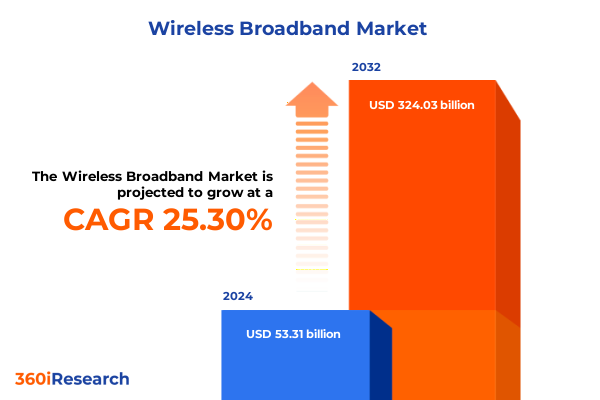

The Wireless Broadband Market size was estimated at USD 67.10 billion in 2025 and expected to reach USD 82.11 billion in 2026, at a CAGR of 25.22% to reach USD 324.03 billion by 2032.

Introduction to the Expanding Wireless Broadband Landscape Highlighting Emerging Technologies Regulatory Dynamics and Market Drivers Fueling Growth

The rapid evolution of digital connectivity has propelled wireless broadband to the forefront of global infrastructure priorities, reshaping how consumers, businesses, and governments interact with digital services. Over the past decade, advancements in network architecture and spectrum management have fostered unprecedented speeds and reliability, laying the groundwork for next-generation applications ranging from immersive virtual reality experiences to mission-critical industrial automation. Moreover, the convergence of consumer demand for high-definition streaming and enterprise requirements for ultra-low latency connectivity has underscored the indispensable role of wireless broadband in supporting economic growth and societal transformation.

In parallel, regulatory bodies around the world have accelerated spectrum allocations and refined licensing frameworks to accommodate burgeoning data traffic. Initiatives such as dynamic spectrum sharing and unlicensed mid-band deployments have emerged to tackle capacity constraints in urban centers and ensure equitable access in underserved communities. Consequently, network operators are recalibrating investment strategies to balance the deployment of fiber backhaul infrastructure with expansive radio access networks. Through strategic partnerships and targeted infrastructure rollouts, the market is poised to deliver more resilient and accessible broadband services across diverse geographies, driving forward a more connected digital ecosystem.

Revolutionary Shifts Redefining Wireless Broadband with 5G Rollouts Spectrum Reallocation and Evolving Consumer Behavior Transforming Connectivity Paradigms

Fundamental shifts in technology paradigms are redefining the contours of wireless broadband, as the mainstream rollout of fifth-generation network platforms ushers in a new era of connectivity capabilities. By harnessing spectrum in millimeter wave frequencies, operators are now delivering multi-gigabit speeds while exploring sub-6 gigahertz allocations to strike an optimal balance between coverage and capacity. Concurrently, innovations such as network slicing have enabled bespoke quality-of-service profiles for distinct use cases, ranging from high-throughput video streaming to ultra-reliable industrial automation.

Furthermore, virtualization trends within the radio access network are dismantling traditional hardware silos, allowing for greater agility in deploying upgrades and scaling capacity dynamically. Edge computing integration is furnishing real-time analytics and content caching closer to end-users, thereby reducing latency and optimizing backhaul utilization. As consumer behavior continues to evolve, with increasing demand for immersive gaming and cloud-based applications, these transformative levers are not only reshaping network design but also catalyzing new business models for service monetization and partnership ecosystems.

Analysis of 2025 United States Tariffs Impact on Wireless Broadband Ecosystem Evaluating Cost Structures Supply Chain Disruptions and Competitive Positioning

Against this backdrop of rapid technological adoption, the cumulative impact of the United States’ 2025 tariff framework is exerting upward pressure on equipment and device costs, compelling stakeholders to reassess supply chain strategies. By imposing additional duties on specific network components and end-user devices, these measures have elevated procurement expenses across network infrastructure, spanning antennas, radios, and core switching equipment. Consequently, operators are absorbing margin contractions in the short term while exploring avenues for localized component manufacturing and alternative sourcing to mitigate cost escalation.

Simultaneously, device manufacturers have begun engineering tariff-resilient production workflows, from modular assembly lines to diversified supplier ecosystems, in order to retain competitive pricing for consumer premises equipment and mobile hotspots. These adaptations, however, require substantial capital investment and prolonged certification processes, which can delay network expansion timelines. Ultimately, the interplay between regulatory trade instruments and industry responses underscores the importance of agile supply chain management and proactive engagement with policy stakeholders to sustain deployment momentum and safeguard service affordability.

