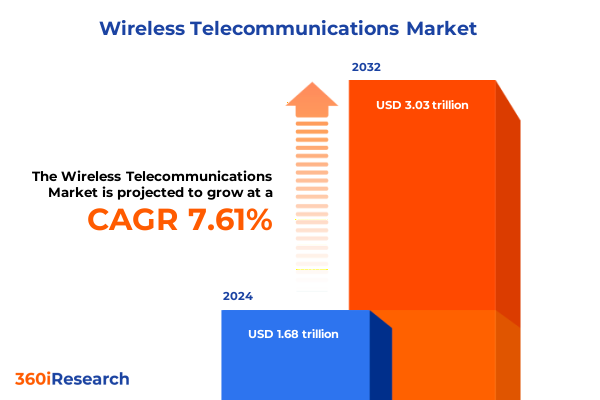

The Wireless Telecommunications Market size was estimated at USD 1.80 trillion in 2025 and expected to reach USD 1.94 trillion in 2026, at a CAGR of 7.66% to reach USD 3.03 trillion by 2032.

Unveiling the Dynamic Forces Shaping the U.S. Wireless Telecommunications Sector in an Era of Rapid Connectivity Advancements and Regulatory Evolution

The United States wireless telecommunications sector stands at a pivotal juncture, characterized by a convergence of technological breakthroughs, shifting regulatory frameworks, and evolving consumer expectations. At its core, the industry continues to navigate the rapid proliferation of mobile data usage driven by high-definition video streaming, connected devices, and emerging digital services. This surge in data demand has intensified the pursuit of network densification and spectrum efficiency, compelling operators and equipment vendors to explore adaptive infrastructure and innovative radio access solutions.

Simultaneously, policy and regulatory landscapes are undergoing substantive change as federal and state authorities work to modernize spectrum allocation, promote rural broadband deployment, and foster competition. These initiatives aim to close digital divides while ensuring network resilience, cybersecurity, and equitable access. In parallel, market participants are responding to sustainability mandates by integrating renewable energy, circular economy principles, and energy-efficient network designs into their operational roadmaps.

Against this backdrop, industry CEOs, technology strategists, and investment committees are seeking clarity on the strategic imperatives that will define competitive advantage over the next decade. These stakeholders require a nuanced understanding of how emerging technologies such as 5G Advanced, private cellular networks, and Low Earth Orbit satellite constellations will reshape connectivity paradigms. This executive summary offers a concise yet comprehensive view of the forces at play, setting the stage for a deeper exploration of transformative shifts, policy impacts, segmentation dynamics, and actionable recommendations.

Exploring Pivotal Transformative Shifts in Wireless Telecommunications That Are Redefining Connectivity, Infrastructure Deployment, and Service Innovation

Over the past two years, the wireless telecommunications industry has experienced transformative shifts that are redefining conventional network architectures and service delivery models. Foremost among these trends is the accelerated rollout of 5G technology, which has progressed from initial urban deployments focused on enhanced mobile broadband to broader implementations supporting mission-critical use cases such as autonomous transport and smart manufacturing. As the ecosystem matures, attention is increasingly turning to 5G Advanced, edge computing platforms, and network slicing mechanisms that enable differentiated service tiers and low-latency applications.

In parallel, satellite integration has emerged as a significant disruptor, driven by the deployment of Low Earth Orbit constellations offering low-latency, high-throughput connectivity to underserved regions. This evolution is prompting wireless operators to establish strategic partnerships and hybrid network architectures that blend terrestrial and space-based infrastructure. Moreover, open and disaggregated radio access network frameworks are gaining traction as operators seek to diversify their vendor ecosystems, reduce capital intensity, and foster innovation through software-defined networking and virtualization.

Another pivotal shift involves the proliferation of private cellular networks tailored for enterprise use cases, ranging from logistics and healthcare to energy and public safety. This trend underscores the growing demand for bespoke connectivity solutions underpinned by dedicated spectrum, robust security protocols, and localized network management. Collectively, these transformative shifts are converging to create a more flexible, scalable, and resilient wireless landscape-one in which agility and collaboration will determine market leadership.

