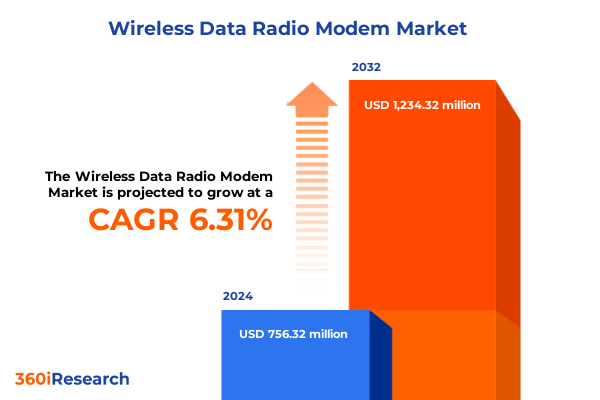

The Wireless Data Radio Modem Market size was estimated at USD 794.32 million in 2025 and expected to reach USD 834.69 million in 2026, at a CAGR of 6.49% to reach USD 1,234.32 million by 2032.

Exploring the Pivotal Role of Wireless Data Radio Modems in Enabling Resilient and Scalable Connectivity for Modern Enterprise and Industrial Networks

Wireless data radio modems have emerged as foundational enablers of real-time, reliable connectivity across a diverse array of applications, from industrial automation to mission-critical utility networks. By bridging gaps where wired infrastructure is impractical or cost-prohibitive, these devices facilitate the seamless exchange of telemetry and control data, underpinning the functionality of modern smart systems. As organizations pursue digital transformation, the need for resilient, long-range communication has driven continuous innovation in modem hardware, firmware, and network integration approaches.

With the proliferation of IoT deployments across manufacturing, energy, transportation, and defense sectors, demand for low-power, wide-area connectivity solutions has surged. Enterprises seek modems capable of supporting variable data rates and diverse network environments while ensuring regulatory compliance and cybersecurity. The advent of cellular-based modems leveraging LPWAN and 5G technologies has expanded the possibilities for scalable, high-throughput wireless links, transcending the limitations of legacy narrowband systems.

Against this backdrop, understanding the evolving capabilities and strategic value of wireless data radio modems is essential for technology leaders and decision-makers. This report provides a comprehensive exploration of how these devices are being integrated into critical infrastructures, the technological advances shaping their development, and the competitive landscape driving market dynamics. As we embark on our analysis, readers will gain a clear view of the state of the industry and the forces propelling future growth.

Transformative Advances Are Reshaping Wireless Data Radio Modem Technology with 5G Innovation, Spectrum Sharing, and Emerging 6G Visions Forging New Paths

The landscape of wireless data radio modems has undergone transformative shifts driven by spectrum sharing innovations and the rapid evolution of cellular technologies. A prime example of dynamic spectrum sharing is the Citizens Broadband Radio Service (CBRS) in the 3.5 GHz band, which has enabled over 400,000 active devices nationwide as of mid-2024 by leveraging automated Spectrum Access Systems to balance incumbent protection with commercial deployments. Beyond conventional licensed allocations, CBRS demonstrates how shared spectrum models can unlock mid-band frequencies for private networks, rural broadband, and enterprise applications with lower entry barriers than traditional auctions.

Parallel to spectrum sharing, the acceleration of 5G adoption continues to reshape modem capabilities and deployment strategies. By the end of 2023, global 5G connections reached 1.6 billion and are projected to constitute over half of all mobile connections by 2029, highlighting the rapid penetration of high-performance wireless networks. These developments have driven modem manufacturers to integrate advanced cellular chipsets supporting ultra-low latency, network slicing compatibility, and enhanced security frameworks. Looking ahead, early research on 6G promises even greater data rates and ubiquitous coverage, signaling further shifts in device design and network architecture.

In conjunction with cellular advances, the ecosystem of equipment vendors, SAS administrators, and certified installers for shared spectrum deployments has grown exponentially. CBRS alone supports nearly 900 General Authorized Access operators and over 40 equipment vendors offering more than 187 base station models. This diversified supplier landscape fosters innovation and competition, resulting in modular, software-defined modems that can be tailored to specific use cases and seamlessly updated over the air. As enterprises increasingly demand turnkey wireless solutions, the convergence of spectrum flexibility, cellular breakthroughs, and ecosystem collaboration marks a pivotal shift in how organizations approach wide-area connectivity.

