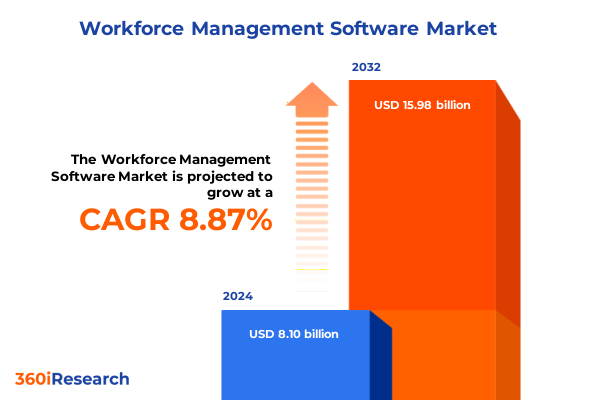

The Workforce Management Software Market size was estimated at USD 8.79 billion in 2025 and expected to reach USD 9.56 billion in 2026, at a CAGR of 8.90% to reach USD 15.98 billion by 2032.

Charting the Path to Workforce Management Excellence by Uncovering Core Industry Drivers and Strategic Imperatives in a Rapidly Evolving Business Landscape

Organizations across industries are navigating a complex environment where workforce dynamics have evolved far beyond traditional attendance tracking and manual scheduling. The rapid proliferation of hybrid and remote work models has introduced new layers of complexity to workforce management, compelling enterprises to adopt more sophisticated digital solutions. In this context, workforce management software has emerged as a strategic enabler, consolidating functions such as time and attendance, leave administration, absence tracking, scheduling, and advanced analytics into a unified platform that drives efficiency and compliance.

As businesses strive to balance employee satisfaction with cost containment, the significance of integrated systems becomes apparent. Seamless data flow between human capital management, payroll, and operational modules is no longer a luxury-it is a necessity. This dynamic environment underscores the importance of understanding both the foundational and emergent forces that will shape the evolution of workforce management software in the years ahead.

Harnessing Disruptive Innovations and Emerging Digital Forces to Redefine Workforce Management Capabilities Across All Organizational Functions and Roles

The workforce management landscape is experiencing a profound transformation driven by disruptive technologies and shifting organizational priorities. Artificial intelligence is infusing routine processes with predictive intelligence, allowing companies to forecast staffing needs based on historical trends and real-time performance indicators. Concurrently, the integration of machine learning algorithms enables prescriptive recommendations, guiding managers to optimize labor allocation in response to changing demand patterns. These innovations are ushering in a new era of intelligent automation, streamlining operations and freeing HR professionals to focus on strategic initiatives.

At the same time, mobile accessibility and user-centric design are redefining how employees interact with workforce applications. Mobile-first interfaces empower front-line workers to view schedules, request time off, and log hours from any location, fostering engagement and compliance. Additionally, seamless connectivity with broader HR ecosystems, including core payroll and talent management systems, ensures that workforce data is consistently synchronized across the enterprise. Taken together, these transformative shifts underscore the critical role of agile, cloud-native architectures and open APIs in delivering scalable, future-ready solutions.

Assessing the Ripple Effects of Recent United States Trade Tariffs on Technology Infrastructure Costs and Strategic Decision Making for Workforce Software Solutions

In 2025, a series of tariff measures enacted by the United States government on imported technology hardware has started to reverberate through the workforce management ecosystem. Tariffs affecting servers, networking equipment, and computer components have incrementally increased the capital expenditures associated with deploying on-premise infrastructure. Consequently, organizations reliant on local data centers are reassessing total cost of ownership and evaluating alternative deployment models to mitigate rising overheads.

These cost pressures are accelerating the shift toward cloud-based workforce management solutions. With tariff-induced hardware premiums eroding the economics of in-house systems, public cloud platforms offer a compelling value proposition through reduced upfront investments and predictable subscription pricing. Moreover, private cloud options have gained traction among enterprises seeking enhanced security controls without exposing themselves to the volatility of global trade policies. Overall, the cumulative impact of these trade measures is reshaping vendor strategies, driving innovation in cloud offerings, and reinforcing the importance of flexible deployment architectures.

