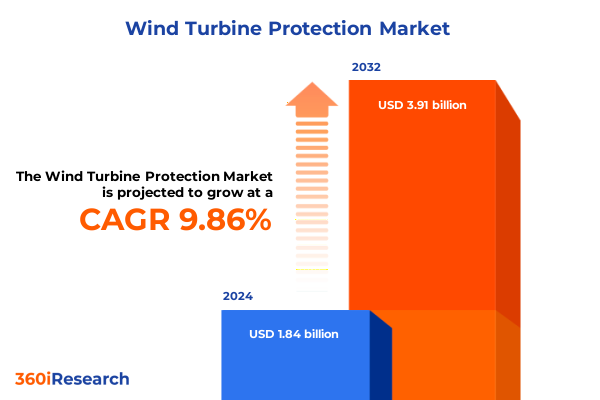

The Wind Turbine Protection Market size was estimated at USD 2.02 billion in 2025 and expected to reach USD 2.21 billion in 2026, at a CAGR of 9.89% to reach USD 3.91 billion by 2032.

Navigating the Critical Imperative of Wind Turbine Protection in an Era of Accelerating Renewable Energy and Evolving Operational Risks

Navigating the Critical Imperative of Wind Turbine Protection in an Era of Accelerating Renewable Energy and Evolving Operational Risks

As global renewable energy deployment accelerates, wind turbine assets have become central to decarbonization strategies and energy security initiatives across major markets. However, with turbines reaching heights exceeding 160 meters and capacities surpassing 5 megawatts, the complexity and vulnerability of these installations have grown dramatically. Modern turbines face a convergence of threats-from cybersecurity breaches targeting control systems to extreme weather events and material fatigue-that can escalate downtime costs and undermine project viability. In recent years, the industry has allocated over five billion dollars annually to address unplanned blade failures, while lightning-related damage alone has accounted for more than one hundred million dollars in repair expenses globally. Such figures spotlight the urgent need for comprehensive protection frameworks that integrate advanced sensors, robust software defenses, and proactive maintenance protocols.

Moreover, regulatory scrutiny and investor expectations now demand demonstrable risk mitigation measures throughout asset lifecycles. Transitioning from reactive fixes to predictive and condition-based maintenance not only enhances turbine longevity but also bolsters stakeholder confidence. By acknowledging these multifaceted pressures-from tariff-driven supply chain disruptions to intensified climate extremes-industry leaders can craft holistic protection strategies that safeguard returns and ensure turbines operate at peak efficiency. This executive summary illuminates the critical shifts shaping turbine protection, analyzes the cumulative impact of recent tariff policies, and presents insights to help decision-makers navigate a rapidly evolving landscape.

Unleashing Digitalization and Advanced Mitigation Strategies to Transform Wind Turbine Protection and Operational Resilience Across the Value Chain

Unleashing Digitalization and Advanced Mitigation Strategies to Transform Wind Turbine Protection and Operational Resilience Across the Value Chain

The wind energy sector is undergoing a profound digital transformation that redefines protection paradigms and operational resilience. The integration of enhanced sensor fusion techniques, which combine vibrational, thermal, acoustic, and electrical data, enables early fault detection with unprecedented accuracy, reducing false alarms and optimizing maintenance windows. AI-driven analytics platforms now synthesize these diverse data streams into actionable insights, empowering operators to preemptively address emerging issues and extend equipment lifespans. This shift toward predictive maintenance, spearheaded by fiber optic sensing technologies, has the potential to save operators billions by identifying blade and gearbox deterioration before failures become catastrophic.

Simultaneously, cybersecurity measures have taken center stage as industrial control systems become increasingly interconnected. Cyber incidents in the energy sector rose by fifty percent between 2021 and 2023, prompting the deployment of holistic frameworks that integrate IT and OT security, regular vulnerability assessments, and incident response protocols tailored for turbine operations. Enhanced lightning protection solutions are also evolving, with real-time alert systems and dynamic risk mapping reducing downtime and repair costs associated with frequent strikes on taller, more exposed blades. Meanwhile, drone-based inspections and unmanned aerial vehicles equipped with high-precision cameras and LIDAR sensors are revolutionizing ice detection and lightning protection assessments, shifting maintenance models from reactive to proactive approaches.