Comprehensive Insights into Technology Device Type Frequency Band Deployment Application and End User Segmentation Shaping Wireless Broadband Strategy

A nuanced understanding of market segmentation is critical to identifying growth opportunities and optimizing resource allocation across the wireless broadband value chain. Technological evolution has expanded the spectrum of access standards from legacy 3G UMTS platforms to advanced 4G LTE networks, which themselves are bifurcated into frequency division duplex and time division duplex modes. Layered atop this foundation, fifth-generation deployments span millimeter wave implementations that maximize throughput alongside sub-6 gigahertz variants that ensure comprehensive coverage in diverse deployment scenarios.

From a device perspective, the customer premises equipment landscape is complemented by portable solutions such as mobile hotspots and integrated smartphone modems, each catering to distinct mobility and performance requirements. Likewise, frequency band utilization splits across high-band allocations that drive peak speeds, mid-band spectrum that balances reach and capacity, and low-band resources that penetrate indoor environments and rural terrains. Deployment strategies further delineate fixed wireless access offerings for residential and small office contexts, mobile wireless services powering vehicular and handheld use cases, and nomadic wireless models that blend portability with enhanced performance.

Application-level influences range from fundamental internet access facilitation to specialized Internet of Things connectivity, machine-to-machine communication frameworks, and public safety or emergency service networks, all of which demand differentiated reliability and latency profiles. Finally, end-user verticals-spanning commercial enterprises, government agencies, industrial operations, and residential consumers-exhibit unique adoption curves and service priorities. By harmonizing these segmentation dimensions, stakeholders can architect targeted offerings and prioritize investments that resonate with specific market niches.

This comprehensive research report categorizes the Wireless Broadband market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Device Type

- Frequency Band

- Deployment

- Application

- End-User

Regional Dynamics Driving Wireless Broadband Adoption across the Americas Europe Middle East Africa and Asia Pacific Shaping Global Connectivity Trends

Regional dynamics hold profound implications for wireless broadband deployment priorities and investment trajectories. In the Americas, the United States and Canada have accelerated spectrum auctions and incentivized rural broadband expansion, fostering an environment where both fixed wireless providers and national mobile operators compete to bridge connectivity gaps. This competitive backdrop amplifies capital deployment toward mid-band and unlicensed spectrum initiatives, driving enhancements in coverage quality and overall network resilience.

Transitioning to Europe, the Middle East, and Africa, regulatory harmonization across member states-and cross-boundary considerations in regions such as the Gulf Cooperation Council-facilitates interoperable spectrum frameworks while stimulating competition among incumbents and new market entrants. Sub-Saharan Africa, in particular, leverages increasingly cost-effective infrastructure solutions to tackle underserved populations, whereas Western European markets emphasize densification in urban corridors and private wireless network pilots for industrial clients.

Across Asia-Pacific, China’s aggressive deployment of expansive sub-6 gigahertz networks coexists with Japan’s pioneering trials of millimeter wave architectures and Australia’s pursuit of fixed wireless remedies to complement national fiber rollouts. Additionally, emerging economies in Southeast Asia and India are implementing targeted subsidy programs and public-private partnerships to expand access, recognizing wireless broadband as a pivotal enabler for digital transformation and socio-economic inclusion.

This comprehensive research report examines key regions that drive the evolution of the Wireless Broadband market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Overview of Leading Wireless Broadband Companies Innovations Partnerships and Competitive Tactics Driving Market Evolution and Industry Leadership

The competitive landscape in wireless broadband is characterized by a blend of established network operators, innovative infrastructure suppliers, and emerging service providers. Leading communications companies have accelerated next-generation rollouts by forging partnerships with equipment manufacturers to co-develop Open RAN solutions, enabling them to reduce vendor lock-in and foster cost efficiencies. At the same time, satellite and remote-access specialists have introduced hybrid fixed wireless and satellite packages that extend broadband reach into historically underserved areas, challenging traditional terrestrial incumbents.

Equipment vendors have responded to shifting demand profiles by diversifying their portfolios across core, transport, and RAN segments. Some have prioritized software-defined networking and cloud-native architectures to support virtualization initiatives, while others leverage proprietary radio designs to capture millimeter wave market share. In parallel, chipset and semiconductor leaders are embedding advanced modulation techniques and power-amplifier innovations to enable higher spectral efficiency and lower energy consumption in both network elements and consumer devices.

New market entrants are harnessing flexible financing models and local rollout expertise to secure spectrum assets and deliver tailored solutions to enterprise and public sector clients. This dynamism underscores an industry in flux, as each category of stakeholder seeks to differentiate through service quality, pricing agility, and integrated managed solutions that address the full spectrum of connectivity, security, and operational management requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireless Broadband market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airspan Networks Inc.

- AT&T Inc.

- Blu Wireless Technology Limited

- Cambium Networks Corporation

- China Mobile Limited

- Cisco Systems, Inc.

- CommScope Holding Company, Inc.

- Deutsche Telekom AG

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Mimosa Networks, Inc. (a Radwin company)

- Nokia Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Siklu Communication Ltd.

