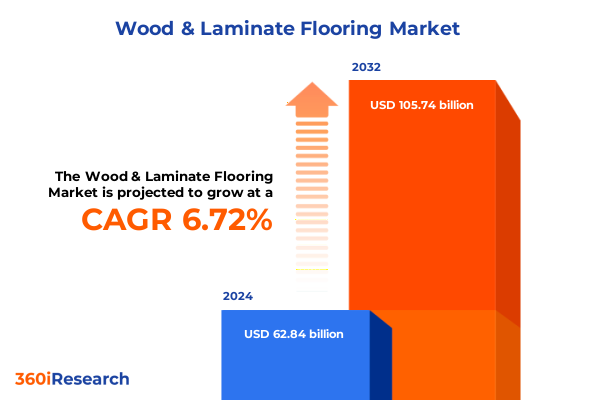

The Wood & Laminate Flooring Market size was estimated at USD 66.05 billion in 2025 and expected to reach USD 69.43 billion in 2026, at a CAGR of 6.95% to reach USD 105.74 billion by 2032.

A Strategic Overview of Market Dynamics Shaping the Wood and Laminate Flooring Industry Amid Rapid Technological Advancements and Changing Consumer Behaviors

From the resurgence of natural materials to the digitalization of design experiences, the wood and laminate flooring sector is undergoing a period of profound transformation. Fueled by shifting consumer preferences toward sustainable and high-performance solutions, the industry landscape is now defined by a complex interplay of material innovation, installation methodologies, and distribution advancements. This executive summary offers a concise yet comprehensive introduction to the factors that are shaping the present and future trajectory of wood and laminate flooring, providing stakeholders with critical context for strategic decision-making.

Anchored by a growing appetite for engineered and solid wood options alongside high-durability laminate alternatives, the sector’s value proposition has never been more nuanced. Engineered Wood flooring continues to capture attention through high-density fiberboard core and medium-density fiberboard core platforms, enhancing stability and cost efficiency. Meanwhile, Solid Wood flooring segments-ranging from bamboo to maple and oak-are being reinterpreted through refined manufacturing and finishing techniques to meet consumer demands for authenticity and longevity. On the laminate side, AC3, AC4, and AC5 ratings serve as reliable indicators of performance, enabling design professionals and end users to align durability requirements with aesthetic aspirations.

Against a backdrop of evolving installation preferences-spanning floating, glue down, and nail down approaches, each with its own sub-methodologies-the distribution network itself is morphing to accommodate both established home improvement stores and specialized online channels. Consequently, this section establishes the foundational narrative for how these converging developments will influence procurement strategies, operational planning, and product innovation across the wood and laminate flooring landscape.

Exploring Revolutionary Technological Integrations and Consumer Preferences Reshaping the Competitive Landscape of Wood and Laminate Flooring

Over the past decade, the wood and laminate flooring industry has witnessed a confluence of groundbreaking developments that are fundamentally reshaping its contours. Advancements in digital design platforms and augmented reality visualization tools now empower architects, designers, and end users to preview finished spaces with unprecedented precision, thereby accelerating decision cycles and enhancing customer satisfaction. Simultaneously, progress in engineered wood core technologies-particularly high-density fiberboard and medium-density fiberboard cores-has elevated performance benchmarks for stability and moisture resistance, effectively bridging the gap between traditional hardwood appeal and modern functionality.

Consumer expectations have also evolved in parallel, with eco-conscious buyers gravitating toward responsibly sourced solid wood options and recycled materials. This shift has catalyzed investment in sustainable harvesting practices for bamboo, maple, and oak, as well as the development of low-emission adhesives and finishes. On the laminate flooring front, the industry has responded with AC3, AC4, and AC5 certifications, offering tiered durability that aligns with both residential and light commercial requirements. As these product transformations intersect with the proliferation of floating, glue down, and nail down installation systems-each featuring specialized techniques such as click lock, dry lay, and staple down-the resulting matrix of options is far more intricate than ever before.

These technological and stylistic advances have not only expanded product portfolios but also forced legacy manufacturers to rethink supply chains, invest in automation, and forge strategic partnerships. In turn, distribution networks are adapting through omnichannel strategies that balance the scale of home improvement superstores with the specialization of boutique online retailers. Collectively, these transformative shifts are redefining competitive parameters and setting the stage for new value propositions in the wood and laminate flooring market.

