confronting new policy headwinds. In the United States, the imposition of tariffs on wind turbine components and the phase-out of certain subsidies have introduced cost pressures and planning uncertainties that reverberate across supply chains. These developments underscore the need for adaptive strategies to sustain growth under evolving regulatory frameworks.

Against this backdrop, the landscape of wind power continues to diversify, driven by digital transformation, repowering of aging assets, and emerging opportunities in green hydrogen production. A nuanced understanding of these dynamics is essential for stakeholders aiming to navigate risks, capture value, and accelerate the transition toward a resilient, low-carbon energy future.

Revolutionizing Wind Power: Key Technological Innovations, Market Disruptions, and Policy Shifts Redefining the Industry Ecosystem

The industry’s transformative trajectory is underscored by a series of pivotal shifts that are redefining how wind energy projects are conceived, financed, and operated. Offshore wind, in particular, is experiencing a remarkable rebound, with global additions expected to reach 19 GW in 2025 underpinned by aggressive auction schedules and robust investment, especially in China which accounts for 65% of new capacity. While established markets such as Germany await auction design reforms to overcome permitting and revenue model challenges, emerging frameworks-like Contracts for Difference-are being advocated to stabilize returns and sustain long-term growth.

Digitalization is catalyzing operational excellence and cost efficiency across onshore and offshore farms. The adoption of AI-driven platforms, exemplified by GE’s Digital Wind Farm which can boost annual energy production by up to 20%, demonstrates the value of real-time analytics and predictive maintenance in optimizing turbine performance and reducing downtime.

In parallel, asset repowering strategies are gaining traction as developers seek to maximize output from existing sites by replacing older facilities with higher-capacity turbines, supported by favorable tax credits and streamlined permitting under recent policy measures. This approach not only enhances energy yield but also mitigates land use and community impact concerns, aligning with evolving sustainability criteria.

Meanwhile, the convergence of wind power and green hydrogen production is moving from concept to pilot phase. The H2Mare project in Denmark, the first to directly link a turbine to electrolyzers on a megawatt scale, and NREL’s hybrid facility simulations highlight the potential for offshore wind-to-hydrogen systems to deliver low-cost hydrogen and support industry decarbonization goals. These innovations signal the sector’s readiness to expand applications beyond electricity generation and shape a broader renewable energy ecosystem.

Navigating the Shockwaves of 2025 Tariff Policies: Assessing the Comprehensive Impacts on the U.S. Wind Power Sector

The cumulative impact of the United States’ 2025 tariff measures has introduced significant cost pressures across the wind power value chain. Proposed tariffs of 25% on imports from Mexico and Canada and 10% on Chinese components have been estimated to raise onshore wind turbine costs by around 7% and overall project expenses by approximately 5%, reshaping procurement strategies and supplier relationships.

Beyond direct component tariffs, steel import restrictions have added an estimated $300 million in additional costs to key offshore projects, contributing to a $955 million writedown by Equinor on its Empire Wind assets in New York. These levies create a dual challenge of higher capital expenditures and elevated levelized costs of energy, potentially eroding the competitive position of wind power relative to other generation sources.

Indirect effects are equally pronounced, as domestic steel producers have leveraged tariff protections to increase prices by up to 40%, compounding input cost volatility and pressuring project budgets. Developers and manufacturers are responding by reassessing global sourcing, rerouting supply chains through alternative hubs, and accelerating US-localization efforts to mitigate exposure.

Consequently, turbine OEMs and EPC firms are reviewing assembly footprints, exploring local component production partnerships, and recalibrating pricing models to reflect the new cost base. While short-term adjustments offer some relief, ongoing policy uncertainty underscores the importance of strategic risk management and collaboration with policymakers to balance trade objectives with the imperative of clean energy deployment.

Unpacking Market Segmentation Strategies: Critical Insights Across Applications, Turbine Types, Sizes, and Component Categories

An in-depth examination of market segmentation reveals distinct performance drivers and considerations across multiple dimensions. In terms of application, the commercial and industrial segment is characterized by corporate sustainability mandates and power purchase agreements, while residential adoption-through grid-tied and standalone systems-advances as distributed energy resources gain favor for resilience and energy independence. Utility-scale projects, spanning new installations and repowering initiatives, remain the cornerstone of large-capacity deployments, propelled by favorable economics and grid integration policies.

