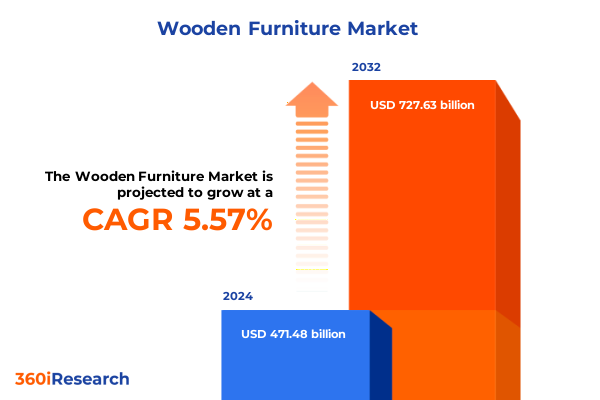

The Wooden Furniture Market size was estimated at USD 496.65 billion in 2025 and expected to reach USD 523.42 billion in 2026, at a CAGR of 5.60% to reach USD 727.63 billion by 2032.

Unveiling the Current Landscape and Foundational Drivers Reshaping the Global Wooden Furniture Industry Amid Shifting Consumer Preferences and Technological Advances

The global wooden furniture industry stands at a pivotal juncture as consumer preferences evolve toward sustainability, versatility, and digital convenience. Increasingly, buyers prioritize eco-friendly materials such as recycled wood, bamboo alternatives, and reclaimed timber in response to heightened environmental awareness. At the same time, multifunctional and modular furniture solutions have gained considerable traction, reflecting lifestyle shifts toward compact living spaces and remote work environments. Manufacturers and retailers alike are responding by blending classic craftsmanship with contemporary adaptability to meet these nuanced demands, underscoring the sector’s dynamic transformation in parallel with broader lifestyle trends.

Transitioning from traditional distribution frameworks to omnichannel models, industry participants are integrating online platforms with brick-and-mortar experiences to deliver seamless commerce. Leading retailers have optimized their e-commerce sites for enhanced configurator tools, enabling customers to customize wood finishes, dimensions, and upholstery virtually before purchase. Concurrently, localized showrooms across key metropolitan areas now serve as immersive design studios where consumers can engage directly with products and access professional styling services. This convergence of digital innovation, sustainability imperatives, and design-centric engagement shapes the strategic horizons of the wooden furniture landscape and frames the critical conversation for industry stakeholders.

Identifying the Major Transformative Forces Revolutionizing Wooden Furniture Production, Supply Chains, and Consumer Engagement Through Digital Innovation and Sustainability

Recent years have witnessed seismic shifts that are redefining how wooden furniture is designed, manufactured, and delivered. Sustainability has emerged as a cornerstone of product development, with major brands eliminating harmful substances such as per- and poly-fluoroalkyl compounds from all North American offerings and pledging to eradicate them globally by 2027. Simultaneously, circular economy practices have accelerated through initiatives like the replacement of plastic fitting bags with paper-based alternatives-cutting over 1,400 tons of plastic annually-and large-scale investments of over €1 billion in recycling infrastructure, underscoring a collective industry commitment to reducing waste and conserving natural resources.

Digital enablement has complemented these environmental strides, as omnichannel strategies rapidly evolve. Furniture giants are expanding direct-to-consumer formats in high-growth markets with both large and small-scale store concepts, while also piloting second-hand online marketplaces across Europe to tap into growing demand for pre-owned goods. On the technological front, AI-driven configurator tools and voice-activated customer support have enhanced personalization, allowing consumers to visualize and refine wood grains, finishes, and upholstery options in real time. These transformative forces converge to create a more responsive, sustainable, and digitally integrated wooden furniture ecosystem.

Analyzing the Comprehensive and Layered Effects of 2025 U.S. Tariffs on Wooden Furniture Imports, Domestic Production, and Global Trade Dynamics

In 2025, the United States has implemented a more complex tariff regime that significantly influences the wooden furniture sector. Average effective duties have surged from historically low levels of around 2.5 percent to approximately 16.6 percent, with proposals under consideration to approach a peak of 20.6 percent-the highest rates since the early 20th century. This escalation has reverberated throughout the value chain, prompting both direct cost increases on imported cabinetry, vanities, and assembled wood products and secondary price adjustments for domestically produced items due to higher raw material expenses and supply chain realignment.

