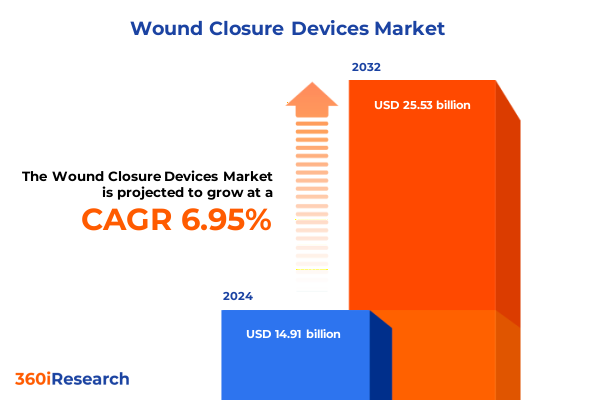

The Wound Closure Devices Market size was estimated at USD 15.91 billion in 2025 and expected to reach USD 17.00 billion in 2026, at a CAGR of 6.98% to reach USD 25.53 billion by 2032.

Unlocking the Future of Wound Closure Devices: Navigating Innovations, Demand Drivers, and Strategic Opportunities in 2025

The wound closure devices sector stands at the forefront of modern surgical innovation, fueled by the surge in both elective and emergency procedures globally. As healthcare systems grapple with rising volumes of chronic wounds from conditions such as diabetic foot ulcers and pressure injuries, demand for advanced closure solutions intensifies. Minimally invasive techniques and aesthetic considerations further drive adoption, underscoring the critical importance of rapid, reliable, and patient-friendly closure methods. Transitioning from traditional sutures to bioactive adhesives and hemostatic agents reflects a broader evolution toward more efficient wound management practices.

Furthermore, the expanding geriatric population and the growing prevalence of comorbidities such as cardiovascular disease and diabetes amplify the necessity for cutting-edge closure technologies. Hemostatic products have gained prominence in controlling surgical bleeding and improving hemostasis during complex interventions, supported by innovations in gelatin sponge matrices, oxidized regenerated cellulose, and novel polysaccharide-based formulations. Consequently, stakeholders must navigate a landscape shaped by clinical imperatives, technological advancements, and shifting patient expectations.

Transformative Breakthroughs Redefining Wound Closure with Smart Sutures, Bioengineered Adhesives, and Minimally Invasive Techniques

The landscape of wound closure is undergoing transformative shifts as smart and bioengineered solutions redefine clinical standards. Innovations such as self-dissolving sutures embedded with biosensors now enable real-time monitoring of healing progression and early detection of infection, marking a departure from passive closure methods. This integration of diagnostics with closure functions accelerates decision-making for postoperative care teams, reducing complications and minimizing readmission rates.

Simultaneously, nanotechnology-based tissue adhesives have emerged as powerful alternatives to mechanical closure, promoting faster epithelialization while delivering antimicrobial activity at the wound interface. Advancements in robotic-assisted suturing systems further underscore the shift toward precision-driven interventions in minimally invasive surgery suites. By enhancing dexterity and reducing human error, these platforms are broadening the adoption of complex laparoscopic procedures and facilitating more consistent patient outcomes.

Assessing the 2025 U.S. Tariff Wave Impact on Wound Closure Devices Supply Chains Costs and Strategic Sourcing Decisions

The introduction of heightened U.S. tariffs in 2025 has introduced significant complexity to the wound closure device supply chain. A baseline 10% import duty on medical devices, coupled with reciprocal tariffs as high as 54% on imports from select countries, directly impacts cost structures and sourcing decisions for manufacturers and healthcare providers alike.

Moreover, phased increases under existing policies have escalated duties on foundational components such as medical gloves to 50% in 2025 and syringes and needles to 100% from earlier levels, further straining procurement budgets. In anticipation, major healthcare organizations are reevaluating supplier portfolios, exploring nearshoring opportunities to mitigate risk, and advocating for reinstatement of targeted exemptions for critical wound closure products. As the tariff landscape continues to evolve, industry participants must refine strategic sourcing frameworks and collaborate with policymakers to safeguard continuity of care.

