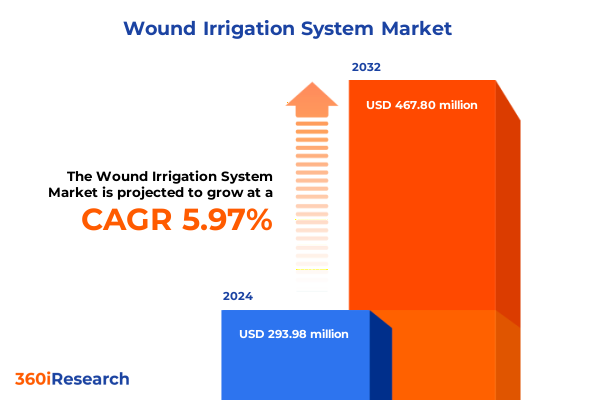

The Wound Irrigation System Market size was estimated at USD 310.59 million in 2025 and expected to reach USD 334.56 million in 2026, at a CAGR of 6.02% to reach USD 467.79 million by 2032.

Innovative Developments in Wound Irrigation Systems Paving the Way for Enhanced Clinical Precision, Patient Safety, and Optimized Healing in Healthcare Practice

In contemporary clinical practice, efficient wound cleansing is fundamental to reducing bacterial burden and promoting tissue regeneration. Wound irrigation systems have evolved from simple gravity-fed reservoirs to sophisticated devices offering precise control over fluid volume and pressure. These innovations have been driven by the imperative to minimize contamination while optimizing patient comfort and clinician workflow. As healthcare providers confront rising case complexity and stringent safety standards, the integration of digital monitoring and customizable flow rates has become a defining feature of next-generation irrigation platforms.

Moreover, the spectrum of technological approaches now extends across both reusable configurations, valued for their durability and cost efficiencies in high-throughput settings, and single-use options, which address sterility concerns and streamline point-of-care deployment. Similarly, diverse mechanism designs accommodate clinical preferences ranging from standard gravity irrigation and manual syringe methods to advanced pressure-based delivery systems. The latter category encompasses pulsatile irrigation units available in both manual-powered and battery-operated formats, each engineered to deliver targeted shear forces that dislodge debris without harming viable tissues. Consequently, these developments have broadened application potential across chronic wound management, urgent trauma care, and intraoperative cleansing procedures. Coupled with tailored distribution strategies that encompass integrated hospital pharmacy procurement, emerging e-commerce channels, and traditional retail pharmacy outlets, the wound irrigation landscape is positioned for sustained growth and ongoing technological refinement.

As regulatory bodies emphasize device traceability and biocompatibility, manufacturers have responded by employing advanced materials and ensuring compliance with stringent quality frameworks. Ultimately, the confluence of clinical necessity, technological advancement, and distribution channel diversification is ushering in an era in which wound irrigation systems transcend their conventional role as adjuncts in care, emerging instead as critical components that directly impact healing trajectories. This introduction sets the stage for an in-depth exploration of market dynamics, segmentation insights, and strategic imperatives that will define the sector’s trajectory in the coming years.

Emerging Disruptions and Technological Breakthroughs Reshaping the Wound Irrigation Market Toward Greater Efficiency and Patient-Centric Care

Healthcare delivery is undergoing a paradigm shift, and wound irrigation systems are at the heart of this transformation. In recent years, the convergence of medical device engineering with digital connectivity has revolutionized the way irrigation devices operate. Embedded sensors now capture real-time flow metrics and pressure profiles, transmitting critical data to centralized dashboards for analysis. This integration of smart technology not only enhances precision in fluid delivery but also supports evidence-based adjustments during treatment protocols. Furthermore, the emphasis on sustainable design has led to the development of eco-friendly disposables that minimize environmental waste without compromising clinical efficacy. Consequently, providers can align their infection control measures with broader organizational sustainability goals.

In parallel, clinical workflows have adapted to accommodate remote and self-administered irrigation modalities, bridging the gap between hospital care and home-based management. Telehealth platforms now feature guided irrigation sessions, enabling wound care specialists to monitor patient compliance and healing progress from afar. Additionally, modular designs allow for rapid device customization, enabling seamless transition between acute surgical settings and long-term chronic wound clinics. Transitioning irrigation technology to support interoperability with electronic health record systems has further streamlined documentation, ensuring that fluid volumes, pressure settings, and irrigation frequencies are recorded accurately for each patient encounter.

