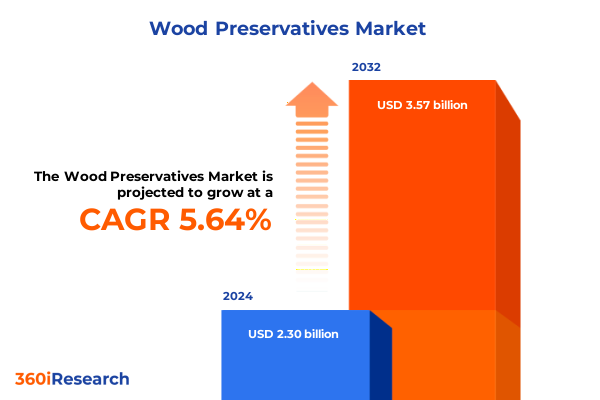

The Wood Preservatives Market size was estimated at USD 2.43 billion in 2025 and expected to reach USD 2.56 billion in 2026, at a CAGR of 5.65% to reach USD 3.57 billion by 2032.

Understanding the Critical Role of Wood Preservatives in Extending Timber Lifespan and Supporting Sustainable Construction Practices

From towering commercial structures to handcrafted furniture, wood remains an indispensable material across a wide spectrum of applications. Its innate beauty, structural strength, and versatility make it a preferred choice for architects, builders, and designers alike. However, when exposed to moisture, pests, fungi, and ultraviolet radiation, untreated timber can rapidly degrade, leading to structural failures and costly replacements. Wood preservatives serve as the frontline defense, penetrating cellular structures to inhibit biological threats and extend the functional lifespan of lumber.

As global emphasis on sustainable construction intensifies and environmental regulations tighten, the role of wood preservation has never been more vital. Preservation treatments not only reduce raw material waste and lower carbon footprints by extending service life, but also safeguard public infrastructure and private investments. In this context, stakeholders across building and construction, furniture manufacturing, utilities, and marine industries are increasingly prioritizing advanced preservation solutions that blend performance, environmental compliance, and cost-effectiveness. By understanding these dynamics, decision-makers can align their strategies with both market demands and regulatory trajectories.

Navigating Revolutionary Advances in Wood Preservation Technologies and Innovative Environmental Regulations Shaping Industry Dynamics

In recent years, wood preservation has undergone a seismic transformation driven by technological breakthroughs and a paradigm shift toward sustainability. Nanotechnology has enabled the development of ultra-fine dispersions of active biocides that penetrate deeper into cellular structures, offering enhanced protection against decay agents. Concurrently, bio-based formulations derived from plant extracts and naturally occurring minerals have gained momentum, reducing reliance on traditional synthetic chemicals and easing environmental impact concerns.

Alongside product innovation, regulatory landscapes are evolving. Jurisdictions worldwide are progressively phasing out legacy preservatives such as chromated copper arsenate and imposing stricter residue thresholds, prompting manufacturers to pivot toward low-toxicity alternatives. Moreover, digitalization has introduced real-time monitoring systems that assess moisture content and microbial activity in situ, enabling proactive maintenance. Collectively, these advances are reshaping competitive dynamics and opening new value streams across the wood preservation ecosystem.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Timber Imports Distribution Costs and Domestic Industry Competitiveness

The imposition of heightened duties on imported timber and preservation chemicals by the United States in 2025 has created a ripple effect across supply chains and end-user segments. Import costs for treated lumber surged, compelling distributors to renegotiate logistics contracts and absorb incremental handling fees. As a result, domestic producers registered elevated demand for in-country treatment capacity, straining existing infrastructure and prompting expedited investments in additional pressure-treatment facilities.

Meanwhile, downstream sectors such as building and construction and utilities experienced tighter margins as procurement budgets were reassigned to cover elevated preservation expenses. Some organizations responded by standardizing on water-based and locally sourced formulations, which faced lower tariff burdens. Despite short-term disruptions, these adjustments are incentivizing a gradual realignment toward resilient, vertically integrated supply models that prioritize regional self-sufficiency and mitigate future trade volatility.

