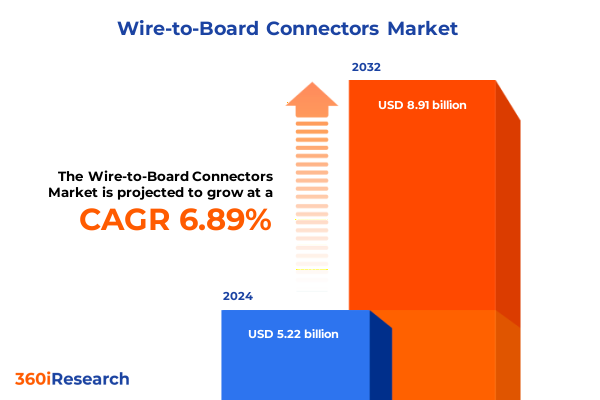

The Wire-to-Board Connectors Market size was estimated at USD 5.48 billion in 2025 and expected to reach USD 5.76 billion in 2026, at a CAGR of 7.16% to reach USD 8.91 billion by 2032.

Emerging Dynamics in Wire-to-Board Connector Applications Driving Industry Evolution Across Multiple Sectors with Advanced Performance Demands

The wire-to-board connector market has emerged as a critical enabler of modern electrical and electronic systems, providing seamless paths for power and signal transmission across diverse sectors. These connectors facilitate the direct interfacing of wiring assemblies to printed circuit boards, supporting the rapid evolution of industries from automotive and industrial automation to consumer electronics and medical devices. Innovations in materials, contact configurations, and manufacturing processes have catalyzed a shift toward more reliable, compact, and high-performance connection solutions capable of meeting exacting standards for durability and electrical integrity.

In this executive summary, readers will find a structured analysis of the transformative dynamics reshaping the wire-to-board connector landscape. The document navigates through emerging technological drivers, regulatory impacts, and market segmentation dimensions without focusing on numerical estimations or growth forecasts. Decision-makers will be guided through regional nuances, competitive insights, and actionable recommendations, all grounded in rigorous primary and secondary research methodologies. By synthesizing the critical themes and strategic considerations that define this domain, the summary sets the foundation for informed executive decisions.

Rapid Technological Advancements Catalyze Transformational Shifts in Connector Design Addressing Miniaturization, Data Throughput, and Power Density Challenges

Rapid progress in electronic miniaturization, power density requirements, and high-speed data transmission has redefined how connectors are designed and applied. Designers are compelled to accommodate denser PCB layouts while upholding signal integrity at frequencies once deemed unattainable for traditional connector architectures. Simultaneously, the push toward electrified transportation and renewable energy systems has elevated current-handling capabilities, prompting material and structural innovations to balance thermal performance with mechanical robustness.

Moreover, the proliferation of the Internet of Things and Industry 4.0 applications has underscored the need for connectors that can endure harsh environments and ensure uninterrupted connectivity. Makers are exploring advanced insulation materials and novel contact finishes to reduce insertion forces, combat corrosion, and support extended lifecycle performance. As these technological imperatives converge, stakeholders are compelled to reevaluate sourcing, design partnerships, and supply chain strategies, aligning product roadmaps with the accelerating pace of end-market innovation.

Comprehensive Analysis of the Ongoing Impact of Newly Implemented United States Tariffs on Connector Supply Chains and Cost Structures in 2025

The United States’ latest round of tariffs on electronic interconnection components, instituted in early 2025, has exerted broad pressure on the wire-to-board connector supply chain. Manufacturers reliant on cross-border sourcing have encountered rising procurement costs, compelling them to seek alternative vendor relationships and reexamine regional inventory strategies. In particular, tariff-driven cost escalations for certain metal alloys and specialized polymers have eroded margin buffers, necessitating price negotiations with key customers or the absorption of a share of incremental expenses to maintain competitive positioning.

Consequently, many producers have accelerated plans for localized assembly and nearshoring initiatives to mitigate duty impacts and enhance supply resilience. This trend has fostered deeper collaboration between connector developers and contract manufacturers in the Americas, with an emphasis on reengineering products for simplified assembly and testing workflows. Regulatory shifts have also highlighted the importance of long-term tariff scenario planning, prompting industry participants to invest in comprehensive cost modeling and to diversify procurement channels to sustain innovation trajectories amid evolving trade landscapes.

