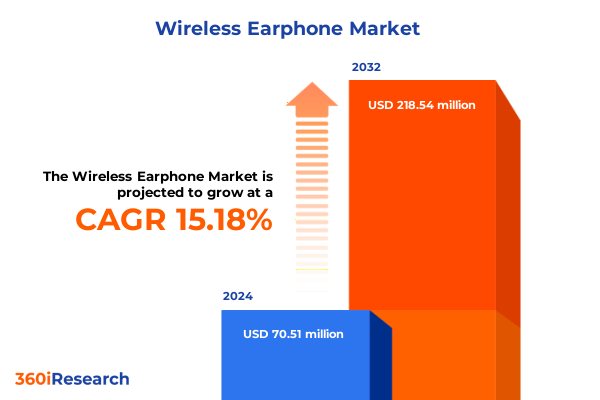

The Wireless Earphone Market size was estimated at USD 80.33 million in 2025 and expected to reach USD 97.16 million in 2026, at a CAGR of 15.37% to reach USD 218.54 million by 2032.

Mapping the Rapid Evolution and Consumer Behavior Drivers Transforming the Wireless Earphone Market into a Core Lifestyle and Productivity Accessory

The wireless earphone sector has undergone a remarkable transformation over the past decade, evolving from niche audiophile gear into a ubiquitous accessory integral to modern lifestyles. This shift has been driven by the widespread removal of the 3.5 millimeter audio jack from nearly all flagship smartphones, which has effectively rendered wired solutions obsolete in premium segments and catalyzed consumer migration toward wireless alternatives. At the same time, the proliferation of hybrid work models and the rise of digital media consumption have elevated demand for devices that offer both convenience and performance in diverse environments.

Moreover, consumers today expect earphones to deliver rich, immersive audio alongside seamless connectivity and portability. The integration of advanced codecs, such as Qualcomm aptX Lossless and Sony LDAC, has enabled CD-quality streaming over Bluetooth, satisfying even the most discerning audiophiles without the physical constraints of cables. Concurrently, active noise cancellation (ANC) technologies have become a standard feature rather than a luxury, responding to the need for focused listening spaces within bustling urban landscapes and open-plan offices.

As a result, wireless earphones have transcended their original role in music playback to become multifunctional tools for communication, fitness monitoring, and immersive gaming experiences. This convergence of lifestyle and productivity applications underscores the urgency for manufacturers and stakeholders to stay attuned to evolving consumer expectations and technology advancements that continue to reshape the market’s trajectory.

Identifying the Pivotal Technological and Market Shifts Redefining Wireless Earphone Performance Connectivity and User Experience in 2025

Throughout 2025, several pioneering technological developments have collectively redefined the performance and user experience of wireless earphones. One of the most significant shifts involves the emergence of Bluetooth LE Audio and Auracast, which together offer enhanced energy efficiency, multi-stream audio capabilities, and the ability to broadcast a single audio source to multiple devices simultaneously. This innovation not only extends battery life but also introduces novel shared listening experiences in public and professional settings.

Simultaneously, the second generation of adaptive noise cancellation (ANC 2.0) is leveraging artificial intelligence to dynamically tailor noise suppression levels in real time, responding to changing ambient conditions without manual intervention. These AI-driven algorithms optimize the listening environment by continuously analyzing and counteracting environmental noise patterns, delivering superior immersion across a spectrum of use cases, from public transit commutes to open-office collaboration zones.

Emerging features such as spatial audio with head tracking have further elevated user engagement by creating a three-dimensional soundstage that mirrors natural listening experiences. This technology not only enriches entertainment consumption but also unlocks new dimensions in mobile gaming and virtual collaboration by providing precise audio localization cues. Concurrently, the integration of biometric sensors within earbud housings-capable of monitoring heart rate, body temperature, and other physiological metrics-has positioned wireless earphones as credible fitness and wellness platforms, replacing standalone wearables for many active consumers.

Moreover, advancements in battery chemistry and charging technologies are dramatically reducing downtime, with ultra-fast charging capabilities now delivering several hours of playback from just a few minutes of power input. AI-driven voice and gesture controls have likewise matured, offering hands-free management of audio playback, call functions, and contextual suggestions without the need for touch-based commands. Together, these transformative shifts are forging a new paradigm in which wireless earphones serve as comprehensive audio and health companions rather than mere accessories.