The turbine type segmentation underscores divergent growth trajectories. Onshore wind continues to benefit from mature supply chains and lower installation costs, with repowering and community-scale projects expanding its reach. Conversely, offshore installations, advantaged by higher wind speeds and space availability, command increasing attention for their role in deep decarbonization, despite higher capital intensity and logistical complexity.

Capacity tiers further delineate the market. Turbines under 1.5 MW serve niche applications and remote sites, between 1.5–3 MW span the bulk of global installations, and units above 3 MW target utility-scale farms seeking maximum output per installation. Each size category entails unique considerations in transportation, foundation design, and grid interconnection.

Finally, component segmentation highlights blades, gearboxes, nacelles, towers, and full turbine systems as critical areas of innovation and supply chain focus. Blade manufacturing and drivetrain production have emerged as potential bottlenecks, prompting investments in local fabrication and modular design, while tower and nacelle assembly continue to benefit from economies of scale in established industrial regions.

This comprehensive research report categorizes the Wind Power market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Turbine Type

- Turbine Size

- Component

- Application

Regional Wind Power Perspectives: In-Depth Analysis of Growth Drivers, Barriers, and Opportunities Across Americas, EMEA, and Asia-Pacific

Regional dynamics play a defining role in shaping wind power trajectories across the globe. In the Americas, the United States leads with a robust onshore pipeline, driven by state renewable mandates and corporate procurement programs, even as tariff and subsidy headwinds necessitate agile supply chain strategies. Canada is enhancing grid connectivity to leverage its vast wind resource, while Latin American markets such as Chile and Brazil are scaling projects to support their clean energy ambitions and reduce reliance on fossil fuels.

The Europe, Middle East & Africa region exhibits a patchwork of maturity levels. Western Europe’s established markets balance capacity expansion with innovations in revenue stabilization-through mechanisms like Contracts for Difference-and repowering. Germany’s offshore rollout, currently stalled at 9.2 GW, underscores the need for auction reform and infrastructure investment to meet 2030 targets. Emerging markets in Eastern Europe and North Africa are accessing international capital to develop foundational onshore projects, while the Middle East explores competitive wind hubs enabled by low-carbon hydrogen synergies.

In Asia-Pacific, China remains the dominant manufacturing and installation powerhouse, commanding around 60% of global wind turbine capacity through substantial state support and scale efficiencies. India’s market is poised for rapid growth under national renewable targets, and Japan is forging public-private collaborations to build a domestic offshore supply chain. Australia is advancing hybrid wind and storage projects, leveraging its resource potential and grid modernization efforts.

This comprehensive research report examines key regions that drive the evolution of the Wind Power market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves and Competitive Strategies: How Leading Wind Power Players Are Shaping the Industry Through Innovation and Partnerships

The competitive landscape is defined by the strategic maneuvers of industry leaders who are redefining market boundaries. Vestas has intensified its focus on long-term service agreements, exemplified by a 25-year LTSA accompanying its 74 MW Finland projects, securing predictable, high-margin streams and reinforcing its EnVentus platform’s adaptability across wind regimes.

GE Vernova, fresh from a spin-off, has surprised investors with a lower-than-anticipated tariff impact on its wind business and has achieved record highs in stock performance. Its Digital Wind Farm initiative and involvement in the Trump-backed Stargate AI infrastructure program underscore its commitment to merging industrial hardware with advanced analytics to drive efficiency gains and portfolio resilience.

Siemens Gamesa is executing a critical turnaround, negotiating with rare earth magnet suppliers to establish European production for greater supply chain control and reducing overhead by €400 million through 2026. The strategic sale of 90% of its India and Sri Lanka business to a TPG-led consortium marks a refocus on core markets and a pathway to break-even by 2026.

Goldwind, China’s dominant OEM, has surpassed 140 GW of global installed capacity, leveraging economies of scale and a diversified product portfolio. Its recent 165 MW Pemuco project in Chile and strong Five-Year Plan demand outlook illustrate its success in both mature and emerging markets, supported by platformization and supply chain optimization to preserve margins under competitive pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wind Power market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Avantis Energy Group

- Bergey Windpower Co.

- Clipper Windpower, LLC

- Doosan Enerbility Co., Ltd.

- Enercon GmbH

- ENERCON GmbH

- Envision Energy Co., Ltd.

- General Electric Company

- Goldwind Science & Technology Co., Ltd.

- Hitachi, Ltd.

- Mingyang Smart Energy Group Co., Ltd.

- Nordex SE

- Northern Power Systems, Inc.

- ReGen Powertech Pvt. Ltd.

