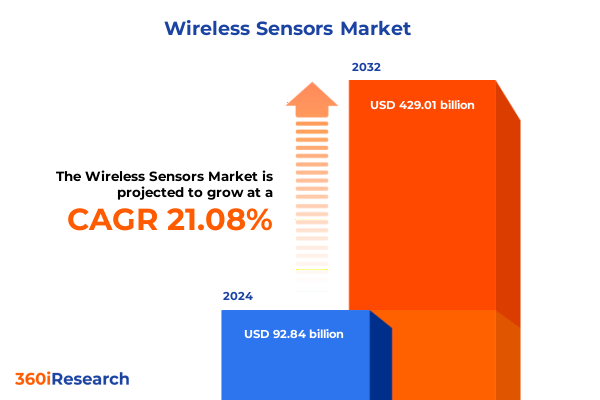

The Wireless Sensors Market size was estimated at USD 112.65 billion in 2025 and expected to reach USD 134.71 billion in 2026, at a CAGR of 21.04% to reach USD 429.01 billion by 2032.

Exploring the Pivotal Role of Wireless Sensor Technology in Catalyzing Next-Generation Connectivity and Intelligent Decision-Making Across Industries

Wireless sensors serve as critical nodes in the expanding Internet of Things ecosystem, embedding connectivity and intelligence across physical assets in industries ranging from manufacturing to smart cities. As organizations pursue digital transformation, the ability to capture real-time data through wireless sensors has become foundational for improving operational efficiency and driving proactive maintenance regimes. The shift from reactive to predictive maintenance demonstrates how these devices deliver continuous monitoring of temperature, vibration, and pressure in production lines and logistics fleets, enabling rapid identification of anomalies before failures occur.

Alongside reliability enhancements, wireless sensors are evolving through breakthroughs in power management and network integration. Innovations in low-power design, including energy-harvesting capabilities and ultra-efficient communication protocols, now permit deployments that can function for years without battery replacement. Moreover, the convergence of 5G connectivity and edge computing architectures empowers on-site data processing with minimal latency, facilitating autonomous decision-making and dynamic system adjustments in smart factories and critical infrastructure environments.

Furthermore, a robust technological infrastructure in North America has underpinned early adoption of wireless sensing in applications such as patient monitoring systems, precision farming, and energy-efficient building management. As regulatory frameworks evolve to mandate environmental reporting and worker safety measures, the integration of wireless sensor networks has become instrumental for organizations seeking both compliance and competitive advantage. This introduction sets the stage for an in-depth exploration of the forces reshaping the wireless sensor market and the strategic insights required to navigate its rapid evolution.

Unveiling the Major Technological and Structural Shifts Shaping the Evolving Wireless Sensor Landscape From Industry 4.0 to Energy Harvesting Innovations

The current wireless sensor landscape is being redefined by the wave of Industry 4.0 adoption, which demands seamless integration of physical and digital systems. Manufacturers are deploying wireless sensors to create digital twins of critical assets, enabling continuous analysis of operational data for anomaly detection and remote control. Predictive maintenance use cases illustrate how businesses are shifting from unplanned downtimes to data-driven schedules, yielding measurable gains in uptime and asset longevity.

Parallel to these digitalization efforts, power efficiency breakthroughs are expanding the reach of wireless sensor deployments into previously inaccessible locations. Energy-harvesting designs that convert ambient light, vibration, or thermal gradients into operational power have eliminated the need for frequent battery changes, opening new possibilities for environmental monitoring and infrastructure health assessment in remote or harsh settings.

The integration of 5G networks and edge computing further accelerates real-time responsiveness within wireless sensor networks. By processing critical data at the edge, organizations minimize latency and bandwidth costs while ensuring privacy and resilience in time-sensitive applications such as autonomous vehicles and industrial robotics.

Meanwhile, evolving regulatory frameworks are heightening the importance of wireless sensors for compliance and safety. Standards for emissions reporting, worker exposure limits, and cybersecurity requirements are prompting businesses to embed wireless sensing into environmental, health, and safety protocols, underscoring the structural transformation underway in sensor-enabled ecosystems.

