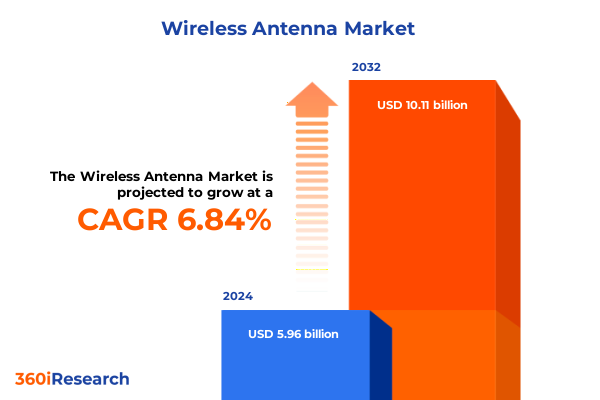

The Wireless Antenna Market size was estimated at USD 6.36 billion in 2025 and expected to reach USD 6.73 billion in 2026, at a CAGR of 6.83% to reach USD 10.11 billion by 2032.

Emerging Dynamics in Wireless Antenna Market Set the Stage for Unparalleled Connectivity and Strategic Innovation Across Industries

The wireless antenna industry is experiencing a period of profound transformation, driven by surging demand for high-speed connectivity and the proliferation of advanced wireless applications. This market segment, once defined primarily by traditional cellular and broadcast deployments, now spans a wide array of use cases ranging from fixed wireless access in underserved areas to mission-critical Internet of Things implementations in smart manufacturing facilities. As operators and enterprises alike seek to overcome capacity constraints and latency limitations, antennas have evolved into highly engineered components that integrate beamforming, multiple-input multiple-output, and phased array capabilities. Consequently, the role of the antenna has shifted from a passive element to a strategic enabler of network performance.

Moreover, collaborative efforts among telecom operators, equipment vendors, and standardization bodies have accelerated the adoption of higher frequency bands, particularly in the millimeter-wave spectrum. These developments are not only unlocking multi-gigabit throughput but are also redefining network architectures, encouraging the densification of small cell deployments and motivating the exploration of novel antenna form factors. In response, manufacturers are investing heavily in research and development to optimize antenna design for compact installations and dynamic environments. This introduction outlines how these converging trends form the foundation of the analysis that follows, setting the stage for a deep dive into the transformative shifts and strategic considerations shaping the wireless antenna landscape.

Groundbreaking Technological and Regulatory Shifts Are Redefining the Wireless Antenna Landscape with New Opportunities and Challenges

In recent years, the wireless antenna landscape has undergone rapid evolution, spurred by paradigm shifts in network architectures and regulatory frameworks. The transition from macrocell-centric networks to heterogeneous deployments has prompted antennas to perform at the edge, delivering precise beam steering and interference mitigation in ultra-dense scenarios. Simultaneously, the rollout of 5G standalone networks has amplified the importance of spectrum efficiency and signal resilience, giving rise to adaptive antenna systems capable of real-time reconfiguration.

Regulatory bodies have also enacted changes to spectrum licensing, making new bands available for both licensed and unlicensed use. This has created a fertile environment for innovation in the millimeter wave range, where directional and sector antennas are being reimagined to overcome propagation challenges and extend coverage through advanced phased array techniques. Meanwhile, in sub-6 gigahertz bands, omni directional and Yagi antennas continue to play a critical role in providing broad-area coverage and point-to-point connectivity. Through these transformations, the industry is witnessing a convergence of product, deployment, and technology trends, ultimately redefining how antennas contribute to network performance and service quality.

Evolving Trade Measures Are Significantly Shaping Component Costs and Supply Chain Resilience within the United States Ecosystem

The implementation of new trade measures in the United States throughout 2025 has introduced both challenges and adaptive strategies for antenna manufacturers and network operators. Tariffs on imported components, particularly semiconductors and specialized RF materials, have increased production costs for directional and phased array antennas. In response, manufacturers have begun to localize certain fabrication processes, forging partnerships with domestic suppliers to mitigate tariff impacts and ensure continuity in the supply chain.

Furthermore, these trade measures have prompted strategic inventory adjustments and advanced procurement planning, as companies seek to lock in component availability ahead of potential tariff escalations. Some leading players are leveraging technology licensing agreements to streamline production of MIMO and smart antenna modules within the United States, while others are optimizing design specifications to reduce reliance on higher-tariff inputs. Despite the cost pressures, this environment has catalyzed innovation in alternative materials and modular architectures, reinforcing supply chain resilience and positioning manufacturers to respond more swiftly to future regulatory shifts.

