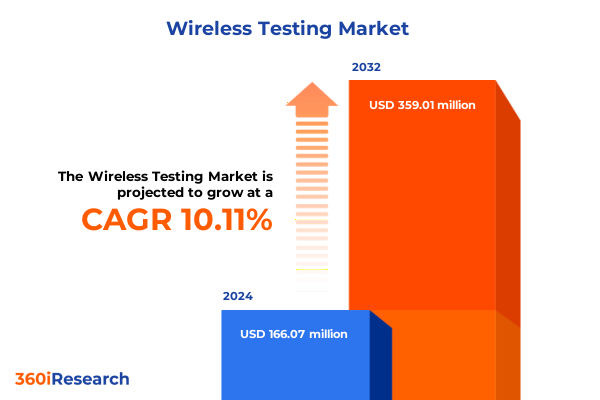

The Wireless Testing Market size was estimated at USD 181.06 million in 2025 and expected to reach USD 203.93 million in 2026, at a CAGR of 10.27% to reach USD 359.01 million by 2032.

Unveiling the Critical Role of Advanced Wireless Testing Frameworks Amid Rapid 5G, IoT, and AI-Driven Network Deployments

The convergence of next-generation network deployments-including 5G Standalone and 5G-Advanced architectures-as well as the widespread proliferation of Internet of Things (IoT) devices and emerging Non-Terrestrial Network (NTN) services has elevated the importance of rigorous wireless testing frameworks. These frameworks now underpin the assurance of performance, interoperability, and security across an increasingly heterogeneous ecosystem where traditional cellular, satellite, and unlicensed technologies coexist and interwork seamlessly

Simultaneously, the evolution toward service-based architectures and cloud-native principles has injected new layers of complexity into testing practices. The deconstruction of monolithic radio access networks in favor of Open RAN and virtualized network functions demands deeper validation of disaggregated components, rigorous conformance to 3GPP protocols, and robust end-to-end performance assurance strategies that span physical, virtual, and hybrid environments

Moreover, the integration of artificial intelligence into test automation workflows is reshaping how test cases are generated, executed, and analyzed. AI-driven frameworks accelerate test development lifecycles, reduce manual intervention, and enable adaptive, specification-aware validation across multi-vendor ecosystems. These advancements lay the foundation for more resilient and scalable testing architectures that can keep pace with rapid network innovation

Revolutionary Technological Disruptions and Ecosystem Innovations Reshaping Wireless Testing for Open RAN, AI Integration, and Non-Terrestrial Networks

The tectonic shift toward open, interoperable Radio Access Networks has been propelled by industry-wide commitments to modularity and vendor diversity. At Mobile World Congress 2025, demonstrations of Open RAN and AI-RAN integration underscored the collective momentum behind disaggregated network architectures, driving demand for hybrid automated Lab-as-a-Service offerings that blend cloud-native environments with carrier-grade physical testbeds

Simultaneously, the maturation of Non-Terrestrial Networks and satellite-based connectivity solutions has introduced novel test scenarios involving variable link characteristics, dual-mode roaming, and cross-layer security validation. Vendors are now required to validate user equipment and network elements across terrestrial, airborne, and orbital segments, elevating test complexity and spurring innovations in signal emulation and channel modeling

In parallel, the anticipated rollout of Wi-Fi 7 and the proliferation of edge computing resources are driving the adoption of software-defined testing frameworks capable of orchestrating automated, over-the-air performance verification. These frameworks harness orchestration engines and intent-driven provisioning mechanisms to replicate real-world conditions, enabling continuous integration and continuous testing pipelines that align closely with agile deployment workflows

Assessing the Multifaceted Consequences of 2025 United States Tariff Policies on the Wireless Testing Supply Chain and Operational Expenditures

New U.S. reciprocal tariff measures introduced in early 2025 have triggered approximately a 7% increase in the capital expenditure budgets of major wireless network operators, as critical 5G equipment sourced from Finland, Sweden, and South Korea now faces levies ranging from 15 to 25%. These surcharges directly impact network test equipment costs, prompting operators to recalibrate deployment timelines and stockpile inventory to mitigate price hikes

Test and measurement specialists, including Keysight Technologies, Teradyne, and Teledyne, have reported substantial exposures to these tariff increases. Keysight has identified annual cost pressures nearing $100 million and is exploring supply-chain optimizations and surcharges, while Teradyne has noted cautious capital spending among mobile and automotive customers. Teledyne anticipates up to $100 million in annual supply-chain cost increases, although it expects inventory buffers to temper the bottom-line impact in the near term