Assessing the Comprehensive Effects of New United States Tariffs on Wireless Sensor Production Costs Supply Chains and Market Dynamics in 2025

By mid-2025, U.S. tariffs on imported sensor components have introduced discernible cost pressures across the wireless sensor value chain, particularly for segments dependent on foreign-manufactured semiconductors and raw materials. Recent analyses indicate production cost increases in the range of four to six percent for key components such as pressure transducers and consumer electronics–grade sensors. These added costs are challenging manufacturers to either absorb narrower margins or pass expenses onto end users, with implications for adoption rates in price-sensitive markets.

Delivering Deep Insights Into Wireless Sensor Market Segmentation by Power Source Application Connectivity and Type to Uncover Hidden Growth Opportunities

The wireless sensor market demonstrates clear differentiation across multiple axes, beginning with power source. Battery-powered nodes currently dominate industrial applications due to their established reliability, while energy-harvesting and self-powered devices are gaining ground in remote monitoring scenarios where maintenance access is limited. Mains-powered sensors remain indispensable for building automation systems requiring continuous uptime, and the rise of hybrid configurations underscores the importance of flexible energy strategies in network design.

Applications form another critical dimension of segmentation, spanning agriculture and environment, consumer electronics, energy and utilities, healthcare, industrial manufacturing, smart buildings, and transportation and logistics. Within agriculture and environment, precision farming is unlocking granular soil and crop health data, while livestock monitoring prioritizes animal welfare and yield optimization. Consumer electronics continues to evolve with smart home and wearable devices that leverage real-time environmental sensing and biometric feedback. Energy and utilities segments focus on grid monitoring and remote metering to enhance distribution efficiency. Healthcare deployments range from patient monitoring wearables to implantable medical devices. Industrial manufacturing leverages sensing across automotive assembly, chemical processing, food and beverage production, and oil and gas operations. Smart buildings integrate sensors for access control, HVAC optimization, lighting automation, and security surveillance. Transportation and logistics rely on asset tracking and fleet management solutions to streamline operations, reduce loss, and improve safety.

Connectivity choices are equally diverse, with Bluetooth Low Energy and Zigbee enabling short-range networks, Wi-Fi supporting data-intensive use cases, and proprietary RF addressing niche requirements. Long-range, low-power options such as LoRaWAN and cellular networks-including 2G/3G/4G, LTE-M, and NB-IoT-serve wide-area deployments demanding robust coverage. Finally, sensor types encompass accelerometers and gyroscopes for motion detection, flow sensors in differential pressure, electromagnetic, and ultrasonic variants, gas sensors using electrochemical and infrared principles, humidity sensors in capacitive and resistive formats, level sensors employing radar and ultrasonic technologies, pressure sensors available as absolute, differential, and gauge instruments, proximity sensors in capacitive, inductive, and ultrasonic designs, and temperature sensors in contact and non-contact configurations. These segmentation insights highlight how end users can align sensor choices with application requirements to optimize performance and cost efficiencies.

This comprehensive research report categorizes the Wireless Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Source

- Connectivity

- Type

- Application

Analyzing Critical Regional Variations in Wireless Sensor Adoption Patterns and Market Drivers Across the Americas EMEA and Asia-Pacific Regions

In the Americas, the United States and Canada lead wireless sensor adoption propelled by a robust technological infrastructure and significant investment in automation technologies. North American enterprises have been early adopters of sensor-enabled solutions, leveraging advanced manufacturing platforms and smart building initiatives to drive operational efficiency and sustainability outcomes. This region’s regulatory environment and strong venture capital ecosystem further accelerate innovation in sensor applications across healthcare, agriculture, and industrial sectors.

Europe, the Middle East, and Africa present a diverse landscape shaped by stringent regulatory standards and localized innovation hubs. In Western Europe, countries such as Germany and the United Kingdom prioritize Industry 4.0 deployments and energy efficiency measures, leading to widespread integration of wireless sensors in manufacturing and building automation. The Middle East’s investment in smart city projects, particularly in the United Arab Emirates and Saudi Arabia, is driving large-scale environmental and infrastructure monitoring deployments. Across Africa, demand for remote asset tracking and environmental sensing in sectors like mining and agriculture is emerging, albeit at a more nascent stage compared to other regions.

