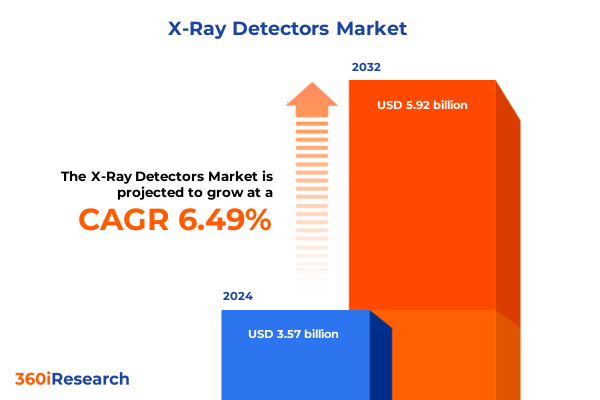

The X-Ray Detectors Market size was estimated at USD 3.79 billion in 2025 and expected to reach USD 4.03 billion in 2026, at a CAGR of 6.54% to reach USD 5.92 billion by 2032.

Discover the Critical Role of X-Ray Detectors in Shaping Advanced Imaging Solutions Across Medical, Industrial, and Security Sectors

The accelerating evolution of X-ray detector technology has become a critical enabler for breakthroughs across medical diagnostics, industrial inspection, and security imaging. As healthcare providers pursue higher diagnostic accuracy with lower radiation doses, advanced detectors have emerged as indispensable tools in cardiology labs, dental clinics, and imaging centers. At the same time, industrial radiography and non-destructive testing have benefited from improvements in panel sensitivity and rapid image acquisition, allowing manufacturers in aerospace and automotive to detect flaws with unprecedented precision. From veterinary imaging to border security scan systems, the expanding footprint of X-ray detectors underscores their transformative potential.

Contemporary demands on imaging infrastructures are reshaping procurement priorities, with end-users emphasizing portability, automation, and seamless integration into digital workflows. The rise of digital radiography, characterized by flat-panel and CMOS-based detectors, has eclipsed legacy computed radiography and charge-coupled devices, driving a shift toward real-time visualization and analytics. Meanwhile, regulatory bodies are tightening quality control benchmarks and radiation safety standards, further elevating the performance bar for detector manufacturers. This introduction sets the stage for a detailed exploration of the technological advancements, policy impacts, market segmentation insights, and strategic imperatives defining the current X-ray detector ecosystem.

Unveiling the Revolutionary Technological Advancements Driving Quantum Leaps in X-Ray Detector Performance and Versatility for Diverse Industries

In recent years, the X-ray detector landscape has undergone a revolution propelled by materials science breakthroughs and digital innovations. The emergence of high-resolution CMOS detectors with native digital readouts has unlocked new diagnostic capabilities, enabling clinicians to visualize minute anatomical details while minimizing patient exposure. Concurrently, amorphous selenium sensors have gained traction in mammography, delivering superior contrast and enhanced lesion detection compared to traditional amorphous silicon panels. These materials-driven enhancements are complemented by sophisticated onboard electronics that support automated image correction, noise reduction, and dynamic range expansion.

Beyond sensor technology, transformative shifts are evident in the integration of artificial intelligence and machine learning algorithms. AI-driven image processing facilitates real-time quality control, anomaly detection, and predictive maintenance, boosting throughput and reducing downtime across both fixed and portable systems. Additionally, modular detector architectures have emerged, allowing rapid customization for diverse applications-from large-area detectors in industrial radiography to compact handheld units for field veterinary diagnostics. These advancements have collectively elevated the versatility, efficiency, and accuracy of X-ray imaging, positioning detectors as intelligent components within broader digital health and Industry 4.0 ecosystems.

Analyzing the Far-Reaching Consequences of Recent United States Tariff Policies on X-Ray Detector Supply Chains and Industry Dynamics

The introduction of new U.S. tariffs on select imaging components and assemblies in early 2025 has generated significant ripple effects across X-ray detector supply chains and procurement strategies. Suppliers reliant on imported amorphous silicon panels and specialized ASICs faced immediate cost pressures, prompting many to reevaluate sourcing options and forge partnerships with domestic manufacturers. This shift has accelerated onshore and nearshore production initiatives, as original equipment manufacturers seek to mitigate exposure to import duties while satisfying stringent medical device regulations.

