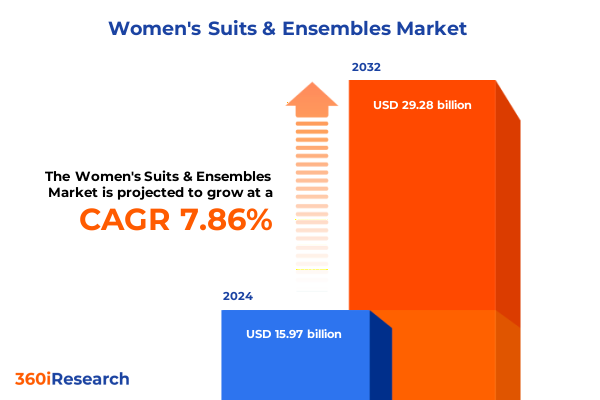

The Women's Suits & Ensembles Market size was estimated at USD 17.21 billion in 2025 and expected to reach USD 18.38 billion in 2026, at a CAGR of 7.88% to reach USD 29.28 billion by 2032.

How evolving consumer preferences and market forces are driving innovation and redefining the competitive landscape of women’s suits and ensembles in a digitally accelerated era

In an environment defined by accelerated digital transformation and shifting lifestyle paradigms, the women’s suits and ensembles segment has emerged as a strategic battleground for both established fashion houses and agile newcomers. What was once perceived as a niche category primarily catering to corporate wear has expanded into a multifaceted market, encompassing varied end uses from formal events to elevated casual occasions. As consumers increasingly demand a fusion of style, comfort, and sustainability, brands are challenged to reimagine traditional silhouettes and delivery channels in order to stay relevant and compelling.

Consequently, this report sheds light on the underlying forces propelling the market forward. It delves into the convergence of evolving consumer preferences with technological advancements, illustrating how digital-first interactions and data-driven insights are guiding design innovation and personalized experiences. Moreover, it examines the amplified importance of supply chain resilience amid global disruptions, highlighting how nimble sourcing strategies and strategic partnerships are becoming essential to navigate the complexities of raw material availability and changing trade regulations.

Uncovering the transformative shifts propelled by digitalization, sustainability imperatives, and hybrid work models that are reshaping women’s suits and ensembles

The landscape of women’s suits and ensembles has undergone transformative shifts that extend far beyond conventional notions of tailored attire. At the core of this evolution lies the rise of hybrid work models, which have blurred the lines between professional formality and at-home comfort. As a result, design houses have responded with adaptive silhouettes that incorporate stretch fabrics, adjustable waistbands, and convertible elements, allowing garments to seamlessly transition from virtual meetings to in-person engagements.

In parallel, a heightened focus on sustainability has prompted brands to reevaluate every stage of the product lifecycle. From sourcing regenerative wool and organic cotton to implementing zero-waste cutting techniques, leading labels are showcasing how environmental responsibility can coexist with sophisticated tailoring. Meanwhile, digitalization has accelerated customization capabilities. Advanced 3D scanning and virtual fitting tools now enable consumers to preview ensembles in real time, fostering deeper brand loyalty and reducing return rates. Together, these developments underscore a fundamental redefinition of the category-one that prioritizes versatility, ethical production, and immersive digital experiences.

Examining the cumulative impact of the United States tariffs enacted in 2025 on supply chains, pricing strategies, and sourcing practices for women’s suits and ensembles

The introduction of expanded tariff measures by the United States in early 2025 has significantly reshaped the sourcing landscape for women’s suits and ensembles. Targeted primarily at imports from key apparel manufacturing hubs, these duties have driven up landed costs and prompted stakeholders to seek alternative raw material and finished-garment suppliers. Many brands have accelerated nearshoring initiatives, turning to suppliers within the Americas for reduced logistical complexity and more predictable lead times.

Moreover, the cumulative impact of these tariffs has spurred negotiation strategies aimed at securing favorable terms with domestic mills and vertically integrated manufacturers. In doing so, companies have leveraged longer-term agreements to mitigate cost escalations while preserving design flexibility. At the same time, pricing strategies have shifted to include tiered offerings that balance premium imports with competitively priced domestically produced lines. This dual-track approach allows brands to maintain margin integrity while catering to both value-focused and luxury-oriented consumer segments.

Analyzing key segmentation insights spanning product types, distribution channels, price tiers, end uses, and fabric materials to illuminate opportunity hotspots

A nuanced understanding of segmentation dynamics reveals where brands can seize competitive advantage within the women’s suits and ensembles arena. When considering product types, tailored blazers-available in both double-breasted and single-breasted variations-continue to anchor professional wardrobes, yet ensemble sets that pair tops with skirts or trousers are gaining traction among audiences seeking coordinated looks with minimal styling effort. Simultaneously, pant suits offering regular, relaxed, and slim fit silhouettes cater to diverse body preferences, while skirt suits in A-line and pencil skirt forms blend timeless appeal with contemporary sensibilities.

