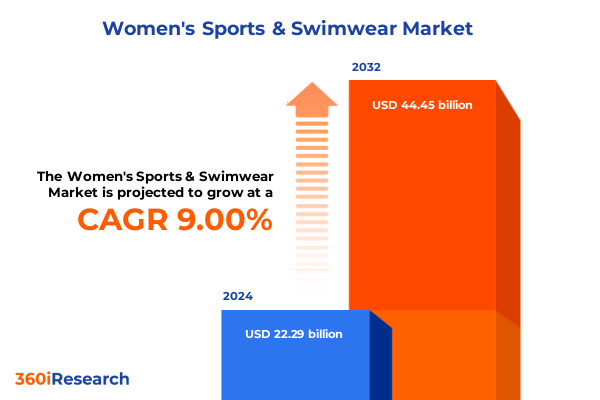

The Women's Sports & Swimwear Market size was estimated at USD 24.31 billion in 2025 and expected to reach USD 26.19 billion in 2026, at a CAGR of 9.00% to reach USD 44.45 billion by 2032.

Emerging Opportunities and Market Dynamics Shaping the Future of Women’s Sports Swimwear Across Diverse Consumer Demographics and Trends

The evolving intersection of athletic performance and fashion aesthetics is redefining the future of women’s sports swimwear. In recent years, rising health and wellness awareness has driven more women to integrate aquatic activities into their fitness routines, elevating demand for pieces that combine technical design with on-trend styling. At the same time, the rise of athleisure culture has blurred the lines between performance gear and everyday wear, leading brands to innovate with materials and silhouettes that perform in the pool while appearing effortlessly chic on the beach or beyond. This dynamic convergence has created fertile ground for established companies and emerging challengers alike to capture market share through differentiated product offerings and compelling brand narratives.

Furthermore, digital commerce platforms and social media channels have become pivotal in shaping consumer preferences and purchase journeys. Online brand communities, influencer endorsements, and shoppable content are empowering consumers to discover and engage with swimwear in real time, driving both spontaneous and planned purchases. With mobile traffic accounting for an increasing share of sales and e-commerce tools offering personalized recommendations, brands that excel in digital engagement are best positioned to foster loyalty among tech-savvy shoppers. As the sector continues to expand, a clear understanding of these underlying drivers will be essential for stakeholders looking to navigate the competitive landscape and capitalize on emerging opportunities.

How Technological Innovations and Consumer Demand Are Driving Transformational Shifts in Women’s Active and Performance Swimwear Landscape Globally

Advancements in fabric science and technological integration are catalyzing a paradigm shift in how women’s sports swimwear is conceptualized and produced. Smart textiles incorporating compression zones, moisture-wicking fibers, and UV-protective weaves are setting new performance benchmarks, enabling athletes at every level to train and compete with enhanced confidence and comfort. Meanwhile, digital manufacturing techniques, such as 3D knitting and laser cutting, are accelerating prototyping cycles and reducing material waste, allowing designers to experiment with novel form factors that seamlessly blend functionality and style. As a result, swimwear collections are no longer confined to seasonal drops but instead evolve in response to real-world performance feedback and consumer insights.

Moreover, sustainability imperatives are reshaping supply chain strategies across the industry. Brands are increasingly collaborating with material innovators to develop recycled or bio-based alternatives to traditional nylon and polyester, simultaneously addressing environmental concerns and meeting consumer demand for eco-conscious products. This shift toward circularity is complemented by digital traceability initiatives, which provide end-to-end visibility into raw material sourcing and manufacturing processes, bolstering brand credibility. In tandem with these technological and environmental developments, the proliferation of omnichannel retail experiences-where consumers move fluidly between digital showrooms, brick-and-mortar flagship stores, and experiential pop-ups-is redefining how swimwear is discovered and purchased. As a result, industry participants that embrace integrated digital–physical ecosystems will unlock new avenues for growth and differentiation.