Assessing the Cumulative Impact of 2025 United States Tariffs on Wireless Telecommunications Supply Chains, Investment Patterns, and Competitive Dynamics

In 2025, a series of tariff adjustments introduced by federal authorities have created significant ripple effects throughout the wireless telecommunications supply chain and broader ecosystem. These policy measures, aimed at recalibrating trade balances and strengthening domestic manufacturing, have resulted in increased duties on network equipment, semiconductor components, and device handsets imported from key offshore markets. Consequently, operators and original equipment manufacturers have been compelled to revisit procurement strategies, turning to alternative suppliers and exploring localized assembly to mitigate cost pressures.

Investment committees within the leading carrier organizations have reprioritized capital expenditure plans, opting to delay or phase network expansion projects in certain regions while accelerating upgrades in high-demand urban centers. Device manufacturers have similarly adjusted their portfolios, shifting production toward tariff-exempt zones and expanding partnerships with domestic foundries. Meanwhile, vendor diversification strategies have gained prominence as service providers aim to avoid concentration risk and maintain bargaining leverage.

At the consumer level, the cumulative effect of higher equipment costs has manifested in moderated handset upgrade cycles and an increased appetite for device financing programs. Service tier pricing strategies have also evolved, with operators balancing the need to preserve average revenue per user against competitive pressures and affordability mandates. Overall, the 2025 tariff landscape has underscored the critical importance of supply chain resilience, strategic sourcing, and adaptive investment frameworks in sustaining network evolution and market vitality.

Revealing Key Segmentation Insights Illuminating How Technology, Service Models, Subscriber Profiles, Application Use Cases, Industry Verticals, and Distribution Channels Drive Wireless Market Dynamics

The wireless telecom market’s segmentation landscape reveals the nuanced interplay between underlying technologies, consumer preferences, enterprise demands, application-specific requirements, industry vertical needs, and distribution dynamics. From a technology standpoint, cellular networks encompass legacy 2G through cutting-edge 5G deployments, satellite wireless spans from traditional geostationary satellites to burgeoning low Earth orbit and medium Earth orbit constellations, and wireless broadband extends across fixed wireless access solutions alongside established Wi-Fi and WiMAX offerings. Within service models, postpaid contracts continue to anchor loyalty among high-usage consumers, while prepaid plans cater to cost-conscious subscribers seeking flexibility without long-term commitments.

Examining subscriber types highlights a bifurcation between consumer segments and enterprise customers. The latter category is further differentiated by the scale and complexity of operations, with large enterprises demanding custom network performance guarantees and SMEs prioritizing cost-effective connectivity bundled with managed services. Delving into application segmentation uncovers distinct requirements for data-centric use cases ranging from fixed wireless access for residential broadband to mobile broadband on handheld devices, messaging solutions that alternate between OTT chat platforms and traditional SMS, and voice services spanning both the burgeoning Internet of Things call scenarios and conventional voice traffic.

Industry vertical segmentation underscores how sector-specific drivers shape adoption and deployment strategies. Financial institutions seek ultra-secure connectivity for real-time transactions, government agencies emphasize coverage and network assurance for public safety, healthcare providers deploy dedicated networks for remote telemedicine, and manufacturing, retail, and transportation operators integrate wireless solutions to streamline logistics, inventory management, and customer engagement. Finally, distribution channels reveal the evolving relationship between direct operator stores, digital storefronts accessed via mobile apps and web portals, and third-party retail networks-both certified partner outlets and independent resellers-that extend market reach and specialized support.

This comprehensive research report categorizes the Wireless Telecommunications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- Industry Vertical

- Distribution Channel

Deciphering Regional Market Nuances Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Illuminate Unique Opportunities and Strategic Priorities

Regional dynamics in the wireless telecommunications space reflect both the maturity of existing infrastructure and the strategic priorities shaping future investments. In the Americas, extensive urban network densification programs coexist with targeted rural broadband initiatives designed to close longstanding digital divides. Leading operators are leveraging a combination of licensed spectrum and unlicensed technologies to deliver fixed wireless access in remote communities while simultaneously deepening mmWave and midband 5G coverage in densely populated metros.