Understanding the Aggregate Consequences of New US Import Tariffs Introduced in 2025 on Wireless Earphone Supply Chains Pricing and Market Strategies

In early April 2025, the U.S. government enacted a blanket 10% tariff on imports of consumer electronics originating from key manufacturing hubs, triggering immediate repercussions across the wireless earphone supply chain. This tariff structure was subsequently paired with reciprocal duties, cumulatively impacting shipments at each stage of production-from raw materials and component fabrication to final assembly and retail distribution. As a result, manufacturers and distributors have been confronting layered cost increases that manifest as sticker price adjustments for consumers.

Leading audio brands have publicly acknowledged the financial strain imposed by these trade barriers. During its spring earnings call, Apple disclosed that global tariffs could elevate its operational costs by approximately $900 million in the April through June quarter, a figure that underscores the tangible impact of import duties on supply-chain economics even for industry giants with diversified manufacturing footprints. While Apple’s strategic shift toward regional assembly hubs in India and Vietnam has mitigated some exposure, most high-volume consumer electronics firms remain vulnerable to tariff-related cost pass-throughs given the concentration of their component sourcing in China.

Furthermore, smaller and mid-tier headphone manufacturers have limited flexibility to absorb these incremental expenses, often facing a stark choice between eroding profit margins or increasing retail prices. Amid these conditions, many companies have been forced to reevaluate their vendor relationships and logistics corridors, seeking alternative production locales or negotiating more favorable terms to counteract tariff pressure. Retailers and consumers alike have responded with heightened price sensitivity, accelerating purchase decisions ahead of anticipated cost increases while simultaneously weighing second-hand and refurbished options more heavily than before.

Unpacking Comprehensive Market Segmentation Insights Across Product Types Connectivity Options Technologies Battery Durations Distribution Channels and End Users

The wireless earphone landscape is shaped by a rich tapestry of product type variations, featuring streamlined neckband models that offer extended battery life as well as truly wireless designs celebrated for their desktop-free convenience. Connectivity protocols range from legacy Bluetooth 4.2 to the latest Bluetooth 5.1 implementations, ensuring a spectrum of performance trade-offs between range, stability, and power efficiency. In parallel, audio technologies diverge between active noise cancellation systems, which employ real-time signal processing to suppress unwanted sounds, and passive noise isolation techniques, relying on ergonomic ear tip and enclosure designs to physically block ambient noise.

End-use applications further segment the market, as devices tailored for voice calling prioritize microphone clarity and wind noise rejection, whereas fitness-oriented models integrate secure ear clips and sweat-resistant coatings to accommodate rigorous workouts. Gaming-focused earphones, subdivided into console and PC variants, emphasize low-latency audio pathways and surround-sound emulation for immersive gameplay experiences. Music enthusiasts, on the other hand, frequently seek hi-fi tuning and customizable equalization curves, underscoring the diversity of user requirements.

Battery life distinctions have become a critical differentiator, as some earphones promise under six hours of continuous playback to maintain ultra-compact form factors, while others exceed twelve hours to support all-day listening. Distribution channels reflect evolving consumer purchasing behaviors, encompassing traditional offline outlets like retail and specialty stores alongside direct-to-consumer online platforms and e-commerce marketplaces. Finally, end-user categories span commercial deployments in corporate and hospitality environments, recreational use by consumers, and specialized sports applications in gym and running contexts. This multifaceted segmentation underscores the imperative for manufacturers to align product development and marketing initiatives with the nuanced demands of each cohort.

This comprehensive research report categorizes the Wireless Earphone market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity Type

- Technology

- Application

- Battery Life

- Distribution Channel

- End User

Delineating Regional Variations and Strategic Growth Dynamics Across the Americas Europe Middle East Africa and Asia-Pacific in the Wireless Earphone Ecosystem

In the Americas, the wireless earphone market benefits from a mature consumer base with high disposable incomes and entrenched brand loyalty. Premium innovations such as adaptive noise cancellation and spatial audio have rapidly permeated urban centers across the United States and Canada, while tariff-driven price adjustments have heightened purchase urgency among budget-conscious shoppers. Conversely, Latin American markets exhibit strong demand for value-oriented models as local economies balance broad smartphone adoption with pricing constraints.

