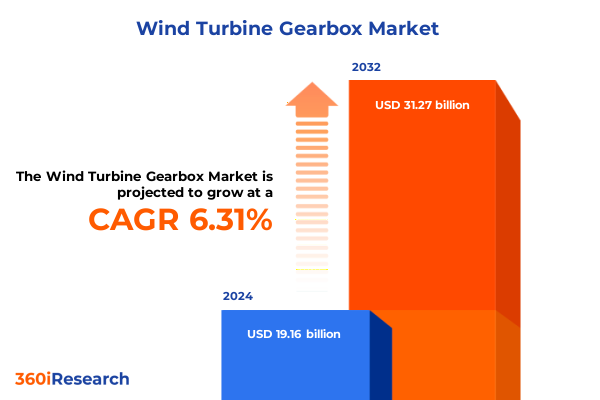

The Wind Turbine Gearbox Market size was estimated at USD 20.39 billion in 2025 and expected to reach USD 21.57 billion in 2026, at a CAGR of 6.30% to reach USD 31.27 billion by 2032.

Unlocking Efficiency and Durability: How Gearbox Advancements are Powering the Next Wave of Wind Energy Growth and Operational Excellence

The global transition toward renewable energy underscores the critical role of wind power in reshaping energy portfolios worldwide. In 2023, the United States added 6,474 megawatts of new land-based wind capacity, bringing cumulative installations to nearly 150,500 megawatts and powering roughly 45 million homes. This growth, driven by policy support and falling costs, intensifies demand for reliable gearbox solutions that enable consistent turbine performance even under fluctuating wind conditions.

As wind turbines scale to harness greater energy yields, the mechanical and design requirements of gearboxes evolve in tandem. Modern turbines now feature larger rotors and taller towers, necessitating drive trains capable of handling higher torque and variable load cycles. These developments underscore the gearbox’s status not merely as a mechanical component but as a strategic asset that influences operational availability, maintenance cycles, and overall project viability.

Navigating Transformative Shifts: Digitalization, Materials Innovation, and Policy Drivers Reshaping Gearbox Dynamics in Wind Power

Over the past five years, the wind turbine gearbox landscape has been transformed by converging forces of policy incentives, digitalization, and advancements in supply chain localization. The U.S. Inflation Reduction Act has catalyzed at least 15 expansions of domestic component factories, including gear housings and bearing assemblies, enabling tier-one suppliers to reduce lead times and mitigate geopolitical risks. This surge in local capacity highlights a strategic pivot toward secure, traceable supply chains that can respond nimbly to evolving project demands.

Concurrently, the integration of condition monitoring systems and digital twins is unlocking new performance frontiers for gearbox operators. By embedding vibration and temperature sensors at critical bearing points, manufacturers can now simulate gearbox behavior under variable wind regimes and detect early signs of component fatigue. This real-time visibility empowers predictive maintenance strategies, lowers unplanned downtime, and extends service intervals, marking a decisive shift from reactive repairs to data-driven asset optimization.

Assessing the Cumulative Impact of New United States 2025 Tariffs on Wind Turbine Drive Trains and Project Economics

In 2025, the United States implemented a 25% tariff on wind turbine components from Mexico and Canada alongside a 10% levy on Chinese imports. According to Wood Mackenzie, these measures could raise turbine drive train costs by up to 7% and overall project expenses by 5%, with a near-term 4% increase in levelized cost of energy. The higher component costs threaten the economic viability of marginal projects, particularly in regions where wind speeds yield lower capacity factors.

Leading manufacturers are deploying mitigation strategies to offset these burdens. Brazilian motor producer WEG plans to reroute exports through Mexico and India, enabling U.S. supply via third-country manufacturing hubs and preserving competitive pricing structures. Despite such adjustments, the steel tariffs alone contributed an estimated $300 million in cost overruns for Equinor’s Empire Wind impairment, illustrating the substantial financial strain placed on offshore wind initiatives.

Unraveling Market Segmentation Insights: From Gearbox Stages to Power Ratings, Applications, and End User Strategies in Wind Energy

The gearbox market’s evolution is best understood through multiple segmentation lenses that reveal distinct demand drivers and performance requirements. Gear stage configurations range from streamlined single-stage designs, ideal for direct-drive concepts, to robust three-stage systems that manage high torque demands in megawatt-class turbines; two-stage arrangements offer a balanced compromise between size, efficiency, and cost. These technical variations influence procurement strategies across project portfolios.