Deep Dive into Product Types Frequency Bands Deployments Technologies and End User Applications Reveals Diverse Market Pathways

An in-depth examination of market segmentation reveals a landscape defined by the interplay of product type, frequency band, deployment scenario, technology choice, end-user industry, and application. Within product categories, directional antennas are gaining traction in point-to-point backhaul and fixed wireless access deployments, while omni directional configurations remain essential for broad coverage in rural and enterprise campus environments. Sector antennas support multi-sector coverage in urban macro networks, and Yagi antennas fulfill niche requirements in rural connectivity and IoT sensor networks.

Turning to frequency bands, the industry is witnessing rapid growth in millimeter wave implementations at 26, 28, and 60 gigahertz, where beamforming and phased array systems are overcoming propagation limitations. At the same time, sub-6 gigahertz segments-specifically 2.4, 3.5, and 5 gigahertz-persist as the backbone for widespread IoT and mid-range connectivity. Deployment insights indicate that indoor ceiling mounted and wall mounted units are optimized for enterprise and healthcare facilities, whereas outdoor pole mounted, rooftop mounted, and tower mounted installations serve telecom operators and transportation corridors. Technology segmentation highlights the expanding role of smart antennas and MIMO configurations in 2x2, 4x4, and 8x8 variants, as well as the proliferation of analog and digital phased array solutions. End-user industries spanning education, IT and data centers, retail, government and defense, healthcare, telecom operators, and transportation each demand tailored antenna solutions to meet their unique performance and reliability criteria. Finally, applications ranging from fixed wireless access to point-to-multipoint and point-to-point networks reflect the critical role of antennas in supporting emerging IoT standards like LoRa, NB-IoT, and Sigfox.

This comprehensive research report categorizes the Wireless Antenna market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Frequency Band

- Deployment

- Technology

- End-User Industry

- Application

Regional Variations in Demand Infrastructure and Regulatory Frameworks Highlight Unique Growth Drivers across the Americas EMEA and Asia Pacific

Regional analysis underscores distinct trends and drivers across the Americas, Europe Middle East and Africa, and Asia-Pacific territories. In the Americas, growth in fixed wireless access and rural broadband initiatives is fueling demand for cost-effective directional and Yagi antennas. Investment in smart city projects and transportation infrastructure is driving the adoption of MIMO and beamforming systems, particularly in urban corridors where capacity requirements continue to intensify.

Conversely, within Europe, the Middle East, and Africa, regulatory harmonization efforts and spectrum auctions have accelerated 5G deployments, fostering demand for advanced phased array and smart antenna configurations. These regions also benefit from growing defense and government spending on resilient communication networks, complementing commercial rollouts. Over in the Asia-Pacific region, high population density and rapid urbanization have generated substantial opportunities for indoor ceiling mounted and wall mounted antennas in enterprise and healthcare sectors, alongside significant investment by telecom operators in tower mounted and rooftop mounted installations to meet escalating data traffic. Together, these regional dynamics shape a nuanced landscape in which localized strategies and regulatory considerations are crucial to market success.

This comprehensive research report examines key regions that drive the evolution of the Wireless Antenna market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Strategies of Leading Manufacturers Emphasize Partnerships Product Innovation and Strategic Alliances to Secure Market Leadership

Leading manufacturers and technology providers in the wireless antenna sector are leveraging strategic partnerships, acquisitions, and joint ventures to strengthen their market positions. Some pioneers have extended their portfolios through collaboration with semiconductor companies, integrating adaptive beamforming chips directly into antenna modules to streamline deployment and improve performance metrics. Meanwhile, other key players are prioritizing in-house research and development initiatives, focusing on next-generation MIMO configurations and intelligent edge-ready antenna systems that incorporate real-time analytics and self-optimizing capabilities.

Beyond product innovation, competitive differentiation is emerging through service offerings such as managed antenna network analytics, remote diagnostics, and lifecycle support programs. Companies are also forging alliances with telecom operators and cloud providers to deliver end-to-end connectivity solutions, encompassing tower mounted hardware, backhaul integration, and orchestration software. As the market advances, agility in navigating component supply constraints, regulatory changes, and shifting end-user demands will remain critical for retaining leadership and driving sustainable growth in this dynamic ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireless Antenna market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- Antenova Ltd

- Comba Telecom Systems Holdings Ltd

- CommScope Holding Company Inc

- Corning Incorporated

- Ericsson AB

- Ezurio formerly Laird Connectivity

- Fractus Antennas SL

- Huawei Technologies Co Ltd

- HUBER+SUHNER AG

- Hughes Network Systems LLC

- JMA Wireless

- Johanson Technology Inc

- Kathrein SE

- KMW Antenna

- Linx Technologies Inc

- Molex LLC

- Murata Manufacturing Co Ltd

- Nokia Corporation

- PCTEL Inc

- PROSE Technologies

- Radio Frequency Systems RFS

- SOLiD Inc

- Taoglas

- TE Connectivity Ltd

Strategic Imperatives for Industry Leaders to Capitalize on Connectivity Trends and Strengthen Supply Chain Agility for Future Success

