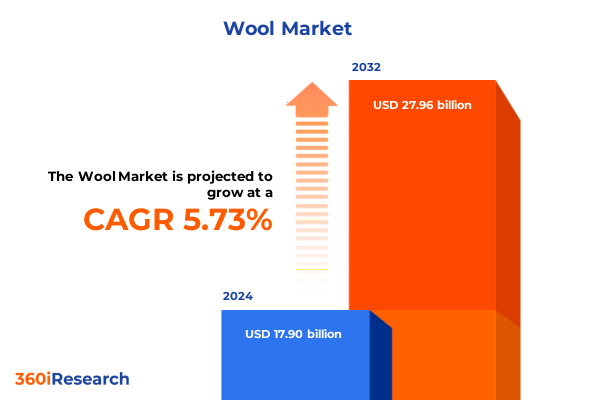

The Wool Market size was estimated at USD 18.91 billion in 2025 and expected to reach USD 19.89 billion in 2026, at a CAGR of 5.74% to reach USD 27.96 billion by 2032.

Emerging Dynamics in the Global Wool Industry Set the Stage for Innovation, Sustainability, and Market Differentiation in the Modern Textile Era

The wool industry has long held a revered place in textile history, weaving its story through centuries of artisan craftsmanship and technological advancement. Today, wool’s compelling blend of natural performance characteristics, renewable sourcing, and biodegradability is fueling a renaissance as stakeholders across the value chain seek sustainable, high-value materials. From high-altitude shepherding regions to advanced finishing mills, the interplay of tradition and innovation is reshaping the landscape. While legacy practices in shearing and sorting remain essential, cutting-edge developments in genetic breeding, traceability systems, and eco-friendly processing are helping wool reclaim its position at the forefront of premium textiles.

Moreover, consumer expectations have evolved; the modern purchaser demands both functional excellence and ethical integrity. This confluence of factors is driving brands to reimagine wool’s potential, leveraging its innate thermal regulation, moisture management, and tactile warmth. Importantly, these qualities are being amplified by breakthroughs in fabric engineering-where nanotechnology, enzyme treatments, and digital knitting platforms are unlocking new realms of softness, durability, and design precision. Consequently, industry participants are challenged to navigate a dual imperative: honoring wool’s rich heritage while propelling it into the vanguard of contemporary apparel, home textiles, and even industrial applications.

In this context, understanding key market drivers-ranging from shifting consumer priorities to evolving trade policies-is critical. The subsequent sections of this executive summary will illuminate transformative shifts in technology and sustainability, examine the cumulative impact of United States tariffs enacted in 2025, highlight segmentation and regional insights, showcase leading company strategies, and distill actionable recommendations. Together, these analyses will provide a comprehensive guide for stakeholders aiming to differentiate their offerings and capture emerging opportunities within the world of wool.

Key Forces Redefining Wool Manufacturing, Consumer Preferences, and Sustainability Benchmarks in the Evolving Textile Value Chain

The wool industry’s landscape is undergoing a profound metamorphosis driven by an intricate web of technological, regulatory, and consumer-led forces. Advances in traceability solutions now allow brands to verify fiber provenance at the herd level, fostering transparency and building trust with eco-conscious consumers. At the same time, climate-responsive breeding programs are optimizing yield and micron consistency, reducing variability and enhancing quality across raw material streams. Complementing these upstream innovations, digital weaving and knitting platforms are enabling on-demand production models that minimize waste and accelerate time to market.

Concurrently, heightened scrutiny of environmental footprints has prompted the rise of circularity initiatives. Pioneering stakeholders are piloting chemical-free degumming processes and enzymatic scouring techniques to slash water and energy consumption in finishing operations. Meanwhile, regulatory frameworks in major markets are mandating stricter wastewater standards and micro-fibre release limits, compelling manufacturers to invest in closed-loop systems and filtration technologies. As a result, companies that proactively integrate sustainability into their operational DNA are gaining competitive advantage, both in cost efficiency and in consumer perception.

Furthermore, the rapid emergence of high-performance wool blends-combining traditional fleece with technical fibers such as elastane and recycled polymers-is expanding wool’s applicability in athleisure, protective wear, and smart textiles. These developments underscore a pivotal shift: wool is no longer solely the domain of luxury suits and cozy knitwear but is poised to redefine performance benchmarks across multiple verticals. This convergence of innovation and sustainability is setting the stage for a new era in which wool’s unique attributes can be fully harnessed to meet the complex demands of modern markets.

