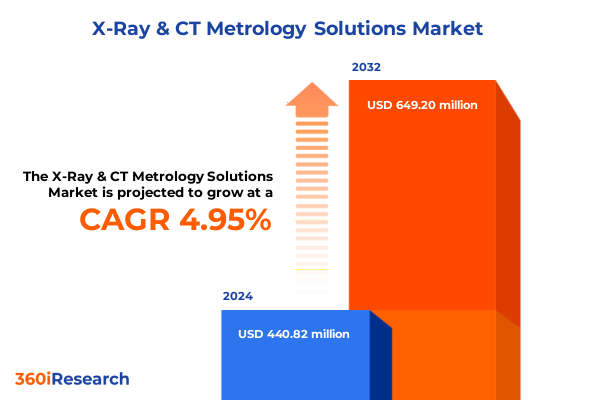

The X-Ray & CT Metrology Solutions Market size was estimated at USD 459.46 million in 2025 and expected to reach USD 485.15 million in 2026, at a CAGR of 5.06% to reach USD 649.20 million by 2032.

Setting the Stage for Innovation in X-Ray and Computed Tomography Metrology Solutions: Unveiling Core Drivers and Strategic Imperatives

The landscape of X-Ray and computed tomography (CT) metrology solutions stands at a pivotal juncture where precision engineering converges with emerging digital technologies to redefine quality assurance and non-destructive testing paradigms. As industries across aerospace, automotive, electronics, healthcare, and manufacturing demand ever-tighter tolerances and accelerated time-to-market, metrology platforms are evolving beyond mere imaging tools into intelligent systems that integrate data analytics, artificial intelligence, and automation to deliver real-time insights. This executive summary offers a high-level exploration of the current state of the market, examining the key drivers, technological innovations, regulatory pressures, and strategic considerations shaping the future trajectory of X-Ray and CT metrology.

By setting the stage with an overview of critical market dynamics, we establish a foundation for understanding the transformative shifts that are propelling adoption, the cumulative impact of tariff regimes on supply chains and cost structures, as well as the segmentation, regional nuances, and competitive forces at play. Readers will gain an appreciation for how industry leaders are leveraging advanced imaging modalities, modular software architectures, and service-oriented delivery models to unlock new value, while also understanding the challenges and opportunities that lie ahead. This introduction serves as both a roadmap and a contextual primer, preparing decision-makers to delve deeper into the insights and recommendations that follow.

Mapping the Radical Evolution of X-Ray and CT Metrology Technologies as Industry Dynamics Shift Toward Digitization and Automation

Over the past several years, the X-Ray and CT metrology market has experienced a radical evolution driven by the convergence of digital transformation and precision diagnostics. Organizations are increasingly integrating artificial intelligence algorithms with high-resolution imaging to automate defect detection, dimensional measurement, and material characterization, drastically reducing manual intervention and cycle times. Concurrently, the proliferation of industrial internet of things (IIoT) connectivity has enabled remote monitoring and predictive maintenance, ensuring system uptime and maximizing return on investment.

Furthermore, the shift toward additive manufacturing and lightweight composite materials has heightened demand for micro-CT and cone beam CT solutions that can verify internal geometries without compromising delicate structures. Regulatory frameworks around product safety and traceability have also become more stringent, compelling manufacturers to adopt nondestructive testing methods that ensure compliance while maintaining throughput. As a result, the market is witnessing a transition from standalone scanning devices to holistic metrology ecosystems that blend hardware, analysis software, and cloud-based data management, creating new avenues for value creation and collaboration across the supply chain.

Examining the Comprehensive Consequences of United States Tariffs on X-Ray and CT Metrology Supply Chains and Innovation Pathways in 2025

In 2025, the enforcement of additional United States tariff measures on imported components has introduced both cost challenges and strategic inflection points for suppliers and end users of X-Ray and CT metrology systems. The imposition of higher duties on detectors, X-ray source assemblies, and precision manipulators sourced from key manufacturing hubs has increased procurement costs and disrupted established supply networks. As a result, organizations are reevaluating supplier portfolios and accelerating efforts to localize critical manufacturing processes.

At the same time, the tariff environment has stimulated innovation in cost-effective component design and alternative material sourcing. Companies are investing in domestic assembly lines and forging partnerships with regional distributors to mitigate exposure to import levies. Meanwhile, the additional costs borne by end users have prompted a reevaluation of total cost of ownership models, leading to increased interest in service-based contracts that bundle equipment, maintenance, and upgrade paths into predictable spending frameworks. Ultimately, while tariffs have exerted upward pressure on prices, they have also catalyzed a strategic realignment that could yield a more resilient and diversified ecosystem for X-Ray and CT metrology solutions.

