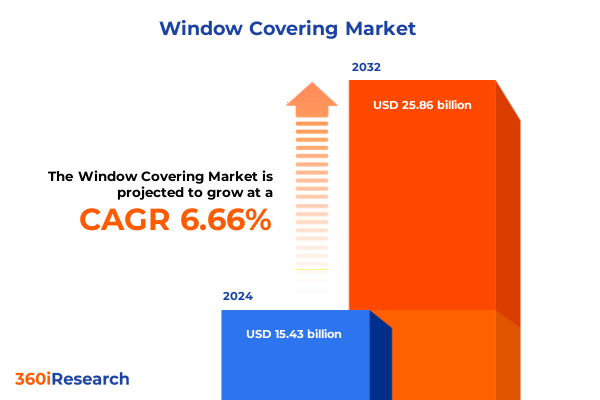

The Window Covering Market size was estimated at USD 16.40 billion in 2025 and expected to reach USD 17.44 billion in 2026, at a CAGR of 6.71% to reach USD 25.86 billion by 2032.

Discover the Rapid Transformation in Window Covering Market Driven by Smart Automation, Eco-Conscious Materials, and Evolving Design Preferences Among Consumers

The window covering industry is at a pivotal juncture where the fusion of traditional craftsmanship and contemporary design is redefining residential and commercial spaces. Interior designers are championing a blend of classic elements such as cafe curtains and ripple fold drapery with modern layering techniques that integrate sheers and woven shades to enhance both aesthetics and functionality. This duality allows for seamless transitions between natural light diffusion and privacy, addressing diverse consumer preferences in every room of the home.

Building on these stylistic undercurrents, motorization is shifting from niche luxury to mainstream convenience, as homeowners embrace app-controlled and voice-activated window treatments. Motorized solutions not only eliminate the challenges of hard-to-reach installations but also align with broader smart home ecosystems, empowering users to automate schedules, optimize daylight, and elevate the overall living experience.

Navigating the Critical Shifts Redefining Window Covering Industry Through Digital Integration, Sustainable Innovation, and Consumer-Centric Solutions

The landscape of window covering manufacturing and distribution is transforming through the integration of digital technologies and sustainable innovations. Market leaders are leveraging IoT-enabled blinds that communicate with thermostats, lighting systems, and weather sensors to optimize energy efficiency and indoor comfort in real time. This interconnectivity is reshaping product roadmaps, with voice control and AI-driven routines moving from experimental to essential features for tech-savvy consumers.

Simultaneously, a heightened focus on environmental responsibility is catalyzing the adoption of eco-friendly materials such as bamboo, hemp, and recycled fabrics. Manufacturers are not only meeting regulatory demands for low-VOC finishes but are also responding to consumer expectations for greener, circular products. As a result, dual-function offerings like blackout-sheer combinations and thermally insulated cellular shades are gaining prominence, demonstrating how design ingenuity and sustainability can coexist harmoniously to create competitive differentiation.

Assessing the Layered Impact of 2025 U.S. Tariff Measures on Window Covering Supply Chains, Cost Structures, and Competitive Landscape

2025 brought a complex array of tariff measures that have significantly impacted the cost structures of window covering supply chains. Following a judicial stay by the U.S. Court of Appeals for the Federal Circuit, the 20% IEEPA tariffs on Chinese-origin goods and the 10% reciprocal duties remain in effect alongside existing Section 301 duties, while proposed increases on imports from Mexico and Canada continue under review.

Manufacturers and importers have also faced the elimination of the $800 de minimis exemption, which had previously exempted low-value shipments from duties. This change has translated into an immediate cost burden - for instance, fabric shades can incur up to 28% additional import costs and bamboo shades as much as 42% - prompting providers to negotiate factory pricing adjustments and apply surcharges to end buyers to protect service and margin levels.

Uncovering Deep-Dive Insights into Market Segmentation Revealing Product, Material, Mechanism, Installation, Application, and Channel Dynamics

Unpacking the market through a product lens reveals nuanced opportunities across blinds, curtains and drapes, shades, and shutters, with roller, Venetian, and vertical blinds catering to minimalist modern interiors while blackout, sheer, and thermal curtain options address light control and acoustic demands. Material innovation spans fabric, metal, plastic, and wood, with cotton, polyester, and silk variants enabling tailored performance in durability, style, and fire resistance.

From an operational standpoint, automatic mechanisms increasingly coexist with manual controls, balancing user preference for convenience against the simplicity and cost-effectiveness of traditional systems. Installation dynamics, whether inside mount for sleek integration or outside mount for full coverage, further influence specification strategies. Application contexts differentiate commercial projects requiring heavy-duty, compliant solutions from the residential market’s emphasis on aesthetic flexibility. Distribution channels range from the personalized expertise of specialty stores to the scale and convenience of online platforms, the latter of which is reshaping go-to-market tactics without superseding established retail partnerships.

This comprehensive research report categorizes the Window Covering market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Operation Mechanism

- Installation Type

- Application

- Distribution Channel

Illuminating Regional Market Dynamics and Growth Patterns Across Americas, Europe Middle East & Africa, and Asia-Pacific Window Covering Sectors

In the Americas, robust home ownership rates and a mature smart home ecosystem drive sophisticated consumer demand. The U.S. smart home market alone is projected to generate approximately US$43.0 billion in revenue in 2025, with nearly 90% household penetration reinforcing the appetite for automated, energy-saving window treatments.