Assessing the Broad Effects of 2025 United States Tariffs on Wool Trade Flows, Cost Structures, and Supply Chain Resilience in Key Markets

The United States government’s tariff revisions in early 2025 have introduced new complexities to the global wool trade, triggering a cascade of cost adjustments and strategic recalibrations. By raising duty rates on wool imports from several traditional sourcing regions, these measures have amplified landed costs across the entire supply chain. As importers grapple with this heightened expense, manufacturers have been compelled to revisit supplier agreements, hedge raw material procurement, and reassess downstream pricing structures. The cumulative effect has been a pronounced reconfiguration of trade flows, with certain value chains pivoting toward countries not subject to the most onerous duties, even when this entails longer transit times or higher freight expenses.

In parallel, the elevated tariff environment has incentivized nearshoring initiatives, as brands seek to mitigate geopolitical risk and compress lead times. While domestic wool processing in the United States has historically faced challenges related to scale and capital intensity, recent investments in mechanized combing and high-velocity knitting equipment are improving domestic competitiveness. Nonetheless, the transition to localized production remains gradual, as existing global hubs continue to benefit from entrenched expertise and economies of scale.

Moreover, the tariff landscape has spurred collaborative efforts between industry associations and government bodies to negotiate tariff rate quotas and secure preferential agreements for specific wool categories. These advocacy initiatives aim to balance the objectives of protecting domestic interests with preserving access to diverse fiber varieties-particularly specialty merino and cashmere blends. For organizations operating across high-end fashion and technical apparel segments, the ongoing tariff dialogue underscores the need for dynamic sourcing strategies and agile supply chain configurations to navigate evolving trade policy.

Unveiling Critical Segmentation Insights Revealing How Application, Product Type, Fiber Selection, and Distribution Channels Shape Wool Industry Strategies

In decoding the nuanced behaviors of wool demand, it is essential to examine the market through multiple segmentation lenses. By application, the industry spans apparel, home textiles, and industrial uses-each with distinctive growth vectors. Apparel offerings, ranging from technical outerwear to tailored suits and artisanal sweaters, reflect a spectrum of performance and aesthetic requirements. Meanwhile, home textiles such as luxurious bedding ensembles, hand-woven carpets, and resilient upholstery fabrics demonstrate wool’s versatility in enhancing interior comfort and style. On another front, industrial segments leverage wool’s inherent flame resistance and thermal insulation in geotextiles and building insulation, solidifying its role in construction and infrastructure projects.

When viewed by product type, wool’s value proliferates across fabric, finished products, and yarn. Knitted fabrics deliver stretch and contouring qualities ideal for activewear, whereas woven textiles lend structure and longevity for formal garments. Finished accessories, from scarves to hats, and heritage garments such as tailored jackets command premium positioning, while yarn formats-spun for softness and worsted for strength-cater to both artisanal handcrafting and high-speed mill operations.

Within the fiber-type segmentation, distinctions between cashmere, lambswool, and merino define quality and price tiering. Cashmere’s ultra-fine diameter and exceptional warmth secure its status as a luxury staple, lambswool’s soft texture and mid-range pricing deliver accessible luxury, and merino’s balanced performance profile has made it a top choice for outdoor and performance apparel brands.

Distribution channels further shape the end-consumer experience, as products flow through department stores-where flagship boutiques present curated collections alongside outlet concepts-alongside online retailers, whether direct from manufacturer websites or via third-party platforms, and specialized boutiques or chain-store networks. Each channel imparts distinct brand narratives and value perceptions, underscoring the importance of channel-specific strategies to optimize reach and reinforce brand ethos.

This comprehensive research report categorizes the Wool market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Product Type

- Fiber Type

- Distribution Channel

Exploring Regional Dynamics Illuminates Diverse Demand Patterns and Infrastructure Considerations Across Americas, EMEA, and Asia-Pacific Market Ecosystems

Regional dynamics in the wool industry reveal stark contrasts in consumption patterns, infrastructure maturity, and regulatory influences. In the Americas, North American markets are anchored by established supply chains and a strong heritage in wool processing, albeit facing intensified competition from alternative fibers. Meanwhile, Latin American economies exhibit nascent but growing interest in domestic wool sourcing and valorization of local sheep breeds, supported by government programs aimed at bolstering rural development.

