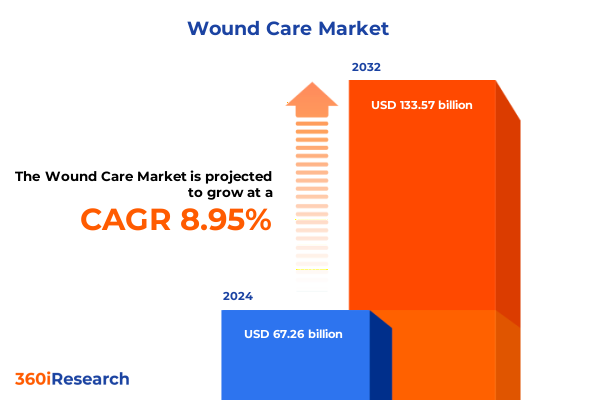

The Wound Care Market size was estimated at USD 73.18 billion in 2025 and expected to reach USD 79.28 billion in 2026, at a CAGR of 8.97% to reach USD 133.57 billion by 2032.

Laying the Strategic Foundation for Future-Focused Wound Care Solutions in an Evolving Global Healthcare and Regulatory Landscape

The evolution of wound care over the past decade has been shaped by significant clinical advancements and emerging patient needs, setting the stage for a future that demands agility and innovation. As healthcare systems worldwide grapple with aging populations, comorbidities such as diabetes, and heightened expectations for quality outcomes, the wound care sector is at a pivotal crossroads. This executive summary opens by framing the critical importance of integrated approaches that marry advanced technologies with patient-centric care pathways.

In this context, stakeholders-from device manufacturers and consumables suppliers to providers and payers-must navigate complex regulatory environments while embracing digital transformation. The convergence of minimally invasive therapies, biocompatible materials, and remote monitoring capabilities underscores a shifting paradigm in wound management. By grounding this report in both clinical rigor and market intelligence, the introduction paves the way for a deeper exploration of transformative trends and the strategic implications they hold for industry leaders.

Spotlighting Innovative Technologies and Data-Driven Care Models Revolutionizing the Wound Care Ecosystem Today

The wound care landscape is undergoing transformative shifts driven by breakthroughs in regenerative medicine, the rise of personalized therapies, and the integration of digital health platforms. Innovations in hydrogel and collagen dressings now incorporate bioactive compounds that accelerate tissue regeneration, while advanced negative pressure systems are becoming more portable and user-friendly. These technological leaps are complemented by growing adoption of photodynamic and ultrasound therapies that offer non-invasive routes to improved healing trajectories.

Concurrently, data analytics and remote patient monitoring are redefining care protocols, enabling early intervention and reducing rehospitalization rates. As value-based reimbursement models gain traction, providers are incentivized to implement outcomes-driven solutions that align with patient experiences. Moreover, heightened focus on infection control has elevated demand for antimicrobial dressings and consumables, prompting a reconfiguration of supply chains toward greater agility and resilience.

Examining the Multifaceted Effects of the 2025 United States Tariffs on Supply Chains and Pricing Dynamics in Wound Care

The implementation of United States tariffs in 2025 has exerted multidimensional pressure across the wound care value chain, influencing raw material sourcing, equipment imports, and device component procurement. Surcharges on specialty polymers and medical-grade adhesives have increased input costs for dressings and closure devices, compelling suppliers to reassess supplier contracts and explore near-shoring alternatives. In certain segments, these cost pressures have been partially offset by renegotiated logistics arrangements and volume-based discounts with domestic manufacturers.

Furthermore, higher duties on advanced therapeutic equipment-such as negative pressure systems and hyperbaric chambers-have prompted regional manufacturing initiatives and collaborative ventures to localize production. While the immediate impact has been a moderate uptick in price per unit for end users, longer-term effects include strategic realignment of product portfolios toward higher-margin offerings and accelerated investment in innovation to shield profitability against evolving trade policies. Ultimately, the 2025 tariff regime underscores the imperative for cross-border supply chain diversification and proactive governmental engagement.

Unpacking How Product, Wound Type, End User, and Channel Segmentation Converge to Drive Nuanced Opportunities

Insight into key segmentation reveals how product, wound type, end user, and distribution channel intersect to shape market dynamics. Within product type, the spectrum ranges from dressings-spanning alginate, collagen, film, foam, hydrocolloid, and hydrogel-to consumables like bandages, gauze, gloves, and tapes, further extending to advanced equipment including hyperbaric oxygen therapy, negative pressure wound therapy, photodynamic therapy, and ultrasound therapy, and concluding with closure devices such as surgical staplers, sutures, and tissue adhesives. This diversity underscores the necessity for tailored strategies that resonate with clinical use cases and provider preferences.

When considering wound type, acute wounds encompass burn, surgical, and traumatic injuries, whereas chronic wounds encompass diabetic foot ulcers, pressure ulcers, and venous leg ulcers, each with distinct healing pathways and cost-burden profiles that demand specialized product features and care protocols. End user segmentation highlights the varying environments in which care is delivered-from ambulatory surgical centers and specialty clinics to hospitals, long-term care facilities, and home care-each requiring different levels of product support, training, and service integration. The distribution channel segment spans direct sales, e-commerce platforms, hospital pharmacies, and retail pharmacies, reflecting evolving procurement behaviors and the growing importance of digital sales channels in ensuring accessibility and speed to market.

