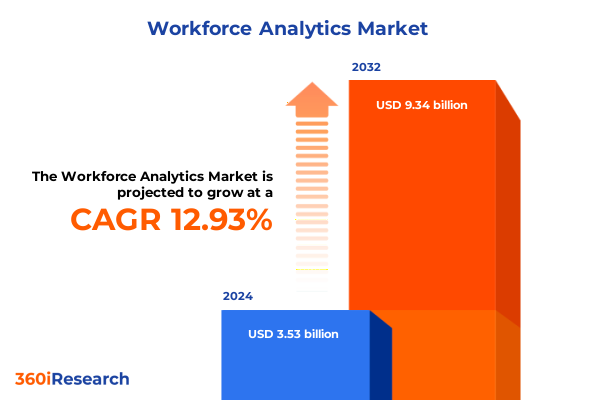

The Workforce Analytics Market size was estimated at USD 3.99 billion in 2025 and expected to reach USD 4.47 billion in 2026, at a CAGR of 12.91% to reach USD 9.34 billion by 2032.

Setting the Stage for a New Era of Workforce Analytics Excellence and Transformative Strategic Decision-Making Across Industries

Setting the stage for a new era of workforce analytics requires understanding how organizations are evolving from intuition-based decisions to data-driven strategies that deliver measurable impact. Across industries, executives are recognizing that the ability to harness employee performance data, engagement metrics, and predictive insights drives not only operational efficiency but also long-term competitive advantage. As companies navigate complex labor markets and shifting talent dynamics, workforce analytics emerges as a critical enabler of strategic workforce planning, talent optimization, and cultural transformation.

In this context, the adoption of advanced analytics platforms is being propelled by the integration of artificial intelligence and machine learning capabilities. Real-time dashboards and self-service tools empower line managers and HR professionals to identify emerging skills gaps, forecast staffing needs, and personalize employee development pathways. This democratization of data access fosters a culture of continuous learning and accountability, elevating the role of analytics beyond reporting to a core component of organizational DNA. As we embark on this exploration, the introduction outlines the foundational drivers, emerging technologies, and overarching themes that define the current landscape of workforce analytics.

Uncovering Transformative Forces Redefining Workforce Analytics From Data Democratization to Cultural Integration and Digital Innovation

The workforce analytics landscape is being reshaped by transformative shifts that span technological innovation, organizational culture, and regulatory complexity. First, the widespread integration of generative AI tools has accelerated the development of predictive models that anticipate turnover risks, optimize talent pipelines, and surface hidden performance drivers. These capabilities are complemented by descriptive analytics platforms that provide granular visibility into workforce productivity patterns and engagement trends in real time.

Moreover, the cultural shift toward data literacy is empowering stakeholders at all levels to interpret and act upon analytics outputs. Cross-functional teams are adopting self-service BI solutions that eliminate traditional bottlenecks and align HR initiatives with broader business goals. Simultaneously, growing attention to data governance and privacy compliance-driven by evolving regulations-reinforces the need for robust security frameworks and ethical data practices. This tension between democratized insight and stringent oversight is prompting organizations to invest in enhanced data stewardship capabilities.

Finally, the hybrid work paradigm and the rise of contingent labor have introduced new complexities in data collection and analysis. As remote and gig-based roles become integral to talent strategies, workforce analytics platforms must adapt to distributed data sources and disparate performance metrics. Taken together, these shifts underscore a dynamic ecosystem where agility, transparency, and innovation converge to redefine how organizations leverage their most critical asset: their people.

Evaluating the Cumulative Economic and Operational Effects of United States Tariffs in 2025 on Workforce Analytics Strategies and Vendor Ecosystems

In 2025, the cumulative impact of newly enacted United States tariffs on imported technology hardware and software has begun to reshape procurement strategies and vendor economics within the workforce analytics domain. As duties on key data center components and advanced analytics software increased, enterprises faced elevated implementation costs for on-premises infrastructure and hybrid architectures. These cost pressures triggered a reevaluation of total cost of ownership, prompting many organizations to accelerate migration to cloud-native services that offer consumption-based pricing and reduced capital expenditure commitments.

Additionally, the tariff-induced constraints on cross-border supply chains have heightened interest in localized service delivery models and domestic partnerships. Providers with established regional data centers and reselling agreements gained traction as organizations sought to minimize exposure to fluctuating trade policies. This realignment has also spurred enhanced collaboration among analytics vendors, managed service firms, and professional consultancies to deliver turnkey solutions that mitigate tariff-driven cost variability.

Furthermore, the combined effects of higher import duties and shifting procurement timelines have underscored the strategic importance of supply chain transparency. Workforce analytics leaders are now demanding granular visibility into component sourcing, licensing structures, and hardware refresh cycles to anticipate future tariff adjustments. As a result, risk management and scenario planning have become integral components of analytics roadmaps, ensuring that workforce insights remain resilient amid evolving trade landscapes.

