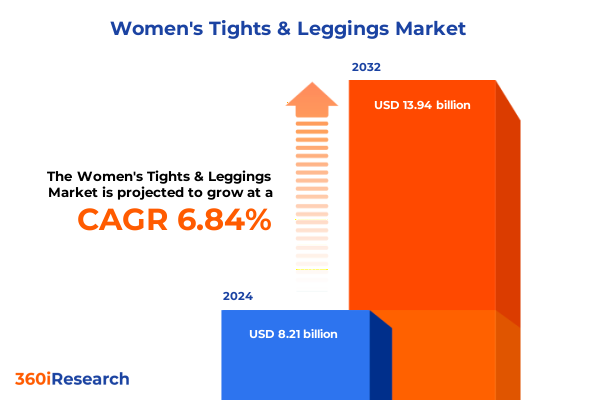

The Women's Tights & Leggings Market size was estimated at USD 8.76 billion in 2025 and expected to reach USD 9.27 billion in 2026, at a CAGR of 6.85% to reach USD 13.94 billion by 2032.

Navigating the Dynamic World of Women's Tights and Leggings Where Evolving Styles, Consumer Demands, Market Drivers, and Sustainability Converge

The women’s tights and leggings sector has evolved rapidly over recent years, driven by shifting consumer lifestyles, technological advancements in textiles, and an accelerating embrace of versatile, comfort-first fashion. Today’s consumers expect their legwear to transition seamlessly from studio workouts to casual outings, while also expressing individual style and adhering to ethical values such as sustainability. As athleisure continues to blur the lines between sportswear and everyday garments, brands are innovating through new silhouettes, fabric blends, and design features that cater to multifaceted wardrobes. Moreover, digital channels and social media influencers amplify trends at unprecedented speed, creating both opportunities and challenges for manufacturers and retailers aiming to stay ahead of consumer expectations.

Against this backdrop, the market is also shaped by rising consumer consciousness around environmental impact and labor practices. Demand for recycled polyester, organic cotton, and plant-derived fibers reflects a broader industry pivot toward eco-friendly materials and transparent supply chains. In parallel, performance-driven technologies like moisture-wicking finishes, four-way stretch constructions, and seamless knitting are elevating the functional appeal of tights and leggings. As a result, companies must balance aesthetics, comfort, and environmental stewardship to resonate with a diverse and socially engaged audience. This introduction sets the stage for a comprehensive exploration of market dynamics, transformative shifts, tariff implications, segmentation insights, and strategic recommendations that underpin the current state and future trajectory of women’s legwear.

Transformative Shifts Reshaping the Landscape of Women’s Tights and Leggings from Design Innovation to Digital Marketplace Expansion and Supply Chain Optimization

The landscape of women’s tights and leggings has undergone transformative shifts, sparked by evolving design paradigms and a wholesale migration to digital-first commerce. Brands no longer compete solely on quality and price; they differentiate through advanced fabric technologies that integrate sustainable fibers with performance-enhancing properties. This shift has been accelerated by collaborations between textile innovators and athleisure labels to produce recycled nylon blends and biodegradable elastane alternatives. Consequently, consumers now have access to legwear that offers environmental benefits without compromising on comfort or durability.

Simultaneously, distribution channels have reconfigured, as online retail platforms shore up investments in direct-to-consumer models and virtual fitting tools. E-commerce has surged ahead of brick-and-mortar specialty stores and traditional supermarkets, enabling rapid market expansion beyond geographic constraints. Digital marketplaces and brand-owned websites deploy data-driven personalization, while multi-brand specialty retailers emphasize experiential showrooms that blend online and offline touchpoints. These shifts have compelled legacy brick-and-mortar players to reimagine store layouts, integrate omnichannel inventory strategies, and offer click-and-collect services to meet modern consumer expectations.

Moreover, the industry has seen a proliferation of niche labels specializing in technical leggings for yoga, high-intensity interval training, or shapewear integration. This design diversification is not merely aesthetic; it responds to consumer demand for purpose-built apparel that aligns with specific activities and body types. As a result, the market’s boundary between athletic and lifestyle wear grows increasingly porous, underscoring the need for brands to stay agile and consumer-centric in an environment where rapid trend cycles and technological breakthroughs continually reshape expectations.

Analyzing the Cumulative Impact of United States Tariff Measures and Trade Policy Disruptions on the Women’s Tights and Leggings Market through 2025

The United States’ tariff regime has exerted a cumulative impact on the women’s tights and leggings market through 2025, influencing sourcing strategies and cost structures across the value chain. Since the initial imposition of Section 301 tariffs on selected imports from China, manufacturers have confronted additional duties on finished textiles and apparel, prompting many to diversify production to Southeast Asia and nearshore facilities. At the start of 2025, further tightening of de minimis thresholds eliminated duty-free entry for low-value shipments, effectively subjecting small packages from fast-fashion platforms to significant tax rates nearing 90%.