Asia-Pacific stands out as the fastest-growing market for wireless sensors, underpinned by rapid industrialization and government-led smart manufacturing programs in China, Japan, and South Korea. The region’s strong electronics manufacturing base fuels both local innovation and global supply, while megacities in countries such as India and Singapore adopt sensor-driven solutions for urban planning, traffic management, and pollution control. These regional dynamics underscore the need for tailored go-to-market strategies and supply chain resilience in a geographically diverse market.

This comprehensive research report examines key regions that drive the evolution of the Wireless Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Shaping the Wireless Sensor Ecosystem With Innovative Solutions Strategic Partnerships and Market-Leading Portfolios

STMicroelectronics fortified its position in the wireless sensor arena by announcing the acquisition of a portion of NXP Semiconductors’ sensor business for up to $950 million in cash, a move designed to enhance its MEMS-based pressure sensing and industrial monitoring portfolio. This strategic expansion underscores STMicro’s commitment to scaling its product breadth and accelerating innovation in safety-critical and industrial applications.

Texas Instruments continues to lead with a comprehensive automotive sensing suite, introducing integrated lidar laser driver chips, high-performance bulk acoustic wave clocks, and next-generation millimeter-wave radar sensors tailored for advanced driver assistance systems (ADAS). These developments reinforce TI’s role in enabling real-time decision-making and improving reliability across demanding automotive and industrial environments.

Silicon Labs and NXP Semiconductors have similarly advanced their wireless sensor portfolios through strategic partnerships and product launches. Silicon Labs has focused on ultra-low-power wireless modules optimized for Bluetooth LE and proprietary protocols, while NXP has invested in secure Near Field Communication (NFC) tags and edge processing solutions. Meanwhile, established industrial automation vendors such as Honeywell, ABB, and Emerson are embedding wireless sensing capabilities within broader control system offerings, reflecting a trend toward integrated hardware and software platforms that deliver end-to-end visibility and analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireless Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Advantech Co., Ltd.

- Analog Devices, Inc.

- Analog Devices, Inc.

- Digi International Inc.

- Emerson Electric Co.

- Honeywell International Inc.

- Laird Connectivity, Inc.

- Monnit Corporation

- Nexcom International Co., Ltd.

- NXP Semiconductors N.V.

- OMRON Corporation

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- Sensirion AG

- Siemens AG

- STMicroelectronics N.V.

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Yokogawa Electric Corporation

Formulating Pragmatic Action Plans for Industry Leaders to Harness Innovation Optimize Supply Chains and Drive Sustainable Wireless Sensor Market Growth

Industry leaders should prioritize the development of adaptive power management strategies by incorporating energy-harvesting and hybrid power solutions into their product roadmaps. These approaches mitigate maintenance challenges and extend device lifecycles, particularly in remote or inaccessible deployments. Adopting modular sensor architectures can further enhance flexibility, allowing manufacturers to tailor solutions to diverse use cases while optimizing unit economics.

To navigate tariff-induced cost fluctuations, companies must diversify their supply chains by nearshoring component assembly and collaborating with alternative suppliers in regions with favorable trade agreements. Establishing dual-source procurement strategies will reduce dependency on any single market and cushion the impact of sudden policy shifts.

Investing in embedded analytics and edge intelligence capabilities will enable organizations to extract actionable insights directly from sensor nodes, reducing data transmission costs and latency. By integrating AI-driven anomaly detection and real-time feedback loops into sensor firmware, businesses can achieve greater operational agility and predictive accuracy, positioning them to capitalize on evolving Industry 4.0 demands.

Collaborating with regulatory bodies and industry consortia to influence emerging standards around cybersecurity, interoperability, and data privacy will help shape a market environment that balances innovation with trust. Engaging in these forums ensures that product designs remain compliant with future mandates and that edge-to-cloud architectures support secure, scalable deployments.

