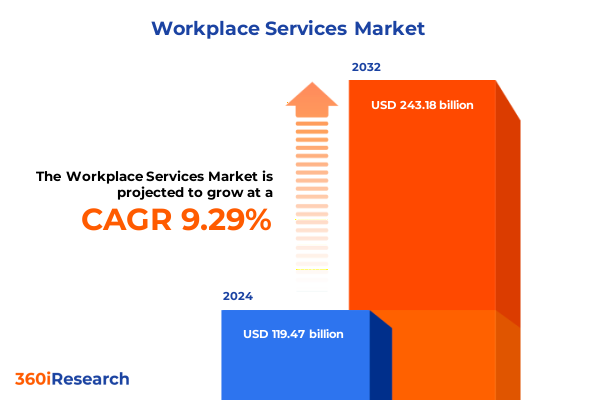

The Workplace Services Market size was estimated at USD 130.82 billion in 2025 and expected to reach USD 141.89 billion in 2026, at a CAGR of 9.26% to reach USD 243.18 billion by 2032.

A Strategic Overview of the Evolving Workplace Services Sphere and Its Critical Role in Driving Operational Agility and Organizational Resilience

The modern workplace services arena stands at a pivotal juncture as organizations embrace increasingly complex operational demands and dynamic workforce expectations. Continuous technological advancements, from intuitive collaboration platforms to automated support infrastructures, have redefined the way employees connect, interact, and perform day-to-day tasks. Against this backdrop, enterprises are seeking holistic solutions that seamlessly integrate communication, infrastructure management, and robust security measures to foster productivity and resilience. In an era where rapid digital transformation has become a strategic imperative rather than a discretionary initiative, understanding the nuances of workplace services is essential for leaders seeking to sustain competitive advantage and future-proof organizational capabilities.

Furthermore, the convergence of cloud-based models with hybrid work modalities has propelled workplace services into new dimensions of scalability and agility. As part of this evolution, companies are evaluating not only the technical merits of service offerings but also how well they align with evolving employee behaviors, regional regulatory landscapes, and shifting cost structures. As such, this executive summary provides a concise yet comprehensive lens through which decision-makers can grasp the critical drivers influencing the workplace services ecosystem. Appreciating these forces ensures that initiatives are underpinned by data-driven insights and strategic foresight.

Mapping the Unprecedented Technological and Behavioral Transformations Reshaping Workplace Services Delivery Models in the Hybrid Era

Over the past two years, workplace services have undergone transformative shifts driven by accelerated adoption of artificial intelligence, the normalization of hybrid work environments, and the rising importance of employee experience. Organizations have transitioned from siloed communication tools to unified collaboration platforms that integrate messaging, file sharing, and video conferencing into a seamless user journey. Meanwhile, managed IT services have matured to encompass proactive monitoring, self-healing infrastructure processes, and embedded analytics for real-time decision-making. In parallel, security solutions have evolved from reactive threat detection to predictive risk mitigation and continuous compliance management.

These technological shifts have been compounded by changing workforce demographics and expectations. A growing percentage of digital-native professionals demand intuitive interfaces, mobility, and personalized support services. In consequence, service providers are investing in modular architectures that allow rapid customization and machine learning–driven automation to enhance user satisfaction and reduce downtime. At the same time, industry alliances and open standards initiatives are forging interoperability across disparate platforms, reducing integration costs and accelerating time to value for enterprise adopters. Collectively, these developments are reshaping the competitive landscape, requiring service providers to differentiate through specialized expertise, regional agility, and outcome-focused service level agreements.

Analyzing How 2025 Tariff Adjustments Have Reshaped Hardware Procurement, Supply Chains, and Cost Structures for Workplace Services

In 2025, the cumulative impact of United States tariffs has reverberated across the hardware supply chain, influencing costs for endpoints, networking equipment, and data center components. Tariffs on key electronic elements have led to recalibrated procurement strategies as organizations seek cost efficiencies through localized assembly and alternative sourcing. This environment has encouraged greater collaboration between service providers and original equipment manufacturers to develop tariff-optimized bundles, thereby preserving margins and ensuring predictable pricing structures for end users.

Concurrently, the incremental duties imposed on cloud infrastructure components have catalyzed the expansion of domestic data center footprints. Leading hyperscale providers have doubled down on local investments to mitigate cross-border duties, delivering greater latency control and regulatory compliance for enterprise customers. These shifts have also prompted a renewed focus on software-defined networking and virtualized service overlays that reduce hardware dependencies. As a result, the workplace services landscape of 2025 features an ecosystem increasingly adept at balancing global supply chain challenges with resilient service architectures, thus guaranteeing seamless user experiences despite external cost pressures.