Across Europe, the Middle East, and Africa (EMEA), regional dynamics are influenced by diverse regulatory frameworks and shifting manufacturing geographies. The European Union’s emphasis on sustainability and electronic waste directives has spurred companies to prioritize modular designs and recyclable materials within their earphone portfolios. Meanwhile, Middle Eastern markets are experiencing a surge in luxury-positioned audio devices aligned with affluent consumer segments, and African nations are exploring low-cost, durable options to meet increasing mobile connectivity without compromising essential features.

Asia-Pacific stands out as the fastest-growing region for wireless earphones, driven by rising smartphone penetration, escalating urbanization, and strong local manufacturing capabilities. Brands from China, South Korea, and Japan are leveraging regional supply-chain synergies to introduce competitively priced models with advanced features such as Bluetooth 5.1 connectivity and AI-powered noise cancellation. Meanwhile, emerging Southeast Asian economies are embracing wearable audio as part of broader digital lifestyle trends, positioning this region at the forefront of innovation adoption and market expansion.

This comprehensive research report examines key regions that drive the evolution of the Wireless Earphone market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Moves Competitive Differentiators and Innovation Roadmaps of Leading Wireless Earphone Manufacturers and Emerging Market Entrants

Major industry stalwarts continue to set the bar for innovation and market presence. Apple’s AirPods series, underpinned by proprietary H2 chip advancements, demonstrate seamless integration with iOS ecosystems and robust active noise cancellation performance. Sony maintains its leadership through the WH-1000XM lineup, featuring class-leading signal processors that optimize ambient noise suppression. Bose persists as an ANC pioneer, with its QuietComfort Ultra models delivering enhanced comfort and adaptive noise management in dynamic environments. Samsung, leveraging Harman Kardon technology within its Galaxy Buds series, distinguishes itself through ecosystem synergy and feature parity across Android devices.

Concurrently, specialist audio companies such as Sennheiser and Audio-Technica reinforce their positions through audiophile-focused tuning and professional-grade build quality. These niche players cater to dedicated listeners who prioritize sound fidelity over mass-market features. At the same time, emerging entrants from Asia, including Huawei and Xiaomi, are disrupting traditional price-performance benchmarks by offering AI-enhanced noise cancellation and high-resolution audio at midrange price points. This strategy has enabled them to capture a meaningful share of the market previously dominated by legacy brands, illustrating the intensifying competition within the wireless earphone segment.

Additionally, a growing cohort of boutique manufacturers is gaining traction through bespoke designs and limited-edition releases, appealing to enthusiasts seeking personalized aesthetics and artisanal craftsmanship. These diverse competitive landscapes underscore the ongoing imperative for established and new-entry firms alike to differentiate through technological leadership, brand experience, and strategic partnerships that resonate with evolving consumer preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireless Earphone market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Boat by Imagine Marketing Services Pvt. Ltd.

- Bose Corporation

- Boult Audio

- GN Store Nord A/S

- Koninklijke Philips N.V.

- Noise by Nexxbase Marketing Pvt Ltd.

- S K ENTERPRISES

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Xiaomi Corporation

Presenting Actionable Strategic Recommendations for Industry Leaders to Navigate Disruption Capitalize on Innovation and Sustain Competitive Advantage

Industry leaders should prioritize supply-chain diversification to mitigate the impact of future trade policies, exploring manufacturing alternatives in regions such as Southeast Asia and Mexico. By establishing flexible vendor networks and dual-sourcing strategies, companies can safeguard cost structures and maintain production continuity in the face of geopolitical shifts.

Simultaneously, investing in next-generation connectivity standards like Bluetooth LE Audio and Auracast will enhance device interoperability and energy efficiency. Firms that collaborate with chipset providers to integrate low-power, multi-stream capabilities will gain a competitive edge by offering differentiated user experiences that align with shared listening scenarios and extended battery requirements.

