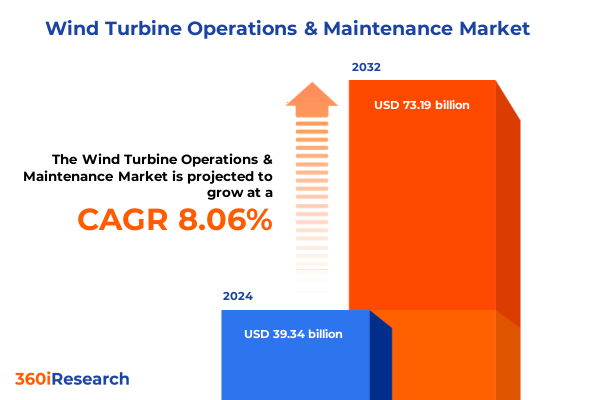

The Wind Turbine Operations & Maintenance Market size was estimated at USD 41.77 billion in 2025 and expected to reach USD 44.35 billion in 2026, at a CAGR of 8.34% to reach USD 73.19 billion by 2032.

Harnessing Operational Excellence in Wind Farm Maintenance to Drive Reliability Performance and Support Sustainable Energy Goals

Wind turbine operations and maintenance stand at the forefront of ensuring reliable, cost-effective, and sustainable energy production in an era marked by ambitious decarbonization and digital transformation goals. As onshore and offshore installations age and mature, the imperative to maximize uptime while controlling lifecycle expenses has intensified. Operators must balance routine preventive and corrective interventions with emerging condition-based and performance-based strategies driven by advanced analytics. The convergence of regulatory pressures, technological innovation, and evolving service models has elevated maintenance from an afterthought to a strategic differentiator.

In parallel, a dynamic supply chain landscape, shaped by tariff policies and localization initiatives, has introduced new complexities in component sourcing and logistical planning. Coupled with workforce challenges and the imperative to uphold rigorous safety and environmental standards, wind farm operators face an intricate matrix of operational variables. This executive summary distills critical developments, segmentation insights, regional nuances, and competitive intelligence to equip decision-makers with a holistic understanding of the current wind turbine O&M environment and the strategic imperatives required to navigate its evolving contours.

Navigating Unprecedented Technological and Regulatory Paradigm Shifts Redefining Operational Strategies and Value Creation in Wind Maintenance

The wind turbine operations and maintenance landscape has undergone transformative shifts, propelled by technological breakthroughs and evolving service paradigms. Predictive maintenance powered by real-time sensor networks and machine learning algorithms has supplanted traditional time-based schedules, enabling operators to identify anomalies early and reduce unplanned downtime. Remote inspection via autonomous drones and robotic crawlers now extends reach to blade surfaces and offshore structures, further diminishing manual risk and accelerating service cycles.

Simultaneously, the proliferation of performance-based contracts, tied to availability guarantees, has redefined incentives for service providers and asset owners alike. Rather than transactional, ad hoc engagements, maintenance agreements increasingly align financial outcomes with turbine reliability, fostering integrated partnerships between operators, OEMs, and independent specialists. This shift has catalyzed a blurring of traditional ownership boundaries and spawned hybrid service models that leverage both in-house expertise and specialized third parties.

Furthermore, regulatory and policy landscapes have steered strategic priorities toward greater localization of service activities, driven by incentives for domestic content and supply chain resilience. Investment tax credits, incentives for repowering aging sites, and sustainability mandates have all contributed to heightened O&M complexity. As a result, companies are forging alliances, pursuing digital twin implementations, and expanding remote-monitoring centers. These developments collectively underpin a new paradigm in which agility, data-driven decision-making, and collaborative ecosystems define the competitive frontier.

Assessing the Aggregate Consequences of 2025 US Tariff Policies on Wind Turbine Operational Expenses, Supply Chain Resilience, and Project Viability

The cumulative impact of the United States’ 2025 tariff policies has introduced notable cost pressures across onshore and offshore wind operations. Analysis from leading energy consultancies indicates that proposed duties-25 percent on imports from Mexico and Canada and 10 percent on Chinese-sourced components-could elevate onshore turbine module costs by as much as 7 percent, with total project expenses potentially climbing 5 percent under current supply chain configurations. These changes translate to a 4 percent near-term increase in levelized cost of energy, with universal application of a 25 percent tariff pushing that figure to around 7 percent.