Amid this challenging environment, targeted exemptions have been granted for smartphones and certain consumer electronics, alleviating some pressure on device manufacturers and network equipment integrators. However, broader sections of the market remain subject to reciprocal levies, underscoring the importance of strategic tariff mitigation through supply-chain diversification, localized manufacturing, and advanced cost-planning mechanisms

In-Depth Segmentation Analysis Highlighting Technology, Solution, Service, Application, End-User, and Deployment Dimensions Driving Testing Strategies

Testing requirements across legacy and next-generation wireless protocols-from foundational 2G and 3G networks through 4G LTE (FDD/TDD), 5G variants (mmWave/Sub-6 GHz), Bluetooth Classic and Low Energy, and Wi-Fi 4, 5, and 6-necessitate specialized equipment and expertise to validate RF performance, coexistence, and interoperability. Each technology layer presents unique measurement parameters, testbed configurations, and compliance criteria, demanding end-to-end orchestration of both hardware and software workflows

Within solution portfolios, device performance test platforms, drive-test suites, network emulation systems, and protocol conformance tools each serve distinct purposes. Performance platforms assess throughput, latency, and power consumption under practical conditions, while drive-test systems capture field data at scale. Emulation solutions replicate complex network topologies for pre-deployment validation, and conformance test suites ensure strict compliance with 3GPP and industry specifications

Service offerings span consultative guidance on test strategy, turnkey hardware testing in physical labs or mobile rigs, and software-based virtual test environments. Consulting engagements optimize test plans and regulatory roadmaps, hardware services leverage specialized anechoic chambers and channel emulators, and software testing accelerates automation through AI-enabled scripts and cloud provisioning

Application-specific testing addresses rigorous requirements for automotive safety communications, IoT device certification, military and public-safety radio interoperability, and smartphone user-experience benchmarking. Each application vertical commands dedicated test scenarios-ranging from latency-sensitive V2X trials to ruggedized performance assessments in extreme environments-and influences toolset selection and test methodology

End-user segments-including enterprise IT operations, government regulators, network operators, and service providers-each wield distinct test imperatives. Enterprises prioritize seamless integration into private networks, agencies focus on compliance and emergency communications, operators emphasize network-wide quality metrics, and providers seek differentiated service-level assurances to attract and retain customers

Finally, deployment modes range from scalable, automated cloud testing environments for early validation, through field testing under real-world RF conditions, to high-precision laboratory testing that supports certification and regulatory compliance. The interplay among these modes shapes test timelines, cost structures, and go-to-market readiness

This comprehensive research report categorizes the Wireless Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Solution Type

- Service Type

- Application

- End User

- Deployment Mode

Comparative Regional Dynamics Illuminating Distinct Wireless Testing Requirements and Growth Drivers Across Americas, EMEA, and Asia-Pacific Markets

In the Americas, relentless 5G network rollouts and the early adoption of AI-driven infrastructure have fueled demand for advanced wireless testing solutions. North American operators have aggressively procured gear ahead of potential tariff escalations, and test equipment suppliers have responded by expanding localized lab-as-a-service offerings to support continuous integration. This market’s vibrancy is further underscored by leading telecoms’ collaborations on satellite-integrated services, necessitating cross-domain test competencies that span terrestrial and NTN environments

Across Europe, the Middle East, and Africa, established legacy networks coexist with nascent 5G-Advanced initiatives. Regulatory emphasis on data privacy, security, and cross-border interoperability has driven comprehensive over-the-air and cybersecurity testing mandates. European test providers are capitalizing on this environment by offering converged RF, protocol, and vulnerability assessments, while regional R&D centers advance open-ecosystem validation in alignment with O-RAN Alliance specifications

Asia-Pacific stands at the vanguard of digital transformation, with governments and enterprises investing heavily in smart city infrastructure, autonomous mobility, and high-capacity broadband. Chinese OEMs are spearheading 10 GbE deployments for data-intensive applications, and regional carriers are piloting satellite-backed NTN services, all of which demand holistic test frameworks that integrate massive MIMO, beamforming, and multi-terrain propagation models. Local test labs are scaling rapidly to address this surge, embedding AI-powered automation to manage sprawling technology portfolios

This comprehensive research report examines key regions that drive the evolution of the Wireless Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Movements and Competitive Dynamics among Leading Wireless Testing Providers Shaping Market Leadership and Innovation Trajectories

Among key industry players, Keysight Technologies’ acquisition of Spirent Communications’ core test assets has been conditioned on divestiture of high-speed Ethernet, network security, and RF channel emulation units to maintain competitive balance. This divestiture, mandated by U.S. antitrust authorities, is reshaping the competitive landscape and enabling new entrants such as Viavi Solutions to capture niche segments in conformance and performance testing