Assessing the Multifaceted Consequences of Recent United States Tariff Policies on North American Wood and Laminate Flooring Supply Chains

The introduction of new tariff measures by the United States in early 2025 has imparted a multilayered impact on the wood and laminate flooring ecosystem. These duties, applied to select imported hardwoods and laminate planks, have reverberated through the supply chain, affecting procurement costs, supplier negotiations, and inventory management. While domestic producers of engineered wood-spanning high-density fiberboard core and medium-density fiberboard core offerings-may benefit from improved price competitiveness, the broader market is grappling with the implications for solid wood categories like bamboo, maple, and oak, which have historically relied on cross-border Raw Material sourcing.

Moreover, the realignment of cost structures has prompted certain distributors to reevaluate the balance between AC3, AC4, and AC5 laminate grades. Products carrying higher durability ratings have absorbed more of the tariff burden due to their reliance on specialized resin composites, resulting in selective price adjustments that have, in some cases, moderated end-user demand. Installation services, particularly glue down and nail down systems that utilize imported adhesives and fasteners, have similarly encountered incremental cost pressures, influencing contractor recommendations and project budgets.

In response, several market participants are exploring domestic certification programs and vertically integrated supply relationships, seeking to mitigate margin erosion and ensure continuous availability. Partnerships with home improvement store chains and specialized online platforms have expanded to include collaborative inventory models and dynamic pricing arrangements, reflecting the need to absorb short-term volatility while preserving channel stability. Collectively, these measures illustrate how the cumulative impact of the 2025 tariff regime is redefining strategic calculus for manufacturers, distributors, and end users alike.

Unveiling Rich Segmentation Insights That Illuminate Distinct Product, Installation, End Use, Application, and Distribution Dynamics

A nuanced understanding of segmentation dynamics sheds light on the distinct drivers and opportunities across product typologies, installation methods, end-use scenarios, application contexts, and distribution pathways. Within the product sphere, engineered wood flooring-divided between high-density fiberboard core and medium-density fiberboard core architectures-offers enhanced dimensional stability, while solid wood flooring variants such as bamboo, maple, and oak appeal to premium and sustainability-focused buyer profiles. Laminate flooring tiers, categorized by AC3, AC4, and AC5 durability ratings, satisfy a spectrum of usage conditions from light residential environments to rigorous commercial settings.

Installation type further refines the competitive landscape. Floating systems, enabled by click lock and loose lay techniques, cater to rapid, tool-free assembly and are gaining traction in both retrofit and rental housing projects. Glue down approaches, including dry lay and wet lay processes, remain prevalent in high-traffic spaces where substrate adhesion is paramount. Nail down and staple down methods maintain a loyal following among purists and heritage installations, where traditional craftsmanship and material authenticity are prioritized.

End-use segmentation reveals divergent trends between commercial and residential projects. Residential refurbishment efforts have been buoyed by consumer interest in turnkey renovation services, while the hospitality, office, and retail segments continue to drive demand for high-performance, visually striking flooring. Application contexts distinguish new construction from renovation priorities, highlighting the influence of building lifecycle considerations on material selection. Finally, distribution channels bifurcate into offline and online models, with home improvement stores serving as one-stop solutions and specialty outlets, both digital and brick-and-mortar, delivering targeted assortments to design professionals and discerning consumers.

This comprehensive research report categorizes the Wood & Laminate Flooring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- End Use

- Application

- Distribution Channel

Analyzing Diverse Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets with Focus on Consumer Preferences and Regulations

Regional analysis underscores how geographic nuances shape market trajectories and competitive strategies across the Americas, Europe, Middle East & Africa, and Asia-Pacific domains. In the Americas, consumer demand has steadily shifted toward engineered wood solutions with medium-density and high-density fiberboard cores, driven by regulatory incentives for sustainable forestry and robust residential renovation cycles. Meanwhile, the region’s extensive network of home improvement retailers continues to reinforce the offline channel, even as online marketplaces carve out specialized niches for premium solid wood variants and high-grade laminate panels.