Addressing mounting concerns over overlapping statutory authorities, an Executive Order issued in late April 2025 mandated that tariffs applied under multiple sections of the U.S. Tariff Act be rationalized to prevent “stacking” and to ensure that duty rates remain aligned with policy objectives without exceeding necessary levels. This directive, effective on March 4, 2025, retroactively invalidated cumulative duties on entries made on or after that date, requiring Customs and Border Protection to process refunds where applicable. At the same time, a White House investigation under Section 232 of the Trade Expansion Act has continued to explore national security risks associated with timber and lumber imports, laying the groundwork for potential future adjustments to import duties and reinforcing the strategic importance of domestic production capacity.

Industry associations have mounted concerted efforts to influence policy outcomes. The commercial furniture arm of a leading industry body cautioned against unilateral tariff hikes that could undermine gains under the USMCA structure and hamper cross-border supply continuity. A coalition of domestic manufacturers and importers submitted data‐driven feedback to the Department of Commerce, emphasizing the adverse impact of elevated Section 232 duties on downstream industries and end consumers. These developments highlight the cumulative and evolving impact of U.S. trade policy on the wooden furniture market in 2025.

Key Segmentation Insights Illuminating How Wood Type, Product Offerings, End-User Applications, and Distribution Channels Define Market Opportunities

Market segmentation by wood type offers critical perspective on performance and innovation trajectories. Engineered wood continues to gain favor for its dimensional stability and cost efficiency, providing an alternative to traditional hardwood species that remain prized for durability, aesthetic variation, and premium positioning. Meanwhile, softwood assortments maintain a strong foothold in entry-level and mass-market offerings, where affordability and rapid renewability resonate with environmentally conscious consumers.

Product-type segmentation further clarifies end-user engagement patterns. The beds category, encompassing adjustable configurations for enhanced ergonomics, space-saving bunk designs for youth markets, and convertible sofa beds for multipurpose living areas, drives differentiation. Seating solutions range from formal dining-grade chairs to more informal lounge chairs, recliners, and rocking chairs designed for wellness and relaxation. Storage units span bookcases, cabinets, chest of drawers, dressers, and wardrobes, reflecting the expanding appetite for integrated organization. Tables, whether configured for home offices or dining rooms, underscore the convergence of functional workspaces and social hubs within domestic environments.

Understanding segmentation by end-user application illuminates market entry strategies. Commercial demand originates from hotels seeking bespoke hospitality furnishings, corporate offices pursuing ergonomic fit-outs, and restaurants curating guest experiences. Institutional purchasers, including educational campuses and government facilities, prioritize compliance, durability, and cost predictability. Residential consumers, subdivided into home office beautification and living space enrichment, drive the personalized design movement and fuel demand for hybrid work-friendly furniture. Lastly, distribution channel dynamics balance traditional brick-and-mortar outlets-department stores, branded showrooms, and artisanal craftsmen workshops-with a burgeoning preference for online retail via direct company platforms and major e-commerce aggregators, reflecting the sector’s gradual embrace of omnichannel reach.

This comprehensive research report categorizes the Wooden Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wood Type

- Product Type

- End-User

- Distribution Channel

Probing Regional Nuances and Consumer Preferences Across the Americas, Europe Middle East Africa, and Asia-Pacific Wooden Furniture Markets

Regional analysis of the wooden furniture industry reveals distinct growth patterns and competitive landscapes across three primary geographies. In the Americas, market participants benefit from a robust domestic manufacturing base and favorable USMCA trade provisions, yet navigate pricing pressures arising from tariff adjustments and heightened consumer expectations for sustainable sourcing. Leading brands have capitalized on this environment by expanding footprint in emerging subregions, exemplified by the recent opening of a flagship store in upstate New York and pilot small-format outlets in Texas to address urban and suburban demand more effectively.