As a result, inventory management practices have evolved, with end-users adopting just-in-time stocking models and diversified vendor portfolios to buffer against pricing volatility. Moreover, manufacturers are accelerating investments in automation and advanced manufacturing techniques to offset tariff-induced cost increases, ultimately safeguarding competitiveness. These cumulative policy impacts underscore the importance of agile supply chain design and proactive risk management. Organizations that swiftly realign procurement, logistics, and quality assurance processes stand to gain resilience, ensuring uninterrupted access to cutting-edge X-ray detectors for critical clinical and industrial applications.

Illuminating Critical Market Segmentation Dimensions Revealing Diverse X-Ray Detector Types, Technologies, Applications, and End-User Requirements

A nuanced understanding of market segmentation reveals the diversity of X-ray detector offerings, each tailored to specific operational and performance requirements. Charge-coupled device detectors, once prevalent in dental imaging, now share the stage with advanced flat-panel detectors that deliver broader dynamic ranges and faster readout speeds for general radiography. Computed radiography systems continue to serve cost-sensitive installations, while line scan detectors support high-throughput industrial inspection lines.

Product differentiation further extends across analog and digital formats. Analog detectors remain entrenched in legacy workflows, but the inexorable shift toward digital X-ray detectors reflects widespread demand for real-time data, remote diagnostics, and seamless integration into Picture Archiving and Communication Systems. Underpinning this transition, a trifecta of sensor technologies-amorphous selenium for high-contrast mammography, amorphous silicon for general radiography, and CMOS for high-speed imaging-enables manufacturers to optimize designs for specialized applications.

Portability is another critical axis of segmentation. Fixed detectors dominate hospital radiology suites, offering large area panels suited to chest and orthopedic imaging, whereas portable detectors empower emergency response teams, veterinary practitioners, and field maintenance crews to conduct on-site inspections with minimal setup time. Panel size variations, ranging from compact small-area devices used in dental imaging to expansive large-area arrays employed in cargo scanning, reflect the interplay between resolution needs and handling ergonomics.

Applications span industrial radiography, non-destructive testing, and security imaging, as well as cardiovascular, dental, mammography, and orthopedic imaging within healthcare settings. Veterinary imaging further broadens the use case spectrum. End-users encompass dental clinics, diagnostic centers, and hospitals in the medical realm, and aerospace, automotive, and electronics manufacturers alongside research institutions in industrial contexts. This multi-dimensional segmentation underscores that no single detector solution fits all, highlighting the imperative for tailored product roadmaps and targeted go-to-market strategies.

This comprehensive research report categorizes the X-Ray Detectors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Detector Type

- Product Type

- Technology

- Portability

- Panel Size

- Application

- End-User

Uncovering Strategic Regional Trends Shaping the Adoption and Innovation of X-Ray Detectors Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the adoption and innovation of X-ray detectors. In the Americas, healthcare systems are prioritizing upgrades to digital radiography platforms that improve diagnostic accuracy and reduce total cost of ownership. Municipal and federal infrastructure investments are also bolstering non-destructive testing capabilities within aerospace and energy sectors, driving demand for high-throughput fixed and portable detectors.

Meanwhile, Europe, the Middle East, and Africa present a spectrum of maturity levels. Western European markets exhibit robust uptake of premium detectors featuring AI-enabled analytics and networked connectivity. In contrast, emerging markets across the Middle East and Africa are focusing on scalable, cost-effective solutions that can be rapidly deployed in remote or resource-constrained environments. Regulatory harmonization efforts in the European Union and GCC countries are facilitating cross-border equipment certification, streamlining procurement cycles and accelerating time to market.

Asia-Pacific stands out as the most dynamic region, with accelerating modernization of healthcare facilities in China, Japan, and India driving significant demand for both fixed and portable X-ray detectors. Simultaneously, the region’s manufacturing hubs are intensifying investments in industrial radiography and security screening solutions to support booming automotive, electronics, and logistics sectors. Collaborative research initiatives between academic institutions and local OEMs are further stimulating innovations in sensor materials and imaging algorithms, cementing the region’s role as a hotbed for next-generation detector technologies.

This comprehensive research report examines key regions that drive the evolution of the X-Ray Detectors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Landscape Through In-Depth Profiles of Leading X-Ray Detector Manufacturers Driving Innovation and Market Leadership

The competitive landscape is characterized by a blend of established multinational corporations and agile niche players, each advancing distinct strategies to capture value. Leading medical imaging companies have leveraged extensive service networks and integrated platform portfolios to cross-sell advanced detectors alongside CT and MRI systems, driving deeper customer engagements. In parallel, specialty firms focusing exclusively on X-ray detectors differentiate through rapid innovation cycles, delivering sensor upgrades and firmware enhancements that address emerging clinical and industrial needs.