Applications bifurcate into onshore platforms, where ruggedized gearboxes must contend with land-based vibration patterns and grid integration constraints, and offshore installations, which demand marine-grade corrosion resistance and extended service intervals. Power rating categories further refine manufacturer offerings, with units specified for up to 500 kilowatts serving distributed and small-scale applications; 500 kilowatt to 1 megawatt systems dominating community and commercial arrays; 1 to 2 megawatt solutions forming the backbone of utility-scale projects; and above 2 megawatt configurations pushing the envelope of high-yield offshore development.

The sales channel dynamic separates original equipment manufacturers-focused on new turbine builds-from the aftermarket segment, where component refurbishment and upgrades drive recurring revenue streams. Material choices, spanning steel alloys for core gearing elements to emerging composite housings aimed at vibration damping and weight reduction, further differentiate supplier portfolios. Finally, end users split between independent power producers, who prioritize total cost of ownership and swift deployment, and utilities, which emphasize lifecycle performance, reliability, and integration with broader energy management systems.

This comprehensive research report categorizes the Wind Turbine Gearbox market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- Power Rating

- Sales Channel

- Material

- End User

Comparative Regional Insights: Americas vs Europe Middle East and Africa vs Asia Pacific Gearbox Market Trends and Growth Catalysts in Wind Energy

In the Americas, abundant land-based resources and supportive federal incentives have spurred both onshore and nascent offshore wind projects. The U.S. pipeline includes nearly 80 gigawatts of offshore capacity in development, a 53% year-on-year increase, complementing robust onshore additions that broaden demand for advanced gearbox solutions.

Europe, Middle East and Africa face a complex regulatory tapestry: Europe alone added 15 gigawatts of new wind capacity in 2024-13 gigawatts offshore and 2 gigawatts onshore-but still falls short of the 30 gigawatt annual target needed to meet its 2030 climate objectives. Wind’s share of electricity in the EU reached 20%, highlighting growth potential amid permitting and grid-connection bottlenecks.

Asia-Pacific is emerging as the fastest-growing market, with China, India, Japan and Australia leading policy-driven deployment. According to the Global Wind Energy Council, the region’s share of global installations is set to rise from about 25% in 2020 to 42% by 2025. This expansion underscores escalating investments in both onshore and offshore sites, while government targets for renewable energy shares exceed 35% in many markets, reinforcing gearbox demand across all power ratings.

This comprehensive research report examines key regions that drive the evolution of the Wind Turbine Gearbox market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Manufacturers: Strategic Movements, Innovations, and Competitive Dynamics Among Top Wind Turbine Gearbox Suppliers

A handful of global OEMs and specialized suppliers shape the wind turbine gearbox landscape. Winergy, headquartered in Germany, leads with both planetary and helical gearbox designs and a growing footprint in service and repair operations across North America and Europe. ZF Wind Power, operating from Belgium, differentiates through modular platforms that streamline maintenance and enable rapid spare-parts deployment. Moventas, part of Clyde Blowers Capital, boasts a legacy dating to the 1980s and supports over 13,000 installed units worldwide, backed by dedicated service centers in key markets.

Traditional turbine OEMs including General Electric Renewable Energy and Siemens Gamesa Renewable Energy continue to integrate in-house gearbox production with wider nacelle assembly capabilities. Under the Biden-era incentives, GE Vernova and Siemens Gamesa have announced expansions of domestic driveshaft and bearing facilities, aiming to localize 50% of component sourcing by 2027 and ensure compliance with advanced manufacturing credits. This strategic activity is reshaping competitive positioning and accelerating product innovation in gear design, diagnostics and circular refurbishment programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wind Turbine Gearbox market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- China High Speed Transmission Equipment Group Co., Ltd.

- Dana Brevini S.p.A.

- David Brown Santasalo

- Elecon Engineering Company Limited

- Flender GmbH

- ISHIBASHI Manufacturing Co., Ltd.

- Liebherr-Components AG

- ME Production A/S

- Moventas Oy

- Nanjing High Speed Gear Manufacturing Co., Ltd.

- Romax Technology Ltd.