In Europe, the Middle East, and Africa, legacy strength in artisanal craftsmanship and premium design underpins consumer readiness to invest in high-quality, heritage-inspired wooden pieces. Sustainability considerations are especially prominent in Western Europe, where second-hand furniture marketplaces have achieved early success phases in Madrid and Oslo, prompting global players to scale pre-owned platforms across the region. Additionally, continent-wide circular economy commitments have driven retailers to pursue voluntary recycling targets and renewable energy mandates within manufacturing and supply chain operations.

The Asia-Pacific region represents a high-velocity frontier for both domestic brands and international entrants. Rapid urbanization, e-commerce proliferation, and rising middle-class incomes have elevated demand for both value-oriented and premium wooden furniture. Manufacturers in India, Indonesia, and China not only serve local consumption but increasingly feed global brand supply chains, supported by expanding dealer networks from companies like MillerKnoll in major cities, including new showrooms in Singapore and Jakarta. This tri-regional mosaic underlines the importance of tailoring strategic initiatives to localized consumer behaviors and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Wooden Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives of Leading Furniture Manufacturers Demonstrating Innovation, Sustainability, and Market Expansion in 2025

MillerKnoll has emerged as a case study in aligning sustainability with operational expansion. In early 2025, the company announced the elimination of all PFAS chemicals from its North American product portfolio and set a global phase-out target by 2027. Its North America Contract segment reported year-over-year order growth driven by corporate and healthcare clientele, even as net sales experienced timing-related fluctuations due to elongated shipment schedules. Concurrent investments in new retail locations-including planned openings in Palm Springs and Fairfax, Virginia-reflect a strategic push to enhance experiential sales formats and diversify revenue streams across direct and dealership channels.

IKEA continues to lead with circular economy innovations and inclusive design collaborations. The launch of the MÄVINN artisan collection, featuring pieces handmade from banana fibers, cotton, and jute by artisans across Asia, underscores IKEA’s ongoing commitment to sustainable sourcing and cultural heritage preservation. Concurrent pilots of second-hand furniture platforms in select European markets have drawn over 200,000 unique visitors, while expansions into underserved U.S. regions with smaller-format stores emphasize convenience and local responsiveness. Moreover, interlocking sustainability goals-such as achieving 75 percent renewable electricity in production and phasing out plastics in packaging-demonstrate a comprehensive approach to environmental stewardship.

Ashley Furniture Industries distinguishes itself through a dual focus on innovation culture and community impact. Named to Fortune’s 2025 list of America’s Most Innovative Companies, Ashley leverages an extensive patent portfolio and employee-driven ideation to refine product design and manufacturing processes. Simultaneously, substantial manufacturing investments-like an $80 million expansion in Mississippi creating 500 jobs-and robust corporate social responsibility initiatives illustrate the brand’s commitment to regional economic development and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wooden Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aavan International, Inc.

- American Woodmark Corporation

- Arhaus, Inc.

- Ashley Furniture Industries, Inc.

- Bassett Furniture Industries, Inc.

- Dorel Industries Inc.

- Durham Furniture, Inc.

- Ethan Allen Interiors Inc.

- Flexsteel Industries, Inc.

- Fortune Brands Innovations, Inc.

- Haworth, Inc.

- Herman Miller, Inc.

- HNI Corporation

- Hooker Furniture Corporation

- Inter IKEA Systems B.V.

- Klaussner Home Furnishings

- La-Z-Boy Incorporated

- Leggett & Platt, Incorporated

- MasterBrand Cabinets, Inc.

- New Classic Home Furnishings

- Raymour & Flanigan

- Rowe Furniture, Inc.

- Sauder Woodworking Co.

- Stanley Furniture Company, Inc.

- Steelcase Inc.

- Universal Furniture International, Inc.

- Williams-Sonoma, Inc.