Moreover, regulatory frameworks are evolving to recognize the role of advanced irrigation mechanisms in reducing surgical site infections and accelerating healing timelines. Reimbursement models increasingly support value-based procurement of devices that demonstrate quantifiable outcomes, incentivizing adoption of cutting-edge irrigation platforms. As a result, transformative shifts in technology, clinical integration, and policy alignment are collectively reshaping the wound irrigation landscape toward greater efficiency and patient-centric care.

Evaluating the Comprehensive Impact of United States 2025 Tariff Adjustments on Wound Irrigation System Supply Chains, Cost Structures, and Domestic Manufacturing Incentives

The imposition of revised tariff structures in early 2025 has exerted significant pressure on the importation of wound irrigation components and complete systems. As duty rates escalated for key components sourced from overseas, healthcare providers and distributors experienced elevated procurement costs, necessitating rapid reevaluation of existing supply agreements. Many organizations faced immediate budgetary constraints, prompting negotiations to redistribute cost increases across stakeholders and maintain continuity of care. Simultaneously, procurement teams accelerated assessments of total cost of ownership to quantify the long-term impact of these tariff adjustments on device maintenance programs and consumables expenses.

Consequently, domestic manufacturers have encountered newfound opportunities to expand production capacities and capture market share. Incentivized by federal initiatives aimed at reshoring critical medical manufacturing, several regional fabricators have scaled up automated assembly lines to deliver irrigation systems that comply with stringent quality standards. This shift has fostered resilience within the supply chain, reducing dependency on international logistics and mitigating the risk of future trade disruptions. Additionally, localized production has enabled faster lead times, which is particularly crucial in emergent scenarios requiring immediate access to irrigation devices for trauma and surgical applications.

Furthermore, the aggregated effect of tariff-induced cost pressures and emerging local capacity has spurred collaborative ventures between original equipment manufacturers and component suppliers. These partnerships focus on process optimization, material innovation, and co-development of modular platforms that can be assembled domestically. As a result, the wound irrigation market is undergoing a recalibration of cost structures and strategic alliances, with a clear emphasis on fortifying domestic supply chains and ensuring uninterrupted access to critical cleansing solutions.

Comprehensive Examination of Wound Irrigation Market Segmentation Revealing Insights into Diverse Technology, Product, Application, End User, and Distribution Channels

A nuanced understanding of the wound irrigation market emerges when examined through multiple lenses of segmentation. From a technological standpoint, the choice between reusable and single-use irrigation platforms reflects a balance between lifecycle cost efficiencies and infection control imperatives. Reusable systems often integrate durable materials and sophisticated cleaning protocols designed for high-volume environments, whereas single-use units respond to increasing demands for point-of-care sterility and operational simplicity.

Product type differentiation further refines these insights. Gravity irrigation remains a mainstay in settings with minimal equipment dependencies, while manual syringe-based approaches offer a cost-effective solution for targeted cleansing requirements. In contrast, pressure irrigation devices deliver consistent stream velocities, optimizing debridement during chronic wound management. Pulsatile irrigation units, available in both battery-operated and manual-powered configurations, facilitate pulsing fluid delivery that mimics physiological shear forces, thereby enhancing debris removal and promoting tissue perfusion without disrupting viable tissue.

Applications span chronic wound treatment regimens, emergency care interventions in trauma units, and intraoperative cleansing protocols within surgical theaters. Correspondingly, the end user landscape includes ambulatory surgery centers that prioritize rapid turnover, home care settings where portability is paramount, hospitals with stringent compliance standards, and specialty clinics focused on advanced wound therapies. Finally, distribution channels play an integral role in market accessibility. Institutional purchasing through hospital pharmacies coexists with the growing influence of online sales platforms, while retail pharmacy offerings cater to over-the-counter irrigation solutions for consumer-driven wound care management.