Across Europe, the Middle East, and Africa, regulatory diversity and spectrum harmonization efforts present both challenges and opportunities. Central authorities in certain EU member states are establishing uniform guidelines for private network licensing, whereas other regions prioritize cross-border interoperability to support multinational enterprises. In the Middle East, sovereign wealth funds are driving greenfield deployments, and in sub-Saharan Africa, public-private partnerships are critical for extending connectivity to underserved populations.

In the Asia-Pacific region, a relentless pace of 5G rollout and spectrum auctions underscores the emphasis on mobile broadband leadership. Countries in East Asia are integrating satellite backhaul and edge data centers to optimize latency-sensitive applications, while emerging economies in Southeast Asia prioritize cost-effective postpaid and prepaid offerings to accommodate rapidly expanding subscriber bases. Across all three regions, operators are fine-tuning their approaches to infrastructure sharing, network virtualization, and multi-access edge computing to achieve both scale and operational agility.

This comprehensive research report examines key regions that drive the evolution of the Wireless Telecommunications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Company Strategies and Competitive Differentiators Among Major Wireless Service Providers and Technology Innovators in the United States Market

Key players in the U.S. wireless telecommunications arena are continuously adapting to stay ahead of technological advances and competitive pressures. Leading national carriers are leveraging integrated fiber backhaul networks, edge computing investments, and spectrum acquisitions to bolster their 5G offerings and enterprise solutions. At the same time, agile challengers are disrupting legacy models by adopting cloud-native architectures, open radio access frameworks, and partnerships with hyperscalers to deliver scalable network services and developer ecosystems.

Infrastructure vendors and equipment manufacturers play a pivotal role in shaping network evolution, driving innovations in multi-antenna systems, software-defined networking, and advanced radio chipsets. These companies collaborate closely with operators to validate new technologies in live environments and co-develop lifecycle management tools that accelerate deployment and maintenance cycles. Their strategic roadmaps increasingly emphasize modular hardware designs, artificial intelligence–enabled network automation, and robust security features to address growing demands for reliability and performance.

Moreover, a cohort of emerging satellite broadband providers and neutral host network integrators is expanding the competitive landscape, particularly in underserved and enterprise market segments. By combining terrestrial and space-based assets, these specialists offer seamless coverage and differentiated service guarantees. Collectively, the diverse strategies of service providers, technology vendors, and ecosystem enablers underscore a market environment defined by collaboration, convergence, and continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireless Telecommunications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- América Móvil, S.A.B. de C.V.

- AT&T Inc.

- Bharti Airtel Limited

- Cedar Telecom Limited

- Charter Communications

- China Mobile Limited

- Deutsche Telekom AG

- Hawaiian Telcom Services Company, Inc.

- Intelsat SA

- Iridium Communications Inc.

- Nokia Corporation

- NTT, Inc.

- Orange S.A.

- Reliance Jio Infocomm Ltd

- Rogers Communications Inc.

- Singtel Optus Pty Limited

- SoftBank Corp.

- StarHub Ltd

- StarHub Ltd

- Tata Communications Limited

- Telefonaktiebolaget LM Ericsson

- Telefónica S.A.

- Telus Corporation

- Verizon Communications Inc.

- Vodafone Group Plc

Actionable Recommendations Equipping Industry Leaders to Navigate Regulatory Complexity, Accelerate 5G Rollouts, and Capitalize on Emerging Wireless Technologies

Industry leaders must embrace a holistic strategy that integrates regulatory foresight, technological innovation, and operational resilience. First, organizations should diversify their supplier ecosystems and localize critical component production to mitigate tariff-induced cost volatility and supply chain disruptions. This approach not only enhances procurement flexibility but also underpins long-term capital efficiency.

Second, accelerating the adoption of open and virtualized network architectures can drive down total cost of ownership while fostering rapid feature rollout. By incorporating multi-vendor interoperability and containerized network functions, operators can respond swiftly to shifting demand patterns and launch differentiated services. Third, strategic collaboration with satellite broadband providers and hyperscale cloud partners will expand coverage footprints and unlock new enterprise use cases, particularly in industries requiring ultra-reliable connectivity and low latency.