Detailing the Comprehensive Research Approach Combining Primary Interviews Secondary Data Quantitative Analysis and Expert Validation

Our research approach commenced with a thorough review of industry literature, technical papers, and regulatory publications to establish a foundational perspective on wireless sensor technologies. We analyzed peer-reviewed studies and white papers to validate emerging trends in power harvesting, edge computing, and connectivity protocols. Concurrently, secondary data sources such as corporate filings, press releases, and financial disclosures informed our understanding of competitive positioning and market dynamics.

Building on this groundwork, we conducted a series of structured interviews with over 30 senior executives, product managers, and subject matter experts across the wireless sensor ecosystem. These discussions yielded qualitative insights into customer use cases, procurement criteria, and technology adoption hurdles. We complemented this primary research with quantitative data collection, surveying equipment installers, system integrators, and end users to capture deployment metrics and performance benchmarks.

To ensure analytical rigor, we employed a triangulation methodology that cross-referenced findings from secondary and primary research. This involved validating anecdotal evidence against market observations and quantifying thematic trends through statistical analysis. Expert validation workshops were held to review preliminary conclusions, address potential biases, and refine the research framework. The result is a robust and transparent methodology designed to deliver actionable insights and precise guidance for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireless Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireless Sensors Market, by Power Source

- Wireless Sensors Market, by Connectivity

- Wireless Sensors Market, by Type

- Wireless Sensors Market, by Application

- Wireless Sensors Market, by Region

- Wireless Sensors Market, by Group

- Wireless Sensors Market, by Country

- United States Wireless Sensors Market

- China Wireless Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Concluding Key Findings and Strategic Imperatives From the Wireless Sensor Market Analysis to Guide Future Investment and Innovation Priorities

The wireless sensor market is at an inflection point driven by technological breakthroughs, regulatory imperatives, and shifting geopolitical dynamics. Advanced power management solutions and emerging connectivity standards are expanding the range of viable applications, while tariff pressures and supply chain realignments are underscoring the need for operational resilience.

Segmentation analysis highlights that tailored sensor selection-spanning power source, application domain, connectivity protocol, and sensor type-is essential for optimizing performance and cost. Regional insights reveal distinct adoption patterns, with North America and Europe leading in industrial and compliance-driven use cases, and Asia-Pacific poised for rapid expansion through large-scale infrastructure and smart city initiatives.

Key industry players are responding through strategic acquisitions, product portfolio expansions, and integrated hardware-software offerings, underscoring the importance of innovation and ecosystem collaboration. Actionable recommendations emphasize supply chain diversification, edge analytics integration, and active engagement with regulatory bodies to navigate evolving standards and trade landscapes.

This synthesis of market forces and strategic imperatives provides a roadmap for organizations seeking to harness the transformative potential of wireless sensors. By aligning technology capabilities with application requirements and geopolitical realities, market participants can drive sustainable growth and secure long-term competitive advantage.

Encouraging Prompt Engagement With Ketan Rohom to Secure Customized Market Insights Enhance Decision-Making and Acquire the Complete Wireless Sensor Report

Engaging directly with Ketan Rohom will provide your organization with tailored insights and strategic guidance based on the comprehensive analysis of the wireless sensor market. As the Associate Director of Sales & Marketing at 360iResearch, Ketan combines deep industry expertise with a client-centric approach to ensure that your specific challenges and objectives are addressed. By partnering with Ketan, you will unlock opportunities for custom data interpretation, scenario planning, and advisory support that align with your operational and investment priorities.

Securing this market research report unlocks exclusive benefits such as one-on-one briefings, detailed segment analysis, and access to proprietary data sets that are not available through public channels. Your team will gain clarity on competitive dynamics, regulatory developments, and emerging technologies that will shape the wireless sensor landscape. Reach out to Ketan Rohom to discuss how to customize the report deliverables, explore volume licensing options, and arrange supplementary workshops or training sessions tailored to your team’s needs.

Take decisive action now to leverage our rigorous research and expert validation. Connect with Ketan Rohom to acquire the complete wireless sensor report and position your business for sustainable growth and innovation in this rapidly evolving industry landscape.

- How big is the Wireless Sensors Market?

- What is the Wireless Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?