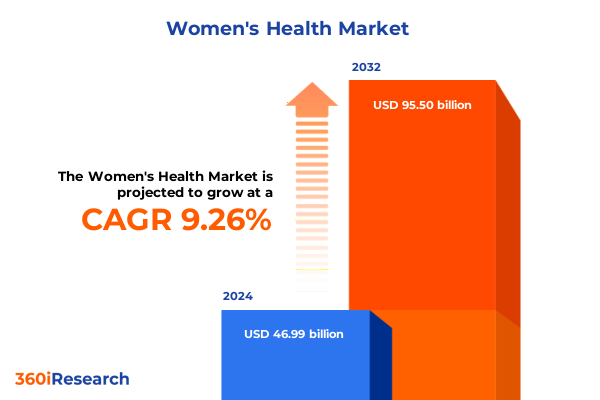

The Women's Health Market size was estimated at USD 51.36 billion in 2025 and expected to reach USD 55.70 billion in 2026, at a CAGR of 9.26% to reach USD 95.50 billion by 2032.

Unveiling the Latest Dynamics and Critical Drivers Shaping the Rapidly Evolving Women's Health Sector within Today’s Complex and Technology-Driven Healthcare Ecosystem

The women’s health domain has witnessed an unprecedented surge in attention as advancements in diagnostics, therapeutics and digital tools converge to create more patient-centric care pathways. This introduction presents an integrated perspective on how evolving demographic trends, shifting societal expectations and policy reforms are collectively transforming the landscape. Building on breakthroughs in biotechnology and data analytics, stakeholders are now better positioned to address previously underserved conditions, from fertility challenges to menopausal management.

As regulatory bodies adapt frameworks to accelerate approvals for novel treatments, private and public organizations are collaborating more closely than ever before. Rapid developments in wearable monitoring platforms and telehealth services have not only expanded access but also reshaped expectations around continuity of care. Simultaneously, rising awareness around preventive interventions is reshaping research priorities and resource allocation, emphasizing a holistic approach to reproductive wellness and hormonal balance management. By contextualizing the interplay between scientific innovation, patient empowerment and policy evolution, this report lays the foundation for deeper investigation into the key drivers and emerging opportunities that will define the coming decade.

Ultimately, the imperative for enterprises, healthcare providers and investors is to navigate this complex ecosystem with agility and foresight. This introduction sets the stage for a comprehensive examination of the transformative shifts, regulatory impacts, segmentation patterns and strategic imperatives that collectively underpin the rapidly evolving women’s health market.

Exploring the Paradigm-Shifting Innovations and Progressive Regulatory Evolutions Redefining Access, Delivery, and Care Models across the Women's Health Spectrum Globally

In recent years, the women’s health sector has undergone paradigm-shifting transformations driven by the convergence of digital innovation and progressive regulatory frameworks. Telehealth platforms now enable remote consultations for conditions ranging from menstrual disorders to hormonal imbalance treatment, effectively dismantling geographical barriers and streamlining patient engagement. Meanwhile, artificial intelligence–driven diagnostic tools offer unprecedented accuracy in early detection of gynecological abnormalities and fertility complications, fostering a proactive mindset in care delivery.

Beyond technological adoption, the landscape is being reshaped by a shift from reactive interventions to preventive and precision-focused solutions. Personalized nutrition and nutraceutical regimens tailored to individual hormonal profiles are gaining prominence, while partnerships between biopharmaceutical firms and data analytics providers are accelerating development of targeted therapeutics. Complementary to these innovations, regulatory agencies are introducing expedited pathways for breakthrough devices and medications, reflecting an industry-wide commitment to inclusivity and equity in women’s health research. Collectively, these transformative shifts underscore the necessity for stakeholders to embrace agile strategies and continuous adaptation to emerging care models.

Assessing the Far-Reaching Consequences of United States 2025 Tariff Adjustments on Supply Chains, Pricing Structures, and Domestic Production Strategies in Women's Health

The United States’ introduction of adjusted tariffs in 2025 has had a notable impact across every tier of the women’s health supply chain. Medical device manufacturers faced increased import duties on key components such as contraceptive device materials and pregnancy monitoring sensor modules, which in turn elevated production costs. To counteract margin pressure, several leading device firms announced plans to localize assembly operations, redirecting investment into domestic manufacturing facilities and workforce training programs.

Similarly, pharmaceutical providers observed heightened prices for active pharmaceutical ingredients previously imported from traditional suppliers in Asia and Europe. This spurred collaborations with domestic raw material producers and accelerated the pursuit of alternative sourcing agreements under existing free trade partnerships. While short-term cost inflation led some distributors to adjust pricing in hospital pharmacies and retail channels, the overall effect prompted a strategic realignment toward shorter, more resilient supply networks.

In response to these dynamics, online distribution channels have gained additional relevance, offering flexible inventory management and direct-to-consumer models that mitigate the inefficiencies of traditional logistics. The cumulative effect of these tariff measures has not only reshuffled global trade patterns but also underscored the importance of supply chain agility and risk diversification for all stakeholders operating in women’s health.