- Siemens Gamesa Renewable Energy, S.A.

- SKF AB

- Stork Gears & Services B.V.

- Suzlon Energy Limited

- The Timken Company

- Turbine Repair Solutions Ltd

- Voith GmbH & Co. KGaA

- Winergy GmbH

- ZF Friedrichshafen AG

Actionable Recommendations for Industry Leaders: Strategies to Optimize Gearbox Supply Chains, Localize Production, and Enhance Lifecycle Performance

To navigate tariff pressures and supply chain volatility, industry leaders should diversify sourcing by establishing alternate manufacturing hubs in Mexico, India and Southeast Asia, mirroring successful models employed by major motor producers. This approach mitigates exposure to single-market levies and accelerates time to market while capturing regional incentives.

Investing in advanced condition monitoring and digital twin frameworks can unlock predictive maintenance regimes that reduce unplanned downtime by up to 30%, extend service intervals and lower lifecycle costs. Aligning these tools with data analytics platforms enhances reliability forecasts and informs design refinements for next-generation gearboxes.

Leaders should also strengthen aftermarket service offerings through performance-based contracts and remanufacturing initiatives that reclaim core components. This circular strategy supports sustainability goals, reduces raw material use and generates high-margin, recurring revenue streams. Cultivating partnerships with independent power producers and utilities to co-develop customized gearbox solutions will further solidify market positions in an increasingly competitive landscape.

Comprehensive Research Methodology: Integrating Primary Interviews, Secondary Data, and Quantitative Analysis to Illuminate the Gearbox Market's Evolution

This analysis integrates a multi-faceted research methodology that combines primary interviews with senior executives at leading gearbox manufacturers, independent power producers and regulatory agencies alongside comprehensive secondary research. Published insights from government sources, including the U.S. Department of Energy’s Land-Based Wind Market Report, and industry intelligence from Wood Mackenzie and global clean energy councils were triangulated to ensure accuracy and depth.

Quantitative modeling of tariff scenarios, segmentation matrices and regional deployment projections was conducted through structured data frameworks and scenario analysis. Key findings were validated via expert panels comprising technical directors, supply chain strategists and service-model innovators to refine strategic recommendations and highlight emerging risks and opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wind Turbine Gearbox market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wind Turbine Gearbox Market, by Type

- Wind Turbine Gearbox Market, by Application

- Wind Turbine Gearbox Market, by Power Rating

- Wind Turbine Gearbox Market, by Sales Channel

- Wind Turbine Gearbox Market, by Material

- Wind Turbine Gearbox Market, by End User

- Wind Turbine Gearbox Market, by Region

- Wind Turbine Gearbox Market, by Group

- Wind Turbine Gearbox Market, by Country

- United States Wind Turbine Gearbox Market

- China Wind Turbine Gearbox Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Conclusion: Synthesizing Key Insights on Technological Advances, Tariff Impacts, and Regional Dynamics to Inform Strategic Decision-Making in the Wind Gearbox Sector

The wind turbine gearbox sector stands at a pivotal juncture as technological innovations, policy frameworks and market segmentation converge to redefine competitive dynamics. Digitalization and localized manufacturing offer pathways to buffer tariff-induced cost pressures and sustain project viability. Regional deployment patterns reveal growth potential across all major markets, while segmentation insights underscore the necessity for tailored gearbox configurations that optimize performance by stage count, power rating and application context.

By embracing predictive maintenance, circular service models and strategic supply chain diversification, industry participants can enhance resilience against geopolitical shifts and secure value across the asset lifecycle. The strategic interplay between OEMs, aftermarket specialists and end users will shape the next wave of gearbox advancements, paving the way for reliable, efficient and sustainable wind power generation worldwide.

Connect with Ketan Rohom to Access Strategic Wind Turbine Gearbox Market Intelligence and Secure Your Competitive Advantage Today

To explore the comprehensive insights presented in this report and discover how these findings can power your strategic initiatives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in energy sector dynamics and can guide you through tailored solutions to address your organization’s challenges and goals. Connect with him today to secure your copy of the Wind Turbine Gearbox Market Intelligence and gain a decisive competitive edge in an evolving renewable power landscape

- How big is the Wind Turbine Gearbox Market?

- What is the Wind Turbine Gearbox Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?