Assessing the Cumulative Impact of 2025 United States Tariff Changes on Wireless Data Radio Modem Supply Chains, Cost Structures, and Manufacturer Strategies

Throughout 2025, a series of U.S. trade actions has significantly influenced the supply chains and cost structures of wireless data radio modems. On January 1, the tariff rate for semiconductors classified under HTS headings 8541 and 8542 doubled from 25 percent to 50 percent, directly impacting modem chipsets and associated electronic components. This adjustment elevated manufacturing costs for cellular and ISM-band modules, prompting many suppliers to reassess sourcing strategies and explore local or alternate supply sources to mitigate margin pressures.

Adding complexity to the trade environment, reciprocal tariffs on China-origin goods surged to 125 percent on April 9, 2025 before a rapid policy shift following a Geneva trade meeting on May 12, which rolled back reciprocal tariffs to 10 percent on most Chinese imports while retaining existing Section 301 and Section 232 levies. These oscillations introduced uncertainty into procurement cycles, forcing product planners to navigate fluctuating duty rates and secure components ahead of potential increases.

Amid these fluctuations, the Office of the U.S. Trade Representative extended certain exclusions from China Section 301 tariffs through August 31, 2025, providing temporary relief for specified technology products but leaving broader semiconductor levies intact. In response, leading modem developers have accelerated implementation of agile tariff engineering practices, including redesigning bills of materials, pursuing tariff classification reviews, and leveraging free trade agreements. As these measures take effect, the cumulative impact of 2025 tariff changes underscores the critical need for proactive supply chain management and collaborative engagement with trade advisors to sustain competitive product offerings.

Revealing Critical Insights from Comprehensive Wireless Data Radio Modem Market Segmentation Across Installations, Components, Frequency Bands, Networks, Data Rates, and End Users

A nuanced understanding of the wireless data radio modem market emerges by examining its core segmentation dimensions, each defining distinct requirements and value propositions. When considering installation parameters, fixed installations generally prioritize high-power, long-range radio links for infrastructure backhaul or utility SCADA applications, whereas mobile installations demand compact, shock-resistant modems optimized for vehicular or asset-tracking use.

Component segmentation further refines market insight: hardware encompasses the radio front-end, transceiver, and antenna assemblies; services cover integration, installation, and ongoing support; software includes management platforms that enable configuration, monitoring, and protocol-stack processing. Within software offerings, management solutions facilitate remote firmware updates and diagnostic analytics, while protocol stacks ensure compliance with cellular, LoRaWAN, or proprietary radio standards.

Analyzing the frequency-band lens reveals that licensed segments deliver predictable performance and interference protection. Within licensed, sub-1 GHz bands serve long-range, low-data-rate scenarios, 1–6 GHz bands accommodate mid-range broadband, and mmWave bands achieve ultra-high throughput for urban hotspots. Conversely, unlicensed 2.4 GHz and 5 GHz frequencies enable cost-effective deployments for private networks and IoT edge devices without licensing fees.

The market also bifurcates by network type: cellular modems support 4G LTE, 5G, and LPWAN protocols such as LoRaWAN and NB-IoT, satellite modems provide global coverage for remote sites, and terrestrial radio modems deliver point-to-point or mesh connectivity in challenging terrains.

Performance demands split into high-speed, medium-speed, and low-speed categories, each aligned to applications from broadband video transmission and real-time surveillance to basic sensor telemetry. Finally, end users span consumer electronics, energy and utilities, government and defense, manufacturing, oil and gas, telecommunications, and transportation and logistics, demonstrating the pervasive role of modems across industries seeking reliable wireless data links.

This comprehensive research report categorizes the Wireless Data Radio Modem market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Installation

- Component

- Frequency Band

- Network Type

- Data Rate

- End User

Uncovering Regional Dynamics Driving Wireless Data Radio Modem Adoption across the Americas, Europe Middle East Africa, and Asia-Pacific's Rapid Digital Transformation

Regional dynamics in the wireless data radio modem market reflect varying adoption drivers and regulatory landscapes. In the Americas, robust investment in smart grid modernization and precision agriculture has fueled demand for long-range, fixed wireless modems, while the proliferation of private LTE and CBRS networks has spurred growth in mid-band cellular solutions. U.S. enterprises leverage mature LPWAN ecosystems and extensive spectrum-sharing frameworks to deploy resilient IoT networks in manufacturing plants, warehouses, and rural utilities, underscoring the region’s leadership in pragmatic wireless innovations.