This shift has reverberated beyond direct tariff costs. Brands and e-commerce retailers have navigated complex customs classifications and higher compliance burdens, while some have elected to absorb tariffs to maintain price competitiveness. According to U.S. import data, China’s textile and apparel shipments to the U.S. rose by over 20% in early 2024 even as per-unit dollar values per square meter equivalent fell by 34% since 2018. Simultaneously, production hubs in USMCA and CAFTA-DR regions experienced declines of 45% and 4.6% respectively, underscoring a shifting global supply mix against an evolving trade policy backdrop.

Looking ahead, the prospect of additional tariff increases under Section 301-particularly on advanced textile technologies or specialty elastomers-continues to shape strategic decisions around vertically integrated manufacturing and regional distribution hubs. As brands recalibrate sourcing portfolios, the balance among cost efficiency, lead times, and regulatory complexity remains at the forefront of operational risk management. Ultimately, the cumulative tariff impact to 2025 has accelerated supply chain transformation, fostering a more resilient but geographically diversified industry ecosystem.

Unlocking Key Segmentation Insights across Product Types Distribution Channels Fabrics Price Ranges and Age Demographics in Women’s Legwear

A nuanced understanding of market segments proves essential to identifying growth levers within women’s legwear. Product type segmentation spans fishnets, jeggings, leggings, and tights, each with distinct consumer drivers and competitive dynamics. Fishnets, whether classic or patterned, often serve fashion-forward niches, whereas jeggings fabricated in denim or faux leather straddle the line between casual wear and edgier style statements. Leggings themselves segment into ankle length, capri, and high-waist variants, satisfying different fit preferences and seasonal occasions while tights offer opaque and sheer forms that cater to both utility and aesthetic layering.

Distribution channels further delineate market behavior, as online retail channels-split between branded e-commerce platforms and third-party marketplaces-deliver convenience and breadth of assortment. Specialty stores, comprising both branded and multi-brand outlets, provide curated in-store experiences, while supermarkets and hypermarkets, including discount formats, leverage scale and price competitiveness to capture value-oriented shoppers. Fabric segmentation reveals consumer emphasis on cotton blends-organic and otherwise-alongside nylon in 20-denier and 6-denier weights, microfiber and standard polyester, and spandex in high-stretch and low-stretch constructions, each offering unique performance and comfort attributes.

Price range and age group segmentation intersect to paint a holistic consumer picture. Economy tier offerings under $20 cater to mass-market demand, whereas mid-range products priced at $20-$50 balance quality and affordability. Premium legwear commanding $50-$100 capitalizes on advanced materials, designer labels, and technical features. Age demographics span teens (18 and below), adults divided into 25-45 and 45-60 cohorts, and seniors over 60, illuminating distinct purchasing rationales-from teen-driven trend adoption to adult focus on performance and senior preferences for comfort and ease of wear. Together, these segmentation layers reveal a complex, multi-dimensional market that demands targeted product and marketing strategies.

This comprehensive research report categorizes the Women's Tights & Leggings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Fabric

- Age Group

Exploring Regional Variations Growth Patterns and Market Drivers in Women’s Tights and Leggings across Americas EMEA and Asia-Pacific Regions

Regional dynamics in the women’s tights and leggings market underscore divergent growth drivers and consumer behaviors across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, North America leads innovation cycles, propelled by athleisure’s mainstream acceptance and strong digital retail infrastructure. The United States’ sophisticated e-commerce ecosystem and high disposable incomes have cemented direct-to-consumer models, while Latin American markets showcase robust demand elasticity alongside emerging local manufacturing capabilities.

Across Europe Middle East & Africa, Western European nations exhibit mature preferences for sustainable and luxury legwear, with consumers gravitating toward recycled fibers and transparent supply chains. In contrast, the Middle East blends fashion traditions with contemporary active lifestyles, spurring demand for modest yet technical leggings. African markets, while nascent, present long-term potential driven by urbanization and rising fitness culture, though infrastructure constraints temper near-term expansion.

The Asia-Pacific region represents both a production powerhouse and a burgeoning consumer base. China remains a leading textile exporter, even as domestic demand in South Korea, Japan, and Australia intensifies for high-performance and premium legwear. Southeast Asian economies, including Vietnam and Indonesia, serve as alternative manufacturing hubs, balancing cost competitiveness with improving quality standards. Meanwhile, India’s sizeable youth demographic and growing digital penetration are fueling exponential online sales growth, positioning the region as a critical frontier for both production and consumption.

This comprehensive research report examines key regions that drive the evolution of the Women's Tights & Leggings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Diving Deep into Leading Companies Driving Innovation Strategic Partnerships and Competitive Approaches in the Women’s Tights and Leggings Industry Globally

Leading companies in the global women’s tights and leggings space differentiate through an amalgamation of brand heritage, product innovation, and strategic partnerships. Lululemon Athletica has cemented its market leadership by pioneering high-waist leggings with patent-pending waistband technology, driving consumer loyalty through product reliability and community-focused marketing events. Nike and Adidas continue to invest heavily in performance fabrics, collaboratively developing moisture-management and compression features alongside professional athletes to reinforce brand credibility.

