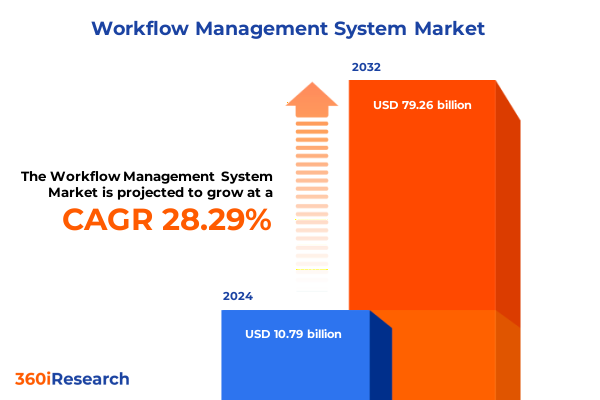

The Workflow Management System Market size was estimated at USD 13.80 billion in 2025 and expected to reach USD 17.54 billion in 2026, at a CAGR of 28.36% to reach USD 79.26 billion by 2032.

Setting the Stage for Strategic Market Insight and Contextual Overview to Navigate the Evolving Technology and Services Landscape

In an era marked by rapid technological innovation and shifting regulatory landscapes, organizations are navigating unprecedented complexity in both strategy and execution. The introduction of new tariff measures, evolving customer expectations, and the proliferation of digital services have collectively reshaped market dynamics across hardware, software, and service offerings. This executive summary provides a foundational overview of the key themes explored in the full report, equipping decision makers with essential context to interpret subsequent analyses and recommendations.

By establishing this comprehensive backdrop, readers will understand how interrelated market forces-from geopolitical developments to technological disruption-are converging to redefine competitive advantage. The layers of insight presented here are designed to foster informed decision making and to facilitate alignment across leadership teams. Through this lens, stakeholders can anticipate emerging challenges, identify strategic inflection points, and position their organizations to capitalize on opportunities as they arise.

Examining the Transformative Shifts Disrupting Industry Dynamics Through Technological Innovation, Regulatory Evolution, and Consumer Behavior Patterns

The market is undergoing transformative shifts fueled by three overarching dimensions: technological innovation, regulatory evolution, and changing consumer behaviour. First, the acceleration of cloud computing, artificial intelligence, and automation is redefining value creation; organizations are increasingly investing in agile infrastructures that can scale dynamically and support real-time analytics. Consequently, demand for integrated solutions that bridge data analytics with robust security frameworks is surging.

Second, recent regulatory changes-including the implementation of new tariff measures and enhanced data protection standards-have introduced fresh complexities into global supply chains. Companies must now balance compliance obligations with cost optimization strategies, which often requires recalibrating sourcing decisions and renegotiating supplier agreements. Moreover, shifting privacy mandates are prompting organizations to adopt more transparent data governance practices, ensuring that consumer trust remains a competitive differentiator.

Finally, evolving customer preferences are driving greater demand for personalized, outcome-based services across consulting, integration, and support offerings. This shift toward service-centric models underscores the importance of customer experience as a key competitive battleground. As the market landscape continues to mature, companies that can seamlessly integrate advanced technology capabilities with differentiated service portfolios will lead the next wave of growth.

Unpacking the Comprehensive Effects of 2025 United States Tariff Measures on Supply Chains, Cost Structures, and Competitive Positioning Across Sectors

The introduction of new United States tariffs in 2025 has had a cumulative impact on cost structures, procurement strategies, and competitive positioning across key industries. With duties imposed on a broad spectrum of imported steel, aluminum, and certain electronic components, manufacturers have experienced elevated raw material costs, which in turn have exerted pressure on pricing strategies throughout the value chain. In response, many organizations have accelerated localization initiatives to mitigate tariff exposure while maintaining supply chain resilience.

Furthermore, service providers have faced indirect cost increases as their hardware-dependent operations navigate higher procurement expenses. Consulting and integration partners are advising clients to explore alternative sourcing regions and to reassess total landed costs, incorporating tariff variables into long-term strategic planning. The compounded effect extends to software vendors as well, as increased infrastructure expenses influence deployment choices and licensing models.

Despite these headwinds, some companies have leveraged tariff-induced market shifts as opportunities to differentiate their offerings. By integrating value-added services-such as end-to-end supply chain analytics, predictive maintenance, and tariff compliance advisory-organizations are reshaping their service portfolios and reinforcing customer loyalty. This strategic reorientation highlights the importance of agility and innovation when confronting macroeconomic and policy-driven disruptions.