Uncovering Critical Market Perspectives Through Comprehensive Formulation Material Compatibility Application Chemical Treatment and Channel Segmentation

A nuanced examination of formulation types underscores a clear shift toward water-based preservatives that balance performance with reduced volatile organic compound emissions, although oil-based and solvent-based options retain relevance in specialized industrial applications. Material compatibility insights reveal that hardwood segments such as mahogany and oak command premium protection focus, while softer substrates like pine and cedar benefit from tailored biocide blends that address differential absorption rates.

Application method analysis highlights that pressure treatment remains the gold standard for large structural elements, whereas spray application and dip&brush treatments are preferred for precision work and retrofits. On the chemical composition front, the emergence of copper azole and ammoniacal copper quaternary has diversified the inorganic preservative landscape, even as organic blends gain traction for low-impact use cases. Treatment function segmentation illustrates that decay and insect resistance continue to dominate product portfolios, with growing interest in waterproofing and fire retardation solutions. Distribution channels show a compelling duality, as online platforms enhance accessibility and traditional offline partners preserve logistical robustness. End-use perspectives attest that building and construction leads consumption, but marine applications and specialized utility treatments are expanding their share of strategic importance.

This comprehensive research report categorizes the Wood Preservatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation Type

- Material Compatibility

- Application Method

- Chemical Composition

- Treatment Function

- Distribution Channel

- End-Use

Analyzing Regional Drivers and Distinct Adoption Trends Shaping Wood Preservation Demand Across Americas Europe Middle East Africa and Asia Pacific

In the Americas, demand for high-performance preservatives is propelled by robust residential construction and infrastructure renewal initiatives. Heightened regulatory oversight in regions such as Canada and the U.S. has accelerated adoption of non-arsenical solutions, while Latin American markets exhibit a growing appetite for cost-effective water-based treatments. A comparative lens on Europe, Middle East & Africa illustrates a heterogeneous tapestry: stringent European Union standards drive continuous innovation and premium pricing, whereas emergent markets in the Middle East and Africa balance price sensitivity with infrastructure build-out that necessitates large-volume, durable treatments.

Meanwhile, Asia-Pacific continues to anchor global lumber treatment volumes, with China and India advancing both traditional pressure treatment and novel bio-preservative systems. Rapid urbanization and governmental investment in sustainable forestry management are key demand drivers in the region. Cross-regional trade flows and technology transfers underscore the increasing interdependence of market dynamics, prompting stakeholders to calibrate regional strategies while anticipating shifting tariff and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Wood Preservatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Initiatives Partnerships and Innovative Solutions from Leading Organizations Driving Growth and Sustainability in Wood Preservation

Leading market participants are aggressively cultivating portfolios that marry environmental stewardship with application versatility. Strategic partnerships between chemical innovators and coating specialists have given rise to hybrid formulations that optimize timber protection and aesthetic finish. Several organizations have launched dedicated research centers to fast-track next-generation biocide discovery, underscoring the centrality of R&D in competitive differentiation.

In parallel, collaborations with academic institutions and government agencies are fostering regulatory alignment and facilitating industry-wide standardization efforts. Digital service offerings-ranging from moisture sensors integrated into rail ties to smartphone apps that guide end-users through proper treatment protocols-illustrate how technology is redefining value propositions. Meanwhile, cross-border acquisitions are consolidating treatment capacity and supply infrastructure, enabling players to leverage economies of scale and expand geographic reach. These strategic moves are collectively reinforcing a competitive landscape characterized by agility, sustainability, and technological prowess.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wood Preservatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel Coatings International B.V.

- Albemarle Corporation

- American Borate Company

- Arxada AG

- BASF SE

- Buckman Laboratories International, Inc.