In Europe, Middle East & Africa, stringent environmental regulations and green building certifications have catalyzed investment in bamboo and oak solid wood options, complemented by a growing appetite for AC4 and AC5 laminate applications in hotel and office refurbishments. Regulatory bodies across EMEA are increasingly aligning import standards with lifecycle assessment criteria, thereby influencing raw material sourcing strategies and manufacturer compliance efforts.

Asia-Pacific stands out for its rapid urbanization and infrastructure expansion, which have created sustained demand for floating installation systems, both click lock and loose lay, in multi-unit residential and commercial projects. Distribution networks in this region are characterized by a duality of traditional specialty stores in mature markets and burgeoning e-commerce platforms in emerging economies. Across all regions, consumer preferences, regulatory frameworks, and supply-chain resilience continue to drive differentiated strategies, compelling stakeholders to adapt to local realities while maintaining global competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Wood & Laminate Flooring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Leadership of Key Players Driving Competitive Advantage in the Wood and Laminate Flooring Industry

Key industry participants are engaging in strategic initiatives to secure market leadership and drive innovation across product development, supply chain optimization, and channel expansion. Among these, established hardwood flooring providers are extending their engineered wood lines through enhanced high-density fiberboard core formulations, investing in next-generation adhesives that align with low-emission standards and partnering with wood certification bodies to strengthen brand credibility. Concurrently, leading laminate manufacturers are differentiating through advanced wear-layer technologies and surface embossing techniques that replicate authentic grain patterns while delivering AC5 performance levels.

Collaborative ventures between flooring producers and installation equipment suppliers are fostering end-to-end solutions, integrating click lock systems with proprietary underlayment technologies to streamline site preparation and acoustic performance. At the distribution level, alliances with national home improvement chains and specialized online portals are being leveraged to pilot dynamic inventory fulfillment models, enabling just-in-time replenishment and customized assortments tailored to regional buying behaviors.

Further, several companies have realigned their commercial strategies to emphasize service offerings-such as design consultation, project management, and extended warranty programs-aimed at enhancing customer lifetime value and reinforcing differentiation in a crowded marketplace. Through targeted mergers, acquisitions, and joint-venture structures, market leaders are consolidating supply networks, accessing new geographies, and accelerating innovation pipelines, thereby reaffirming their status as trendsetters within the wood and laminate flooring industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wood & Laminate Flooring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alsafloor S.A.

- An Xin

- Armstrong Flooring, Inc.

- Balterio Laminate Flooring

- Beaulieu International Group N.V.

- Beaulieu International Group

- Classen Group

- Congoleum Corporation

- Der International Flooring

- EGGER Holzwerkstoffe GmbH

- Faus Group

- Formica Group

- Gerflor Group

- Greenlam Industries Ltd.

- Homenice

- Kaindl Flooring GmbH

- Kronospan Holding GmbH

- Mannington Mills, Inc.

- Meisterwerke

- Mohawk Industries, Inc.

- Nature Home Holding Company Limited

- Power Dekor Group Co., Ltd.

- Quick‑Step Flooring

- Shaw Industries Group, Inc.

- Swiss Krono Group

- Tarkett S.A.

Delivering Targeted Strategies and Operational Recommendations to Maximize Efficiency and Profitability Across Wood and Laminate Flooring Value Chains

To successfully navigate the complexities of the contemporary wood and laminate flooring landscape, industry participants should adopt a multifaceted strategic approach that aligns product innovation with operational excellence. First, manufacturers are advised to accelerate development of hybrid engineered wood constructs that leverage both high-density and medium-density fiberboard cores, delivering optimal stability and cost-efficiency while minimizing reliance on imported hardwood inputs.

Second, flooring companies should invest in digital design and configuration platforms that enable clients to visualize finished spaces with precise material, grout, and finish options. This digital front door enhances customer engagement, shortens sales cycles, and creates opportunities for value-added consultation services. Third, stakeholders across the value chain must reassess distribution models by piloting omnichannel inventory strategies, incorporating predictive analytics to synchronize stock levels between home improvement store networks and specialty online channels.

Fourth, materials and installation ecosystems can be optimized through partnerships with underlayment and adhesive technology providers, ensuring that glue down, floating, and nail down systems adhere to evolving performance and environmental standards. Fifth, commercial flooring specialists should tailor product assortments to the nuanced demands of hospitality, retail, and office segments, deploying enhanced AC4 and AC5 laminate solutions that meet rigorous traffic and design requirements.