To capitalize on the evolving wireless antenna landscape, industry leaders should prioritize a series of strategic imperatives. First, accelerating investment in modular antenna architectures will enable rapid customization of beamforming and MIMO solutions to diverse deployment scenarios. Second, cultivating partnerships with domestic material suppliers and semiconductor foundries will reduce tariff exposure and bolster supply chain reliability. Third, integrating analytics and machine learning capabilities into antenna systems will provide operators with predictive maintenance and automated tuning features, optimizing network performance.

Moreover, stakeholders should engage proactively in spectrum policy discussions and industry consortia to influence licensing frameworks and ensure equitable access to emerging bands. Equally important is the development of comprehensive end-to-end connectivity suites in collaboration with cloud and edge-computing providers, enabling seamless integration from antenna hardware through orchestration layers. Finally, fostering a culture of continuous innovation-supported by targeted R&D investments and cross-functional project teams-will empower organizations to respond swiftly to technological advances and shifting market requirements, maintaining a competitive edge in a rapidly evolving industry.

Comprehensive Multistage Research Approach Combines Primary Engagement and Secondary Analysis to Ensure Data Integrity and Insight Depth

This study employs a robust, multistage research framework designed to deliver comprehensive insights and maintain data integrity. Initially, secondary research aggregated information from leading technical journals, patent databases, and regulatory filings to establish a foundational understanding of industry standards, spectrum allocations, and technological roadmaps. Concurrently, a series of primary interviews with network operators, OEM engineers, and procurement specialists validated key trends and uncovered real-world deployment challenges.

Subsequently, quantitative analysis of global installation case studies and procurement patterns provided qualitative depth, illuminating correlations between deployment strategies and performance outcomes. Data triangulation methods, including cross-referencing telemetry data from live networks and supply chain shipment records, ensured the reliability of the findings. Throughout the process, strict quality controls and peer reviews were conducted to uphold the highest standards of accuracy. This methodology underpins the insights presented, offering decision-makers a fact-based narrative of the wireless antenna market’s evolving landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireless Antenna market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireless Antenna Market, by Product Type

- Wireless Antenna Market, by Frequency Band

- Wireless Antenna Market, by Deployment

- Wireless Antenna Market, by Technology

- Wireless Antenna Market, by End-User Industry

- Wireless Antenna Market, by Application

- Wireless Antenna Market, by Region

- Wireless Antenna Market, by Group

- Wireless Antenna Market, by Country

- United States Wireless Antenna Market

- China Wireless Antenna Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesis of Market Dynamics and Strategic Imperatives Underlines the Critical Role of Innovation Collaboration and Policy in Driving Industry Growth

As the wireless antenna market continues to evolve, innovation in product design, deployment strategies, and supply chain management will play pivotal roles in shaping the industry’s trajectory. The confluence of beamforming advancements, higher frequency band utilization, and smart antenna integration signifies a broader shift toward intelligent, adaptive networks capable of supporting the demands of next-generation connectivity. Equally, the impact of trade measures has underscored the importance of supply chain agility and domestic manufacturing partnerships.

Looking ahead, stakeholders who effectively leverage modular architectures, engage in collaborative ecosystem initiatives, and integrate real-time analytics into their solutions will be best positioned to address future market disruptions. The regional nuances and segmentation insights detailed herein emphasize the necessity of tailored strategies, while the recommended actions provide a clear roadmap for navigating competitive pressures. Ultimately, this analysis underscores that success in the wireless antenna space will depend on a synergistic approach, combining technological excellence with strategic foresight and regulatory awareness.

Engage with Ketan Rohom to Unlock In-Depth Insights and Empower Strategic Decisions with the Latest Wireless Antenna Market Intelligence

To explore the full breadth of insights within this comprehensive wireless antenna report and to receive personalized guidance on how these findings can translate into actionable strategies for your organization, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will gain access to tailored briefings that delve into the nuances of product innovations, regional demand shifts, and strategic partnerships uncovered in our research. His expertise will guide you through the report’s implications for your specific use case, ensuring you extract maximum value from the market intelligence provided. Take this opportunity to secure your competitive advantage by leveraging data-driven analyses and forward-looking recommendations. Contact Ketan today to discuss package options, licensing agreements, and collaborative opportunities that align with your business objectives. Your next strategic milestone starts with a conversation-empower your decision-making with unparalleled clarity and confidence.

- How big is the Wireless Antenna Market?

- What is the Wireless Antenna Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?