- Eco Chemical Inc

- EnviroSafe Wood Preservative

- Hexion Inc.

- ISK Biocides Inc.

- Kop-Coat Inc.

- Koppers Holdings Inc

- Nisus Corporation

- Osmose Utilities Services, Inc.

- PCI Products, Inc.

- Permachink Systems, Inc.

- Rust-Oleum Corporation

- TimberPro Coatings Ltd

- U.S. Borax Inc

- Viance, LLC

Empowering Industry Leaders with Targeted Strategic Actions to Leverage Emerging Technologies Regulatory Insights and Market Opportunities

Industry leaders should prioritize investment in emerging bio-based and nano-engineered preservative platforms to preempt regulatory phase-outs and capture early-adopter advantages. Strengthening supply chain resilience through regional treatment hubs and strategic inventory buffers will mitigate the impact of future tariff fluctuations and logistic disruptions. Concurrently, aligning product innovation with digital monitoring solutions can generate new service-based revenue streams while enhancing customer retention.

It is equally imperative to cultivate collaborative ecosystems with forestry associations, standards bodies, and environmental advocacy groups to streamline approval processes and bolster market credibility. Tailoring go-to-market strategies by region-leveraging premium, sustainable offerings in mature markets and cost-optimized solutions in emerging economies-will maximize penetration. Finally, engaging in selective mergers and acquisitions can accelerate access to niche chemistries and proprietary application technologies, reinforcing long-term leadership.

Detailing Rigorous Research Methodology Integrating Primary Stakeholder Inputs Secondary Data Triangulation and Expert Validation Processes

The research methodology underpinning this executive summary integrates a dual-track approach combining primary stakeholder engagements with comprehensive secondary research. Over the course of multiple interviews, senior executives from timber producers, chemical manufacturers, treatment service providers, and regulatory agencies provided qualitative insights into market drivers, pain points, and innovation priorities.

This primary input was triangulated against an extensive review of publicly available patents, environmental agency publications, trade association reports, and peer-reviewed journals. Quantitative data consistency was ensured through cross-verification across independent sources. All findings were further validated by a panel of external experts in wood science and industrial chemistry, whose feedback refined the final analysis and reinforced the rigor of conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wood Preservatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wood Preservatives Market, by Formulation Type

- Wood Preservatives Market, by Material Compatibility

- Wood Preservatives Market, by Application Method

- Wood Preservatives Market, by Chemical Composition

- Wood Preservatives Market, by Treatment Function

- Wood Preservatives Market, by Distribution Channel

- Wood Preservatives Market, by End-Use

- Wood Preservatives Market, by Region

- Wood Preservatives Market, by Group

- Wood Preservatives Market, by Country

- United States Wood Preservatives Market

- China Wood Preservatives Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Critical Findings and Strategic Imperatives to Chart the Future Course of the Wood Preservation Industry with Confidence and Insight

In synthesizing these insights, it is evident that the wood preservation landscape is at an inflection point where technological innovation, regulatory evolution, and shifting trade policies converge. Organizations that embrace bio-based chemistries, digital service integration, and resilient supply networks will be best positioned to thrive amid increasing environmental mandates and market fragmentation.

Strategic imperatives include fostering collaborative partnerships, optimizing regional treatment capabilities, and investing in application-specific solutions that align with end-user requirements. By adopting a holistic, data-driven approach to product development and market entry, industry stakeholders can not only navigate existing challenges but also unlock new growth opportunities, ensuring the continued vitality and longevity of timber assets worldwide.

Drive Your Business Forward by Partnering with Ketan Rohom to Access the Definitive Wood Preservatives Market Research Report and Gain Unmatched Strategic Intel

Ready to elevate your strategic planning and unlock decisive competitive advantages with a deep dive into wood preservative innovations and market intelligence? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive wood preservatives market research report and empower your organization with the insights needed to shape the future of timber protection

- How big is the Wood Preservatives Market?

- What is the Wood Preservatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?