Unveiling Segmentation Dynamics Across Service Type Deployment Models Organizational Hierarchies and Vertical Use Cases Driving Differentiated Service Adoption

Insights derived from service type segmentation reveal that collaboration tools have transcended basic communication, emerging as integrated hubs that cloak file sharing, messaging, and video conferencing within unified interfaces. Organizations are shifting away from standalone solutions, instead opting for platforms that deliver contextual collaboration alongside AI-driven productivity enhancements. Managed IT services, once limited to help desk support, have expanded into comprehensive infrastructure and network management disciplines. Proactive infrastructure monitoring utilizes predictive analytics to preempt failures, while network management services leverage software-driven orchestration to maintain high availability and rapid incident response. Simultaneously, security offerings now emphasize holistic data protection frameworks, identity management protocols that incorporate adaptive authentication, and advanced threat detection engines using behavioral analytics.

Evaluating organizational size segmentation illuminates divergent priorities between large enterprises and smaller businesses. Large corporations invest heavily in integrated, enterprise-grade suites that support thousands of users and stringent compliance requirements, whereas small and medium enterprises favor modular, subscription-based services that allow for rapid scaling and cost alignment. The flexibility of on-demand managed IT solutions appeals to mid-market companies that lack extensive in-house technical resources, whereas large entities typically engage in multi-year contracts to secure service level guarantees and dedicated support.

The deployment model segmentation underscores the enduring appeal of cloud-based services, with public and private cloud variants offering distinct value propositions. Public cloud deployments deliver rapid provisioning and global reach, appealing to companies with distributed workforces, while private cloud environments satisfy the security and control imperatives of regulated sectors. Hybrid deployment strategies, bridging on-premises infrastructure with public cloud elasticity, have gained traction for organizations balancing legacy investments with digital transformation objectives.

Industry vertical segmentation highlights BFSI firms prioritizing data protection and identity management to comply with evolving financial regulations, while healthcare providers emphasize secure file sharing and threat detection to safeguard patient data and ensure HIPAA compliance. IT and telecom companies leverage advanced network management to maintain continuous connectivity, manufacturing enterprises adopt collaboration tools to streamline supply chain workflows, and retail organizations integrate messaging platforms with customer experience systems to enhance omnichannel engagement.

This comprehensive research report categorizes the Workplace Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Organization Size

- Deployment Model

- Industry Vertical

Highlighting Regional Variations in Cloud Adoption Privacy Mandates Security Priorities and Collaboration Preferences Shaping Service Delivery

Regional analysis reveals that the Americas region continues to lead in adoption of cloud-centric workplace services, propelled by North American enterprises pursuing digital-first initiatives and sustained investment in advanced IT infrastructure. Latin American markets are accelerating uptake of managed IT offerings as data sovereignty concerns drive local partnerships and regional hosting solutions. In Europe, Middle East, and Africa, stringent data privacy regulations and geopolitical considerations shape service architectures. Organizations in EMEA require flexible deployment models that offer both regional hosting and sovereignty-compliant encryption frameworks, prompting service providers to enhance local data center networks and multi-jurisdictional certifications.

Meanwhile, Asia-Pacific demonstrates some of the fastest growth rates in security and collaboration services, underpinned by digital transformation mandates from government initiatives and burgeoning small business adoption across Southeast Asia. Major APAC enterprises are integrating AI-infused threat detection to combat sophisticated cyberattacks, while also deploying unified communication platforms to bridge language barriers and facilitate cross-border teamwork. Across each region, the interplay of regulatory, cultural, and technological factors compels service providers to tailor offerings and support models, thereby ensuring relevance and efficacy in diverse market environments.

This comprehensive research report examines key regions that drive the evolution of the Workplace Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Strategic Acquisitions Platform Integrations and Specialized Expertise Are Defining Market Leaders in Workplace Services

Leading technology corporations have fortified their positions in the workplace services domain through strategic acquisitions, robust platform ecosystems, and continuous innovation cycles. Major cloud-native vendors have deepened their collaboration tool portfolios, integrating workflow automation and AI-driven insights to deliver contextual recommendations and optimize user experiences. Infrastructure specialists have expanded managed IT service portfolios by embedding self-service portals and leveraging machine learning algorithms to automate routine maintenance tasks while reducing mean time to resolution. Meanwhile, security-focused companies are differentiating through advanced threat intelligence networks, real-time analytics, and zero-trust architectures, forging partnerships with consultancies to deliver end-to-end risk assessment and remediation programs.