Actionable Recommendations for Industry Leaders to Navigate Tariffs, Harness Segmentation Strategies, and Drive Sustainable Growth in Wooden Furniture

To navigate the evolving tariff landscape and maintain competitive margins, industry leaders should implement granular supply-chain mapping to identify exposure points for high-duty product lines. By diversifying sourcing across regions with favorable trade agreements and leveraging domestic forestry capacity where possible, manufacturers can mitigate cost volatility. In parallel, proactive collaboration with industry bodies to articulate data-backed policy recommendations can influence the design and application of Section 232 and Section 301 measures to better align with national security and economic objectives, ensuring that tariff policies support rather than stifle domestic production and employment growth.

Capitalizing on segmentation and regional insights, organizations should tailor product portfolios to resonate with distinct consumer cohorts. Deploying market intelligence to refine wood-type offerings-emphasizing engineered options in high-velocity mass channels and premium hardwoods within boutique and contract segments-will optimize revenue potential. Expanding omnichannel engagement through immersive digital configurators, localized showroom experiences, and targeted sustainability narratives will further strengthen customer loyalty. Finally, embedding circular economy principles-such as modular design for disassembly, take-back programs, and recycled packaging-will reinforce brand differentiation and align with regulatory expectations in key regions.

Comprehensive Research Methodology Employing Primary Interviews, Secondary Data, and Rigorous Triangulation to Ensure Analytical Integrity

This analysis is underpinned by a rigorous mixed-methodology approach combining primary and secondary research. Remote interviews and in-person consultations were conducted with senior executives, supply-chain managers, and design specialists across key geographies to capture strategic priorities and operational challenges. These qualitative insights were triangulated with secondary data drawn from government publications, industry association reports, and reputable news outlets to validate trends and policy impacts.

Quantitative data collection included structured surveys targeting end-users across commercial, institutional, and residential segments to gauge purchase drivers, price sensitivity, and brand perceptions. Advanced statistical techniques, including regression analysis and cluster segmentation, were applied to identify correlation patterns between tariff fluctuations, material preferences, and distribution channel performance. All findings underwent peer review by an internal editorial board to ensure analytical integrity and consistency with best practices in market research methodology.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wooden Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wooden Furniture Market, by Wood Type

- Wooden Furniture Market, by Product Type

- Wooden Furniture Market, by End-User

- Wooden Furniture Market, by Distribution Channel

- Wooden Furniture Market, by Region

- Wooden Furniture Market, by Group

- Wooden Furniture Market, by Country

- United States Wooden Furniture Market

- China Wooden Furniture Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Concluding Reflections Underscoring the Industry’s Strategic Imperatives and the Path Forward for Wooden Furniture Stakeholders

The wooden furniture industry in 2025 is characterized by the intersection of sustainability imperatives, evolving trade policies, and rapid digital transformation. Progressive environmental commitments-from phasing out PFAS and plastics to investing in renewable energy and recycling infrastructure-are redefining product innovation and consumer expectations. At the same time, dynamic tariff regimes and executive directives on trade have introduced complexity into cross-border sourcing, compelling stakeholders to adopt more resilient and diversified supply-chain strategies.

Segmentation and regional differentiation offer clear pathways for growth. Manufacturers who align material offerings with functional applications and engage consumers through omnichannel experiences will unlock untapped demand across the Americas, EMEA, and Asia-Pacific. Innovation-driven companies, exemplified by MillerKnoll’s chemical-free pledge, IKEA’s circular platforms, and Ashley’s community-focused investments, illustrate the competitive advantage conferred by blending sustainability with strategic expansion. As the market continues to evolve, organizations that integrate policy advocacy, targeted segmentation, and actionable sustainability frameworks will be best positioned to lead the next chapter of wooden furniture excellence.

Connect Directly with Ketan Rohom for Exclusive Access to the Comprehensive Wooden Furniture Market Research Report

I invite you to connect with Ketan Rohom (Associate Director, Sales & Marketing) to secure your comprehensive market research report, which provides the detailed insights and strategic guidance you need to make informed decisions. Reach out to discuss how this in-depth analysis can support your organization’s objectives and position you to capitalize on the evolving wooden furniture landscape. Don’t miss the opportunity to leverage this essential resource and stay ahead in a rapidly shifting industry environment.

- How big is the Wooden Furniture Market?

- What is the Wooden Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?