These technological strides are complemented by modular manufacturing and localized supply chain strategies, which bolster resilience against geopolitical disruptions and tariff shocks. By embracing digital ecosystems that unify advanced analytics, AI-driven security, and next-generation sensors, industry stakeholders can significantly elevate turbine protection standards and operational uptime.

Assessing the Financial and Operational Toll of Recent United States Steel, Aluminum, and Component Tariffs on Wind Turbine Projects

Assessing the Financial and Operational Toll of Recent United States Steel, Aluminum, and Component Tariffs on Wind Turbine Projects

The reintroduction and escalation of U.S. Section 232 tariffs have substantially altered the economic calculus for wind turbine protection components. In February 2025, proclamations reinstated a 25 percent duty on steel imports and introduced a matching 25 percent tariff on aluminum, eliminating key exemptions and tightening “melted and poured” standards to ensure domestic production preference. A subsequent June proclamation raised both steel and aluminum tariffs to fifty percent, with differentiated treatment for U.K. imports under the U.S.-U.K. Economic Prosperity Deal. These tariff actions have translated into cascading cost pressures across turbine towers, nacelle components, grounding systems, and surge arrestors, as domestic supply has struggled to scale in parallel with heightened demand.

Beyond raw materials, targeted Section 301 tariffs on critical mineral inputs and Chinese-origin components have imposed duties of up to 125 percent on certain wind turbine magnets and control modules, compelling major OEMs to reconfigure global sourcing strategies and incur additional logistics and quality assurance costs. The cumulative effect has manifest in elongated lead times and elevated procurement budgets, squeezing project margins and delaying commissioning schedules. Industry analyses anticipate that up to one percent of total project costs will be directly attributable to these tariff measures, while broader clean energy sectors could absorb over fifty-three billion dollars in annual tariff expenses.

Consequently, developers and asset owners are pivoting toward flexible contract structures that incorporate tariff escalation clauses and leveraging long-term procurement agreements with domestic fabricators. Some stakeholders are accelerating investments in local steel rolling and aluminum smelting capacity to mitigate recurrent tariff risks. However, until U.S. manufacturing can reliably meet the specialized quality standards required for wind infrastructure, supply chain volatility will remain a key challenge for maintaining cost-effective turbine protection programs.

Revealing How Nuanced Protection, Service, End-Use, Turbine, Capacity, Installation, and Voltage Segments Define Market Needs and Opportunities

Revealing How Nuanced Protection, Service, End-Use, Turbine, Capacity, Installation, and Voltage Segments Define Market Needs and Opportunities

The wind turbine protection market is intrinsically segmented by type of protection, service offering, end-use environment, turbine design, capacity range, installation context, and voltage class, each driving distinct technology and service demands. Protection requirements span from cybersecurity frameworks safeguarding endpoint and network integrity within SCADA and control systems to fire detection solutions utilizing smoke detectors and thermal cameras. Ice detection strategies leverage optical sensors and ultrasonic systems to identify blade icing conditions, while lightning protection depends on grounding systems and surge arrestors. Vibration monitoring, through accelerometers and velocity sensors, completes this spectrum of asset safeguards, with each application necessitating specialized integration and calibration.

Service models further differentiate market dynamics as hardware segments-comprising control units and sensor modules-intersect with consulting, installation, and maintenance offerings, and analytics platforms paired with monitoring software. Offshore and onshore environments present contrasting operational challenges; fixed and floating offshore platforms demand corrosion-resilient and marine-grade materials, whereas flat and mountainous onshore sites require adaptive protection to varied climatic and terrain conditions. Turbine typology introduces another layer of nuance, with downwind and upwind horizontal axis machines presenting different load profiles, and vertical axis designs such as Darrieus and Savonius necessitating bespoke sensor positioning and enclosure strategies.