To capture segment-specific opportunities, companies should accelerate research and development efforts in AI-driven active noise cancellation, spatial audio rendering, and biometric health monitoring. These feature sets can be tailored to distinct consumer cohorts-such as fitness enthusiasts, remote workers, and gamers-by aligning technical roadmaps with clearly defined use cases.

Moreover, expanding regional penetration through targeted partnerships with local distributors and leveraging e-commerce platforms will enable rapid market entry and scalable distribution. Emphasizing sustainability initiatives, such as modular repair programs and recyclable packaging, can also strengthen brand reputation in markets with stringent environmental regulations. Lastly, cultivating seamless integration with leading mobile and wearable ecosystems through strategic alliances will reinforce product stickiness and foster long-term customer loyalty.

Detailing Rigorous Research Methodology Employed to Gather Comprehensive Market Data and Validate Insights for the Wireless Earphone Industry Analysis

This analysis is grounded in a multi-layered research methodology combining comprehensive primary and secondary data collection. Primary research involved detailed interviews with senior executives of leading earphone manufacturers, component suppliers, and distribution partners to capture firsthand perspectives on market dynamics and strategic priorities.

Secondary research leveraged a wide range of industry publications, corporate financial disclosures, regulatory filings, and trade association reports to validate market trends and contextualize technical advancements. Proprietary databases and patent filings were also consulted to track innovation trajectories, while public sentiment analysis provided insights into consumer preferences and emerging use-case scenarios.

Quantitative data was triangulated using shipment figures, import-export records, and retail sales metrics to ensure robustness, whereas qualitative findings were cross-verified through expert panel discussions and advisory board reviews. The integration of these diverse research streams underpinned an iterative validation process, guaranteeing that final insights reflect the current state of the wireless earphone industry and anticipate near-term developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireless Earphone market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireless Earphone Market, by Product Type

- Wireless Earphone Market, by Connectivity Type

- Wireless Earphone Market, by Technology

- Wireless Earphone Market, by Application

- Wireless Earphone Market, by Battery Life

- Wireless Earphone Market, by Distribution Channel

- Wireless Earphone Market, by End User

- Wireless Earphone Market, by Region

- Wireless Earphone Market, by Group

- Wireless Earphone Market, by Country

- United States Wireless Earphone Market

- China Wireless Earphone Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Strategic Takeaways to Guide Stakeholders Through The Evolving Wireless Earphone Market and Emerging Opportunities

In summary, the wireless earphone market has ascended from a niche segment to a cornerstone of contemporary audio consumption, propelled by smartphone design shifts, hybrid work behaviors, and consumer demand for immersive sound experiences. Technological breakthroughs-ranging from Bluetooth LE Audio and AI-driven noise cancellation to biometric health features-are redefining device capabilities and expanding addressable use cases.

However, the landscape remains complex, with 2025 trade policies introducing new cost considerations that reverberate across global supply chains. Market segmentation is increasingly granular, encompassing variations in form factor, connectivity standards, noise management approaches, battery endurance, distribution frameworks, and end-user requirements. Regional patterns further underscore the need for adaptive strategies, as mature Western markets, regulatory-driven EMEA environments, and high-growth Asia-Pacific economies each present distinct challenges and opportunities.

Against this backdrop, leading companies must refine their innovation roadmaps, diversify sourcing models, and cultivate partnerships that enhance both technical differentiation and operational resilience. By aligning strategic investments with evolving consumer priorities and regulatory landscapes, stakeholders can secure sustainable growth and maintain competitive advantage in an industry defined by rapid change and relentless innovation.

Engaging with Ketan Rohom to Secure In-Depth Wireless Earphone Market Research Insights and Empower Data-Driven Strategic Decisions

If you’re ready to elevate your strategic planning with comprehensive insights into the wireless earphone landscape, Ketan Rohom is eager to guide you through our market research report. As Associate Director of Sales & Marketing, he possesses deep expertise in translating complex industry data into actionable strategies. By connecting with Ketan, you’ll gain tailored perspectives on supply chain dynamics, segmentation opportunities, regional variances, and competitive intelligence-enabling your organization to make informed, data-driven decisions. Reach out today to discuss how this research can be customized to address your unique business challenges and unlock growth potential in the evolving wireless audio market.

- How big is the Wireless Earphone Market?

- What is the Wireless Earphone Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?