Unveiling Essential Segmentation Insights That Illuminate Growth Drivers Based on Product Types, End Users, Applications, Channels, and Organizational Scale

Understanding the nuanced drivers of market demand requires a detailed segmentation perspective. When examining the market based on product type, distinct growth trajectories emerge across hardware, services, and software. The services segment further reveals differentiated adoption patterns among consulting, integration, and support offerings, reflecting varying levels of maturity and value realization. Transitioning to end-user categories highlights how sectors such as banking, financial services and insurance, healthcare, manufacturing, retail, and information technology and telecommunications each pursue tailored solutions to meet industry-specific requirements.

In terms of application, demand for cloud management and data analytics remains robust, yet networking and security applications are experiencing significant acceleration. Within the security domain, subsegments such as application security, endpoint security, and network security demonstrate divergent investment priorities, driven by evolving threat landscapes and compliance obligations. Equally important is the distribution channel dimension: offline channels-comprising both direct sales and distributors-continue to serve as foundational engagement points, while online channels, including company websites and e-commerce platforms, are rapidly gaining momentum through enhanced self-service capabilities.

Lastly, when assessing market activity by company size, large enterprises pursue comprehensive, integrated solutions to support expansive digital transformation agendas, whereas small and medium enterprises often prioritize modular, scalable offerings that align with more constrained resource profiles. These multifaceted segmentation lenses collectively inform a granular understanding of customer needs and growth inhibitors across diverse market contexts.

This comprehensive research report categorizes the Workflow Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Company Size

- End User

- Application

Revealing Critical Regional Perspectives That Highlight Demand Variations Across the Americas, Europe–Middle East–Africa, and Asia-Pacific Markets

Regional dynamics play a critical role in shaping market demand and strategic priorities. In the Americas, digital transformation investments continue to be driven by financial services firms seeking to modernize legacy infrastructures and by technology providers expanding their cloud and analytics footprints. Cross-border trade flows, however, are being recalibrated in response to tariff-related supply chain shifts, prompting some organizations to diversify their vendor portfolios.

Across Europe, the Middle East and Africa, the interplay of stringent data privacy regulations and varying levels of cloud infrastructure maturity creates a heterogeneous landscape. While Western Europe leads in early adoption of advanced analytics and security frameworks, emerging economies in the Middle East and North Africa are prioritizing investments in foundational networking and support services to establish a baseline digital ecosystem.

In the Asia-Pacific region, explosive growth is evident across multiple sectors, with governments and private enterprises alike accelerating smart manufacturing initiatives and telecommunication upgrades. This region’s emphasis on innovation ecosystems and strategic partnerships underscores a long-term commitment to integrated solutions that combine hardware, software, and services. Together, these regional perspectives inform a comprehensive strategic roadmap that aligns product and service portfolios with localized demand signals.

This comprehensive research report examines key regions that drive the evolution of the Workflow Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Leaders and Innovators Shaping Market Trajectories Through Strategic Partnerships, Product Development, and Competitive Differentiation

A small cohort of industry leaders and innovators is setting the pace for market evolution through strategic partnerships, continual product development, and differentiated service delivery models. Leading global technology suppliers are enhancing their portfolios by embedding advanced analytics and security features directly into hardware offerings, thereby creating more seamless integration paths for enterprise customers. At the same time, specialist service providers are gaining traction by bundling consulting and integration services with robust support models, delivering turnkey solutions that address specific pain points such as end-to-end supply chain visibility and real-time performance optimization.

Meanwhile, emerging challengers are carving out niches in high-growth segments, focusing on modular cloud management platforms and purpose-built data analytics tools that cater to industry verticals such as healthcare and manufacturing. These companies often collaborate with academic and research institutions to integrate cutting-edge innovations into commercial products, accelerating time-to-value and fostering customer loyalty. In addition, channel partners and distributors are evolving their value propositions to include managed services, professional training, and rapid deployment frameworks, effectively becoming extension arms for both vendors and end users.

Collectively, these key players are shaping competitive dynamics through ecosystem strategies that emphasize interoperability, customer experience, and ongoing innovation. Their actions provide a blueprint for how organizations can establish or defend market positions in an increasingly complex environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Workflow Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Appian Corporation

- Automation Anywhere, Inc.

- Bonitasoft S.A.

- Camunda GmbH

- International Business Machines Corporation

- Kissflow Technologies Pvt. Ltd.

- Microsoft Corporation

- monday.com Ltd.

- Nintex Global Ltd

- Oracle Corporation

- Pegasystems, Inc.

- ProcessMaker, Inc.

- Salesforce, Inc.

- ServiceNow, Inc.

- Smartsheet Inc.

- TIBCO Software Inc.

- UiPath, Inc.

- Workato, Inc.