- T-Mobile US, Inc.

- Telefonaktiebolaget LM Ericsson

- Ubiquiti Inc.

- Verizon Communications Inc.

- ZTE Corporation

Insightful Recommendations for Wireless Broadband Industry Leaders to Leverage Technology Trends Optimize Investments and Navigate Geopolitical Complexities

Industry leaders should prioritize mid-band spectrum acquisitions and deployments, given this range’s balance of coverage and capacity, to unlock the full potential of enhanced mobile broadband services. It is essential to accelerate investments in network virtualization frameworks and edge computing platforms to deliver low-latency experiences for applications such as autonomous vehicles, augmented reality, and real-time industrial control. By doing so, organizations can differentiate their offerings and capture new revenue streams aligned with enterprise digitalization trends.

Moreover, executives should work closely with supply chain partners to develop tariff mitigation strategies, including dual-sourcing agreements and regional manufacturing alliances, to minimize exposure to trade policy volatility. In parallel, embracing open architecture principles through Open RAN and disaggregated network designs will foster a competitive vendor ecosystem and streamline capital outlays. Directors should also consider strategic collaborations with cloud providers and system integrators to co-create managed services bundles, thereby catering to the growing demand for turnkey connectivity solutions.

Finally, reinforcing public safety network capabilities and expanding IoT-centric platforms will position organizations to support critical infrastructure modernization and smart city initiatives. By aligning strategic planning with regulatory trajectories and end-user application requirements, wireless broadband stakeholders can fortify market positioning and drive sustainable growth.

Rigorous Research Methodology Leveraging Primary Interviews Secondary Data Triangulation and Statistical Analysis to Ensure Credibility in Wireless Broadband

This research draws upon a rigorous methodology that combines primary interviews with senior executives, network architects, and policy experts alongside comprehensive secondary data analysis. Primary engagements were conducted through in-depth discussions to validate emerging trends, untangle regulatory developments, and ascertain strategic priorities directly from decision-makers across carriers, equipment providers, and enterprise end-users. These qualitative insights were complemented by an extensive review of licensing filings, tariff regulations, and corporate disclosures to establish a robust factual foundation.

To ensure accuracy and mitigate bias, data points were cross-validated through triangulation, juxtaposing vendor reports, independent financial statements, and publicly available spectrum auction results. Quantitative analyses employed statistical techniques to identify correlations between spectrum allocation patterns and network performance metrics, while qualitative assessments examined the influence of consumer adoption curves and application-specific service requirements. An iterative peer-review process with subject-matter specialists further reinforced the credibility of findings and refined the interpretive frameworks applied across segmentation and regional analyses.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireless Broadband market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireless Broadband Market, by Technology

- Wireless Broadband Market, by Device Type

- Wireless Broadband Market, by Frequency Band

- Wireless Broadband Market, by Deployment

- Wireless Broadband Market, by Application

- Wireless Broadband Market, by End-User

- Wireless Broadband Market, by Region

- Wireless Broadband Market, by Group

- Wireless Broadband Market, by Country

- United States Wireless Broadband Market

- China Wireless Broadband Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives Synthesizing Key Insights from Technological Evolution Regulatory Dynamics and Market Trends to Guide Future Wireless Broadband

As the wireless broadband landscape continues to evolve under the influence of technological innovation, regulatory adjustments, and global trade dynamics, stakeholders must remain agile and forward-looking. The advent of diverse spectrum utilization strategies, combined with new architectural paradigms like network slicing and virtualization, presents both opportunities and complexities. Tariff environments, while creating short-term cost pressures, also catalyze supply chain resilience initiatives and encourage localized manufacturing investments.

By synthesizing segmentation insights across technology standards, device types, deployment models, application domains, and end-user verticals, organizations can calibrate their strategic roadmaps to serve targeted market niches more effectively. Meanwhile, regional considerations-from the robust 5G rollouts in North America to the harmonized spectrum frameworks in Europe and the aggressive fixed wireless expansions in Asia-Pacific-underscore the need for tailored engagement strategies. Ultimately, companies that embrace open ecosystems, invest in mid-band capacity, and prioritize flexible supply chains will be best positioned to capitalize on the next wave of wireless broadband advancements.

Immediate Call To Action Engage with Ketan Rohom to Acquire In-Depth Wireless Broadband Market Research Delivering Strategic Insights to Drive Business Growth

To explore the full breadth of insights uncovered in this research and secure a competitive advantage in the dynamic wireless broadband domain, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Drawing upon deep market intelligence and an understanding of evolving technology trends, he can guide your organization through tailored solutions that address strategic planning, investment prioritization, and go-to-market acceleration. Reach out today to gain immediate access to the comprehensive report, enabling informed decision-making and positioning your leadership team at the forefront of the next wave of broadband innovation

- How big is the Wireless Broadband Market?

- What is the Wireless Broadband Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?