Illuminating Diverse Market Segmentation Perspectives to Highlight Tailored Adoption Trends and Preferences Across Components Deployment Models Organization Sizes and Industry Verticals

A nuanced examination of solution components reveals distinct adoption patterns within workforce management portfolios. Modules dedicated to absence and leave management continue to serve as foundational capabilities, ensuring compliance with evolving labor regulations. Beyond these essentials, time and attendance systems have incorporated advanced tracking mechanisms-including biometric integrations-to deliver granular visibility into labor costs. The scheduling function has bifurcated into demand based scheduling for high-variability environments and shift based scheduling for structured workforce frameworks. At the apex of the component hierarchy, analytics capabilities are segmented into descriptive, predictive, and prescriptive tiers, each delivering progressively sophisticated insights for workforce optimization.

Deployment preferences further delineate the market’s contours. Cloud-based models, comprising public and private variants, are experiencing robust uptake as organizations seek scalability and operational resilience. Meanwhile, traditional on-premise installations persist in sectors with stringent data residency or security mandates. Size of organization also influences technology selection: large enterprises prioritize comprehensive platforms with deep integration and customization potential, whereas small and medium enterprises gravitate toward modular, cost-effective solutions that deliver rapid time to value. Industry verticals, spanning banking, financial services, insurance, government, healthcare, manufacturing, and retail, impose unique functional requirements that shape vendor roadmaps and integration priorities.

This comprehensive research report categorizes the Workforce Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- Industry Vertical

Revealing Regional Adoption Dynamics and Growth Enablers Across Major Geographies to Inform Strategic Investments and Localization Strategies for Workforce Management Solutions

Regional dynamics play a pivotal role in shaping workforce management strategies. In the Americas, early adopters continue to drive demand for cloud-native platforms enhanced by embedded AI capabilities and mobile access. Regulatory frameworks at federal and state levels encourage real-time visibility into labor practices, reinforcing the value of compliant, automated solutions. Cross-border organizations leverage these advancements to harmonize workforce policies and reporting across national jurisdictions.

Europe, Middle East & Africa exhibits a heterogeneous landscape influenced by data privacy regulations such as the GDPR and emerging localized compliance standards. Enterprises in this region balance between on-premise deployments to meet stringent residency requirements and hybrid cloud configurations that facilitate centralized management. Scalability and multilingual support are essential considerations, particularly for pan-regional employers. Meanwhile, in Asia-Pacific, rapid digital transformation, cost sensitivity, and diverse regulatory environments are catalyzing growth. Markets such as Australia and Japan lead with sophisticated implementations, while emerging economies prioritize mobile-first, intuitive interfaces that empower workforces across geographically dispersed locations.

This comprehensive research report examines key regions that drive the evolution of the Workforce Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives to Understand Competitive Positioning and Innovation Roadmaps Shaping the Future of Workforce Management Software

A cohort of established players and innovative challengers is defining the competitive battleground in workforce management software. Legacy vendors with an extensive footprint are advancing their cloud offerings and infusing AI across modules to secure enterprise accounts. Simultaneously, pure-play cloud providers are capitalizing on agility and rapid release cycles to attract midmarket and specialty use cases. Strategic partnerships with global system integrators and technology alliances further extend these vendors’ reach into new industries and geographies.

Product roadmaps emphasize continuous enhancement of analytics engines, expanded mobile capabilities, and deeper integrations with talent management and payroll systems. Recent acquisitions and joint ventures are enabling vendors to broaden their functional footprint, offering holistic suites that appeal to organizations seeking a unified human capital management ecosystem. As competition intensifies, differentiation hinges on user experience, implementation velocity, and the ability to deliver measurable improvements in workforce productivity and compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Workforce Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Automatic Data Processing, Inc.

- Ceridian HCM Holding Inc.

- International Business Machines Corporation

- NICE Ltd.

