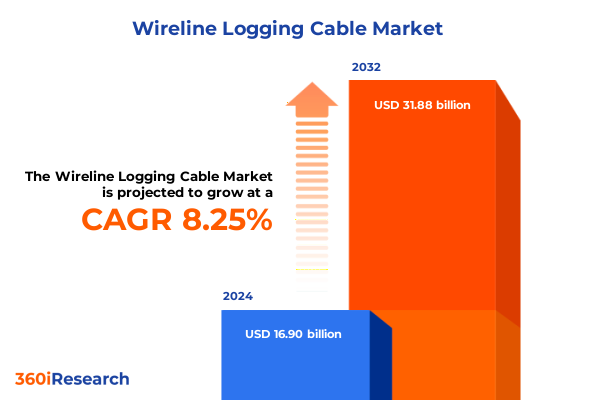

The Wireline Logging Cable Market size was estimated at USD 18.21 billion in 2025 and expected to reach USD 19.65 billion in 2026, at a CAGR of 8.32% to reach USD 31.88 billion by 2032.

Pioneering the Future of Exploration with Advanced Wireline Logging Cables Delivering Unmatched Precision and Reliability in Subsurface Analysis

Wireline logging cable serves as the vital lifeline for subsurface data acquisition, enabling accurate measurements and real-time communication in some of the world’s most challenging downhole environments. These specialized cables transmit critical information about formation properties, wellbore stability, and environmental conditions, thereby undergirding exploration and production strategies across multiple industries. Beyond their traditional roles in oil and gas logging, these cables have become indispensable for mineral exploration, environmental monitoring, and geothermal well characterization. As global demand for reliable subsurface data intensifies, wireline logging cable technologies continue to evolve to meet rising expectations for durability, signal fidelity, and operational efficiency.

Innovation in materials science, conductor design, and manufacturing processes has propelled wireline logging cables into a new era of performance. Modern iterations integrate advanced fiber optic cores alongside electrical conductors to support high-bandwidth telemetry and real-time downhole imaging. Simultaneously, improvements in tensile strength and armor design have extended operational depth ratings, enabling deeper, more complex well interventions. With energy companies and service providers increasingly focused on cost control and data quality, the role of logging cables has expanded beyond passive conduits to active enablers of digital transformation and predictive maintenance strategies.

Navigating the Digital Transformation Revolution in Wireline Logging Cable Technology Shaping the Next Generation of Subsurface Data Acquisition and Analysis

The landscape of wireline logging cable technology is undergoing a profound shift driven by digital transformation and integration of smart functionalities. Where legacy systems relied primarily on electrical telemetry, today’s cables leverage hybrid architectures that combine electrical, fiber optic, and sensor arrays in a single robust assembly. This convergence has unlocked capabilities such as distributed acoustic sensing, real-time multiphysics measurements, and adaptive data compression algorithms. As a result, service providers can deliver richer datasets faster and with greater energy efficiency, creating new paradigms for well diagnostics and reservoir evaluation.

Parallel to technological convergence, operational workflows are being reimagined through remote monitoring and predictive analytics. By harnessing Internet of Things frameworks, operators are able to stream downhole conditions to cloud-based platforms, where machine learning models identify anomalies and optimize logging parameters on the fly. This shift not only reduces nonproductive time but also elevates the safety profile of interventions by minimizing human exposure at rig sites. In tandem, manufacturers are deploying modular cable designs that simplify field repairs and reduce logistic footprints, further accelerating deployment cycles and supporting agile exploration strategies.

Assessing the Far-Reaching Consequences of United States Tariffs in 2025 on Wireline Logging Cable Supply Chains, Cost Structures, and Operational Viability

In 2025, the imposition of additional United States tariffs on imported metals, polymer compounds, and cable components has introduced a new layer of complexity to the wireline logging cable supply chain. Manufacturers dependent on overseas suppliers of high-grade steel armor and specialty insulating materials are experiencing extended lead times and elevated procurement costs. These changes have forced many producers to reassess sourcing strategies, pivoting toward regional suppliers or increasing in‐house production to mitigate the risk of further trade fluctuations.