- Senvion S.A.

- Siemens Energy AG

- Sinovel Wind Group Co., Ltd.

- Suzlon Energy Limited

- Windey Energy Technology Group Co., Ltd.

Strategic Imperatives for Wind Energy Leaders: Actionable Recommendations to Build Resilience, Drive Growth, and Navigate Challenges

To navigate the complex and evolving wind power landscape, industry leaders should prioritize several strategic imperatives. First, supply chain resilience must be enhanced through near-shoring and diversification agreements to mitigate tariff and geopolitical risks. Building localized fabrication for blades, gearboxes, and nacelles can provide cost certainty and shorten lead times.

Second, investment in digital transformation-spanning AI-enabled predictive maintenance, real-time performance analytics, and digital twin simulations-will be essential to optimize asset productivity, lower operational costs, and extend equipment lifecycles. Partnerships with technology providers and participation in AI initiatives can accelerate these capabilities.

Third, stakeholders should leverage repowering opportunities to maximize output from aging onshore sites, combining higher-capacity turbines with hybrid storage solutions to stabilize generation profiles and unlock new revenue streams through ancillary services.

Fourth, engagement in emerging integrated value chains, such as wind-to-hydrogen and offshore hybrid platforms, will position companies at the forefront of decarbonization pathways and unlock novel market segments.

Finally, active policy engagement is critical to shape balanced trade frameworks and stable incentive structures, ensuring that clean energy objectives remain aligned with economic competitiveness and energy security goals.

Rigorous Research Methodology: Comprehensive Framework and Approach Underpinning Wind Power Industry Analysis and Insights

This analysis integrates a rigorous research methodology combining primary and secondary data sources. Primary research included in-depth interviews with industry executives, policy makers, and technology experts to capture real-time insights into market strategies and operational challenges. Secondary research comprised a review of regulatory filings, financial disclosures, and authoritative publications from organizations such as the International Energy Agency, National Renewable Energy Laboratory, and major news agencies.

Data triangulation techniques were employed to validate findings, correlating quantitative import and installation statistics with qualitative stakeholder perspectives. The segmentation framework was constructed based on established industry taxonomies, ensuring comprehensive coverage across applications, turbine typologies, and regional markets.

The research process was further enhanced by scenario analyses to assess the sensitivities of policy and technology variables under different market conditions, providing robust strategic guidance. All sources have been critically evaluated for credibility and relevance, ensuring that conclusions reflect the latest trends and data in the wind power sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wind Power market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wind Power Market, by Turbine Type

- Wind Power Market, by Turbine Size

- Wind Power Market, by Component

- Wind Power Market, by Application

- Wind Power Market, by Region

- Wind Power Market, by Group

- Wind Power Market, by Country

- United States Wind Power Market

- China Wind Power Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Sailing Toward a Sustainable Future: Synthesizing Core Findings and Implications for the Wind Power Industry’s Next Chapter

The evolving wind power industry is characterized by dynamic interplay between technological innovation, policy direction, and market forces. As offshore installations surge and onshore repowering revitalizes mature assets, the sector stands at the threshold of unprecedented growth opportunities, complemented by digitalization efforts that enhance operational efficiency.

Yet, challenges such as trade policy uncertainty, component cost inflation, and supply chain disruptions underscore the necessity of strategic resilience. Companies that proactively invest in localized manufacturing, data-driven optimization, and diversified business models will be best positioned to sustain momentum.

Regional diversity in market maturity and regulatory environments demands tailored strategies that leverage local strengths while aligning with global sustainability imperatives. Collaborative approaches-spanning public-private partnerships, cross-sector integration with hydrogen, and value-chain alliances-will accelerate the transition toward a resilient, low-carbon energy system.

Ultimately, the capacity to adapt to policy shifts, harness emerging technologies, and cultivate agile operational models will determine which stakeholders lead the industry’s next transformative chapter.

Engage with Expert Insights: Connect with Ketan Rohom to Unlock Premium Wind Power Market Research Tailored for Strategic Decision-Making

Unlock unparalleled strategic insights and drive your decision-making by securing access to the full wind power market research report. To explore detailed analyses, exclusive data, and expert recommendations tailored to your business objectives, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engage with a dedicated consultation to understand how this authoritative research can guide your investment, operational, and policy strategies in the rapidly evolving wind energy sector, and take a decisive step toward achieving your organizational goals with clarity and confidence.

- How big is the Wind Power Market?

- What is the Wind Power Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?