Turning to EMEA, Europe’s wool sector continues to prioritize sustainability, with stringent environmental regulations accelerating adoption of biodegradable dyes and energy-efficient finishing mills. Luxury centers such as Italy and France maintain leadership in high-end suiting and knitwear, while emerging markets in the Middle East are capturing opportunities in bespoke interior textiles and premium fashion segments. Across Africa, pilot initiatives in countries like South Africa and Morocco are leveraging indigenous wool varieties for niche home textile exports and artisanal apparel, though infrastructure limitations temper scale.

In the Asia-Pacific region, Oceania remains the world’s largest wool production powerhouse, benefitting from expansive grazing lands and integrated processing facilities. Concurrently, consumer markets in China and India are experiencing surging demand for premium wool products, fueled by rising disposable incomes and a shift toward Western-inspired apparel. E-commerce channels in the region are rapidly scaling, allowing domestic brands and international players alike to reach second- and third-tier cities with targeted marketing and logistics solutions. Together, these regional nuances highlight the necessity of geographically attuned strategies for stakeholders seeking to harness wool’s global potential.

This comprehensive research report examines key regions that drive the evolution of the Wool market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations from Prominent Wool Industry Leaders Driving Quality, Sustainability, and Market Differentiation Globally

A review of leading industry players underscores a broad spectrum of strategies shaping the wool value chain. Vertically integrated fiber suppliers are investing heavily in regenerative grazing programs to enhance soil health, reduce greenhouse gas emissions, and capture premium pricing for certified sustainable wool. Concurrently, boutique mills specializing in small-batch worsted yarns are forging partnerships with luxury fashion houses, driving innovation in texture and dyeing techniques while preserving artisanal craftsmanship.

On the manufacturing front, fabric producers are deploying digital color-matching systems and laser-enabled finishing lines to improve precision and reduce waste. These technological upgrades support agile production runs that cater to rapid trend cycles and limited-edition capsule collections. Meanwhile, major apparel brands are piloting wool blend collaborations with technical fiber innovators, integrating performance attributes such as moisture wicking and ultraviolet protection into fashion-forward garments.

In the distribution arena, omnichannel pioneers are blending immersive flagship experiences with seamless online-to-offline integration, leveraging data analytics to personalize customer journeys. Simultaneously, specialty retailers and chains are curating exclusive collections that emphasize provenance, offering consumers deeper insights into fiber origins and processing narratives. Collectively, these company-level initiatives demonstrate the growing importance of purpose-driven innovation and customer-centric models in capturing market share and driving brand loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wool market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Woolen Company

- British Wool Marketing Board

- Cape Wools South Africa

- Chargeurs PCC

- Dormeuil S.A.

- Faribault Woolen Mill Co.

- Holland & Sherry Limited

- Johnson Woolen Mills

- Lanificio Luigi Botto S.p.A.

- Lempriere Wool Pty Ltd

- Loro Piana S.p.A.

- MacAusland's Woollen Mills Ltd.

- Modiano Wool Company

- Pendleton Woolen Mills

- Reda S.p.A.

- Scabal International S.A.

- Schneider Group

- Tessitura Monti S.p.A.

- The Woolmark Company

- Vitale Barberis Canonico S.p.A.

- Woolyarns Limited

- Z. Hinchliffe & Sons Ltd

- Zegna Baruffa Lane Borgosesia S.p.A.

Strategic Recommendations for Industry Leaders to Navigate Tariff Challenges, Leverage Segmentation Insights, and Accelerate Sustainable Growth in Wool Markets

To thrive in this rapidly evolving environment, industry leaders should adopt a suite of strategic measures that prioritize resilience, differentiation, and sustainable value creation. First, companies must diversify their sourcing portfolios by establishing multi-regional supply networks, thereby mitigating tariff exposure and weather-related risks. This approach should be complemented by dynamic contract structures that allow for volume flexibility and cost pass-through in volatile markets.

Second, investing in end-to-end traceability platforms will not only satisfy regulatory imperatives but also resonate with ethically minded consumers. By leveraging blockchain or similar technologies, stakeholders can deliver real-time visibility into fiber origin, animal welfare practices, and processing footprints. Such transparency will strengthen brand equity and facilitate premium positioning across both digital channels and brick-and-mortar outlets.