Decoding the Nuanced Segmentation Landscape of X-Ray and CT Metrology Markets Through Product Type, Application, End User, and Component Lens

The segmentation of the X-Ray and CT metrology market reveals distinct avenues for specialized innovation and targeted value capture. In terms of product type, the space encompasses high-precision X-Ray CT Systems-ranging from cone beam CT for large-scale industrial parts to micro CT for fine structural analysis-and X-Ray Diffractometers, which include both powder and single crystal variants optimized for material phase identification. Complementing these are X-Ray Inspection Systems configured for nondestructive testing scenarios as well as stringent security inspection protocols.

Regarding application, the technology is deployed across critical sectors such as aerospace, where composite inspection and turbine blade validation demand sub-micron accuracy; automotive, where chassis assembly and engine component analysis benefit from rapid throughput; and electronics and semiconductors, where printed circuit board and semiconductor wafer quality are paramount. Additionally, food and beverage packaging inspection, dental and orthopedic healthcare diagnostics, and industrial casting and welding inspection all rely on tailored metrology workflows.

From an end user perspective, the market extends to healthcare providers including diagnostic laboratories and hospitals; manufacturing entities across aerospace, automotive, and electronics verticals; research institutions in both academic and industrial laboratories; and security agencies operating at airports and border control points. Finally, component-level segmentation highlights the roles of detectors, manipulators, and X-ray sources within hardware suites, alongside services such as consulting, maintenance, and training, and sophisticated analysis and image processing software that drives actionable insights.

This comprehensive research report categorizes the X-Ray & CT Metrology Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

- Deployment Mode

Unraveling Regional Variances in X-Ray and CT Metrology Solution Adoption and Growth Enablers Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the X-Ray and CT metrology landscape underscore the importance of localized strategies and market-specific value propositions. In the Americas, strong manufacturing bases in automotive, aerospace, and industrial sectors have fostered demand for end-to-end metrology solutions, complemented by robust healthcare expenditures that drive adoption of CT-based diagnostic tools. North American and Latin American organizations are also exploring service-oriented delivery to manage capital outlay and ensure rapid deployment.

In Europe, Middle East & Africa, stringent regulatory requirements around product safety, coupled with significant defense and security spending, have elevated the relevance of high-throughput inspection systems and portable nondestructive testing platforms. Collaborations between research institutions and industrial players in this region are accelerating the development of digital twin integration and green inspection technologies.

Across Asia-Pacific, the rapid expansion of electronics manufacturing in markets such as China, South Korea, and Taiwan, alongside government initiatives to enhance semiconductor self-sufficiency, has driven robust uptake of precision X-Ray CT Systems and diffractometers. Regional stakeholders are prioritizing domestic production capabilities and automated inspection lines, creating fertile ground for technology providers to establish local partnerships and innovation hubs.

This comprehensive research report examines key regions that drive the evolution of the X-Ray & CT Metrology Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Driving Advances and Competitive Differentiation in X-Ray and CT Metrology Solutions

The competitive arena for X-Ray and CT metrology solutions is characterized by a blend of established global corporations and agile specialized innovators. Leading equipment manufacturers are continuously expanding their portfolios through R&D investments in high-resolution detectors, advanced imaging software, and integrated robotic handling systems. Strategic collaborations and mergers are commonplace, enabling organizations to bundle hardware, software, and services into unified metrology ecosystems.

In parallel, smaller technology providers are carving out niche positions by focusing on rapid prototyping of custom modules, cloud-enabled analytics platforms, and turnkey service models. These firms often engage in co-development partnerships with end users to tailor solutions for specific materials and geometries, driving higher levels of customer intimacy and application expertise. This dual landscape of major incumbents and nimble challengers fosters healthy competition, accelerates innovation cycles, and ultimately delivers more versatile, cost-effective metrology solutions to the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the X-Ray & CT Metrology Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avonix Imaging, LLC

- Baker Hughes Company

- Carl Zeiss AG

- Comet Group

- Gulmay Ltd

- Hamamatsu Photonics K.K.

- KLA Corporation

- Nikon Corporation

- Non-Destructive Testing (NDT) Products Limited

- North Star Imaging Inc.

- Rigaku Holdings Corporation

- Sanying Precision Instruments Co.,Ltd.

- Shimadzu Corporation

- Technosys

- Thermo Fisher Scientific Inc.