Legacy telecom equipment suppliers Nokia and Ericsson continue to vie for market leadership, balancing tariff-driven cost pressures with persistent investments in North American R&D centers. Nokia has revised profit guidance downward due to tariff and currency headwinds, while Ericsson has leveraged forward-purchased orders to bolster year-end earnings, underscoring the strategic importance of supply-chain resiliency and localized manufacturing footprints

Innovators and specialized labs are forging strategic partnerships to accelerate O-RAN deployments and validate complex multi-vendor ecosystems. Viavi Solutions’ VALOR Lab-as-a-Service, backed by NTIA funding, and its ACCoRD collaborations with major U.S. carriers exemplify how public-private synergies can expedite interoperability testing and drive certification readiness at academic and commercial facilities alike

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireless Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AEM Holdings Ltd.

- Anritsu Corporation

- Chroma ATE Inc.

- Cobham plc

- EXFO Inc.

- Keysight Technologies Inc.

- National Instruments Corporation

- Rohde & Schwarz GmbH & Co. KG

- Spirent Communications plc

- Viavi Solutions Inc.

Targeted Strategic Imperatives and Investment Pathways for Industry Leaders to Capitalize on Emerging Wireless Testing Trends and Market Opportunities

To navigate the tariff-impacted supply-chain landscape, industry leaders should diversify sourcing across low-tariff regions and invest in near-shore manufacturing partnerships. Incorporating Lab-as-a-Service models can mitigate capital outlays for physical testing infrastructure while ensuring scalable access to specialized anechoic and channel emulation facilities

Organizations can accelerate validation cycles by adopting AI-driven, specification-aware test frameworks. Integrating LLM-powered test case generation and cloud-native orchestration yields higher consistency, reduced manual overhead, and faster time-to-market. Early pilots of collaborative Automation orchestration platforms have demonstrated significant reductions in test execution time without compromising accuracy

Engaging proactively in industry-led interoperability events-such as O-RAN Alliance PlugFests and multi-vendor demos-empowers ecosystem participants to identify integration gaps and co-develop standardized test protocols. Strategic participation in public-private initiatives and regulatory working groups can also inform regulatory roadmaps and accelerate ecosystem certification efforts

Robust Multi-Methodological Research Approach Integrating Primary and Secondary Data to Derive Actionable Wireless Testing Market Intelligence

This research synthesizes insights from primary interviews with C-level executives and R&D leads at leading test equipment manufacturers, network operators, and regulatory agencies. Supplementary data were gathered through on-site observations of advanced Lab-as-a-Service facilities and live testbed demonstrations at global trade events. Secondary sources include peer-reviewed technical papers, regulatory filings, and reputable news outlets. Quantitative validation of emerging trends was performed through comparative analysis of recent financial disclosures and documented test case studies. Collectively, these multi-method data streams ensure a robust, triangulated perspective on current and future wireless testing imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireless Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireless Testing Market, by Technology

- Wireless Testing Market, by Solution Type

- Wireless Testing Market, by Service Type

- Wireless Testing Market, by Application

- Wireless Testing Market, by End User

- Wireless Testing Market, by Deployment Mode

- Wireless Testing Market, by Region

- Wireless Testing Market, by Group

- Wireless Testing Market, by Country

- United States Wireless Testing Market

- China Wireless Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesis of Core Insights Emphasizing the Imperative of Adaptive Wireless Testing Strategies in a Complex and Evolving Ecosystem

As wireless networks evolve toward greater openness, intelligence, and hybrid connectivity paradigms, the imperative for adaptive, end-to-end testing strategies has never been more critical. Stakeholders must embrace automated, cloud-native frameworks and hybrid Lab-as-a-Service models to maintain pace with rapid technological innovation. Collaborative ecosystem engagement-spanning public-private partnerships, interoperability events, and standards bodies-will be instrumental in harmonizing test protocols and accelerating certification cycles. Ultimately, organizations that strategically integrate AI-powered test automation, diversified testing footprints, and proactive tariff mitigation will secure a sustainable competitive advantage in this dynamic landscape.

Empower Your Strategic Decision-Making: Secure Expert Access to Comprehensive Wireless Testing Intelligence Through a Tailored Market Report

For a detailed exploration of the evolving wireless testing landscape and to equip your organization with strategic guidance, reach out to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in curating bespoke market research and tailored solutions will ensure you gain unparalleled insights and actionable intelligence. Engage now to secure a comprehensive market research report that aligns with your strategic objectives and keeps you ahead of emerging industry trends.

- How big is the Wireless Testing Market?

- What is the Wireless Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?