Competitive dynamics reveal that agility and industry-specific expertise define leaders in the market. Firms that offer sector-tailored solutions for finance, healthcare, and manufacturing are securing stronger win rates, as they can demonstrate compliance adherence, workflow optimizations, and rapid deployment timelines. Other companies differentiate by offering transparent pricing models and outcome-based contracting, aligning provider incentives with business performance metrics. Additionally, the most impactful players have established global support networks, ensuring 24/7 availability and multilingual assistance, thereby meeting the demands of an increasingly distributed and diverse workforce.

This comprehensive research report delivers an in-depth overview of the principal market players in the Workplace Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Atos SE

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Computacenter PLC

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- Ernst & Young Global Limited

- Fujitsu Limited

- HCL Technologies Limited

- Hitachi Ltd.

- IBM Corporation

- Infosys Limited

- Kyndryl Holdings Inc.

- NTT Data Corporation

- Ricoh Company Ltd.

- Stefanini Group

- Tata Consultancy Services Limited

- Unisys Corporation

- Wipro Limited

Implementing Unified Service Architectures Outcome Based Models and Regional Partnerships to Accelerate Value Delivery

To capitalize on emerging opportunities, industry leaders should prioritize holistic platform integration that unites collaboration, managed IT, and security under a singular governance framework. By consolidating service providers and streamlining vendor management, enterprises can achieve greater operational visibility, enforce unified security policies, and reduce integration overhead. Furthermore, investing in AI and automation across service layers will not only accelerate incident resolution but also deliver predictive insights that preempt inefficiencies and enhance user satisfaction. Leaders should cultivate partnerships with regional data center operators to navigate regulatory complexities and localize service delivery effectively.

In addition, it is vital to adopt outcome-based contracting models that align provider performance with business objectives. By defining clear service level objectives tied to operational metrics-such as network uptime, collaboration usage rates, and threat detection response times-organizations can incentivize continuous improvement and foster reciprocal accountability. Finally, ongoing investment in workforce training and change management is essential to drive adoption, ensure consistent user experiences, and maximize return on workplace services investments.

Detailing Rigorous Primary Expert Interviews Secondary Market Analysis and Triangulation Methods Ensuring Robust Multidimensional Insights

This research synthesizes qualitative and quantitative data collected through primary interviews with CIOs, IT directors, and security architects across multiple regions and industry verticals. Detailed secondary analyses were performed on publicly available financial reports, regulatory filings, vendor whitepapers, and technology trend studies to validate market dynamics. A rigorous triangulation methodology was employed, cross-referencing quantitative data points with expert insights to mitigate bias and ensure comprehensive coverage.

Segmentation frameworks were developed based on service type, organizational scale, deployment model, and industry vertical to provide multidimensional perspectives. Each category was analyzed for adoption rates, driving factors, and barriers to entry. Regional assessments incorporated local regulatory considerations, infrastructure maturity indices, and macroeconomic indicators. Competitive landscape evaluations leveraged scoring models that quantified vendor capabilities across innovation, scalability, and service quality. To maintain accuracy, all data sources were verified for authenticity and currency as of mid-2025 through iterative validation cycles with industry experts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Workplace Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Workplace Services Market, by Service Type

- Workplace Services Market, by Organization Size

- Workplace Services Market, by Deployment Model

- Workplace Services Market, by Industry Vertical

- Workplace Services Market, by Region

- Workplace Services Market, by Group

- Workplace Services Market, by Country

- United States Workplace Services Market

- China Workplace Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings on Integration Strategies Hybrid Models and AI Enabled Differentiators Steering Future Workplace Services Trajectories

The workplace services market is evolving at an unprecedented pace, shaped by digital natives, hybrid work models, and emerging regulatory landscapes. Organizations that strategically integrate collaboration, managed IT, and security solutions will unlock operational efficiencies, enhance employee engagement, and fortify resilience against cyber threats and supply chain disruptions. By embracing flexible deployment architectures and outcome-driven service agreements, enterprises can navigate tariff-induced cost pressures while delivering seamless user experiences.

As the market matures, differentiation will hinge on a provider’s ability to offer tailored industry solutions, region-specific compliance capabilities, and AI-augmented service delivery. Decision-makers armed with the insights presented in this executive summary are equipped to make informed technology selections, forge strategic partnerships, and implement governance frameworks that align with both current demands and future challenges.

Connect with Ketan Rohom to Access Exclusive Workplace Services Insights and Drive Strategic Growth from Our Comprehensive Research Report

To explore tailored strategies, gain deeper competitive intelligence, and unlock the full potential of workplace services, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expert guidance can help you navigate report insights and craft solutions that align perfectly with your organization’s goals. Secure your copy of the definitive workplace services research report today to empower data-driven decision-making and accelerate business growth.

- How big is the Workplace Services Market?

- What is the Workplace Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?