Assessing the Broad Spectrum Consequences of Newly Implemented United States 2025 Tariff Measures on the Women’s Sports Swimwear Supply Chain

The implementation of escalated tariff measures in early 2025 has introduced significant headwinds across the women’s sports swimwear supply chain, affecting costs and sourcing strategies. According to analyses by leading economic think tanks, average import duties on apparel rose sharply, with some rates climbing from a baseline of 11–12 percent to as high as 38–65 percent for products originating in key manufacturing hubs such as China, Vietnam, and Bangladesh. This sudden increase in duties has compelled brands to reassess long-standing vendor relationships and explore alternative sourcing destinations with lower tariff burdens, yet often higher production costs and capacity constraints.

Moreover, consumer price inflation rippled throughout the summer of 2025, driven in part by tariff-induced cost pressures. Estimates suggest that apparel prices could surge by up to 17 percent in the short term, with daily essentials like stretch fabrics and performance textiles facing the steepest hikes. In response, leading swimwear manufacturers have adopted a range of mitigation tactics, including partial absorption of the incremental duties, strategic allocation of higher-cost SKUs to premium tiers, and renegotiated logistics contracts to contain overall landed costs. At the same time, some industry players have accelerated investments in nearshoring and domestic manufacturing capabilities to reduce exposure to unpredictable trade policy shifts. As these adjustments take hold, the competitive landscape is poised to favor agile organizations that can balance cost efficiency, product innovation, and resilient supply networks.

Deep Diving into Critical Segmentation Parameters Revealing Diverse Consumer Preferences in the Women’s Sports Swimwear Market

In today’s women’s sports swimwear market, consumer preferences are nuanced and multifaceted, shaped by a complex interplay of product characteristics, price considerations, and performance priorities. When evaluating product types, customers navigate choices between classic bikinis-including bandeau, high-waist, and triangle silhouettes-versus one-piece designs that emphasize adjustable straps or cheeky cuts, as well as versatile swimdresses and tankinis that blend style with coverage. This wide array of offerings has led to targeted design strategies from brands seeking to satisfy both fashion-forward swim enthusiasts and those focused on functional support for intensive aquatic training.

Distribution channels further refine purchasing behaviors, with traditional outlets such as hypermarkets, supermarkets, and sports retailers coexisting alongside digital storefronts hosted on brand websites and popular e-commerce platforms. Specialty boutiques concentrating on swimming and sports equipment also maintain dedicated followings, offering curated product assortments and expert fitting services. In parallel, price tier segmentation delineates market positioning, from budget-friendly essentials to mid-range and premium lines, culminating in luxury swim collections that feature bespoke detailing and advanced materials. Layered atop these dimensions, sport type segmentation reveals distinct needs among competitive swimmers, recreational users, and training athletes, each seeking targeted performance attributes.

Material composition-from quick-drying nylon and durable polyester blends to high-elasticity spandex elastane-remains a critical factor in product innovation, influencing everything from fit and mobility to longevity and comfort. Demographic profiling by age group, spanning 18–24, 25–34, 35–44, 45–54, and 55-plus, illuminates diverse lifestyle priorities and spending habits, guiding brands to tailor marketing narratives and design features that resonate with each cohort. By synthesizing insights across these segmentation pillars, industry stakeholders can align product development and distribution strategies with evolving consumer expectations, ensuring optimal market resonance.

This comprehensive research report categorizes the Women's Sports & Swimwear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Price Tier

- Sport Type

- Material

Unveiling Regional Nuances and Distinct Growth Drivers Shaping the Trajectory of Women’s Sports Swimwear Across Global Markets

Regional dynamics in the women’s sports swimwear arena illustrate a tapestry of growth drivers and consumer behaviors that vary significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, particularly within North America, robust digital adoption underpins the rising share of online sales, while brand collaborations with high-profile athletes and lifestyle influencers amplify consumer engagement. Meanwhile, Latin American markets are witnessing a surge in demand for budget to mid-range performance swimwear driven by expanding urbanization and heightened water-sport participation among younger demographics.

Across Europe, the Middle East, and Africa, sustainability and luxury positioning have emerged as key differentiators. Western European consumers increasingly prioritize eco-responsible materials and transparent supply chains, encouraging brands to introduce recycled fabric lines and circular design initiatives. In Gulf Cooperation Council countries, premium and luxury swimwear segments are flourishing, fueled by affluent coastal lifestyles and year-round resort tourism. Conversely, African markets display varying stages of maturity, with select urban centers in South Africa and Nigeria embracing both international and homegrown brands that cater to recreational and competitive swimmers.