The ripple effects of these tariffs extend beyond raw materials. Import duties on proprietary fiber optic cores have had the unintended consequence of driving some service providers to explore domestic alternatives, fostering innovation in homegrown optical fiber manufacturing. While cost pressures have been passed through to end users in the short term, leading operators are leveraging longer-term contracts and collaborative R&D agreements to secure stable pricing. As the regulatory environment continues to evolve, stakeholders must remain vigilant, adopting flexible procurement frameworks and diversifying supplier portfolios to ensure sustained operational viability.

Unveiling Critical Segmentation Insights across Application Scenarios, Cable Types, Armor Configurations, Depth Ratings, and End User Profiles

A comprehensive examination of market segmentation reveals distinctive dynamics that define the wireline logging cable industry. When evaluated by application, environmental monitoring emerges as a critical growth driver, propelled by heightened regulatory scrutiny and the need for continuous subsurface surveillance in carbon sequestration and groundwater assessments. Meanwhile, mining operations are increasingly relying on robust logging cables to support acoustic and resistivity measurements in deep shaft environments. However, oil and gas logging remains the backbone of the sector, demanding cables engineered for ultra-deep wells and high-temperature conditions.

Delving into cable type illustrates a diverse spectrum of architectures tailored to specific performance requirements. Electrical conductors, available in both multi conductor and single conductor formats, continue to offer reliable telemetry for conventional logging phases. Fiber optic variants, encompassing multi mode and single mode cores, enable ultrahigh bandwidth data transfer for advanced sonic and electromagnetic surveys. Hybrid cables, featuring active electronic modules or passive sensor arrays, represent the vanguard of innovation, facilitating integrated measurement while elevating data integrity in harsh downhole contexts.

Armoring strategies further differentiate product offerings, with double armor constructions delivering maximum tensile strength for extreme depth operations. Multi armor configurations balance flexibility and protection in wells with moderate deviation, while single armor designs cater to shallow or reentry applications where agility and ease of handling are paramount. Depth rating considerations reinforce these distinctions; cables rated up to 10,000 feet serve many conventional wells, those spanning 10,000 to 20,000 feet address deepwater or extended-reach scenarios, and ratings above 20,000 feet enable ultra-deep exploration ventures.

Finally, the end user profile delineates two principal cohorts shaping demand. Drilling contractors prioritize cables that minimize downtime and streamline handling under rigorous project schedules. In contrast, logging service companies emphasize data fidelity and interoperability with a broad spectrum of surface equipment. By understanding these intersecting segmentation layers, stakeholders can tailor product development and sales strategies to targeted operational needs and maximize technology adoption.

This comprehensive research report categorizes the Wireline Logging Cable market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Armor Type

- Depth Rating

- Armor Material

- Temperature Rating

- Application

- End User

Exploring Distinct Regional Dynamics Shaping the Adoption and Innovation of Wireline Logging Cables in Americas, Europe Middle East Africa, and Asia Pacific

Regional analysis of the wireline logging cable sector underscores how geography influences both demand patterns and technological priorities. In the Americas, the legacy of deepwater exploration in the Gulf of Mexico has driven investment in cables capable of withstanding extreme pressures and corrosive environments. Concurrently, the push for carbon capture initiatives in North America has elevated the importance of continuous environmental monitoring systems bolstered by reliable cable infrastructures.

Across Europe, the Middle East, and Africa, regional diversity shapes a multifaceted market. North Sea operators demand high-temperature and high-pressure cable solutions for mature fields, while Middle East projects emphasize high-duty cycle performance amid elevated downhole temperatures. In East and West Africa, nascent offshore and onshore developments are spurring interest in mid-range depth rating cables that balance cost-effectiveness with operational resilience.

In Asia Pacific, a surge in renewable energy and geothermal exploration is expanding the remit of wireline logging technologies. Offshore basins around Australia and Southeast Asia necessitate cables that accommodate complex well trajectories and ultra-deep deployments. At the same time, stringent environmental regulations in countries such as Japan and South Korea are catalyzing demand for advanced fiber optic monitoring to ensure the integrity of subsea carbon storage and groundwater protection initiatives.