Distribution channels further illuminate paths to market dominance. Online platforms, whether via direct-to-consumer brand websites or third-party marketplaces, are experiencing robust engagement driven by streamlined checkout journeys and immersive digital showrooms. Nonetheless, store-based channels remain vital for elevated service and personalized fittings, with boutiques, department stores, and specialty retailers offering curated product assortments and concierge-style experiences. Price tier segmentation underscores the delicate balance between aspirational luxury labels, premium and mid-range collections, and mass-market offerings, each addressing distinct consumer budgets and value perceptions. In parallel, end-use distinctions draw a clear line between casual iterations designed for relaxed settings, corporate-focused ensembles for office environments, and formal options tailored for ceremonial or evening occasions. Finally, fabric material choices-from blended constructions to pure cotton, polyester, and traditional wool-play a pivotal role in functionality, drape, and seasonal adaptability, enabling brands to refine their storytelling and justify premium positioning.

This comprehensive research report categorizes the Women's Suits & Ensembles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Price Tier

- End Use

- Fabric Material

Exploring critical regional insights across the Americas, Europe, Middle East & Africa, and Asia-Pacific to reveal the geographical dynamics influencing market growth

Geographical dynamics exert a profound influence on the performance and outlook of the women’s suits and ensembles market. In the Americas, mature markets in the United States and Canada increasingly prioritize made-in-region credentials, driving collaborations between domestic mills and fashion brands to reinforce local production capacities. Meanwhile, Latin American nations serve as both burgeoning consumer bases and alternative sourcing locations, gaining attention for competitive labor costs and proximity to North American distribution networks.

Across Europe, the Middle East, and Africa, heritage luxury houses maintain their stronghold, especially in Western Europe, where artisanal craftsmanship remains a key differentiator. At the same time, Middle Eastern markets exhibit surging demand for bespoke tailoring, fueling high-end bespoke services and made-to-order programs. In Africa, nascent fashion hubs are emerging, with a growing emphasis on ethical manufacturing practices and intra-continental trade agreements fostering new partnerships. Conversely, the Asia-Pacific region stands out for its dual role as a powerhouse of mass production-anchored by established manufacturing ecosystems in Southeast Asia-and as a rapidly expanding consumer frontier, particularly in China, India, and Southeast Asia, where a rising middle class is embracing aspirational Western styling.

This comprehensive research report examines key regions that drive the evolution of the Women's Suits & Ensembles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into the profiles, strategies, and competitive positioning of leading companies shaping the women’s suits and ensembles market ecosystem today

The competitive terrain of the women’s suits and ensembles sector is characterized by an eclectic mix of long-standing fashion houses, innovative contemporary labels, and digitally native entrants. Legacy players with deep heritage in tailoring continue to leverage their reputations for quality and fit, focusing on product innovation that integrates sustainable materials and advanced manufacturing techniques. Simultaneously, independent designers and emerging brands are capturing share by championing niche positioning, whether it be gender-fluid silhouettes, artisanal craftsmanship, or cutting-edge technology integrations such as smart textiles.

Furthermore, e-commerce pioneers are reshaping consumer expectations through data-driven personalization and seamless omnichannel journeys. These companies harness predictive analytics to curate assortments, optimize inventory, and deliver contextualized marketing. Partnerships between established brands and tech startups have also proliferated, with collaborations spanning from virtual try-on platforms to blockchain-enabled supply chain traceability solutions. Such alliances underscore a broader industry imperative: marrying the heritage of classic tailoring with the agility and responsiveness required in today’s digital-first marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Women's Suits & Ensembles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akris AG

- Ascena Retail Group Inc.

- Brooks Brothers Inc.

- Burberry Group plc

- Chanel S.A.

- Chico's FAS Inc.

- Diane von Furstenberg Studio LP

- Eileen Fisher Inc.

- Elie Tahari Ltd.

- Escada SE

- Gap Inc.

- Hugo Boss AG

- J.Crew Group Inc.

- Max Mara Fashion Group S.r.l.

- Michael Kors Holdings Limited

- Nicole Miller LLC

- PVH Corp.

- Ralph Lauren Corporation

- Regalia Inc.

- St. John Knits International Inc.

- Sycamore Partners

- Talbots Inc.