The Asia-Pacific region remains the fastest-growing landscape, led by strong demand in China, Australia, and Southeast Asian nations. Rising disposable incomes and a cultural emphasis on recreational and competitive aquatic sports are fueling investments in performance-oriented swimwear innovations. E-commerce platforms localized for language and logistics convenience are also catalyzing rapid market penetration, making the region pivotal for brands seeking scale and regional partnerships. By understanding these distinct regional contours, industry players can calibrate product portfolios, marketing strategies, and supply chain footholds to capture long-term growth across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Women's Sports & Swimwear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Brands and Strategic Collaborations Defining Competitive Dynamics in the Women’s Sports Swimwear Arena

Market leadership in women’s sports swimwear is characterized by a blend of established heritage brands and agile newcomers, each leveraging unique strengths to secure competitive advantage. Legacy swimwear houses invest heavily in R&D to refine fabric technologies and fit profiles, while innovators forge strategic partnerships with research institutes and athletic teams to validate performance claims. Meanwhile, full-service sportswear conglomerates integrate swimwear into broader active apparel portfolios, enabling cross-category marketing synergies and global distribution networks.

Emerging entrants differentiate through disruptive business models, including direct-to-consumer platforms that offer customization, limited-edition collaborations, and rapid seasonal releases. These digital-native brands cultivate highly engaged communities on social media, translating authentic storytelling into brand loyalty and premium valuation. At the same time, selective licensing agreements with global sports federations and professional swimming leagues enhance brand visibility and credibility, positioning licensees as official providers of performance Swimwear for elite athletes.

Strategic acquisitions and joint ventures also shape the industry map, as multi-category apparel providers seek to expand their swimwear footprint through targeted M&A and capital investments in high-growth segments. Conversely, niche swimwear specialists pursue capital injections to scale production and broaden geographic reach. In this dynamic competitive landscape, companies that balance innovation, brand equity, and operational excellence will emerge as the most resilient and impactful players.

This comprehensive research report delivers an in-depth overview of the principal market players in the Women's Sports & Swimwear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Alo Yoga

- Arena S.p.A.

- Beach Riot LLC

- Beyond Yoga LLC

- Carbon38 LLC

- Frankies Bikinis LLC

- Lululemon Athletica Inc.

- Marysia LLC

- Nike Inc.

- Onzie LLC

- Outdoor Voices Inc.

- Puma SE

- Reebok International Ltd.

- Seafolly Pty Ltd.

- Solid & Striped LLC

- Speedo International Ltd.

- Sweaty Betty Ltd.

- TYR Sport Inc.

- Under Armour Inc.

Implementable Strategic Pathways and Best Practices for Industry Leaders to Capitalize on Emerging Opportunities in Swimwear

Industry leaders seeking to strengthen their position should adopt a multi-pronged approach that aligns operational agility with consumer-centric innovation. Prioritizing advanced materials partnerships can accelerate the development of swimwear lines that deliver enhanced performance and sustainability credentials, creating a compelling value proposition for eco-conscious athletes. Embedding real-time consumer feedback loops through digital platforms and community initiatives will further enable rapid iteration of design features and marketing messages, fostering stronger brand affinity.

Moreover, cultivating flexible supply chains that incorporate nearshoring, dual sourcing, and inventory diversification strategies can mitigate the impact of policy volatility and logistical disruptions. Strategic investments in data analytics and demand forecasting tools will support more precise production planning, reducing excess inventory and optimizing working capital. Industry players should also explore collaborative ventures with e-commerce and technology platforms to enrich omnichannel experiences, such as virtual fit sessions and AI-driven personalization, providing seamless transitions between online and offline touchpoints.

Finally, establishing targeted training and certification programs for retail partners and sales teams will elevate customer service quality and product knowledge, amplifying conversion rates and average selling prices. By pursuing these integrated initiatives, swimwear companies can fortify their competitive edge, adapt swiftly to market shifts, and unlock sustainable growth in an increasingly complex environment.