Third, aligning research and development efforts with emerging consumer trends-such as performance-driven blends, natural antimicrobial attributes, and circularity programs-will open new revenue streams beyond traditional apparel. Collaboration with material science start-ups and academic institutions can accelerate the commercialization of breakthrough treatments and processes.

Lastly, companies should refine their commercial models to harness the power of advanced analytics. Predictive demand planning, scenario modeling for tariff shifts, and segmentation-driven marketing campaigns can improve inventory turns and enhance customer engagement. By integrating these initiatives within a cohesive strategic framework, industry participants will be better equipped to navigate uncertainties and capitalize on wool’s enduring appeal.

Comprehensive Overview of Research Methodology Including Data Collection, Analytical Frameworks, and Validation Processes Underpinning Wool Industry Insights

This analysis is grounded in a rigorous research framework combining both qualitative and quantitative methods. Primary data collection involved in-depth interviews with wool growers, spinning mill executives, fabric manufacturers, brand strategists, and distribution channel leaders across key regions. These conversations provided granular perspectives on operational challenges, innovation priorities, and emerging consumer behaviors.

Secondary research encompassed a thorough review of trade association reports, government trade documentation, sustainability certification standards, and academic studies on wool genetics, processing technologies, and environmental impacts. This multifaceted literature synthesis was augmented by proprietary tracking of industry events, patent filings, and corporate disclosures.

Analytically, the study employed a cross-functional approach, integrating Porter’s Five Forces and SWOT assessments with segmentation mapping to decode market dynamics. Tariff impact scenarios were modeled qualitatively through comparative analysis of historical trade flows and stakeholder interviews, allowing us to elucidate likely adaptations rather than forecast specific figures.

To ensure robustness, preliminary findings were validated through a series of expert workshops, where senior leaders and technical specialists provided feedback on draft insights and challenged assumptions. This iterative validation process enhanced the credibility and practical relevance of the conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wool market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wool Market, by Application

- Wool Market, by Product Type

- Wool Market, by Fiber Type

- Wool Market, by Distribution Channel

- Wool Market, by Region

- Wool Market, by Group

- Wool Market, by Country

- United States Wool Market

- China Wool Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Core Findings and Strategic Implications to Offer a Clear Perspective on Evolving Opportunities and Challenges Within the Wool Industry Landscape

Through this exploration of technological evolutions, segmentation nuances, tariff impacts, and regional variations, a cohesive picture emerges: the wool industry stands at an inflection point. Stakeholders who embrace innovation, from traceability to performance blends, will unlock new avenues of differentiation. Meanwhile, those who proactively manage trade policy shifts and calibrate sourcing strategies will reinforce supply chain resilience in an uncertain global backdrop.

Segmentation and channel insights reveal that success lies in tailoring offerings to distinct consumer expectations-whether in luxury suiting, home comfort, or industrial insulation-while capitalizing on distribution models that best convey value narratives. Regional differences underscore the importance of local market intelligence, enabling nuanced approaches that respect regulatory regimes and consumer preferences.

Leading companies demonstrate that sustainability and profitability can coexist when embedded into core strategies. By aligning operational upgrades with environmental stewardship, and by harnessing data to sharpen decision-making, industry participants can navigate complexity with confidence.

Ultimately, the intersection of heritage and innovation will define wool’s trajectory in the coming years. Organizations that synthesize these insights into cohesive strategic plans will be well positioned to harness wool’s enduring strengths and to pioneer the next generation of high-performance, sustainable textile solutions.

Engage with Associate Director of Sales & Marketing Ketan Rohom to Unlock Premium Wool Market Research Insights and Elevate Your Strategic Decision Making Today

To gain comprehensive and actionable insights that will empower your strategic planning, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in wool market dynamics and consultative approach will ensure you receive tailored guidance aligned to your business objectives, whether you seek to deepen your understanding of tariff impacts or optimize your product segmentation strategy. By connecting with Ketan, you’ll access an exclusive overview of the full report, complete with proprietary data, expert analysis, and compelling case studies. Secure your pathway to competitive advantage today by reaching out to Ketan Rohom and unlocking the premium research report that can elevate your decision-making in the wool industry.

- How big is the Wool Market?

- What is the Wool Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?