Insightful Breakdown of Key Connector Market Segmentation Dimensions Highlighting Type Variations, Contact Configurations, and End-User Applications

A detailed exploration of market segmentation reveals distinct performance and application vectors that define product development and go-to-market strategies. Connector type categories underscore the fundamental differences in interconnection approaches, with board-to-board interfaces-further broken down into edge connectors designed for precise alignment and press-fit connectors engineered for robust mechanical retention-demanding specialized fabrication techniques relative to wire-to-board and wire-to-wire solutions. Contact type variations, spanning pin and socket options, impose unique considerations for contact plating and mating endurance, driving targeted material selection and tooling investments.

Beyond contact architecture, the number of positions-ranging from single positions geared toward simple signal routing to multi-position arrays engineered for dense data channels and dual position variants balancing signal and power pathways-creates further product diversification. Housing materials, whether constructed from metal for high-shielding applications or molded from plastic for cost-effective lightweight solutions, shape the thermal and mechanical performance envelope. Current rating classifications, from sub-10 amp connectors to those rated for 10–20 amp and above 20 amp, align directly with emerging electrification demands. Mounting style options, including panel mounting, surface mounting, and through-hole mounting, dictate compatibility with assembly lines and thermal management strategies. Insulation materials such as liquid crystal polymer, polyamide, and thermoplastic guide dielectric behavior under electrical stress. Finally, end-user industries drive tailored connector architectures, with aerospace and defense segments incorporating configurations for aircraft components and military equipment, automotive applications differentiating between aftermarket and OEM needs, consumer electronics targeting mobiles and wearables, industrial use cases encompassing automation and heavy machinery, medical devices spanning diagnostic instruments and therapeutic devices, and telecommunications supporting data centers and networking equipment.

This comprehensive research report categorizes the Wire-to-Board Connectors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connector Type

- Type of Contacts

- Number of Positions

- Housing Material

- Current Rating

- Mounting Style

- Insulation Material

- End-User

Strategic Regional Perspectives Revealing Distinct Growth Patterns and Adoption Drivers Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional insights illuminate how distinct economic, regulatory, and technological landscapes influence connector adoption and innovation priorities. In the Americas, robust investments in automotive electrification and industrial automation drive demand for high-reliability wire-to-board connections that meet stringent safety and performance standards. North American manufacturers are increasingly integrating value-added services such as in-line testing and customization to differentiate their offerings in a competitive environment.

In Europe, the Middle East, and Africa, a strong focus on sustainability and regulatory compliance has prompted the adoption of eco-friendly housing materials and RoHS-compliant plating technologies. Manufacturers in this region emphasize modular connector platforms that facilitate rapid adaptation to divergent national standards and emerging digital infrastructure requirements. Asia-Pacific stands out for its rapid manufacturing scale-up and cost leadership, supporting the mass production of consumer electronics connectors while simultaneously advancing capabilities in high-current and high-frequency designs. Regional collaboration between OEMs and local connector specialists fosters a dynamic environment for pilot projects, particularly in the rapidly electrifying Chinese automotive sector and Southeast Asia’s burgeoning data center market.

This comprehensive research report examines key regions that drive the evolution of the Wire-to-Board Connectors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Analysis of Leading Connector Manufacturers Emphasizing Innovation Strategies, Strategic Collaborations, and Competitive Positioning Dynamics

Leading firms in the connector industry have demonstrated a range of strategies to secure technological leadership and supply chain resilience. Several prominent manufacturers have prioritized in-house development of advanced contact coatings and housing materials, establishing dedicated research centers to validate performance under accelerated aging and rigorous environmental stress testing. These investments have fortified their product portfolios, enabling them to tailor solutions for emerging applications such as electric vehicle charging modules and 5G infrastructure components.

Strategic collaborations have also gained prominence, with connector providers entering co-development agreements alongside major electronics OEMs. Through these partnerships, participants have expedited the introduction of connectors with integrated sensing and diagnostic capabilities, delivering real-time performance monitoring. Mergers and acquisitions continue to reshape the competitive landscape, as larger entities acquire niche specialists in high-power or micro-pitch connectors to broaden their offerings. Across the board, companies that align innovation roadmaps with end-user roadmaps and leverage digital design tools for rapid prototyping have outpaced peers in time-to-market and customization agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wire-to-Board Connectors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adam Technologies, Inc.

- AirBorn, Inc.

- Amphenol Corporation

- ASSMANN WSW components GmbH by BCS Group GmbH

- BR-CONNECTORS GMBH

- CnC Tech, LLC

- Connectronics Corp.

- Connfly Electronic Co., Ltd.

- CviLux Group

- Foxconn Interconnect Technology Limited

- Fujitsu Limited

- GREENCONN Co., Ltd.

- HARTING Technology Group

- Harwin PLC

- HIROSE ELECTRIC CO., LTD.

- J.S.T. (U.K.) Ltd.

- Japan Automatic Machine Co., Ltd.