This comprehensive research report examines key regions that drive the evolution of the Wireline Logging Cable market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Technological Advancements, Competitive Positioning, and Collaborative Strategies in the Wireline Logging Cable Ecosystem

Key industry participants have adopted distinct strategies to capture value in the evolving wireline logging cable market. Global service giants invest heavily in proprietary cable platforms, integrating digital telemetry and sensor technologies within vertically integrated supply chains to deliver end-to-end solutions. Their scale allows for rigorous testing protocols and expedited product iterations, which translate into higher reliability and lower failure rates in the field.

Mid-tier vendors focus on strategic partnerships and customization to differentiate offerings. By collaborating with specialized material suppliers and research institutions, these companies introduce niche products such as corrosion-resistant armor alloys and low-dispersion fiber designs. Their agility facilitates rapid response to emerging customer requirements, particularly in regions where localized support and after-sales service are crucial.

A growing cohort of agile innovators emphasizes sustainable manufacturing practices and modular architectures. These companies champion cable designs that minimize raw material usage while maintaining performance thresholds. In parallel, they are pioneering remanufacturing programs and circular economy models, allowing operators to refurbish and redeploy high-value cable components, thereby reducing total cost of ownership and environmental footprint.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wireline Logging Cable market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AnTech Ltd.

- Baker Hughes Company

- BFGeosupply

- Chengdu Esimtech Petroleum Equipment Simulation Technology Co., Ltd.

- China Vigor Drilling Oil Tools and Equipment Co, Ltd

- Chongqing Gold Mechanical & Electrical Equipment Co.,Ltd

- Dajan

- Fibercore by Humanetics Innovative Solutions, Inc.

- Forum Energy Technologies, Inc.

- GOWell Petroleum Equipment, Co. Ltd.

- Halliburton Energy Services, Inc.

- Henan Rancheng Machinery Co., Ltd.

- Hexatronic Group AB

- Huadong Cable Co.,Ltd

- Hunting PLC

- JEM Electronics, Inc.

- Jiangsu Huaneng Cable Co.,LTD.

- Lander Group

- McClain Oil Tools

- Nine Energy Service

- NOV Inc.

- NPC GALVA

- Omac Italy s.r.l.

- Petromac

- PICO Technologies LLC

- Qingdao Yilan Cable Co., Ltd.

- ROBERTSON GEOLOGGING LTD

- Schlumberger Limited

- Synergy Industries LLC

- Tecnikabel SpA

- Weatherford International plc

- WireCo WorldGroup

- Wireline Logging Solutions

- XACT Technologies USA

- Xi'An Celestep Co., Ltd.

- Zhongman Petroleum and Gas Group Co., Ltd.

Implementing Strategic Roadmaps and Operational Best Practices to Enhance Performance, Mitigate Risks, and Foster Innovation in Wireline Logging Cable Operations

Industry leaders can seize competitive advantage by prioritizing an integrated technology roadmap that aligns with evolving operational demands. Embracing fiber optic and hybrid cable architectures, combined with onboard intelligence modules, will deliver richer datasets while enabling real-time decision-making. By investing in next-generation sensor fusion and edge-computing capabilities, service providers can optimize logging parameters autonomously, reducing nonproductive time and mitigating downhole risks.

Proactive risk management through supply chain diversification is essential in the current geopolitical climate. Companies should establish strategic partnerships with multiple regional vendors for critical materials, including high-grade steel and specialty polymers, to buffer against tariff fluctuations and trade restrictions. Concurrently, onshoring key manufacturing processes or developing joint ventures in tariff-exempt zones can further safeguard cost structures and enhance responsiveness to local demand.

Cultivating strong relationships with regulatory bodies and industry consortia will accelerate technology adoption and ensure compliance in a landscape of tightening environmental standards. Engaging in collaborative pilot programs for carbon storage monitoring or groundwater surveillance provides early access to novel use cases, allowing cable manufacturers to refine product specifications ahead of commercial rollouts. Similarly, forging alliances with software firms specializing in data analytics can enrich service offerings through integrated performance dashboards and predictive maintenance alerts.