Across Europe, the Middle East, and Africa, a diverse regulatory and economic landscape shapes market dynamics. The EMEA region is set to reach US$49.3 billion in smart home revenue in 2025, with varying household penetration rates - from under 40% in Middle Eastern markets to over 60% in Western Europe - prompting multinational suppliers to customize offerings for regional standards and consumer expectations.

In Asia-Pacific, rapid urbanization and government incentives for energy-efficient housing are fueling the fastest regional growth, with smart home revenues anticipated at US$69.4 billion in 2025 and household penetration exceeding 80%. Manufacturers are capitalizing on high disposable incomes and supportive policy frameworks to expand distribution networks and invest in local production capabilities.

This comprehensive research report examines key regions that drive the evolution of the Window Covering market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations and Competitive Moves by Leading Players Shaping the Window Covering Industry Today and Future Trajectories

Leading suppliers are accelerating innovation to capture shifting consumer and commercial preferences. Hunter Douglas’s April 2025 launch of a 100% recycled-materials product line underscores a strategic pivot toward sustainability, while Somfy’s introduction of solar-powered smart blinds highlights the convergence of renewable energy and automation in premium installations.

Meanwhile, Levolor’s Design Studio digital platform, introduced in early 2025, exemplifies the power of end-to-end customization, enabling users to configure bespoke window treatments online and seamlessly integrate options such as cordless motorization and smart home compatibility. At the same time, Norman® USA and BMD Materials are deepening partnerships with tech firms to advance IoT capabilities, reinforcing the competitive drive toward enhanced convenience and energy management features.

This comprehensive research report delivers an in-depth overview of the principal market players in the Window Covering market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Budget Blinds, LLC

- Ching Feng Home Fashions Co., Ltd.

- Comfortex Window Fashions

- Coulisse B.V.

- Decora Blind Systems Ltd.

- Draper Inc.

- Griesser AG

- Himalaya Sales Inc.

- Hunter Douglas N.V.

- Innovative Openings, Inc.

- Inpro Corporation

- Inter IKEA Holding B.V.

- Kvadrat A/S

- Lafayette Venetian Blind, Inc.

- Louvolite

- Markisol

- Nanik Japan, Inc.

- Nichibei Co., Ltd.

- Nien Made Enterprise Co., Ltd.

- Persan Home Studio

- Polar Shades Sun Control

- ROMA KG

- Skandia Window Fashions, Inc.

- Springs Window Fashions, LLC

- Tachikawa Corporation

- The Bombay Dyeing & Manufacturing Co Ltd.

- The Shade Store, LLC

- TOKYO BLINDS COMPANY LIMITED

- TOSO Company, Limited

- VAKO

- Vista Products Inc.

Empowering Industry Leadership with Tactical Recommendations to Drive Growth, Resilience, and Innovation in Window Covering Businesses

To mitigate ongoing tariff pressures and safeguard margins, industry leaders should diversify supply chains by partnering with manufacturers in tariff-exempt countries and establishing contingency inventories in regional distribution centers, ensuring uninterrupted delivery even amid policy shifts.

Simultaneously, investing in direct-to-consumer e-commerce platforms and immersive digital tools - such as virtual reality simulations for installation previews - can enhance customer engagement, reduce channel conflicts, and unlock higher-margin sales. Strategic alliances with smart home integrators and material innovators will further differentiate offerings and align product roadmaps with evolving energy-efficiency standards, fostering sustainable growth in an increasingly competitive environment.

Explaining the Multi-Method Research Approach Underpinning Robust Insights and Comprehensive Analysis of the Window Covering Market

Our analysis is grounded in a systematic secondary research process, drawing on public HTS data, government trade rulings, industry association publications, corporate press releases, and leading design media. This desk research established a factual baseline for tariff impacts, market trends, and technology adoption, ensuring our insights are both current and comprehensive.

Complementing the secondary stage, primary research included in-depth interviews with key executives, product managers, and distribution partners across North America, Europe, and Asia-Pacific, augmented by targeted surveys of end-user segments. Through methodological triangulation, we validated emerging themes and quantified qualitative findings, delivering a robust, multidimensional portrait of the global window covering market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Window Covering market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Window Covering Market, by Product Type

- Window Covering Market, by Material Type

- Window Covering Market, by Operation Mechanism

- Window Covering Market, by Installation Type

- Window Covering Market, by Application

- Window Covering Market, by Distribution Channel

- Window Covering Market, by Region

- Window Covering Market, by Group

- Window Covering Market, by Country

- United States Window Covering Market

- China Window Covering Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Closing Remarks on Strategic Imperatives and Future Pathways Driving the Window Covering Market Forward with Innovation and Sustainability Emphasis

The window covering market stands at the confluence of technological advancement, sustainability imperatives, and dynamic consumer preferences. Industry participants who effectively integrate smart automation, eco-conscious materials, and flexible go-to-market frameworks will establish a durable competitive advantage. Meanwhile, vigilant management of trade policy developments and agile supply chain strategies will be crucial to maintaining cost efficiencies and service excellence.

By harnessing the strategic imperatives outlined herein, companies can navigate the complexities of 2025 and beyond, transforming emerging challenges into growth opportunities and positioning themselves as leaders in a rapidly evolving global market.

Take Action Now to Equip Your Organization with Comprehensive Window Covering Market Insights and Gain a Competitive Edge in 2025 and Beyond

To unlock the full potential of the window covering market and empower your team with indispensable strategic insights, connect directly with Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through the comprehensive market research report, ensuring you have the detailed analysis, actionable findings, and competitive intelligence needed to make timely, confident decisions. Secure your copy today to stay ahead in an industry where innovation and sustainability define tomorrow’s success.

- How big is the Window Covering Market?

- What is the Window Covering Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?