Capacity brackets from less than 1.5MW to greater than 5MW drive scale economies and sensor fidelity requirements, as larger machines produce more significant dynamic loads and require higher-resolution monitoring. Furthermore, new installations invoke post- and pre-commissioning validation services, while retrofit scenarios focus on ad hoc repairs and scheduled maintenance upgrades. Voltage classifications-low, medium, and high voltage-also determine insulation standards, surge protection ratings, and compliance protocols. This granular segmentation underscores the importance of tailored solutions that align with each turbine protection scenario’s unique technical and service specifications.

This comprehensive research report categorizes the Wind Turbine Protection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Protection Type

- Offerings

- Turbine Type

- Capacity Range

- Installation Type

- Voltage Class

- End Use

Highlighting Regional Dynamics and Local Drivers Shaping Wind Turbine Protection Demand in the Americas, Europe Middle East & Africa, and Asia-Pacific

Highlighting Regional Dynamics and Local Drivers Shaping Wind Turbine Protection Demand in the Americas, Europe Middle East & Africa, and Asia-Pacific

Regional market trajectories for wind turbine protection diverge significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific, reflecting disparate regulatory environments, infrastructure maturity, and climatic risks. In the Americas, the United States continues to dominate demand, driven by expansive onshore repowering projects and an increasingly competitive offshore leasing landscape. Here, rising insurance premiums and stringent asset integrity standards incentivize the adoption of advanced lightning and vibration monitoring systems, while Canada’s remote northern installations prioritize robust ice detection and de-icing solutions.

The Europe Middle East & Africa region benefits from a historically mature wind sector complemented by aggressive decarbonization policies and substantial research funding. Offshore markets in the North Sea have pioneered real-time lightning intelligence, and the Gulf’s nascent projects leverage integrated cybersecurity and operational analytics to manage extreme thermal environments. Regulatory frameworks in Africa are evolving, catalyzing investments in modular protection packages tailored to grid-constrained onshore turbines and challenging voltage stability concerns.

Asia-Pacific exhibits rapid capacity expansion, particularly in China and India, where coastal and inland installations contend with typhoon-level storms and monsoonal icing. Manufacturers in this region are advancing locally optimized grounding systems and surge arrestors to address high lightning frequencies, while digital twin platforms and edge computing solutions have emerged to meet tight O&M budgets. Japan and South Korea’s offshore floating pilot programs emphasize corrosion-resistant hardware and condition-based maintenance software. These regional distinctions underscore the necessity for market participants to develop geographically attuned protection portfolios that respond to local technical, regulatory, and environmental imperatives.

This comprehensive research report examines key regions that drive the evolution of the Wind Turbine Protection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Steering Wind Turbine Protection Technology, Partnerships, and Strategic Growth Trajectories

Profiling Leading Innovators and Established Players Steering Wind Turbine Protection Technology, Partnerships, and Strategic Growth Trajectories

The wind turbine protection ecosystem features a blend of global conglomerates and specialized innovators driving progress through strategic collaborations and targeted R&D investments. Industry giants leverage extensive manufacturing footprints to produce corrosion-resistant grounding systems and surge arrestors at scale, while advanced sensor startups pair proprietary accelerometers and velocity sensors with AI-driven analytics platforms to deliver predictive maintenance capabilities that mitigate unplanned downtime. Partnerships between technology providers and service integrators are proliferating, enabling turnkey solutions that bundle hardware, software, and maintenance contracts into unified offerings.

Key cybersecurity firms have forged alliances with turbine OEMs to embed security-by-design within control unit development, ensuring that endpoint and network protections align with evolving regulatory mandates. Similarly, leading fire detection companies are collaborating with thermal imaging specialists to create hybrid smoke detection and camera systems tailored for confined turbine nacelles. Ice detection technology developers, often spin-outs from meteorological research institutes, co-innovate with blade manufacturers to integrate optical and ultrasonic sensors directly into composite structures. On the services front, major consulting groups and maintenance providers are expanding their global presence to oversee post-commissioning validation, scheduled maintenance programs, and ad hoc repair operations across diverse geographies.