Offshore projects have similarly felt the burden of heightened import levies. Major developers report tariff-related charges accruing across steel, electrical systems, and specialized hardware. One prominent utility disclosed an estimated $4 million in incurred costs through the second quarter, with a projection of $500 million in additional expenses should tariffs persist through project completion in late 2026. Moreover, large-scale impiainments recorded by international operators underscore the strategic risk posed by abrupt policy shifts. In one case, steel tariffs alone were attributed to approximately $300 million in escalated project costs, contributing decisively to a $955 million writedown on U.S. offshore wind assets.

The ramifications extend beyond direct component pricing. Supply chain actors are rerouting manufacturing footprints, revising inventory strategies, and reassessing service agreements to mitigate tariff drag. Some turbine OEMs anticipate the tariff burden will fall at the lower end of previous estimates (near $300 million), reflecting adaptive sourcing and partial tariff exemptions for domestically assembled components. Nevertheless, the interplay of fluctuating duties, evolving exemptions, and enforcement uncertainties has compelled stakeholders to elevate tariff scenario planning as an integral element of maintenance budgeting and strategic decision-making.

Unveiling Segmentation-Driven Patterns in Contractual Structures, Turbine Configurations, Ownership Frameworks, Maintenance Approaches, Service Providers, and Component Management

Segment-driven analysis reveals distinct operational imperatives across contractual, technological, and service dimensions. Full-service agreements enforce comprehensive coverage spanning preventive inspections through corrective overhauls, whereas maintenance-only engagements concentrate expertise on sustaining baseline performance. Technical support arrangements, in turn, have emerged as a modular alternative, offering targeted diagnostic and advisory functions to augment in-house capabilities. Offshore turbines-whether fixed-bottom or floating-demand specialized logistics, corrosion-resistant materials, and rigorous marine maintenance protocols, creating a differentiated service environment compared to onshore installations.

Ownership models vary from fully in-house management-where asset managers and owner-operators retain direct operational oversight-to OEM-provided frameworks that leverage manufacturer warranties and remote analytics platforms. Meanwhile, third-party structures bifurcate into hybrid providers, blending OEM expertise with independent service networks, and fully independent specialists focused on cost-competitive maintenance offerings. Maintenance modalities themselves range from condition-based regimes-incorporating both manual inspections and sensor-driven diagnostics-to performance-based contracts tied to availability guarantees and uptime metrics. Time-based scheduling persists as a legacy approach, yet it now faces displacement by more dynamic, data-centric methodologies that optimize intervention timing based on real-world turbine health metrics.

Service provider typologies encompass OEM divisions with inherent brand alignment, hybrid operators combining OEM and independent strengths, and pure-play third parties emphasizing flexible, market-driven pricing. Maintenance service categories-from condition monitoring through drone inspections, SCADA analytics, oil analysis, thermography, ultrasonic testing, vibration assessments, and hands-on repairs-have evolved into specialized verticals requiring both granular expertise and integrated digital platforms. Component-focused segments attest to the criticality of blade inspections, gearbox overhauls, generator rewinds, and tower integrity assessments, each with its own risk profile and service cadence. Inspection methodologies themselves span autonomous drones and UAVs, manual climbing routines, robotic crawlers, and sensor arrays such as acoustic, temperature, and vibration devices, reflecting the layered approach needed to safeguard turbine health across diverse geographies and operating conditions.

This comprehensive research report categorizes the Wind Turbine Operations & Maintenance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Contract Type

- Turbine Type

- Ownership Model

- Maintenance Model

- Service Provider Type

- Component Type

- Inspection Method

- Application

Regional Disparities and Emerging Trends in Wind Turbine Maintenance Demand Across the Americas, EMEA, and Asia-Pacific Power Markets

Regional dynamics underscore the differential maturation and policy drivers influencing wind turbine maintenance demand. In the Americas, robust repowering incentives and decarbonization mandates have fueled the transition of aging onshore assets to advanced O&M regimes. U.S. market participants grapple with tariff-related supply chain shifts, leading to increased domestic tower and blade manufacturing, while Latin American operators contend with infrastructure bottlenecks and emerging grid stability concerns, often adopting condition-based models to extend asset life and defer capital expenditure.

