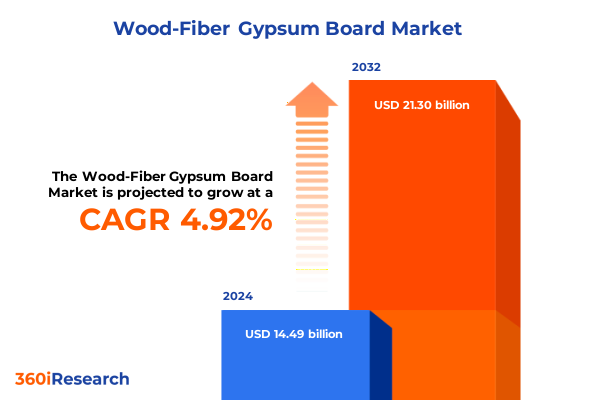

The Wood-Fiber Gypsum Board Market size was estimated at USD 15.13 billion in 2025 and expected to reach USD 15.80 billion in 2026, at a CAGR of 5.00% to reach USD 21.30 billion by 2032.

Discover How Wood-Fiber Gypsum Board Is Revolutionizing Construction by Delivering Eco-Friendly Composition Durability and Superior Acoustic Performance

Wood-fiber gypsum board represents an innovative fusion of recycled wood fibers and calcium sulfate dihydrate, yielding a composite panel that meets stringent environmental and performance criteria. This material combines the durability of gypsum with the resilience of wood, offering a compelling alternative to conventional wall and ceiling substrates.

In recent years, green building initiatives have accelerated the adoption of wood-fiber gypsum board. Its unique cellular matrix enhances acoustic attenuation and contributes to moisture equilibrium within interior environments, supporting healthy indoor air quality. Architects and developers appreciate its lightweight handling characteristics, which streamline installation workflows without sacrificing structural reliability.

Furthermore, advances in digital fabrication and automated paneling systems have enhanced precision and reduced waste, aligning with lean construction principles. Collaborative initiatives between material suppliers and software developers have enabled seamless integration into building information modeling workflows, fostering design customization and shortened project timelines.

The thermal performance of wood-fiber gypsum board also supports energy conservation goals by offering supplementary insulation capabilities. Heightened regulatory emphasis on reducing embodied carbon and achieving net-zero targets has positioned this material at the forefront of sustainable construction strategies. Supply chain diversification efforts have further increased its appeal among stakeholders seeking locally sourced and low-impact alternatives.

This executive summary distills the most critical insights on market evolution, transformative technological shifts, the cumulative impact of 2025 United States tariffs, and segmentation perspectives. Additionally, it presents regional dynamics, key competitive profiles, actionable recommendations, and an overview of the rigorous research methodology that anchors this analysis.

Uncover the Transformative Technological Innovations Market Dynamics and Sustainability Drivers Reshaping the Wood-Fiber Gypsum Board Landscape Worldwide

The landscape of wood-fiber gypsum board is undergoing transformative shifts driven by breakthroughs in material science and mounting sustainability imperatives. Innovative formulations now incorporate advanced binders and additives that enhance board flexibility and fire resistance without compromising environmental credentials. These advancements are reshaping product roadmaps as manufacturers balance performance with circular economy principles.

Simultaneously, digitalization across the supply chain-from raw material traceability to predictive maintenance of production lines-has intensified operational efficiencies. Internet of Things–enabled monitoring systems now provide real-time insights into moisture levels and curing cycles, ensuring consistent quality and reducing on-site waste streams. As a result, production agility and supplier transparency have emerged as competitive differentiators.

Market dynamics have also evolved in response to stringent green building certifications and shifting customer priorities. Developers increasingly demand materials that not only meet architectural aesthetics but also contribute to health and wellness metrics. This alignment has fueled collaborative pilot projects exploring modular construction and prefabricated panel assemblies, where wood-fiber gypsum board plays a central role in lightweight, high-performance envelope systems.

Furthermore, the growing emphasis on decarbonization is driving partnerships between board producers and renewable energy providers. Integrating biomass byproducts and sourcing low-emission gypsum variants are becoming standard practice. These collective shifts underscore a broader industry trajectory toward resilient, resource-efficient solutions that address both regulatory requirements and market expectations.