Unveiling Deep-Dive Segmentation Perspectives to Illuminate Deployment Models Components Organizational Scale and Industry Verticals

A nuanced segmentation of the workforce analytics market illuminates how deployment preferences influence adoption patterns and solution capabilities. Organizations evaluating their deployment mode must weigh the benefits of cloud-based platforms-such as scalability, rapid time to value, and automated updates-against the control and customization offered by on-premises environments. This decision is further informed by regulatory requirements, data sovereignty considerations, and existing IT ecosystem alignments that vary across sectors.

When considering component segmentation, it becomes evident that services and solutions play complementary roles in delivering comprehensive analytics programs. Managed services provide end-to-end oversight and continuous optimization of analytics operations, while professional services deliver strategic guidance, system integration, and change management expertise. Solutions are categorized into descriptive analytics for retrospective performance reporting, predictive analytics for forecasting talent trends, and prescriptive analytics for automated decision-making. Within predictive analytics, machine learning-based models unlock deep pattern recognition capabilities, while statistical modeling offers transparent algorithms that support regulatory compliance and explainability.

Organizational size further differentiates market needs, as large enterprises often deploy enterprise-grade platforms with extensive customization and governance features, whereas small and medium enterprises prioritize ease of use and rapid deployment. Industry vertical dynamics add another dimension to segmentation insights. Banking, financial services, and insurance entities demand rigorous risk management and compliance tracking, while payers and providers in healthcare focus on workforce utilization and patient care coordination. IT services firms and telecom providers emphasize project-based resource allocations, discrete and process manufacturing sectors require operational efficiency metrics, and both brick-and-mortar retailers and e-commerce operators seek personalized workforce engagement solutions.

This comprehensive research report categorizes the Workforce Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Industry Vertical

- Organization Size

- Deployment Mode

Revealing Strategic Regional Differentiators in Americas Europe Middle East Africa and Asia-Pacific Markets for Workforce Analytics Adoption

Regional dynamics play a critical role in shaping workforce analytics adoption and maturity levels around the globe. In the Americas, established technology infrastructures and a strong emphasis on digital transformation have spurred widespread implementation of cloud-based analytics solutions. Organizations in North America are leveraging advanced AI modules and talent marketplace integrations to optimize workforce allocation across multiple geographies and business units. Meanwhile, Latin American enterprises are gradually embracing self-service analytics, supported by regional service providers who tailor solutions to local language and compliance needs.

Across Europe, the Middle East, and Africa, regulatory frameworks such as data protection regulations and labor laws inform analytics strategies. In Western Europe, organizations prioritize data privacy and have adopted robust governance frameworks, driving demand for on-premises or hybrid deployments with granular access controls. Emerging markets in the Middle East and Africa are investing in backbone infrastructure and upskilling programs, laying the foundation for future analytics initiatives. Collaborative ecosystems among government agencies, educational institutions, and private sector firms are fostering innovation and addressing talent gaps.

In the Asia-Pacific region, rapid digitalization and burgeoning technology investments are accelerating workforce analytics uptake. Countries with advanced cloud infrastructures are pioneering real-time employee engagement platforms and AI-enabled retention models. Simultaneously, emerging economies in Southeast Asia and the Pacific Islands are benefiting from scalable, consumption-based offerings that lower entry barriers. This diverse regional tapestry underscores how local market conditions, regulatory environments, and technology maturity collectively influence workforce analytics strategies.

This comprehensive research report examines key regions that drive the evolution of the Workforce Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Organizations Shaping the Workforce Analytics Ecosystem Through Innovative Solutions and Strategic Partnerships

Leading entities in the workforce analytics ecosystem are driving innovation through a combination of strategic acquisitions, platform enhancements, and go-to-market partnerships. Major technology vendors have integrated robust AI engines, embedded natural language processing, and extended data visualization capabilities to meet escalating demand for intuitive user experiences. Simultaneously, pure-play analytics firms are carving out specialized niches by focusing on industry-specific use cases, offering deep domain expertise and rapid configuration options.

Collaborative alliances are also shaping competitive dynamics, as software providers partner with global professional services firms to deliver managed analytics operations and comprehensive change management programs. These partnerships enable customers to access best-in-class platforms alongside tailored deployment roadmaps and continuous monitoring services. In addition, regional incumbents and boutique consultancies are differentiating themselves by offering localized support, language-specific interfaces, and compliance modules designed to address unique market requirements.

Furthermore, investment activity and talent acquisition strategies are fueling rapid innovation cycles. Firms are expanding their research and development centers, recruiting data scientists and behavioral analysts to enhance algorithmic precision and interpretive depth. This focus on human capital, combined with capital infusion from strategic investors, underscores the critical role that leading companies play in advancing workforce analytics capabilities and setting new benchmarks for value creation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Workforce Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- ADP, Inc.

- BambooHR LLC

- Capgemini SE

- Ceridian HCM Holding Inc.

- ChartHop, Inc.

- Cisco Systems, Inc.