This comprehensive research report categorizes the Wound Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Wound Type

- End User

- Distribution Channel

Examining Regional Market Drivers and Tailored Approaches to Maximize Impact Across Diverse Geographies

Regional dynamics exert a powerful influence on market trajectory, with the Americas leading in technology adoption and integrated care models supported by robust reimbursement frameworks. North American innovators continue to push boundaries in regenerative dressings and digital monitoring solutions, while Latin American markets emphasize cost-effective consumables and capacity building within public health systems. Across Europe, Middle East & Africa, stringent regulatory pathways coexist with diverse payer landscapes that favor high-value, evidence-based therapies, driving consolidation among key players.

The Asia-Pacific region presents a tapestry of growth drivers, with expanding healthcare infrastructure in China and India, increasing prevalence of chronic disease, and government initiatives aimed at rural health access propelling demand. Manufacturers are leveraging local partnerships and contract manufacturing to meet cost sensitivity while navigating complex regulatory harmonization efforts. Together, these regional insights underscore the importance of aligning market entry and expansion strategies with localized economic, clinical, and policy considerations.

This comprehensive research report examines key regions that drive the evolution of the Wound Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Investigating How Leading Wound Care Organizations Leverage Innovation, Partnerships, and M&A to Secure Competitive Advantage

Leading stakeholders in the wound care market are distinguished by robust portfolios, strategic alliances, and relentless focus on innovation. Key players invest heavily in R&D to refine proprietary dressing materials that enhance biocompatibility and moisture management, while simultaneously developing modular delivery platforms integrating sensors for real-time wound assessment. Collaborations with academic centers and technology firms have accelerated the translation of next-generation therapies, particularly in the realm of cellular and gene-based approaches.

Beyond product innovation, companies are enhancing service offerings through digital platforms that facilitate telehealth consultations, analytics-driven care pathways, and outcome tracking. Strategic mergers and acquisitions continue to reshape competitive dynamics, enabling broader geographic reach and complementary product line augmentation. Financial strength combined with agile commercialization strategies positions these enterprises to capitalize on evolving reimbursement models and growing demand for premium wound care solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wound Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Acelity L.P. Inc.

- Baxter International Inc.

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- Coloplast A/S

- ConvaTec Group plc

- Derma Sciences, Inc.

- DermaRite Industries, LLC

- DeRoyal Industries, Inc.

- Essity Aktiebolag (publ)

- Hollister Incorporated

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson

- Medline Industries L.P.

- Mölnlycke Health Care AB

- Organogenesis Inc.

- Smith & Nephew plc

- Systagenix Wound Management, Limited

- Urgo Medical SA

Recommend Strategic Imperatives Including Supply Chain Resilience, Digital Integration, and Collaborative Innovation to Drive Market Leadership

Industry leaders must take decisive action to thrive in this environment of rapid change and heightened competition. Prioritizing supply chain resilience through multi-sourcing agreements and regional manufacturing hubs will mitigate exposure to trade disruptions and cost volatility. Simultaneously, expanding value-added services by integrating digital wound monitoring and telehealth capabilities can differentiate offerings and align with outcomes-based reimbursement models.

A renewed emphasis on strategic collaborations-with academic institutions, technology startups, and payer organizations-can unlock co-development opportunities and accelerate market access. Cultivating close engagement with clinicians and patients will inform design thinking for next-generation products, ensuring solutions resonate with real-world care workflows. Lastly, embedding sustainability and patient education initiatives within corporate strategies can enhance brand reputation and drive long-term loyalty among healthcare providers and end users alike.

Outlining a Robust Mixed-Methods Research Framework Leveraging Expert Interviews, Surveys, and Triangulation for Reliable Insights

This report synthesizes insights from a rigorous research methodology combining primary interviews, proprietary surveys, and extensive secondary research. Expert consultations with clinicians, procurement specialists, and health economists provided qualitative depth, while survey data from a broad range of end users delivered quantitative validation. Secondary sources included peer-reviewed journals, regulatory filings, and industry whitepapers to ensure comprehensive coverage of clinical, technological, and policy developments.

Data triangulation techniques were employed to reconcile discrepancies and enhance reliability. Findings were subjected to iterative validation workshops involving cross-functional stakeholders to test assumptions and refine strategic frameworks. Throughout the research process, methodological rigor and transparency were maintained to deliver actionable insights that withstand scrutiny and support evidence-based decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wound Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wound Care Market, by Product Type

- Wound Care Market, by Wound Type

- Wound Care Market, by End User

- Wound Care Market, by Distribution Channel

- Wound Care Market, by Region

- Wound Care Market, by Group

- Wound Care Market, by Country

- United States Wound Care Market

- China Wound Care Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights to Inform Holistic Strategies That Balance Clinical Innovation with Operational Excellence for Sustainable Growth

As the wound care market stands at the intersection of technological innovation and evolving healthcare value propositions, stakeholders must embrace agility, collaboration, and patient-centered thinking. Advanced materials, digital health solutions, and targeted therapies are no longer aspirational; they represent the new baseline for efficacy and cost-effectiveness. Companies that effectively navigate regulatory landscapes, align with reimbursement trends, and forge strategic partnerships will secure leadership positions.

Ultimately, the path forward demands a holistic approach that balances clinical performance with operational excellence. By synthesizing the insights presented here-spanning transformative trends, trade dynamics, segmentation nuances, regional considerations, and competitive landscapes-decision-makers are equipped to craft strategies that drive sustainable growth and improved patient outcomes in an ever-more complex wound care ecosystem.

Unlock Strategic Intelligence by Connecting with Associate Director of Sales & Marketing to Secure Comprehensive Wound Care Market Insights

To access the full market research report and unlock strategic intelligence on the wound care landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the report’s depth of analysis, customizable data modules, and value-added insights that will inform your decision-making. Engage with him today to explore tailored licensing, team workshops, or executive briefings designed to accelerate your organization’s growth and competitive positioning in this dynamic market.

- How big is the Wound Care Market?

- What is the Wound Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?