Examine How the 2025 United States Tariff Regime Intensifies Supply Chain Challenges and Alters Competitive Dynamics for Wood-Fiber Gypsum Board Manufacturers

The introduction of new tariff measures by the United States in early 2025 has created a complex operating environment for wood-fiber gypsum board producers. Import duties on certain gypsum derivatives and wood pulp inputs have elevated input costs, compelling manufacturers to reevaluate supply chain configurations. In particular, reliance on cross-border materials from neighboring markets has been scrutinized under the revised regulatory regime.

Consequently, many industry participants are accelerating onshore processing capabilities to mitigate cost exposure. Strategic investments in domestic gypsum recovery facilities and wood fiber recycling centers reflect a broader shift toward localized sourcing. This realignment not only buffers against tariff volatility but also reduces logistical lead times and carbon emissions associated with long-haul transport.

Conversely, some stakeholders have pursued tariff engineering strategies, such as reclassifying composite panels under alternative harmonized codes to optimize duty structures. While these methods can yield short-term relief, they require rigorous compliance oversight to avoid regulatory disputes. As a result, legal and trade experts have become integral to corporate risk management teams focused on tariff navigation.

Overall, the cumulative impact of the United States tariffs in 2025 has prompted a strategic pivot: from globalized reliance on imported gypsum and wood fibers toward hybrid supply models that blend domestic capabilities with carefully curated import streams. This evolution underscores the importance of adaptive procurement strategies and continuous engagement with policymakers to protect profitability and ensure material availability.

Explore Segmentation Insights Covering Board Types End Uses Distribution Channels Applications Board Thicknesses and Sizes That Influence Market Trajectories

Segmentation analysis reveals critical opportunity zones across board types, where acoustic insulation variants attract project specifiers seeking superior noise attenuation, while fire resistant panels-both Type C and Type X formulations-address stringent building codes in high-occupancy structures. Moisture resistant compositions, bolstered by hydrophobic coatings, find favor in wet-area applications, whereas mold resistant offerings leverage biocide integration to maintain hygienic conditions. Regular boards continue to serve baseline installations, underscoring their cost-effectiveness in less demanding environments.

End use segmentation highlights distinct channel preferences: commercial projects embrace wood-fiber gypsum board for open-plan office ceilings and retail mall partitions that demand aesthetic versatility and performance consistency. Industrial facilities, including manufacturing operations and warehousing, rely on moisture and impact-resistant formulations to withstand operational rigors. In the residential space, multifamily dwellings benefit from enhanced acoustic separation, while single family homes adopt these boards to meet evolving energy and health standards.

Distribution channel segmentation illustrates a balance between direct relationships and third-party networks. Institutional and project sales teams negotiate large-scale contracts, whereas local and national distributors ensure nationwide availability. Home improvement stores and specialty outlets cater to renovation markets, while e-commerce marketplaces and manufacturer websites provide digital storefronts for smaller orders and rapid replenishment.

Application-based segmentation underscores the versatility of ceiling panels and wall panels in both fixed and movable partition systems. Partition panels, available in fixed or relocatable configurations, support agile workspace design. Finally, board thicknesses ranging from under nine millimeters to above fifteen millimeters serve diverse structural and aesthetic requirements, and standard dimensions-spanning 1200 × 2400 to 1200 × 3600 millimeters-facilitate efficient panelization across project scales.

This comprehensive research report categorizes the Wood-Fiber Gypsum Board market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Board Type

- End Use

- Distribution Channel

- Application

- Board Thickness

- Board Size

Illuminate Regional Performance Dynamics Across the Americas Evolving Europe Middle East & Africa Nexus and the Rapid Growth Trajectory of Asia-Pacific Markets

In the Americas, robust infrastructure investments and stringent energy codes have driven demand for high-performance gypsum panels. North American markets, in particular, have embraced wood-fiber composites for both renovation and new construction, spurred by incentives for low-carbon materials. Regional producers have leveraged integrated forest management programs to secure sustainable wood fiber sources, while cross-border trade adjustments in light of recent tariff revisions have reshaped sourcing networks.