Deriving Strategic Insights from Comprehensive Product, Distribution, Application, and End User Segmentation to Illuminate Growth Opportunities in Women's Health

A nuanced analysis of product segmentation reveals that medical devices, pharmaceuticals and supplements each play distinct roles in addressing women’s wellness needs. Contraceptive devices, diagnostic tools and pregnancy monitoring systems constitute the core of the medical device segment, with diagnostic advancements enabling earlier detection of gynecological conditions. In pharmaceuticals, fertility medications, hormonal drugs and specialized pain management therapies are evolving rapidly, driven by a deeper understanding of endocrine pathways and reproductive physiology. Meanwhile, supplements and nutraceutical offerings focused on bone health and prenatal/postnatal vitamins continue to bridge gaps in preventive care.

Distribution channels further highlight evolving consumer preferences. Traditional offline outlets such as direct sales teams, hospital pharmacies and retail pharmacies remain critical for acute care and procedural settings, while e-commerce platforms and online pharmacies are expanding reach and convenience for at-home supplementation and chronic condition management. This dual-channel ecosystem underscores the value of integrating both brick-and-mortar expertise and digital engagement strategies.

When dissecting applications, the market’s offerings span fertility enhancement, gynecological procedures, hormonal imbalance treatment, menstrual disorder management and broader reproductive health services. This breadth of application underscores the sector’s complexity and the need for cross-functional innovation. Additionally, end-user segmentation among clinics, homecare settings and hospitals illustrates varied care delivery models, each with unique operational requirements and patient expectations. By synthesizing these segmentation dimensions, stakeholders can identify targeted opportunities to optimize product portfolios and distribution networks while enhancing patient outcomes.

This comprehensive research report categorizes the Women's Health market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Distribution Channel

- Application

- End User

Uncovering Distinct Regional Dynamics Influencing Women's Health Markets across the Americas, EMEA, and Asia-Pacific in the Wake of Shifting Healthcare Priorities

Regional dynamics in the women’s health market reveal distinct priorities and growth trajectories across the Americas, EMEA (Europe, Middle East and Africa) and Asia-Pacific. In the Americas, large-scale investment in digital health infrastructure and high consumer spending power have positioned the region at the forefront of telemonitoring solutions and remote fertility counseling. Public–private partnerships are accelerating access to innovative diagnostics, while established reimbursement frameworks facilitate rapid adoption of advanced therapies.

Within EMEA, harmonization efforts under emerging regulatory coalitions are streamlining approval processes for novel devices and drugs, particularly in Western Europe. Concurrently, the Middle East has seen expanding interest in fertility support services and wellness-focused supplements, underpinned by shifting demographic trends and government-led initiatives to enhance women’s health outcomes. In parts of Africa, expanding public health programs are driving awareness and uptake of preventative care, although infrastructure and funding disparities persist.

Asia-Pacific stands out for its rapid digital adoption and the proliferation of online pharmacies that cater to a tech-savvy consumer base. Government-backed campaigns aimed at reducing maternal mortality and improving bone health among women have stimulated demand for nutraceutical products. Additionally, increasing partnerships between local players and multinational corporations are fostering the development of region-specific formulations and device designs, tailored to diverse patient profiles. These regional insights underscore the importance of adaptive strategies that account for regulatory frameworks, cultural nuances and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Women's Health market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Portfolios of Leading Organizations Driving Competitive Advantage within the Women's Health Industry

Leading organizations in women’s health are deploying varied strategies to build competitive advantage and drive innovation. Prominent medical device firms have launched next-generation smart contraceptives and AI-enabled monitoring platforms, positioning themselves as pioneers in connected care ecosystems. In parallel, global pharmaceutical companies are investing significantly in biologics and targeted hormonal therapies, leveraging strategic licensing agreements and research collaborations to accelerate clinical development.

In the supplements and nutraceutical arena, specialized manufacturers are differentiating through clinically validated formulations for bone health and maternal nutrition, securing research partnerships with academic institutions to bolster product credibility. Digital health startups are also capitalizing on mobile applications and remote patient monitoring to deliver personalized guidance on menstrual health and fertility planning. These entrants frequently ally with established channel partners to expand distribution beyond traditional pharmacy networks.

Across all segments, strategic alliances, mergers and acquisitions are reshaping the competitive landscape. Recent deals have focused on securing proprietary technologies, broadening geographic reach and enhancing margin structures through integrated value chains. As a result, the industry is entering a phase of intensified convergence, where cross-sector expertise in data analytics, supply chain management and clinical development will define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Women's Health market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- Bayer AG

- CooperCompanies, Inc.

- Endo International plc

- Evofem Biosciences, Inc.

- Ferring Holding SA

- Gedeon Richter Plc

- Hologic, Inc.