In Europe, the Middle East & Africa, established offshore corridors in the North Sea have catalyzed a cluster of specialized maintenance hubs, integrating state-of-the-art robotic inspections and fabric maintenance yards. Regional wind players navigate complex regulatory frameworks that vary from feed-in tariffs to auctions, prompting flexible service structures that can accommodate varying risk tolerances. Meanwhile, emerging O&M markets in North Africa and the Gulf Cooperation Council blend rapid project expansions with nascent service ecosystems, spurring partnerships between European OEMs and local independent providers to localize technical capabilities.

Across Asia-Pacific, diverse market maturity profiles dictate O&M strategies ranging from intensive preventive maintenance in mature Australian installations to growth-focused, lightweight service models in Southeast Asia. China’s integrated supply chain has enabled OEM-backed service centers to proliferate, yet operators are increasingly piloting performance-based contracts to meet ambitious national renewable targets. Japan and South Korea emphasize digital twin applications and predictive analytics to combat typhoon-related risks and extend turbine lifecycles, leveraging advanced SCADA and remote monitoring platforms to optimize maintenance windows within tight weather constraints.

This comprehensive research report examines key regions that drive the evolution of the Wind Turbine Operations & Maintenance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Service Providers Shaping the Future of Wind Farm Operations and Maintenance Ecosystem Dynamics

Key stakeholders across the wind O&M ecosystem showcase a spectrum of strategic approaches, from full-service integration to niche specialization. Leading OEMs have expanded beyond manufacturing into global service networks, deploying centralized monitoring centers and proprietary analytics suites that deliver performance insights and predictive alerts. Independent service providers have carved out market share by offering competitive pricing, rapid response times, and tailored troubleshooting services, often in collaboration with hybrid partners to access OEM-certified parts and platforms.

Utility-scale operators with in-house asset management teams are increasingly forming alliances with third-party experts to bridge capability gaps and share risk through performance guarantees. Major energy companies and infrastructure funds have entered the service space via acquisitions, seeking to control maintenance spend and secure long-term uptime. Specialized component experts-focused on gearbox overhauls, blade repair and retrofits, and generator rewinds-remain indispensable for addressing critical failure modes, while diagnostic specialists concentrate on vibration analysis, thermography, and oil sampling to extend maintenance intervals and optimize capital deployment.

Across this competitive battleground, collaboration has emerged as a differentiator. Joint ventures, technical alliances, and regional hubs enable stakeholders to harness diverse strengths-from deep OEM design knowledge to agile independent execution-to deliver holistic O&M offerings. As digital transformation accelerates, partnerships centered on data sharing, AI-driven decision support, and remote assistance become ever more critical to differentiate service portfolios and secure long-term client relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wind Turbine Operations & Maintenance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acciona, S.A.

- Deutsche Windtechnik AG

- Enercon GmbH

- General Electric Company

- Mitsubishi Heavy Industries, Ltd.

- Nordex SE

- Orsted A/S

- Siemens Gamesa Renewable Energy, S.A.

- Statkraft AS

- Vestas Wind Systems A/S

- Xinjiang Goldwind Science & Technology Co., Ltd

Strategic Imperatives and Action-Oriented Measures to Optimize Asset Performance and Mitigate Risks in a Complex Wind Energy Maintenance Environment

Industry leaders must prioritize the integration of advanced analytics and digital twin technologies to transition from reactive and preventive frameworks to fully autonomous, condition-based maintenance regimes. By leveraging machine learning algorithms on high-fidelity SCADA data, operators can uncover latent failure patterns, optimize intervention timing, and reduce unplanned downtime. Investing in remote inspection fleets-comprising autonomous drones, robotic crawlers, and sensor-embedded test rigs-can further enhance safety, accelerate diagnostics, and lower logistical overheads, particularly for offshore deployments.

To mitigate the impact of tariff volatility and supply chain disruptions, organizations should cultivate diversified sourcing strategies that blend domestic localization with nearshore assembly partnerships. Proactive scenario planning for duty changes, coupled with long-term supplier agreements, can stabilize component availability and cost structures. Additionally, embracing performance-based contract models, aligned to availability and output guarantees, will incentivize service providers and internal teams to collectively pursue reliability improvements and cost reductions, ensuring alignment of financial outcomes with operational objectives.