As capacity ranges push beyond five megawatts, strategic investments focus on scaling analytics platforms and monitoring software to handle the voluminous data streams generated by large turbine fleets. Voltage class considerations have prompted providers to diversify their portfolios, offering modular insulation and surge protection solutions suited for low-, medium-, and high-voltage systems. This dynamic competitive landscape underscores the value of continual innovation and cross-sector collaboration to meet the evolving demands of wind turbine protection.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wind Turbine Protection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Cathwell AS

- DEHN SE

- Det Norske Veritas Group

- ENERCON GmbH

- General Electric Company

- Goldwind Science & Technology Co., Ltd.

- Halma PLC

- Hempel A/S

- Hitachi Ltd.

- Ming Yang Smart Energy Group Limited

- Nordex SE

- Pilz GmbH & Co. KG

- PolyTech A/S

- Schunk Group

- Siemens AG

- Suzlon Energy Ltd.

- Trelleborg AB

- Vestas Wind Systems A/S

- Wenzhou Arrester Electric Co., Ltd.

Delivering Strategic, Tactical, and Technological Recommendations to Optimize Wind Turbine Protection Investments and Enhance Long-Term Asset Reliability

Delivering Strategic, Tactical, and Technological Recommendations to Optimize Wind Turbine Protection Investments and Enhance Long-Term Asset Reliability

Industry leaders must prioritize a multi-layered protection strategy that integrates digital, physical, and organizational measures. Strategically, organizations should map critical turbine assets against risk profiles to direct resources toward high-consequence components, such as blade lightning receptors and gearbox housings. Financial planning must incorporate tariff escalation clauses for steel, aluminum, and critical mineral imports, thereby safeguarding project margins against future policy shifts.

Tactically, operators should transition from calendar-based inspections to condition-based maintenance by adopting advanced sensor fusion and AI-driven analytics platforms. Implementing drone-enabled visual and LIDAR assessments can substantially reduce inspection cycle times, minimize technician exposure, and extend asset lifespans. Stakeholders must also fortify cybersecurity architectures by unifying IT and OT security teams, conducting regular penetration testing, and establishing incident response protocols specific to turbine control systems.

Technologically, investing in real-time lightning intelligence and preemptive ice detection systems will mitigate the most costly weather-related damages. Technologies such as fiber optic sensing, edge computing modules, and adaptive surge arrestors should be prioritized to capture and interpret localized operational data. Furthermore, extending partnerships with domestic steel and aluminum manufacturers can stabilize supply chains and improve lead-time predictability. By executing these recommendations, industry participants can elevate turbine reliability, optimize lifecycle costs, and strengthen their competitive positioning in a dynamic market environment.

Outlining Rigorous Primary and Secondary Research Methodologies Underpinning Insights into Wind Turbine Protection Market Intelligence and Analysis

Outlining Rigorous Primary and Secondary Research Methodologies Underpinning Insights into Wind Turbine Protection Market Intelligence and Analysis

This research employs a robust methodology combining primary interviews with key industry stakeholders and comprehensive secondary data analysis. Primary inputs were gathered through structured interviews with wind farm operators, OEM engineering teams, materials suppliers, and cybersecurity specialists, ensuring a holistic view of protection challenges and solution adoption trends. Supplementary qualitative insights were obtained from technology developers, service integrators, and regulatory bodies across major regions, refining the granularity of segment-specific demand drivers.