Elsewhere, Under Armour and Puma leverage sports heritage to extend into lifestyle and fitness segments, while Spanx has disrupted shapewear integration by embedding supportive mesh panels within leggings that modulate body contour. Meanwhile, emerging players such as Gymshark utilize influencer-driven social commerce and agile design sprints to capture Gen Z attention. Hanes Brands competes on value and scale, offering economy-tier products under established quality assurances, whereas Alo Yoga taps the wellness movement with premium materials and curated in-store yoga experiences. Collectively, these companies illustrate the spectrum of competitive approaches-from performance leadership to digital-native brand building-that define the current industry landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Women's Tights & Leggings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Back Seam Apparel LLC

- Capezio/Ballet Makers Inc.

- Commando LLC

- Commando LLC

- Hanesbrands Inc.

- Heist Studios Ltd.

- Hipstik Inc.

- Jockey International Inc.

- Leg Resource Inc.

- Lululemon Athletica Inc.

- Nike Inc.

- Sheertex Inc.

- Spanx LLC

- Swedish Stockings AB

- Under Armour Inc.

- Wolford AG

Actionable Recommendations for Industry Leaders to Harness Market Opportunities Navigate Tariff Challenges and Embed Sustainability in Women’s Legwear

Industry leaders should prioritize investments in sustainable material innovation, adopting a circular economy framework to reduce environmental impact and meet rising consumer expectations. Integrating recycled fibers and biodegradable elastomers can drive brand differentiation and foster long-term supply chain resilience. Additionally, expanding direct-to-consumer digital platforms with advanced virtual try-on technologies will enhance personalization, decrease return rates, and accelerate customer acquisition across age demographics.

Simultaneously, companies must develop agile tariff mitigation strategies, including geographic diversification of manufacturing footprints and strategic sourcing partnerships within USMCA and Southeast Asian trade zones. This ensures cost stability amidst potential future trade policy shifts. Brands should also harness data analytics to refine segmentation targeting-customizing product offerings across price tiers and age groups to optimize inventory turnover and maximize margin.

Finally, forging collaborative innovation partnerships-whether with textile developers, technology startups, or fitness influencers-can catalyze next-generation performance attributes and amplify brand storytelling. By uniting cross-functional capabilities in design, sustainability, and digital marketing, industry players can navigate competitive pressures and capitalize on evolving consumer demands.

Comprehensive Research Methodology Employed to Analyze the Women’s Tights and Leggings Market Ensuring Data Rigor and Triangulation of Insights

This research integrates primary and secondary methodologies to ensure robust, triangulated insights. Primary data collection comprised in-depth interviews with industry executives, supply chain managers, and channel partners, complemented by consumer surveys that gauged purchasing motivations across demographics. Secondary research drew from publicly available trade data, industry white papers, reputable business publications, and cross-referenced import/export statistics from the U.S. International Trade Commission and National Council of Textile Organizations.

Quantitative analysis employed statistical models to assess regional and segment trends, while qualitative synthesis identified key themes in sustainability, design innovation, and digital transformation. Data validity was reinforced through a multi-source verification process, ensuring alignment between proprietary estimates and external benchmarks. The resulting framework provides a comprehensive lens on market dynamics, enabling stakeholders to make informed strategic decisions grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Women's Tights & Leggings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Women's Tights & Leggings Market, by Product Type

- Women's Tights & Leggings Market, by Distribution Channel

- Women's Tights & Leggings Market, by Fabric

- Women's Tights & Leggings Market, by Age Group

- Women's Tights & Leggings Market, by Region

- Women's Tights & Leggings Market, by Group

- Women's Tights & Leggings Market, by Country

- United States Women's Tights & Leggings Market

- China Women's Tights & Leggings Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Reflections on the Evolution Trajectory and Strategic Imperatives for the Women’s Tights and Leggings Market in a Changing Environment

The women’s tights and leggings market stands at the intersection of fashion, performance, and sustainability, shaped by tariff regimes, digital retail evolution, and shifting consumer values. As brands navigate the complex tapestry of material innovation, distribution strategies, and trade policy impacts, success will hinge on adaptability and consumer-centricity. Understanding nuanced segmentation-from product type preferences to regional consumption patterns-enables more precise targeting and product development.

Looking forward, the melding of circular design principles with advanced performance technologies promises to redefine industry standards, while digital platforms will continue to drive personalized experiences and brand engagement. Companies that proactively address tariff volatility through diversified supply chains and strategic partnerships will be better positioned to optimize cost structures and maintain competitive pricing. In this dynamic environment, sustained growth will derive from the ability to balance innovation, operational resilience, and an unwavering focus on the evolving needs of women worldwide.

Together, these strategic imperatives underscore a vibrant and resilient market landscape, where forward-looking decision-makers can leverage actionable insights to chart a course toward sustainable, profitable expansion.

Secure Your Competitive Edge by Partnering with Ketan Rohom to Access the Definitive Women’s Tights and Leggings Market Research Report

Elevate your strategic planning by accessing the full market research report on women’s tights and leggings. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored insights and unlock the competitive intelligence you need to drive growth and innovation in this dynamic sector. Contact him today to secure your copy and gain a decisive advantage in the evolving apparel landscape.

- How big is the Women's Tights & Leggings Market?

- What is the Women's Tights & Leggings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?