Finally, forging strategic alliances between OEMs, independent service firms, and technology providers can yield integrated solutions that combine deep component expertise with scalable analytics platforms. Such partnerships should emphasize knowledge transfer through joint training programs, shared digital infrastructure, and cross-functional innovation hubs. By fostering a collaborative ecosystem, stakeholders can pool resources, accelerate the adoption of best practices, and drive continuous improvement across the wind turbine lifecycle.

Comprehensive Research Framework Integrating Primary Interviews, Secondary Data Sources, and Analytical Techniques for Robust Wind O&M Market Insights

This research leverages a comprehensive methodology integrating primary and secondary data sources to ensure robust, actionable insights. Primary research entailed in-depth interviews with senior operations managers, maintenance engineers, and service executives across leading utilities, OEMs, and independent service providers. These interviews facilitated a nuanced understanding of emerging challenges, technology adoption barriers, and evolving contractual frameworks impacting wind turbine maintenance.

Secondary research encompassed an extensive review of regulatory filings, technical whitepapers, industry association reports, and academic studies. Data on tariff policies, regional project portfolios, and technological deployments were synthesized from reliable public sources, including government agencies, industry consortiums, and peer-reviewed journals. Market segmentation analysis drew on publicly disclosed contract structures, ownership arrangements, and maintenance modalities to map the competitive landscape and uncover key growth vectors.

Analytical techniques incorporated both qualitative thematic analysis and quantitative scenario modeling. Condition-based maintenance adoption rates and performance-based contract prevalence were estimated through triangulation of interview insights and published case studies. Regional demand projections and segmentation overlays were validated via expert panels, ensuring that strategic recommendations reflect practical feasibility, risk considerations, and technology readiness levels across diverse operating environments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wind Turbine Operations & Maintenance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wind Turbine Operations & Maintenance Market, by Contract Type

- Wind Turbine Operations & Maintenance Market, by Turbine Type

- Wind Turbine Operations & Maintenance Market, by Ownership Model

- Wind Turbine Operations & Maintenance Market, by Maintenance Model

- Wind Turbine Operations & Maintenance Market, by Service Provider Type

- Wind Turbine Operations & Maintenance Market, by Component Type

- Wind Turbine Operations & Maintenance Market, by Inspection Method

- Wind Turbine Operations & Maintenance Market, by Application

- Wind Turbine Operations & Maintenance Market, by Region

- Wind Turbine Operations & Maintenance Market, by Group

- Wind Turbine Operations & Maintenance Market, by Country

- United States Wind Turbine Operations & Maintenance Market

- China Wind Turbine Operations & Maintenance Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3498 ]

Consolidating Insightful Conclusions to Illuminate Key Drivers and Future Trajectories of Wind Turbine Maintenance and Operational Excellence Strategies

In conclusion, the wind turbine operations and maintenance sector is at an inflection point where technological innovation, policy shifts, and evolving service structures converge to reshape long-term operational strategies. Predictive analytics and sensor-driven maintenance have transcended pilot phases, demonstrating measurable improvements in reliability and cost efficiency. At the same time, tariff-induced supply chain realignments and regional policy imperatives have introduced new complexities that demand agile sourcing and contract management approaches.

Segmentation analysis highlights the need for tailored service models that address diverse ownership arrangements, turbine types, and maintenance philosophies, while regional insights underscore the importance of localizing capabilities and adapting to jurisdictional regulatory frameworks. Collaborative ecosystems-spanning OEMs, independent specialists, and technology providers-emerge as the cornerstone for scaling advanced maintenance solutions and mitigating risk across asset lifecycles. Ultimately, operators that embrace data-driven decision-making, strategic partnerships, and proactive tariff mitigation strategies will secure a sustainable competitive advantage in a rapidly evolving wind energy landscape.

Engage with Associate Director of Sales and Marketing to Unlock In-Depth Wind Turbine Operations and Maintenance Market Intelligence and Empower Decisions

We invite industry leaders and decision-makers seeking comprehensive, actionable insights on wind turbine operations and maintenance to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in translating rigorous research into strategic opportunities ensures that stakeholders receive tailored guidance aligned with their organizational objectives. By engaging directly, you can explore customized research deliverables, clarify report findings, and secure the critical intelligence needed to optimize maintenance planning, enhance reliability, and drive sustainable growth within the rapidly evolving wind energy sector. Reach out today to gain the competitive advantage afforded by in-depth market research and expert consultation.

- How big is the Wind Turbine Operations & Maintenance Market?

- What is the Wind Turbine Operations & Maintenance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?