Decoding Critical Segmentation Dynamics Revealing How Product Types, Applications, End Users, and Materials Drive Market Complexity

Understanding the intricacies of wound closure demand requires exploring multiple segmentation dimensions. Different product types ranging from hemostats, staples, surgical tapes, sutures, and tissue adhesives serve discrete clinical needs: hemostats span gelatin sponges, oxidized regenerated cellulose, and polysaccharide matrices; staples include both manual and powered systems; surgical tapes present microporous and transparent variants; sutures split into absorbable and nonabsorbable fibers; and tissue adhesives cover albumin biopolymers, cyanoacrylates, and fibrin-based formulas.

Applications further stratify the market, with cosmetic procedures prioritizing minimal scarring, dental practices requiring precision closure in delicate oral tissues, emergency care demanding rapid hemostasis, and surgical theaters seeking robust, reliable solutions. End users vary from high-throughput hospital complexes and specialized ambulatory surgical centers to community clinics and home healthcare settings where ease of application and patient comfort hold sway. Finally, material composition-whether absorbable for temporary support or nonabsorbable for long-term tensile strength-drives selection criteria and shapes regulatory pathways.

This comprehensive research report categorizes the Wound Closure Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Wound Type

- Usability

- Application

- Patient Group

- End User

- Distribution Channel

Spotlight on Regional Growth Patterns Exposing Varying Adoption Rates and Innovation Hotspots Across Major Global Markets

Geographic dynamics in wound closure device adoption reveal divergent trends across major regions. In the Americas, robust healthcare infrastructure and significant R&D investment have accelerated uptake of next-generation adhesives and staple technologies, while regulatory alignment facilitates rapid product approvals. In contrast, the Europe, Middle East & Africa region exhibits a heterogeneous landscape where established markets in Western Europe lead in minimally invasive suturing systems and hemostatic innovations, whereas emerging economies in the Middle East and Africa emphasize cost-effective solutions and local manufacturing partnerships.

Meanwhile, the Asia-Pacific market has witnessed exponential growth driven by expanding hospital networks, government initiatives to bolster domestic medical device industries, and rising patient awareness of advanced wound care options. Combined, these regional dynamics underscore the necessity for tailored market entry strategies and partnership models that reflect local regulatory frameworks, reimbursement practices, and cultural preferences.

This comprehensive research report examines key regions that drive the evolution of the Wound Closure Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlighting Market-Leading Innovations and Strategic Moves by Top Wound Closure Device Manufacturers

The competitive landscape of wound closure devices is defined by leading medical technology manufacturers advancing their portfolios through targeted R&D and strategic acquisitions. Johnson & Johnson’s Ethicon division continues to pioneer antimicrobial-coated sutures and powered stapling platforms, propelling growth despite tariff-induced cost pressures and reaffirming its market leadership position. Medtronic has expanded its Endo Stitch and V-Loc sutures lines, integrating user-friendly deployment mechanisms favored in minimally invasive procedures.

Meanwhile, 3M’s Steri-Strips and Precise Skin Stapler underscore the company’s focus on noninvasive closure methods, delivering consistent performance in both hospital and home care environments. Smith+Nephew and Baxter have bolstered their offerings with advanced fibrin-based sealants and biologically engineered adhesives that promote faster hemostasis and reduced scarring. Notably, emerging players such as Teleflex and NeatStitch are capitalizing on robotic-assisted systems and AI-enabled wound closure platforms, signaling a broader move toward digital integration in surgical workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wound Closure Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Medical Solutions Group plc

- Alliqua BioMedical, Inc.

- AROA BIOSURGERY LIMITED

- AVITA Medical, Inc.

- B. Braun SE

- Baxter International Inc.

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Chemence, Inc.

- Coloplast A/S

- Convatec Group Plc

- CooperSurgical, Inc.

- Corza Medical

- DermaClip US, LLC

- Dukal, LLC

- Essity AB

- Futura Surgicare Pvt. Ltd.