Europe, the Middle East, and Africa exhibit a diverse regulatory tapestry, where the European Union’s spectrum harmonization efforts and directives for critical infrastructure have accelerated private 5G and unlicensed band deployments. Utility companies in EMEA increasingly adopt ruggedized terrestrial radio modems for SCADA modernization, while satellite modems bridge connectivity gaps in remote Middle Eastern and African regions. Collaborative initiatives among regulators, network operators, and industrial consortia are driving tailored solutions that balance performance, security, and cost-effectiveness.

In the Asia-Pacific region, rapid industrialization and expansive urbanization have positioned it as the fastest-growing market for wireless data radio modems, with major economies such as China, India, and Japan investing heavily in smart city infrastructure and Industry 4.0 automation. Government-backed digital inclusion programs prioritize rural broadband and IoT connectivity, elevating demand for versatile, low-power wide-area modems. This dynamic environment, characterized by high innovation rates and a large vendor ecosystem, underscores Asia-Pacific’s emerging dominance in the global wireless modem narrative.

This comprehensive research report examines key regions that drive the evolution of the Wireless Data Radio Modem market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Driving Innovation and Consolidation in the Wireless Data Radio Modem Sector through Strategic Acquisitions, Partnerships, and Product Excellence

Innovation and consolidation continue to define the competitive landscape of wireless data radio modems. In a landmark 2023 transaction, Semtech Corporation completed its acquisition of Sierra Wireless for approximately USD 1.2 billion, integrating ultra-low-power LoRa solutions with cellular IoT cloud services to form a comprehensive connectivity platform and expand its market opportunity by an estimated tenfold by 2027. This consolidation underscores the strategic imperative for companies to offer end-to-end solutions that blend diverse technologies for scalable IoT deployments.

Meanwhile, emerging entrants such as 5Gstore have revitalized legacy brands by acquiring Ericsson’s router division and reclaiming the Sierra Wireless name, signaling a market appetite for trusted solutions with deep-rooted customer loyalty. These moves reflect a broader trend of repositioning established brands to cut through market confusion and reinforce quality assurances.

Legacy players like Digi International showcased their latest ConnectCore 91 system-on-modules and XBee 3 Global LTE Cat 4 smart modems at electronica 2024, highlighting the importance of seamless edge-to-cloud integration and remote management capabilities via cloud services. Such product innovations, coupled with partnerships between modem manufacturers and major cellular carriers and chipset providers, are fostering interoperability and accelerating time-to-market for customized solutions.

As large original equipment manufacturers and niche specialists continue to pursue acquisitions, alliances, and product differentiation, market leaders are focusing on enhancing security features, streamlining device management, and expanding multi-network compatibility. These strategic initiatives are pivotal in meeting the evolving demands of enterprise, industrial, and infrastructure customers seeking resilient wireless connectivity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireless Data Radio Modem market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- Arada Systems, Inc

- CalAmp Corp.

- Campbell Scientific Inc.

- Cohda Wireless Pty Ltd

- Digi International Inc.

- Fibocom Wireless Inc.

- Huawei Technologies Co., Ltd.

- Multi-Tech Systems, Inc.

- Quectel Wireless Solutions Co., Ltd.

- Schneider Electric SE

- Sierra Wireless, Inc.

- Thales S.A.

- u-blox Holding AG

Actionable Recommendations for Industry Leaders to Navigate Emerging Opportunities, Optimize Supply Chains, and Capitalize on Wireless Data Radio Modem Market Shifts

To thrive amid rapid technological and regulatory changes, industry leaders should prioritize flexible modular designs that support multi-band operation and over-the-air firmware updates to extend device lifecycles and reduce field maintenance costs. Establishing strategic supplier partnerships and diversifying component sources will mitigate tariff-related risks and ensure continuity of supply in volatile trade environments.

Investing in software ecosystems that bundle management platforms and analytics services can create differentiated value propositions. By offering turn-key solutions that integrate device provisioning, network optimization, and predictive maintenance capabilities, vendors can capture higher service revenues and deepen customer loyalty.