By implementing these targeted recommendations, companies will cultivate resilience against external disruptions, reinforce brand differentiation, and unlock new avenues for profitable growth within the wood and laminate flooring sector.

Presenting a Robust Methodological Framework Combining Primary Insights and Secondary Research for Comprehensive Industry Analysis

This analysis is grounded in a methodologically rigorous framework that integrates both primary and secondary research modalities. Primary insights were gathered through structured interviews with flooring executives, installation professionals, and distribution partners, supplemented by in-depth surveys targeting architects, designers, and end users. These direct engagements provided qualitative perspectives on material performance, installation preferences, and emerging design trends.

Secondary research involved systematic reviews of industry publications, technical standards, environmental certification guidelines, and company disclosures. Comprehensive data collection spanned publicly accessible government trade databases and proprietary retail sales trackers to validate supply-chain dynamics and pricing fluctuations. Historical trade data, tariff schedules, and product registration records were carefully triangulated to map the trajectory of regulatory impacts and to identify actionable patterns within the import/export landscape.

Quantitative findings were further refined through cross-sectional analysis techniques and thematic coding of interview transcripts, enabling the distillation of core drivers and pain points across diverse stakeholder groups. The final research outputs were subjected to expert peer reviews and quality assurance checks to ensure accuracy, consistency, and relevance. This methodological rigor underpins the credibility of the insights presented herein and provides a transparent blueprint for replication in subsequent studies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wood & Laminate Flooring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wood & Laminate Flooring Market, by Product Type

- Wood & Laminate Flooring Market, by Installation Type

- Wood & Laminate Flooring Market, by End Use

- Wood & Laminate Flooring Market, by Application

- Wood & Laminate Flooring Market, by Distribution Channel

- Wood & Laminate Flooring Market, by Region

- Wood & Laminate Flooring Market, by Group

- Wood & Laminate Flooring Market, by Country

- United States Wood & Laminate Flooring Market

- China Wood & Laminate Flooring Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings and Strategic Imperatives to Chart the Future Path for Stakeholders in the Wood and Laminate Flooring Sphere

In synthesizing the critical findings of this study, several strategic imperatives emerge for stakeholders seeking to capitalize on the evolving wood and laminate flooring market. The convergence of technological innovations-with core enhancements in engineered wood stability and advanced wear-layer formulations-affirms the necessity of continuous product development investments. Likewise, the reconfiguration of supply chains in response to tariff pressures underscores the importance of vertical integration and strategic sourcing agreements.

Segmentation analysis highlights the value of tailoring offerings across varied product types, installation modalities, and end-use applications, while regional insights reveal that local regulatory frameworks and consumer preferences will continue to exert significant influence on market viability. Companies that successfully align distribution strategies across offline and online channels will be best positioned to meet the dynamic needs of retail and trade customers, whereas those that cultivate partnerships with installation and material technology providers will unlock new efficiencies and performance benchmarks.

Ultimately, the path forward rests on a holistic approach that balances innovation, collaboration, and operational agility. By heeding the evidence-based recommendations delineated in this summary-ranging from hybrid core development to omnichannel inventory optimization-industry leaders can transform emerging challenges into sustainable competitive advantages. This conclusion serves as both a reflection on current realities and a call to action for organizations to proactively shape the future of the wood and laminate flooring sector.

Empower Your Business Decisions with Detailed Market Research from Ketan Rohom to Stay Ahead in the Wood and Laminate Flooring Sector

To gain a competitive edge and equip your leadership team with unparalleled market intelligence, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan Rohom offers personalized guidance on leveraging this comprehensive report to identify high-impact opportunities, navigate complex regulatory landscapes, and align your product roadmap with emerging consumer trends. By partnering with Ketan, you will unlock a tailored engagement that ensures your organization’s strategic priorities are met with actionable insights, empowering you to make informed investments and accelerate growth in the dynamic wood and laminate flooring sector. Reach out today to secure your copy of this essential market research report and transform data into decisive action.

- How big is the Wood & Laminate Flooring Market?

- What is the Wood & Laminate Flooring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?