This comprehensive research report categorizes the Wound Irrigation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Application

- End User

- Distribution Channel

In-Depth Regional Perspectives Unveiling the Evolving Wound Irrigation Landscape across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the evolution of wound irrigation systems, beginning with the Americas, where the intersection of advanced healthcare infrastructure and diverse payer models shapes device adoption. In North America, reimbursement pathways that reward outcome-based interventions have catalyzed the uptake of premium irrigation platforms featuring digital connectivity. Latin American markets, while facing pricing constraints, demonstrate growing interest in single-use devices that address infection control and simplify supply chain management.

Across Europe, the Middle East & Africa, regulatory harmonization initiatives have streamlined device approvals, fostering confidence among healthcare providers in adopting novel irrigation technologies. European Union directives emphasize sustainability, driving manufacturers to introduce eco-conscious disposables. In contrast, select Middle Eastern healthcare hubs invest in integrating irrigation data with broader hospital information systems, whereas African markets often leverage cost-effective gravity and manual syringe methods to meet pressing clinical needs under budgetary limitations.

Meanwhile, the Asia-Pacific region offers a heterogeneous mosaic of demand profiles. Developed markets such as Japan and Australia exhibit rapid uptake of advanced pulsatile units, underscored by strong domestic manufacturing capabilities. Emerging economies in Southeast Asia and the Indian subcontinent prioritize scalability and affordability, leading to partnerships that localize production of manual-powered and battery-operated irrigation devices. Consequently, each region’s regulatory environment, economic conditions, and healthcare delivery models collectively define a distinctive set of requirements for wound irrigation solution providers.

This comprehensive research report examines key regions that drive the evolution of the Wound Irrigation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Industry Participants Driving Innovation and Competitive Edge in Wound Irrigation Solutions Domain

The competitive landscape in wound irrigation is shaped by a handful of leading participants whose strategic initiatives influence industry direction. Established global medical device conglomerates leverage extensive R&D budgets and expansive distribution networks to introduce integrated irrigation platforms with complementary visualization and suction capabilities. Their focus on modularity and interoperability fosters seamless incorporation of irrigation data into hospital-wide clinical decision support systems.

At the same time, specialized manufacturers concentrate on precision-engineered irrigation units that cater to niche clinical applications. Through targeted collaborations with academic medical centers, these innovators validate device performance metrics-such as shear force profiles and volumetric accuracy-under simulated and real-world conditions. Consequently, they secure key endorsements from thought leaders in wound care, bolstering their credibility among procurement committees.

Meanwhile, emerging entrants harness advances in materials science to develop biodegradable components for single-use irrigation devices, appealing to providers seeking to reduce environmental footprint. Strategic partnerships with contract manufacturing organizations enable rapid scale-up and market entry without the overhead of large capital investments. Collectively, these varying approaches-ranging from vertical integration to collaborative outsourcing-illustrate how diverse corporate models and strategic priorities converge to drive continuous innovation in the wound irrigation domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Wound Irrigation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- Centurion Medical Products Corporation

- Coloplast Group

- ConvaTec Group Plc

- Hollister Incorporated

- Integra LifeSciences Holdings Corporation

- Irrimax Corporation

- McKesson Corporation

- Medline Industries, LP

- Mölnlycke Health Care AB

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Practical Strategic Recommendations Empowering Healthcare and Manufacturing Leaders to Capitalize on Market Opportunities in Wound Irrigation

Industry leaders should prioritize investment in precision-controlled, single-use pulsatile systems that marry the sterility benefits of disposability with the clinical efficacy of targeted fluid dynamics. By aligning product development with regulatory frameworks that reward documented outcomes, device manufacturers can command premium market positioning and foster reimbursement support. Furthermore, cultivating strategic alliances with telehealth providers offers an avenue to extend irrigation solutions into home care environments, reinforcing customer loyalty and unlocking new revenue streams.

In parallel, healthcare institutions are encouraged to integrate irrigation data into electronic health records and analytics platforms, enabling granular tracking of treatment regimens and correlation with patient recovery metrics. This data-driven approach facilitates outcome-focused procurement decisions and supports continuous quality improvement initiatives. Supply chain teams should also explore diversification strategies that combine domestic manufacturing partnerships with select international sourcing, mitigating exposure to future trade policy shifts.