- Grünenthal GmbH

- Healthium Medtech Limited

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Mölnlycke Health Care AB

- Riverpoint Medical

- Smith+Nephew plc

- Stryker Corporation

- Teleflex Incorporated.

- Zimmer Biomet Holdings, Inc.

Strategic Imperatives for Industry Leaders to Enhance Supply Resilience, Drive Innovation, and Capitalize on Emerging Wound Closure Trends

To navigate the evolving wound closure terrain, industry leaders must prioritize supply chain agility by diversifying sourcing and establishing alternate manufacturing hubs closer to key markets. Collaborative partnerships with material science innovators and technology firms can accelerate the development of next-generation adhesives and smart sutures, while joint ventures in emerging regions can enhance cost efficiency and local market responsiveness.

Furthermore, organizations should invest in clinical evidence generation to substantiate product differentiation, leveraging real-world data to support superior healing outcomes and cost-of-care reductions. Engaging with regulatory bodies early in the product development cycle will streamline approval timelines and maintain compliance amid shifting international trade policies. Finally, integrating digital tools-from AI-driven wound assessment to automated dispensing systems-will fortify stakeholder engagement, optimize inventory management, and deliver measurable improvements in patient satisfaction.

Robust Multi-Source Research Methodology Integrating Primary Interviews Secondary Analysis and Data Triangulation for In-Depth Market Insights

This analysis employed a comprehensive, multi-stage research methodology combining primary interviews with C-suite executives, key opinion leaders, and clinical specialists to capture firsthand insights into evolving clinical needs and procurement strategies. Secondary research encompassed extensive review of regulatory filings, patent databases, and financial disclosures, supplemented by analysis of peer-reviewed publications and industry conferences to map technological breakthroughs.

Data triangulation validated findings against trade association reports and government statistics, while quantitative modeling assessed the impact of trade policy changes on cost structures. The study’s rigorous approach ensured balanced representation of established and emerging market players, while ongoing stakeholder consultations throughout 2025 provided real-time perspectives on tariff negotiations and adoption barriers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wound Closure Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wound Closure Devices Market, by Product Type

- Wound Closure Devices Market, by Wound Type

- Wound Closure Devices Market, by Usability

- Wound Closure Devices Market, by Application

- Wound Closure Devices Market, by Patient Group

- Wound Closure Devices Market, by End User

- Wound Closure Devices Market, by Distribution Channel

- Wound Closure Devices Market, by Region

- Wound Closure Devices Market, by Group

- Wound Closure Devices Market, by Country

- United States Wound Closure Devices Market

- China Wound Closure Devices Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Concluding Insights Emphasizing Strategic Priorities And The Path Forward For Stakeholders In The Evolving Wound Closure Devices Arena

In conclusion, the wound closure devices market is poised for sustained transformation driven by demographic pressures, technological innovation, and evolving regulatory landscapes. Precision-engineered adhesives, sensor-enabled sutures, and minimally invasive closure platforms will redefine clinical workflows and patient expectations. However, the intricacies of global trade policies and tariff escalations necessitate proactive supply chain strategies and policy advocacy to preserve access to critical devices.

Stakeholders equipped with holistic market intelligence will be best positioned to anticipate clinical demand, align product roadmaps with regional priorities, and foster collaborative ecosystems. As the sector advances into new frontiers of bioengineering and digital integration, continuous investment in evidence generation and strategic partnerships will remain essential to optimize outcomes and achieve sustainable growth.

Get the Comprehensive Wound Closure Devices Market Report Today and Connect with Ketan Rohom for Exclusive Insights and Tailored Purchasing Options

Unlock unparalleled insights into the wound closure devices landscape by securing the full market research report. Connect directly with Ketan Rohom, Associate Director, Sales & Marketing, to explore customized purchasing options and unlock expert guidance on leveraging these insights for strategic advantage. Reach out today to obtain your comprehensive analysis and gain the competitive edge required to drive growth and innovation.

- How big is the Wound Closure Devices Market?

- What is the Wound Closure Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?