- Theory LLC

- Vince LLC

Providing actionable recommendations for industry leaders to capitalize on emerging trends, optimize operations, and future-proof growth in women’s suits and ensembles

In order to thrive amidst the rapid evolution of the women’s suits and ensembles market, industry leaders must adopt a proactive and multifaceted approach. First, supply chain diversification should be prioritized by blending nearshoring collaborations with strategic alliances in emerging markets. This will not only enhance resilience against tariff fluctuations but also ensure consistent quality and design agility. Next, investment in digital infrastructure-encompassing virtual fitting technologies, AI-driven demand forecasting, and immersive online showrooms-will be crucial to meet rising consumer expectations for personalized, frictionless shopping experiences.

Equally important is the integration of sustainability across all facets of operations. By embracing circular design principles, sourcing regenerative materials, and transparently communicating environmental commitments, brands can fortify consumer trust and command premium positioning. Additionally, elevating the in-store experience through services such as made-to-measure fittings and personalized styling consultations will reinforce the value proposition of physical retail. Finally, cultivating cross-sector partnerships-ranging from technology innovators to textile research institutes-will accelerate innovation cycles and unlock new growth avenues, ensuring organizations remain at the forefront of this dynamic market.

Outlining the rigorous research methodology and analytical framework that underpins the comprehensive insights into women’s suits and ensembles market

This study employs a comprehensive, multi-tiered methodology designed to deliver robust qualitative insights into the women’s suits and ensembles market. The research framework integrates an extensive review of secondary sources-industry publications, trade journals, and regulatory databases-to contextualize the macroeconomic and regulatory environment. Concurrently, primary qualitative interviews were conducted with a diverse panel of stakeholders, including design executives, sourcing directors, and retail innovators, to capture firsthand perspectives on emerging trends and strategic imperatives.

Analytical rigor was achieved through a structured segmentation approach that dissects the market by product type, distribution channel, price tier, end use, and fabric material. Data triangulation techniques ensured validation of findings by cross-referencing industry feedback, case study evidence, and expert commentary. Additionally, regional deep dives were performed to uncover localized dynamics, while comparative analysis across competitive benchmarks highlighted best-practice strategies. This layered methodology underpins the report’s actionable recommendations, ensuring they are both evidence-based and aligned with current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Women's Suits & Ensembles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Women's Suits & Ensembles Market, by Product Type

- Women's Suits & Ensembles Market, by Distribution Channel

- Women's Suits & Ensembles Market, by Price Tier

- Women's Suits & Ensembles Market, by End Use

- Women's Suits & Ensembles Market, by Fabric Material

- Women's Suits & Ensembles Market, by Region

- Women's Suits & Ensembles Market, by Group

- Women's Suits & Ensembles Market, by Country

- United States Women's Suits & Ensembles Market

- China Women's Suits & Ensembles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing core findings and strategic implications to underscore the critical takeaways and next steps for stakeholders in women’s suits and ensembles

This executive summary encapsulates the pivotal themes shaping the women’s suits and ensembles market, from the integration of digital innovation and sustainability to the strategic ramifications of newly enacted tariffs. By examining segmentation nuances, regional dynamics, and competitive profiles, it distills critical insights that inform strategic decision-making. The convergence of hybrid work trends with consumer demand for personalization underscores a pivotal shift in product design and customer engagement strategies.

Looking ahead, brands that adeptly navigate supply chain complexity, embrace data-driven innovation, and commit to environmental stewardship will emerge as category leaders. Stakeholders are encouraged to leverage the full report’s detailed analyses to refine business models, optimize channel strategies, and forge the partnerships necessary for sustained competitive advantage. Ultimately, this research serves as a catalyst for informed action, guiding industry participants toward greater resilience and market differentiation.

Drive strategic decision-making today by partnering with Ketan Rohom to access the authoritative market research report on women’s suits and ensembles for actionable insights

To gain a decisive competitive edge in the rapidly evolving women’s suits and ensembles market, connect with Associate Director of Sales & Marketing, Ketan Rohom, to secure your copy of the in-depth market research report. This comprehensive study delivers actionable insights, expert analyses, and strategic guidance tailored to the complex demands of product development, supply chain optimization, and omnichannel distribution.

By partnering directly with Ketan Rohom, you will receive personalized support to navigate the report’s findings, apply data-driven recommendations, and align your organization’s objectives with the latest trends shaping product innovation and consumer engagement. Enhance your strategic planning sessions with exclusive access to qualitative market intelligence, leading-practice case studies, and forward-looking perspectives designed to inform executive decision-making and drive outstanding business outcomes.

Don’t let crucial market shifts pass you by. Reach out to Ketan Rohom today to unlock the full potential of this authoritative resource and propel your women’s suits and ensembles business toward sustainable growth and competitive leadership.

- How big is the Women's Suits & Ensembles Market?

- What is the Women's Suits & Ensembles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?