Furthermore, prioritizing cybersecurity frameworks and end-to-end network visibility is essential in an era of increasingly sophisticated threats. Implementing AI-driven monitoring and anomaly detection can safeguard service continuity and customer trust. Finally, embedding sustainability metrics into network planning-from energy-efficient tower designs to circular hardware lifecycle programs-will align corporate objectives with environmental mandates and support long-term brand equity.

Outlining a Robust Research Methodology Combining Primary Interviews, Industry Data Synthesis, and Rigorous Analytical Frameworks to Ensure Insightful Market Intelligence

The research underpinning this analysis has been developed through a rigorous methodology designed to ensure depth, accuracy, and strategic relevance. Primary data was gathered via in-depth interviews with C-level executives, network architects, supply chain managers, and policy experts across leading wireless service providers, equipment manufacturers, and regulatory bodies. These firsthand insights were complemented by targeted surveys capturing perspectives from enterprise IT decision-makers and consumer focus groups.

Secondary research encompassed a comprehensive review of public regulatory filings, spectrum auction results, patent databases, and industry association reports. Proprietary databases tracking network deployment metrics, tariff schedules, and vendor performance were synthesized with open-source intelligence to validate emerging trends and technology adoption rates. Advanced analytical frameworks-including scenario analysis, network ecosystem mapping, and risk-adjusted impact modeling-were applied to triangulate qualitative inputs and ensure robust conclusions.

Throughout the process, rigorous data validation protocols and inter-rater reliability checks were employed to maintain consistency and mitigate bias. This layered approach, combining both qualitative and quantitative methodologies, provides a holistic view of the market and underpins the strategic recommendations outlined in this summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireless Telecommunications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireless Telecommunications Market, by Product Type

- Wireless Telecommunications Market, by Technology

- Wireless Telecommunications Market, by Application

- Wireless Telecommunications Market, by Industry Vertical

- Wireless Telecommunications Market, by Distribution Channel

- Wireless Telecommunications Market, by Region

- Wireless Telecommunications Market, by Group

- Wireless Telecommunications Market, by Country

- United States Wireless Telecommunications Market

- China Wireless Telecommunications Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding Perspectives on the Future Trajectory of the U.S. Wireless Telecommunications Landscape Amid Technological Innovation and Macro Policy Shifts

As the wireless telecommunications landscape continues to evolve, the successful navigation of technological innovation, regulatory shifts, and competitive dynamics will hinge on strategic agility and collaboration. The trends identified in this analysis-from accelerated 5G and satellite integration to evolving tariff regimes and segmented market needs-illustrate the multifaceted challenges and opportunities that lie ahead.

Leaders who proactively embrace open architectures, diversify supply chains, and forge cross-industry partnerships will be best positioned to deliver value-added services and capture new revenue streams. Moreover, a nuanced appreciation of regional market dynamics, customer segmentation, and distribution channel evolution will enable tailored strategies that resonate with diverse end-user segments.

Ultimately, the future trajectory of the U.S. wireless telecommunications market will be defined by those organizations that balance innovation with operational resilience, align investments with sustainability goals, and remain agile in the face of policy and technology inflection points. This executive summary provides the essential insights to guide executive decision-making and chart a course for sustained growth in an era of unprecedented connectivity transformation.

Empowering Your Wireless Market Strategy with Comprehensive Insights and Direct Support from Associate Director Sales & Marketing Ketan Rohom to Secure Your Report

I appreciate your dedication to staying ahead in the rapidly evolving wireless telecommunications market. To gain a comprehensive view of the trends, drivers, and strategic imperatives that will shape industry success over the coming years, we invite you to secure your copy of the full market research report. With in-depth analysis across technology segments, service models, applications, regional dynamics, and competitive landscapes, this report equips your organization with the actionable intelligence needed to make confident, data-driven decisions. For personalized guidance, insights on custom research options, and direct support with purchase details, please reach out to Associate Director, Sales & Marketing Ketan Rohom. He will ensure you receive timely, tailored information and can address any specific questions or requirements. Empower your leadership team with the strategic clarity and foresight that this report delivers, and position your organization to capitalize on the transformative shifts redefining wireless telecommunications.

- How big is the Wireless Telecommunications Market?

- What is the Wireless Telecommunications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?