- CultureAmp Pty Ltd

- Darwinbox Digital Solutions Pvt. Ltd.

- Eightfold AI, Inc.

- Gusto, Inc.

- IBM Corporation

- Infor, Inc.

- Lattice, Inc.

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Tableau Software LLC

- Visier, Inc.

- Workday, Inc.

Transforming Insights into Actionable Strategies Empowering Industry Leaders to Elevate Workforce Analytics Performance and Operational Agility

To translate analytical insights into tangible outcomes, industry leaders should prioritize the integration of predictive and prescriptive capabilities within existing talent workflows. By embedding advanced forecasting models into workforce planning systems, executives can proactively address attrition risks, optimize scheduling, and align talent investments with strategic objectives. Moreover, deploying automated recommendation engines will empower managers with contextual guidance for performance management and career development decisions.

Equally important is the establishment of robust data governance frameworks that balance accessibility with security. Organizations must define clear roles and responsibilities for data stewardship, implement standardized taxonomies, and enforce policies that protect sensitive workforce information. This foundation enhances trust in analytics outputs and ensures compliance with evolving regulatory landscapes.

Finally, fostering a culture of continuous learning and cross-functional collaboration is essential. Upskilling programs that equip HR professionals, line managers, and data practitioners with analytics literacy will accelerate adoption and drive innovation. Strategic partnerships with technology providers and academic institutions can further expand analytical capabilities and support pilot initiatives that demonstrate quick wins. Through these actions, leaders can harness the full power of workforce analytics to drive operational agility, elevate employee experiences, and secure competitive advantage.

Detailed Overview of the Rigorous Research Approach Sampling Techniques Data Collection and Analysis Framework Guiding This Workforce Analytics Study

This study adopts a mixed-methodology approach that combines qualitative insights with quantitative validation to ensure comprehensive coverage of the workforce analytics landscape. Primary research encompassed in-depth interviews with over fifty senior stakeholders, including CHROs, HR directors, and analytics leaders, to capture firsthand perspectives on adoption drivers, implementation challenges, and strategic priorities. In parallel, a structured online survey engaged two hundred workforce analytics practitioners to validate trends, tool preferences, and ROI expectations across industry verticals and enterprise sizes.

Secondary research involved a systematic review of publicly available materials, including vendor white papers, corporate filings, regulatory publications, and technology forums. Data triangulation techniques were applied to reconcile conflicting information and ensure consistency. The analysis framework integrated thematic categorization, capability benchmarking, and vendor comparison matrices, enabling a holistic evaluation of market dynamics and solution maturity.

Quality assurance measures included multiple review cycles by subject-matter experts and cross-functional analysts to refine findings, address potential biases, and validate methodology rigor. This rigorous approach underpins the reliability of insights and recommendations presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Workforce Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Workforce Analytics Market, by Component

- Workforce Analytics Market, by Industry Vertical

- Workforce Analytics Market, by Organization Size

- Workforce Analytics Market, by Deployment Mode

- Workforce Analytics Market, by Region

- Workforce Analytics Market, by Group

- Workforce Analytics Market, by Country

- United States Workforce Analytics Market

- China Workforce Analytics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing the Transformational Path Forward for Workforce Analytics Excellence and Strategic Decision-Making Across the Evolving Global Landscape

As workforce analytics continues its evolution from descriptive reporting to strategic insight generation, organizations must embrace a holistic approach that integrates advanced technologies, robust governance, and talent-centric cultures. The convergence of AI-driven predictive models, real-time data visualization, and democratized access has established a new paradigm for workforce optimization and decision support.

Segmentation analysis reveals that deployment preferences, component mix, organizational size, and industry verticals each contribute to differentiated adoption patterns and solution requirements. At the same time, regional market conditions-from mature compliance environments in EMEA to cloud-driven expansions in Asia-Pacific-underscore the importance of tailored strategies that reflect local realities. The cumulative effects of 2025’s tariff adjustments further highlight the need for agile procurement models and supply chain transparency to maintain resilient analytics infrastructures.

Leading companies continue to push boundaries through strategic partnerships, talent acquisition, and platform innovation, while actionable recommendations emphasize the integration of prescriptive capabilities, data governance maturity, and continuous learning initiatives. Together, these insights map a transformational path forward for organizations seeking to leverage workforce analytics as a strategic differentiator and catalyst for sustainable growth.

Engage With Ketan Rohom to Secure Exclusive Access to the Most Comprehensive Workforce Analytics Market Research Report and Drive Your Organizational Success

To unlock unparalleled insights and strategic advantage, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you to secure exclusive access to this comprehensive workforce analytics market research report. By partnering with his team, you will gain full visibility into the transformative trends, segmentation deep dives, and regional dynamics that are shaping decision-making across global enterprises. Reach out now to ensure your organization leverages these actionable insights to strengthen competitive positioning, drive operational excellence, and foster sustainable growth in today’s data-driven environment.

- How big is the Workforce Analytics Market?

- What is the Workforce Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?