Across Europe, the Middle East and Africa, regulatory frameworks aimed at reducing environmental impact have amplified interest in wood-fiber gypsum board. The European Union’s circular economy package has encouraged manufacturers to adopt recycled wood streams and low-emission production processes. Meanwhile, key markets in the Gulf region are investing in innovative façade applications that combine thermal performance with design flexibility, opening pathways for premium fire resistant boards.

Asia-Pacific markets continue to register rapid expansion, driven by urbanization and rising infrastructure spending. Nations such as China and India are prioritizing affordable housing initiatives that incorporate moisture and mold resistant composite panels to enhance occupant well-being. Additionally, partnerships between local suppliers and global material innovators have accelerated technology transfer and localized production, reducing lead times and aligning with national sustainability goals.

This comprehensive research report examines key regions that drive the evolution of the Wood-Fiber Gypsum Board market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlight Strategies Operational Strengths and Collaborative Initiatives of Leading Producers Driving the Wood-Fiber Gypsum Board Industry Forward

Leading producers have undertaken diverse strategies to strengthen their market positions. One global supplier has focused on vertical integration of wood fiber sourcing and gypsum processing, securing a transparent supply chain while reducing production lead times. Another key participant has prioritized collaboration with architectural firms to showcase design-oriented applications and drive specification uptake.

Strategic acquisitions have also emerged as a critical growth lever. Several prominent players have acquired niche panel manufacturers specializing in high-humidity and fire rated boards, thereby expanding product portfolios and entering adjacent end-use segments. These transactions have enabled rapid scale-up of manufacturing footprints in regional strongholds.

Operating excellence programs have been deployed to optimize manufacturing processes. Investments in lean production techniques and automated panel finishing systems have improved yield rates and reduced material waste. Concurrently, select companies are piloting digital twin platforms to simulate production workflows, boosting responsiveness to demand fluctuations and enabling continuous process improvements.

In the realm of customer engagement, leading brands have unveiled interactive digital tools that assist project teams in choosing the optimal board type and thickness. By integrating performance calculators and specification libraries into online portals, these innovators are enhancing user experience and establishing themselves as solution providers rather than commodity suppliers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wood-Fiber Gypsum Board market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- China National Building Material Company Limited

- Compagnie de Saint-Gobain S.A.

- Etex Group NV

- Everest Industries Limited

- Fletcher Building Limited

- Georgia-Pacific Gypsum LLC

- Gypsemna Co. L.L.C.

- Holcim Ltd

- Jason New Materials Co., Ltd.

- KCC Corporation

- Knauf Gips KG

- National Gypsum Company

- PABCO Building Products, LLC

- USG Corporation

- Yoshino Gypsum Co., Ltd.

Empower Industry Leaders with Targeted Strategies to Leverage Sustainable Innovations Optimize Supply Chains and Capitalize on Emerging Market Niches

Industry leaders should prioritize sustainable innovation by investing in next-generation binders and additives that further improve fire resistance and moisture management while maintaining eco-credentials. Furthermore, deploying advanced process control systems will enhance manufacturing consistency and reduce scrap rates, thereby strengthening profit margins under fluctuating input costs.

Supply chain optimization must also remain a strategic focus. Organizations are encouraged to establish flexible sourcing agreements that balance domestic gypsum recovery with selective imports of specialized additives. Implementing risk management protocols that incorporate tariff scenario analyses will safeguard against future regulatory shifts and ensure uninterrupted material flows.

Expanding channel engagement through digital sales platforms can unlock new customer segments and drive volume growth in renovation and DIY markets. Tailored e-commerce solutions, coupled with remote specification assistance, will cater to evolving buyer preferences and shorten lead times for smaller orders. Meanwhile, cultivating partnerships with distributors to offer turnkey supply solutions will reinforce brand visibility in traditional outlets.

Finally, forging collaborative alliances with academic institutions and technology providers will accelerate the development of proprietary formulations. Co-developing pilot projects that demonstrate unique board capabilities in real-world applications will generate compelling case studies to support specification in high-profile projects, ultimately reinforcing market credibility and stimulating demand.