To capitalize on regional growth opportunities, companies should tailor go-to-market strategies to local operational preferences. In mature markets such as the Americas and North Sea, premium solutions emphasizing durability and extended depth ratings will resonate with established operators. In contrast, emerging markets across Asia Pacific and Africa may respond more favorably to scalable cable platforms that balance performance with affordability. Finally, enhancing field support capabilities through localized training programs and digital troubleshooting tools will strengthen customer loyalty and drive repeat business.

Detailing Rigorous Research Methodologies Leveraging Qualitative and Quantitative Techniques for Comprehensive Analysis of the Wireline Logging Cable Market

The research framework underpinning this report draws on a blend of qualitative and quantitative methods to ensure a robust analysis. Primary data was gathered through in-depth interviews with field engineers, project managers, and technical directors across upstream operators, drilling contractors, and service companies. These conversations provided granular insights into operational challenges, technology preferences, and procurement decision criteria.

Secondary research involved a thorough review of technical publications, patent filings, and industry white papers, as well as examination of regional drilling activity reports and equipment specification sheets. This phase enabled cross-validation of primary findings and identification of emerging trends in cable design, materials innovation, and telemetry methods. Additionally, competitive profiling was conducted by analyzing corporate filings, investor presentations, and strategic partnerships, offering perspective on market positioning and growth strategies.

Data triangulation was employed to reconcile disparate information sources, ensuring that conclusions reflect both field realities and broader market dynamics. Segmentation analysis incorporated parameters such as application area, cable type, armor configuration, depth rating, and end user category, allowing for a multidimensional view of demand patterns. Regional assessments leveraged drilling activity indices and regulatory frameworks to interpret geographic drivers. Throughout the methodology, rigorous checks and peer reviews were instituted to maintain analytical integrity and uphold the highest standards of research quality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wireline Logging Cable market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wireline Logging Cable Market, by Type

- Wireline Logging Cable Market, by Armor Type

- Wireline Logging Cable Market, by Depth Rating

- Wireline Logging Cable Market, by Armor Material

- Wireline Logging Cable Market, by Temperature Rating

- Wireline Logging Cable Market, by Application

- Wireline Logging Cable Market, by End User

- Wireline Logging Cable Market, by Region

- Wireline Logging Cable Market, by Group

- Wireline Logging Cable Market, by Country

- United States Wireline Logging Cable Market

- China Wireline Logging Cable Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Decision-Making and Drive Sustainable Growth in the Evolving Wireline Logging Cable Sector

This report has synthesized the critical developments, segmentation insights, regional dynamics, and competitive strategies defining the wireline logging cable sector. By examining technological inflection points such as digital telemetry convergence and hybrid cable architectures, stakeholders can anticipate the next wave of performance enhancements that will shape downhole data acquisition.

A clear understanding of the impact of regulatory measures, including recent tariff adjustments, enables more informed procurement and supply chain planning. Segmentation analysis has illuminated how applications span environmental monitoring, mining, and oil and gas logging, each with unique technical requirements. Regional insights further underscore how market maturity and regulatory environments influence technology adoption across the Americas, EMEA, and Asia Pacific landscapes.

Ultimately, the path forward for industry participants hinges on strategic investments in innovation, supply chain resilience, and collaborative partnerships. By aligning technology roadmaps with end user needs and regional priorities, companies can unlock new efficiencies and drive sustainable growth. The insights and recommendations presented herein provide a foundation for decision-makers to chart a course in this complex, dynamic market.

Connect Directly with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Access to the Wireline Logging Cable Market Intelligence Report

To gain a deeper understanding of emerging trends and strategic imperatives shaping the wireline logging cable sector, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. By partnering with Ketan, you will secure comprehensive access to an industry-leading market intelligence report that delivers expert insights on technological innovations, competitive landscapes, and regional developments. This report is designed to empower decision-makers with actionable data and analysis, enabling you to stay ahead of market dynamics and make informed investments. Connect today to explore bespoke solutions tailored to your organizational objectives and unlock the full potential of your wireline logging cable initiatives.

- How big is the Wireline Logging Cable Market?

- What is the Wireline Logging Cable Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?