Transparent Overview of Research Methodology Ensuring Rigor and Reliability in Women’s Sports Swimwear Market Analysis

This study draws upon a structured research methodology designed to ensure the accuracy and reliability of market insights. Primary research was conducted via interviews and surveys with a cross section of industry stakeholders, including senior executives at swimwear brands, material suppliers, retail buyers, and sports program directors. These qualitative engagements provided first-hand perspectives on product innovation priorities, consumer behaviors, and supply chain challenges. Concurrently, quantitative data were collected from proprietary panel databases tracking sales performance across diverse distribution channels and price tiers, complemented by syndicated industry reports focusing on textile production and trade flows.

The analytical framework combined top-down and bottom-up approaches. A top-down assessment of global trade statistics, macroeconomic indicators, and import-export duty schedules was integrated with bottom-up aggregation of company-level performance data to deliver a holistic view of market dynamics. Rigorous data triangulation procedures were applied, cross-verifying findings against independent secondary sources, including customs records, financial disclosures, and industry association publications. Additionally, scenario-based modeling was employed to evaluate the potential impacts of policy shifts, such as tariff adjustments and sustainability regulations, on long-term supply chain and cost structures.

To uphold methodological transparency, all data sources were documented, key assumptions were clearly stated, and calculation methodologies were reviewed by an independent advisory panel composed of technical experts and former industry leaders. This multi-layered research design ensures that the findings and recommendations presented herein are grounded in robust evidence and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Women's Sports & Swimwear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Women's Sports & Swimwear Market, by Product Type

- Women's Sports & Swimwear Market, by Distribution Channel

- Women's Sports & Swimwear Market, by Price Tier

- Women's Sports & Swimwear Market, by Sport Type

- Women's Sports & Swimwear Market, by Material

- Women's Sports & Swimwear Market, by Region

- Women's Sports & Swimwear Market, by Group

- Women's Sports & Swimwear Market, by Country

- United States Women's Sports & Swimwear Market

- China Women's Sports & Swimwear Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesis of Core Insights and Strategic Takeaways Guiding Stakeholders Through the Women’s Sports Swimwear Landscape

Throughout this executive summary, we have outlined the forces reshaping women’s sports swimwear-from advanced material innovations and omnichannel retail transformations to the implications of evolving trade policies. The segmentation analysis highlights a market defined by intricate consumer preferences around product type, distribution channels, price tiers, sport categories, materials, and age demographics, underscoring the need for finely tuned portfolio strategies. Regional insights reveal distinct growth drivers: digital commerce dominance in the Americas, sustainability and luxury priorities in Europe Middle East & Africa, and rapid expansion across Asia-Pacific territories.

Competitive profiling illuminates how legacy brands, global sportswear conglomerates, and agile direct-to-consumer entrants each leverage distinctive strengths to secure market leadership. Actionable recommendations emphasize the importance of forging materials partnerships, optimizing flexible supply chains, and harnessing data-driven consumer engagement to drive sustained competitive advantage. By adhering to rigorous research protocols and transparent data validation, this report provides stakeholders with a comprehensive roadmap for navigating complexity and capitalizing on emerging opportunities.

As the industry continues to evolve, decision-makers equipped with these insights will be well-positioned to craft strategic initiatives that resonate with diverse consumer segments, respond to policy fluctuations, and deliver superior value. Armed with a deep understanding of market dynamics and best practices, companies can anticipate trends, mitigate risks, and achieve lasting growth in the dynamic women’s sports swimwear sector.

Engaging with Our Expert Associate Director Sales and Marketing to Secure Comprehensive Women’s Sports Swimwear Intelligence Today

For customized insights and a deeper dive into the women’s sports swimwear landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through tailored solutions aligned with your strategic goals. Don’t miss the opportunity to leverage comprehensive intelligence designed to empower your next move in an increasingly competitive marketplace. Contact Ketan today to secure your copy of the detailed market research report and unlock actionable insights that drive growth and innovation.

- How big is the Women's Sports & Swimwear Market?

- What is the Women's Sports & Swimwear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?