Moreover, corporate responsibility mandates dictate a commitment to sustainable design through the adoption of eco-friendly materials and packaging. By articulating clear environmental impact reductions, companies can appeal to increasingly conscientious purchasers across public and private sectors. Ultimately, a holistic strategy that intertwines technological differentiation, data integration, supply chain resilience, and sustainability will empower both manufacturers and providers to thrive in the dynamic wound irrigation market.

Transparent Multimethod Research Design Highlighting Qualitative and Quantitative Approaches Underpinning Market Insights and Analysis

This analysis is founded upon a rigorous multimethod research framework that combines qualitative and quantitative approaches to deliver comprehensive market insights. Primary research efforts included in-depth interviews with wound care specialists, procurement managers, and clinical engineers from diverse healthcare settings. These conversations were supplemented by structured surveys designed to capture usage patterns, clinical preferences, and unmet needs related to irrigation device performance.

Secondary research involved exhaustive review of regulatory filings, technical white papers, and peer-reviewed journal articles to validate device efficacy and compliance trends. Proprietary datasets detailing import/export volumes, tariff schedules, and distribution channel performance were also analyzed to inform the assessment of supply chain dynamics. Data triangulation techniques were applied to reconcile information from multiple sources, ensuring the robustness of segmentation classifications and regional market characterizations.

Finally, all findings underwent a rigorous validation process, wherein key data points were cross-checked against publicly available industry reports and manufacturer disclosures. This methodological approach guarantees that the insights presented herein reflect both the current state of the wound irrigation market and the emerging forces likely to shape its trajectory in the near term.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Wound Irrigation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Wound Irrigation System Market, by Technology

- Wound Irrigation System Market, by Product Type

- Wound Irrigation System Market, by Application

- Wound Irrigation System Market, by End User

- Wound Irrigation System Market, by Distribution Channel

- Wound Irrigation System Market, by Region

- Wound Irrigation System Market, by Group

- Wound Irrigation System Market, by Country

- United States Wound Irrigation System Market

- China Wound Irrigation System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Reflections Emphasizing Critical Advances and Strategic Imperatives in Wound Irrigation for Future Healthcare Excellence

In closing, recent advancements in wound irrigation technology underscore a fundamental shift toward devices that integrate precision, safety, and data-driven intelligence. The interplay between reusable and single-use platforms reflects broader healthcare imperatives for cost efficiency, sterility assurance, and operational adaptability. Meanwhile, evolving tariff policies have catalyzed domestic manufacturing expansion, fostering a more resilient supply chain ecosystem. Together, these forces reveal a market poised for continued innovation and value-oriented growth.

Segmentation insights demonstrate that diverse product types and applications-ranging from gravity-fed irrigation to battery-operated pulsatile units-cater to distinct clinical requirements across multiple end-user environments. Regional analyses further highlight the importance of tailoring strategies to localized regulatory, economic, and infrastructure realities. Leading companies continue to refine their competitive posture through partnerships, material innovations, and digital integration, setting a precedent for emerging entrants.

Ultimately, the wound irrigation landscape is defined by a convergence of technological breakthroughs, policy realignments, and strategic collaborations. Decision-makers who embrace a holistic view-one that harmonizes device performance with data analytics, supply chain resilience, and sustainability-will be best positioned to drive superior patient outcomes and achieve lasting competitive advantage.

Engage with Ketan Rohom for Exclusive Market Intelligence and Secure Your Comprehensive Wound Irrigation System Report Today

We invite you to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discover how our comprehensive report can equip your organization with unparalleled insights into the wound irrigation landscape. Through a detailed dialogue, Ketan will guide you through the report’s unique value proposition, demonstrating how advanced segmentation, regional analyses, and competitive intelligence can inform your strategic decision making.

Engaging with Ketan will provide you with a tailored overview of the methodologies and cutting-edge data that underpin our findings, ensuring you fully appreciate the actionable intelligence within each section. By securing your copy today, you position your team at the forefront of industry developments, ready to leverage market dynamics, regulatory shifts, and emerging innovations to optimize your product roadmap and distribution strategies. Connect with Ketan to transform research into results and accelerate your growth journey in the wound irrigation domain.

- How big is the Wound Irrigation System Market?

- What is the Wound Irrigation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?