- Johnson & Johnson

- Mayne Pharma Group Limited

- Merck & Co., Inc.

- Myovant Sciences Ltd.

- Organon & Co.

- Pfizer Inc.

- Radius Health, Inc.

- Roche Holding AG

- Theramex HQ UK Limited

- TherapeuticsMD, Inc.

- Zambon S.p.A.

Formulating Targeted Recommendations Empowering Industry Leaders to Capitalize on Emerging Trends and Navigate Complex Challenges in Women's Health

To capitalize on the evolving women’s health landscape, industry leaders must prioritize investments in digital platforms that enhance patient engagement and data-driven decision-making. Cultivating agile supply chain models, including dual sourcing and localized manufacturing, will mitigate the impact of future trade disruptions and cost volatility. At the same time, forging partnerships with technology innovators and academic research centers can streamline product development and regulatory approvals.

Organizations should also embrace personalized care frameworks by integrating genomics, real-world evidence and patient-reported outcomes into their value propositions. Engaging directly with end users through telehealth and mobile applications will foster brand loyalty and deepen market penetration. Furthermore, navigating complex regulatory environments demands proactive dialogue with health authorities and continuous monitoring of policy trends.

Finally, sustainability considerations-from eco-friendly device materials to green packaging in supplement lines-should inform corporate social responsibility strategies and resonate with increasingly conscious consumers. By implementing these targeted recommendations, standing at the intersection of innovation, efficiency and patient-centricity will drive both long-term growth and improved health outcomes.

Detailing a Robust Multi-Method Research Framework Incorporating Primary Insights, Secondary Data Analysis, and Rigorous Validation for In-Depth Market Intelligence

This comprehensive market analysis is underpinned by a rigorous multi-method research framework that integrates both qualitative and quantitative approaches. Primary data was gathered through in-depth interviews with key opinion leaders, healthcare practitioners and senior executives across device manufacturers, pharmaceutical companies and digital health startups. Concurrently, secondary research entailed systematic reviews of peer-reviewed journals, regulatory filings and policy communications to ensure contextual accuracy.

Quantitative modeling leveraged proprietary databases and publicly available datasets to validate observed trends and triangulate findings. The segmentation framework was meticulously crafted to reflect real-world product categories, distribution channels, applications and end-user profiles. All data underwent multiple rounds of cross-validation and expert review to address inherent biases and enhance reliability.

To maintain transparency, assumptions and data sources are thoroughly documented in the full report, alongside sensitivity analyses for key variables. Ethical considerations, including confidentiality commitments to participating stakeholders, were strictly observed. This robust methodology ensures that the insights presented here are not only actionable but also grounded in the highest standards of market research integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Women's Health market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Women's Health Market, by Product

- Women's Health Market, by Distribution Channel

- Women's Health Market, by Application

- Women's Health Market, by End User

- Women's Health Market, by Region

- Women's Health Market, by Group

- Women's Health Market, by Country

- United States Women's Health Market

- China Women's Health Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights to Articulate the Imperative Path Forward for Stakeholders Shaping the Future of Women's Health Solutions and Services

In synthesizing the critical findings presented, it becomes clear that the women’s health sector is poised at an inflection point defined by technological integration, regulatory evolution and shifting patient expectations. From the rise of personalized therapeutics to the reshaping of supply chains in response to trade policies, stakeholders must remain vigilant and adaptive to maintain competitive relevance.

Strategic segmentation insights highlight opportunities for targeted innovation across product categories, distribution platforms and application areas, while regional analyses underscore the need for localized approaches informed by cultural, economic and regulatory nuances. The competitive intelligence on leading organizations further illustrates how integrated portfolios and collaboration models can accelerate market entry and strengthen value propositions.

As the industry continues to evolve, sustained investment in digital transformation, strategic partnerships and patient-centric offerings will be essential. By embracing the recommendations outlined herein and leveraging the comprehensive methodological foundations, organizations can navigate uncertainties, seize emerging growth pathways and ultimately drive meaningful improvements in women’s health outcomes.

Engaging Directly with Associate Director Ketan Rohom to Secure Your Comprehensive Women's Health Market Research Report and Elevate Strategic Decision-Making

I invite you to connect with Associate Director Ketan Rohom to explore how this in-depth analysis can be tailored to your strategic goals. Leveraging his expertise in sales and marketing, you can gain personalized guidance on the most relevant findings, ensuring that investment and development decisions align with the market’s most promising opportunities. By engaging directly with Ketan, you will receive a comprehensive overview of the report’s valuable insights, including actionable data on product innovation, regulatory pathways and segmentation dynamics. Secure your copy today to empower your organization with evidence-backed strategies that accelerate growth, enhance competitive positioning and drive superior outcomes in women’s health. Don’t miss the opportunity to harness this indispensable resource for informed decision-making and sustainable success. Reach out to Ketan Rohom to purchase the full market research report and transform your vision into measurable results.

- How big is the Women's Health Market?

- What is the Women's Health Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?