- Japan Aviation Electronics Industry, Ltd.

- KYOCERA AVX Components Corporation

- Molex, LLC

- OMRON Corporation

- Phoenix Contact Group

- PRECI-DIP SA

- TE Connectivity

- TXGA LLC

- WAGO Corporation

- WCON ELECTRONICS (GUANGDONG) CO., LTD.

- Würth Elektronik eiSos GmbH & Co. KG

Actionable Strategic Recommendations to Enhance Supply Chain Resilience, Foster Product Differentiation, and Accelerate Market Penetration in Connector Industry

Industry leaders aiming to strengthen their market stance should prioritize the development of modular connector platforms that can be rapidly configured to meet specific end-user requirements, thereby reducing time-to-market while preserving economies of scale. Adopting advanced materials for enhanced thermal and mechanical performance will ensure products remain fit for next-generation electrification and data transmission applications. In parallel, integrating sensor and diagnostic features into connector designs will unlock new value propositions around predictive maintenance and system uptime.

Supply chain resilience can be further enhanced by establishing dual sourcing agreements for critical raw materials and by forging partnerships with regional contract manufacturers to mitigate tariff and logistical challenges. Companies should invest in digital twin and virtual validation tools to accelerate design iterations and minimize physical prototyping cycles. Finally, fostering closer collaboration between product engineering teams and end-user stakeholders will facilitate deeper alignment on performance specifications, enabling offerings that not only meet but anticipate emerging market demands.

Rigorous Research Methodology Leveraging Primary Interviews, Comprehensive Secondary Data Triangulation, and Robust Analytical Frameworks for Connector Study

This research integrates insights from a blend of primary and secondary sources to ensure robust, multi-dimensional perspectives. Primary research entailed in-depth interviews with engineers, procurement leaders, and quality managers across leading connector manufacturing and end-user companies, capturing firsthand feedback on design challenges, sourcing strategies, and performance expectations. Secondary research encompassed an extensive review of technical standards, patent filings, and trade association publications to validate emerging trends and materials innovations.

Data triangulation balanced expert interviews with analysis of publicly available technical papers and regulatory documentation, ensuring that conclusions reflect both commercial realities and evolving industry standards. Analytical frameworks, including product ecosystem mapping and supply chain impact modeling, were applied to distill critical themes without relying on numerical market projections. This methodology ensures that the findings and recommendations presented here are grounded in empirical evidence and aligned with current best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wire-to-Board Connectors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wire-to-Board Connectors Market, by Connector Type

- Wire-to-Board Connectors Market, by Type of Contacts

- Wire-to-Board Connectors Market, by Number of Positions

- Wire-to-Board Connectors Market, by Housing Material

- Wire-to-Board Connectors Market, by Current Rating

- Wire-to-Board Connectors Market, by Mounting Style

- Wire-to-Board Connectors Market, by Insulation Material

- Wire-to-Board Connectors Market, by End-User

- Wire-to-Board Connectors Market, by Region

- Wire-to-Board Connectors Market, by Group

- Wire-to-Board Connectors Market, by Country

- United States Wire-to-Board Connectors Market

- China Wire-to-Board Connectors Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Conclusive Reflections Highlighting Core Findings, Strategic Implications, and Future Outlook of the Wire-to-Board Connector Landscape for Decision Makers

The convergence of technological advancements, regulatory pressures, and shifting trade policies has set the stage for a dynamic period in the wire-to-board connector industry. Core findings highlight the imperative for manufacturers to adopt agile product architectures, invest in advanced material science, and build resilient supply chains that can absorb tariff shocks and logistical disruptions. Strategic implications underscore the value of collaboration-both internally across engineering and supply functions, and externally with key end-user partners-to accelerate innovation cycles and secure competitive advantage.

Looking ahead, connectors will play an increasingly integrated role in smart systems, with embedded intelligence and diagnostics transforming them from passive components into active enablers of system health monitoring. Companies that embrace modular design principles and align R&D investments with evolving standards for high-speed and high-power applications will be best positioned to capture new opportunities. This synthesis of insights provides a clear roadmap for decision-makers aiming to navigate the complexities of the connector landscape and drive sustained success.

Compelling Call to Engage with Associate Director of Sales Marketing for Exclusive Access and Purchase of the Comprehensive Connector Market Research Report

If you seek to gain an unmatched understanding of the wire-to-board connector market and secure the strategic insights needed to drive your business forward, reach out directly to Ketan Rohom, an experienced Associate Director of Sales & Marketing, for exclusive access to this comprehensive research report and partnership opportunities that will empower your next move.

- How big is the Wire-to-Board Connectors Market?

- What is the Wire-to-Board Connectors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?