- Zapier, Inc.

- Zoho Corporation Pvt. Ltd.

Outlining Actionable Strategies for Industry Leaders to Leverage Emerging Trends, Mitigate Risks, and Drive Sustainable Competitive Advantage

To capitalize on the trends and address the challenges outlined in this report, industry leaders must adopt a multi-pronged approach that balances immediate priorities with long-term strategic investments. First, executives should prioritize digital transformation initiatives that integrate cloud management and data analytics capabilities into existing infrastructures. By doing so, they can unlock real-time insights and operational efficiencies, while also enhancing security posture through embedded network and endpoint safeguards.

In parallel, supply chain diversification should be elevated as a core risk-mitigation strategy. This involves evaluating alternative sourcing regions and engaging with local suppliers to reduce tariff exposure and shipping delays. Furthermore, cultivating strategic partnerships with technology vendors and specialized service providers can accelerate implementation timelines and provide access to best-in-class expertise.

Equally crucial is the development of flexible go-to-market models, which blend direct engagement through offline channels with frictionless, self-service online experiences. Organizations should tailor their channel strategies to customer preferences, emphasizing seamless integration between sales, service, and support touchpoints. Finally, leadership teams must foster a culture of continuous innovation by investing in talent development and cross-functional collaboration, ensuring that businesses remain agile and responsive to evolving market demands.

Detailing Rigorous Research Methodology Emphasizing Data Collection, Expert Validation, and Analytical Frameworks Ensuring Robust Market Intelligence

Our research methodology combines rigorous primary and secondary research techniques to deliver robust and reliable market intelligence. Secondary research involved a comprehensive review of publicly available information, including regulatory filings, industry white papers, trade publications, and corporate websites. This foundation was complemented by primary research, which consisted of in-depth interviews with senior executives, industry experts, and domain specialists to validate hypotheses and uncover nuanced perspectives.

Data triangulation formed a critical component of our approach, ensuring that insights derived from varied sources converged to form a cohesive understanding of market trends and challenges. Quantitative data points were cross-verified through multiple channels, and qualitative feedback from expert interviews was systematically analyzed to identify recurring themes and outlier viewpoints.

Analytical frameworks, such as Porter’s Five Forces and SWOT analysis, were applied to dissect competitive dynamics and assess strategic priorities. Geographic and vertical segmentation analyses provided further granularity, illuminating differential growth patterns and investment drivers. Throughout the research process, stringent quality control measures were implemented, including peer reviews and methodology audits, to ensure accuracy and consistency across findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Workflow Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Workflow Management System Market, by Product Type

- Workflow Management System Market, by Company Size

- Workflow Management System Market, by End User

- Workflow Management System Market, by Application

- Workflow Management System Market, by Region

- Workflow Management System Market, by Group

- Workflow Management System Market, by Country

- United States Workflow Management System Market

- China Workflow Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Deliver a Cohesive Market Perspective That Guides Decision Makers Toward Informed Strategic Moves

This executive summary has distilled the essential insights necessary for organizations to navigate the rapidly evolving technology and services market landscape. From transformative shifts in digital innovation and regulatory evolution to the strategic implications of 2025 tariff measures, the analysis underscores the importance of agility, resilience, and customer-centricity. Moreover, the segmentation and regional insights provide a multi-dimensional view of growth drivers and competitive dynamics.

As industry leaders chart their strategic roadmaps, integrating these insights into decision-making processes will be crucial. The actionable recommendations highlight the imperative to invest in cloud and analytics capabilities, diversify supply chains, and foster collaborative ecosystems. By adhering to these principles and leveraging the comprehensive research methodologies outlined, organizations can position themselves for sustainable growth and competitive differentiation.

Ultimately, the complexity of today’s market demands an informed and proactive approach. Leaders who embrace a data-driven mindset and who align organizational capabilities with emerging trends will be best equipped to seize opportunities and mitigate risks in this dynamic environment.

Inspiring Stakeholder Engagement with a Compelling Call to Acquire Comprehensive Market Analysis and Collaborate with Associate Director Ketan Rohom

To deepen your understanding of these market dynamics and harness the strategic opportunities we have outlined, we invite you to secure the comprehensive market research report today. By partnering directly with Associate Director, Sales & Marketing Ketan Rohom, you will gain personalized insights, expert guidance, and tailored recommendations that align with your organization’s objectives. Engage in a detailed discussion to explore custom data visualizations, prioritize focus areas, and map out your next steps with confidence. Reach out to initiate a collaborative process that will equip your team with the intelligence necessary to stay ahead of industry shifts and drive long-term growth.

- How big is the Workflow Management System Market?

- What is the Workflow Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?