Detail the Comprehensive Research Framework Integrating Primary Interviews Secondary Data Analysis and Rigorous Validation to Ensure Reliability

This analysis is underpinned by a comprehensive research framework combining primary and secondary methodologies. Primary insights were obtained through structured interviews with senior executives, product managers, and technical specialists across key manufacturing hubs. Site visits to production facilities provided firsthand understanding of process capabilities, equipment configurations, and quality control protocols.

Secondary research encompassed a thorough review of trade publications, patent filings, regulatory documents, and sustainability standards. Technical whitepapers and standards from recognized building code bodies were examined to contextualize material performance requirements. Publicly available financial statements and corporate presentations supplemented interviews to validate strategic priorities and investment trends.

Data triangulation ensured robustness of findings. Quantitative inputs were cross-checked against qualitative insights to reconcile divergences and refine conclusions. A multi-layer validation process involved peer reviews by industry experts and iterative feedback loops with technical advisors, enhancing the credibility of segmentation analyses and regional assessments.

This mixed-method approach yields a balanced perspective that aligns market realities with emerging technological trajectories. By integrating diverse data sources and applying rigorous validation protocols, the research delivers actionable intelligence to support informed decision-making and strategic planning in the wood-fiber gypsum board sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wood-Fiber Gypsum Board market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wood-Fiber Gypsum Board Market, by Board Type

- Wood-Fiber Gypsum Board Market, by End Use

- Wood-Fiber Gypsum Board Market, by Distribution Channel

- Wood-Fiber Gypsum Board Market, by Application

- Wood-Fiber Gypsum Board Market, by Board Thickness

- Wood-Fiber Gypsum Board Market, by Board Size

- Wood-Fiber Gypsum Board Market, by Region

- Wood-Fiber Gypsum Board Market, by Group

- Wood-Fiber Gypsum Board Market, by Country

- United States Wood-Fiber Gypsum Board Market

- China Wood-Fiber Gypsum Board Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesize Key Discoveries Implications and Strategic Outlook Emphasizing the Pivotal Role of Wood-Fiber Gypsum Board in Future Construction Sustainability

This executive summary has highlighted the dynamic evolution of wood-fiber gypsum board as a material of choice for sustainable, high-performance construction. Key technological shifts in binder chemistry, digital fabrication, and circular economy integration have established new benchmarks in product capabilities. Meanwhile, evolving regulatory frameworks and 2025 tariff revisions have reshaped supply chain strategies and competitive positioning.

Segmentation insights illuminate distinct demand pockets across board types, end uses, distribution channels, applications, thicknesses, and sizes. Regional assessments underscore the unique drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific, reflecting diverse policy landscapes and construction norms. Profiles of leading manufacturers illustrate how strategic acquisitions, operational excellence, and digital engagement are reinforcing market leadership.

Actionable recommendations urge industry leaders to pursue sustainable process innovations, diversify sourcing frameworks, and enhance digital sales channels. Collaborative R&D and strategic partnerships will accelerate product differentiation and specification in high-value projects. Collectively, these strategies position stakeholders to capture emerging opportunities while mitigating regulatory and tariff-related risks.

As the construction sector intensifies its focus on decarbonization and occupant well-being, wood-fiber gypsum board stands poised to play a pivotal role in future building ecosystems. The insights and recommendations presented herein serve as a roadmap for navigating market complexities and achieving sustainable growth in this transformative segment.

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence and Secure Your Comprehensive Wood-Fiber Gypsum Board Report for Strategic Advancement

To obtain a comprehensive view of emerging trends, in-depth analyses, and strategic pathways for wood-fiber gypsum board, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored insights designed to inform critical decisions and fuel competitive advantage.

Secure access to the full market research report to explore detailed profiles of leading manufacturers, rigorous segmentation breakdowns, and actionable recommendations that drive long-term growth. Contact Ketan Rohom today to unlock the complete suite of intelligence necessary to elevate your strategic initiatives in the evolving construction materials landscape.

- How big is the Wood-Fiber Gypsum Board Market?

- What is the Wood-Fiber Gypsum Board Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?