Secondary research encompassed the systematic review of government proclamations, industry publications, and peer-reviewed technical journals to validate tariff developments, technological advancements, and regional market dynamics. Key sources included official tariff fact sheets, reputable news outlets reporting on Section 232 and Section 301 policy impacts, and leading energy sector analyses documenting cost implications for clean power infrastructure. Market segmentation frameworks were corroborated through product literature and white papers detailing sensor, service, and installation typologies. Data triangulation was achieved by cross-referencing manufacturer specifications, case study performance metrics, and publicly disclosed maintenance cost figures to ensure the accuracy and relevance of our insights. This dual-stream approach provides a credible foundation for the strategic recommendations and market interpretations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wind Turbine Protection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wind Turbine Protection Market, by Protection Type

- Wind Turbine Protection Market, by Offerings

- Wind Turbine Protection Market, by Turbine Type

- Wind Turbine Protection Market, by Capacity Range

- Wind Turbine Protection Market, by Installation Type

- Wind Turbine Protection Market, by Voltage Class

- Wind Turbine Protection Market, by End Use

- Wind Turbine Protection Market, by Region

- Wind Turbine Protection Market, by Group

- Wind Turbine Protection Market, by Country

- United States Wind Turbine Protection Market

- China Wind Turbine Protection Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3498 ]

Synthesizing Key Findings and Insights into Wind Turbine Protection Trends, Challenges, and Strategic Imperatives Driving Industry Evolution

Synthesizing Key Findings and Insights into Wind Turbine Protection Trends, Challenges, and Strategic Imperatives Driving Industry Evolution

The wind turbine protection landscape is defined by accelerating digital innovation, multifaceted threat vectors, and shifting policy environments. Advanced sensor fusion and AI-powered analytics are driving a transition from reactive to predictive maintenance models, offering opportunities to significantly reduce unplanned downtime and lifecycle costs. Concurrently, cyber-physical security measures are gaining prominence as turbines become more interconnected, necessitating robust frameworks that bridge IT and operational technology domains.

Significant tariff adjustments on steel, aluminum, and key component imports have imposed cost and lead-time pressures, reinforcing the importance of localized manufacturing partnerships and agile procurement strategies. Bi-modal service offerings that encompass hardware, software, and consulting further enable operators to customize protective measures to specific end-use environments-whether fixed offshore platforms or mountainous onshore terrains. Regional distinctions underscore diverse demand drivers, from lightning-intensive zones in Asia-Pacific to regulatory-driven markets in Europe Middle East & Africa and repowering mandates in the Americas.

Leading companies are responding through strategic collaborations, innovative product development, and expanded service networks. Actionable recommendations urge stakeholders to adopt integrated protection frameworks, leverage digital twins and edge computing for real-time monitoring, and incorporate tariff risk mitigation into financial planning. These collective insights underscore a clear strategic imperative: embracing a holistic, data-driven approach to wind turbine protection is essential for enhancing asset reliability and sustaining growth in a rapidly evolving energy transition.

Take the Next Step Toward Securing Comprehensive Wind Turbine Protection by Engaging with Ketan Rohom to Acquire Your In-Depth Research Insights

Seize the Opportunity to Enhance Wind Turbine Protection with Tailored Insights from Expert Associate Director Ketan Rohom

Empower your organization with the critical intelligence required to safeguard wind turbines against evolving threats and operational challenges. By engaging with Ketan Rohom, Associate Director of Sales & Marketing, you gain direct access to an authoritative market research report designed to illuminate the most pressing risks, advanced mitigation strategies, and key investment opportunities. Ketan Rohom’s expertise ensures a seamless, consultative approach to securing the full suite of actionable data and nuanced analyses your team needs to drive resilience and sustained growth.

Contacting Ketan Rohom positions your organization to leverage a comprehensive, customizable research package that spans section-specific deep dives-from tariff impact assessments to regional demand dynamics and competitive benchmarking. His guided overview will help you identify high-impact areas, prioritize protective technologies, and align your strategic roadmap with the latest industry advancements. Don’t let uncertainty undermine your wind turbine assets; reach out today and transform risk intelligence into lasting competitive advantage.

- How big is the Wind Turbine Protection Market?

- What is the Wind Turbine Protection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?