- Tokyo Seimitsu Co., Ltd.

Implementing Forward-Looking Strategies and Best Practices to Accelerate Market Leadership and Operational Excellence in X-Ray and CT Metrology Sectors

Industry leaders seeking to maintain or attain a competitive edge should embrace a series of targeted actions. First, diversifying supply chains through strategic alliances and dual-sourcing agreements will mitigate tariff and geopolitical risks while ensuring material continuity. Second, integrating artificial intelligence and machine learning into imaging workflows can enhance defect detection accuracy, reduce false positives, and enable predictive maintenance of scanning equipment.

Moreover, fostering close partnerships with research institutions and end users will accelerate application-specific innovation, from additive manufacturing inspection to semiconductor wafer analysis. Offering flexible service contracts that combine installation, on-site maintenance, and remote diagnostics will transform capital expenditures into predictable operational spending. Finally, prioritizing robust cybersecurity measures and data governance protocols will safeguard sensitive inspection data, building trust and compliance in highly regulated environments.

Demystifying Rigorous Research Approaches and Data Collection Methodologies Underpinning Comprehensive X-Ray and CT Metrology Market Analysis

Our research integrates multiple layers of data collection and analysis to ensure comprehensive coverage of the X-Ray and CT metrology landscape. Primary research involved structured interviews with senior executives, R&D managers, and end users across key industry verticals, yielding nuanced perspectives on technology adoption drivers, pain points, and investment priorities. Secondary research encompassed an exhaustive review of technical journals, patent filings, trade association publications, and public financial disclosures to map competitive positioning and innovation trajectories.

Quantitative data was triangulated with qualitative insights through rigorous cross-validation exercises, ensuring consistency and reliability. We also leveraged trade flow statistics and tariff schedules to assess the impact of import duties on component sourcing and pricing dynamics. Finally, a panel of independent industry experts and academic researchers reviewed intermediate findings, providing critical feedback that refined our segmentation framework and validated market observations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our X-Ray & CT Metrology Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- X-Ray & CT Metrology Solutions Market, by Component

- X-Ray & CT Metrology Solutions Market, by Technology

- X-Ray & CT Metrology Solutions Market, by Application

- X-Ray & CT Metrology Solutions Market, by End User

- X-Ray & CT Metrology Solutions Market, by Deployment Mode

- X-Ray & CT Metrology Solutions Market, by Region

- X-Ray & CT Metrology Solutions Market, by Group

- X-Ray & CT Metrology Solutions Market, by Country

- United States X-Ray & CT Metrology Solutions Market

- China X-Ray & CT Metrology Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Converging Critical Insights and Strategic Imperatives That Shape the Future Trajectory of X-Ray and CT Metrology Solutions Across Industries

This executive summary has illuminated the critical forces shaping the trajectory of X-Ray and CT metrology solutions, from the digital transformation wave to evolving tariff structures and regional market idiosyncrasies. We have dissected the segmentation landscape, identified the competitive strategies of leading players, and offered actionable recommendations for sustaining growth and innovation. Through a robust methodology that blends primary interviews, secondary research, and expert validation, we have delivered a panoramic view of the ecosystem, highlighting both opportunities and challenges.

As metrology technologies continue to converge with cloud computing, AI analytics, and advanced robotics, industry leaders must adopt adaptive strategies that balance technological prowess with supply chain resilience. The insights presented here serve as a strategic compass for decision-makers aiming to capitalize on emerging trends, mitigate risks, and achieve operational excellence. Ultimately, success in this dynamic market will hinge on the ability to innovate rapidly, collaborate across the value chain, and deliver measurable quality improvements that drive competitive advantage.

Connect with Ketan Rohom to Unlock Deep Expertise and Accelerate Your Strategic Decision-Making in X-Ray and CT Metrology Market Intelligence Purchase Today

For further insights into how advanced metrology strategies can revolutionize your operational efficiency and quality assurance, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in X-Ray and CT metrology will guide you through tailored solutions that align with your strategic objectives, whether you seek to optimize inspection processes, enhance analytical capabilities, or navigate complex supply chain challenges. Engage with Ketan to discuss your specific requirements, explore custom research deliverables, and uncover hidden value in your inspection workflows. Accelerate your decision-making with authoritative market intelligence and actionable guidance designed for immediate impact. Reach out now to secure your competitive edge and drive sustained growth in the dynamic world of X-Ray and CT metrology.

- How big is the X-Ray & CT Metrology Solutions Market?

- What is the X-Ray & CT Metrology Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?