- Oracle Corporation

- SAP SE

- The Ultimate Kronos Group, Inc.

- Verint Systems Inc.

- Workday, Inc.

- Zebra Technologies Corporation

Empowering Industry Leaders with Actionable Insights and Best Practices to Drive Operational Efficiency and Maximize Return on Investment in Workforce Management Technologies

Industry leaders should prioritize a strategic shift toward AI-driven workforce analytics to extract actionable insights from vast repositories of labor data. By embedding predictive models into scheduling and absence management workflows, organizations can proactively optimize staffing levels and minimize operational disruptions. Transitioning to cloud-native architectures with robust public and private options will ensure resilience against external shocks such as trade policy changes while maintaining strict security and compliance standards.

Furthermore, integrating workforce management solutions with core HR, payroll, and enterprise resource planning systems is critical to eliminating silos and achieving end-to-end process automation. Embracing intuitive, mobile-first interfaces will foster higher employee engagement by providing self-service capabilities for time tracking, schedule adjustments, and leave requests. Finally, establishing a governance framework that aligns technology investments with organizational objectives and change management practices will accelerate adoption and sustain long-term value realization.

Detailing a Rigorous Multi Method Research Approach Combining Qualitative Expertise Quantitative Validation and Data Triangulation to Ensure Robust Insights and Credibility

This research harnesses a multi-method approach that triangulates insights from primary interviews with industry practitioners, secondary analysis of regulatory and technology reports, and quantitative validation through structured surveys. In-depth discussions with HR executives, IT leaders, and end users illuminated key pain points, feature preferences, and adoption barriers. Concurrently, a systematic review of vendor documentation and public filings provided clarity on roadmap trajectories and investment trends.

Data triangulation involved cross-referencing interview feedback with survey outcomes to ensure consistency and uncover divergent perspectives. Expert panels convened to validate emerging hypotheses and refine thematic frameworks. Throughout the process, rigorous quality checks-including peer reviews and iterative refinement-ensured that findings reflect a comprehensive, credible, and actionable understanding of the workforce management software landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Workforce Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Workforce Management Software Market, by Component

- Workforce Management Software Market, by Deployment Mode

- Workforce Management Software Market, by Organization Size

- Workforce Management Software Market, by Industry Vertical

- Workforce Management Software Market, by Region

- Workforce Management Software Market, by Group

- Workforce Management Software Market, by Country

- United States Workforce Management Software Market

- China Workforce Management Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Takeaways to Provide Decision Makers with a Clear Vision for Enhancing Workforce Management Maturity and Sustaining Competitive Advantage

The convergence of advanced analytics, AI-enabled automation, and flexible deployment models is redefining the workforce management landscape. Organizations across sectors are leveraging integrated suites to navigate the complexities of hybrid work, regulatory compliance, and shifting labor dynamics. Segmentation insights underscore the importance of tailoring solutions to specific component requirements, deployment preferences, organizational scales, and vertical nuances.

As regional adoption patterns evolve, decision makers must align technology roadmaps with both local compliance imperatives and global strategic objectives. The competitive field, enriched by established vendors and nimble innovators, is delivering ever more sophisticated capabilities designed to enhance workforce productivity. By following the actionable recommendations outlined, industry leaders can harness these advancements to drive operational excellence and establish sustainable competitive advantage in an increasingly dynamic environment.

Engaging Decision Makers with a Personalized Invitation to Collaborate and Secure Comprehensive Workforce Management Intelligence Through a Strategic Partnership with Our Expert Representative

We invite you to engage with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore customized solutions and secure your organization’s competitive advantage through comprehensive workforce management intelligence. By discussing your unique challenges and objectives, you can gain clarity on how advanced software capabilities align with your operational goals and drive measurable outcomes.

Connecting with Ketan Rohom provides direct access to in-depth analysis, strategic guidance, and tailored insights that empower decision makers to implement the right mix of technologies. Schedule a personalized consultation today to learn how this research can support your transformation initiatives and optimize your workforce management processes.

- How big is the Workforce Management Software Market?

- What is the Workforce Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?