Moreover, active engagement in spectrum-sharing initiatives and private network trials, such as CBRS deployments and localized unlicensed band pilots, will position companies as trusted partners for enterprises seeking bespoke connectivity. Collaboration with standards bodies and industry consortia will influence future regulatory frameworks and facilitate early access to emerging frequency bands, including those earmarked for 6G trials.

Finally, adopting customer-centric go-to-market strategies that include demonstration labs, proof-of-concept programs, and flexible subscription models will accelerate adoption in sectors like utilities, transportation, and manufacturing. These actionable steps will empower organizations to harness the full potential of wireless data radio modems in an increasingly connected world.

Comprehensive Research Methodology Detailing Rigorous Data Collection, Expert Consultations, and Analytical Frameworks Underpinning the Wireless Data Radio Modem Study

This study integrates a comprehensive mix of primary and secondary research methodologies to ensure robust, reliable insights. Secondary data sources encompass industry publications, technical standards documents, regulatory filings from the FCC and USTR, and expert analyses from IEEE Spectrum and NTIA reports. These sources provided quantitative data on spectrum usage, deployment counts, and technology trends.

Primary research included in-depth interviews with key stakeholders, including network operators, system integrators, and leading modem manufacturers. These discussions validated secondary findings, elucidated emerging customer requirements, and surfaced qualitative insights on innovation drivers and operational challenges.

Further, supply chain assessments leveraged trade data from the U.S. International Trade Commission and customs statistics to map the impact of tariff changes on component sourcing. Competitive benchmarking was performed by analyzing company financial reports, press releases, and acquisition filings to identify strategic priorities and market positioning.

Analytical frameworks employed SWOT analysis, Porter’s Five Forces, and scenario planning to evaluate market attractiveness, vendor dynamics, and regulatory developments. Throughout the research process, data triangulation ensured consistency and accuracy in reporting key trends, segmentation insights, and regional variations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireless Data Radio Modem market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireless Data Radio Modem Market, by Installation

- Wireless Data Radio Modem Market, by Component

- Wireless Data Radio Modem Market, by Frequency Band

- Wireless Data Radio Modem Market, by Network Type

- Wireless Data Radio Modem Market, by Data Rate

- Wireless Data Radio Modem Market, by End User

- Wireless Data Radio Modem Market, by Region

- Wireless Data Radio Modem Market, by Group

- Wireless Data Radio Modem Market, by Country

- United States Wireless Data Radio Modem Market

- China Wireless Data Radio Modem Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Observations on How Wireless Data Radio Modems Are Positioned to Transform Connectivity Landscapes Amidst Technological and Regulatory Evolutions

In conclusion, wireless data radio modems stand at the intersection of critical infrastructure modernization and digital transformation. The convergence of spectrum-sharing models like CBRS, the maturation of 5G networks, and the promise of future 6G advancements have collectively elevated the role of modems in enabling resilient, scalable connectivity across industries.

Meanwhile, geopolitical and trade policy developments have underscored the importance of agile supply chain strategies and proactive tariff management. Market leaders are responding with M&A activity, product innovation, and strategic collaborations to deliver comprehensive, future-proof solutions.

As organizations navigate this evolving landscape, the insights presented herein provide a blueprint for understanding key segmentation dynamics, regional growth drivers, and competitive priorities. By leveraging these findings, stakeholders can make informed decisions that align technological capabilities with business objectives, ensuring reliable data flow and operational continuity in an increasingly connected world.

Take the Next Step to Secure Your Competitive Edge by Contacting Ketan Rohom for the Ultimate Wireless Data Radio Modem Market Research Solutions

Ready to gain unparalleled insights into the wireless data radio modem market and position your organization for strategic growth, reach out today to secure your comprehensive report. Our detailed analysis covers the most critical trends, segmentation insights, and regional dynamics that will inform your next moves.

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who is poised to guide you through the breadth and depth of our findings. His expertise ensures you obtain the tailored market intelligence needed to make confident, data-driven decisions. Contact him now to discuss how our report can provide the clarity and strategic advantage your team requires.

- How big is the Wireless Data Radio Modem Market?

- What is the Wireless Data Radio Modem Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?