Strategic partnerships and joint ventures are reshaping alliances across the value chain. Collaborations between semiconductor foundries and imaging specialists have accelerated the commercialization of novel CMOS sensors, while tie-ups with software developers have embedded AI-powered diagnostic tools directly into detector hardware. Mergers and acquisitions remain active as larger players assimilate innovative startups to bolster their digital offerings, enhance supply chain control, and expand geographic reach.

Meanwhile, service and maintenance excellence has emerged as a competitive battleground. Manufacturers that offer predictive maintenance platforms, remote monitoring services, and turnkey retrofit programs for legacy installations are securing long-term contracts and driving recurring revenue streams. This emphasis on lifecycle management underscores a shift from transactional equipment sales to comprehensive value-added partnerships that sustain technology leadership in the evolving X-ray detector market.

This comprehensive research report delivers an in-depth overview of the principal market players in the X-Ray Detectors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Agilent Technologies, Inc.

- Analogic Corporation

- Bruker Corporation

- Canon Inc.

- CareRay Digital Medical System Co., Ltd.

- Carestream Health, Inc.

- Comet Group

- Detection Technology PLC

- Fujifilm Corporation

- General Electric Company

- Hamamatsu Photonics K.K.

- iRay Technology Company Limited

- JPI Healthcare Co. Ltd.

- KA Imaging Inc.

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- Moxtek, Inc. by Polatechno Co. Ltd.

- Rayence Co., Ltd.

- Rigaku Holdings Corporation

- Siemens Healthineers AG

- Teledyne Digital Imaging Inc.

- Thales Group

- Toshiba Corporation

- Varex Imaging Corporation

- Vieworks Co. Ltd.

- Villa Sistemi Medicali Spa

- Ziehm Imaging GmbH by ATON GmbH

Delivering Practical Strategic Roadmaps to Empower Industry Leadership and Accelerate Growth in the Evolving X-Ray Detector Ecosystem

To thrive amid intensifying competition and evolving regulatory landscapes, industry leaders must pursue a multi-pronged strategic roadmap. First, cultivating a resilient supply chain through diversified sourcing and onshore manufacturing partnerships will mitigate exposure to geopolitical and tariff-related disruptions. Concurrently, ramping up investments in advanced sensor materials and embedded AI capabilities will maintain a technological edge as end-users demand higher resolution, faster throughput, and intelligent diagnostics.

Adopting data-driven service models can unlock new revenue streams while strengthening customer loyalty. By deploying predictive maintenance platforms and remote diagnostic tools, manufacturers can preempt equipment failures, optimize field service operations, and offer subscription-based analytics packages. In tandem, exploring emerging applications-such as security imaging for autonomous vehicle screening or veterinary point-of-care diagnostics-can open high-growth adjacencies beyond traditional healthcare and industrial use cases.

Finally, tailoring go-to-market strategies to regional nuances and end-user needs will be critical. Engaging regulatory bodies early in product development, aligning with local healthcare initiatives, and forging partnerships with research institutions can accelerate market entry in different geographies. Clear communication of value propositions, combined with flexible financing and leasing options, will empower decision-makers to invest in next-generation detectors with confidence.

Detailing Rigorous Research Frameworks and Analytical Techniques Underpinning the Comprehensive X-Ray Detector Market Intelligence Study

This study employs a robust research framework combining primary interviews, secondary data analysis, and rigorous triangulation to ensure comprehensive market intelligence. Primary research comprised in-depth discussions with key stakeholders, including clinical end-users, industrial radiography specialists, equipment OEMs, sensor material suppliers, and regulatory experts. These conversations provided real-world perspectives on performance requirements, procurement challenges, and future technology roadmaps.

Secondary research involved systematic review of peer-reviewed journals, patent databases, and industry whitepapers, supplemented by analysis of corporate filings and regulatory documentation. The proprietary segmentation hierarchy integrates detector type, product format, sensor technology, portability, panel size, application, and end-user, ensuring granular insights across all market dimensions. Data triangulation across multiple sources validated consistency and minimized biases.

Quality control measures included iterative review by subject-matter experts, cross-validation of technical specifications, and alignment with prevailing international standards for radiation safety and imaging performance. Geographic coverage spanned North America, Europe, the Middle East and Africa, and Asia-Pacific, allowing for thorough regional comparisons and trend analyses. This methodology underpins a reliable and actionable intelligence platform for stakeholders seeking to navigate the dynamic X-ray detector market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our X-Ray Detectors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- X-Ray Detectors Market, by Detector Type

- X-Ray Detectors Market, by Product Type

- X-Ray Detectors Market, by Technology

- X-Ray Detectors Market, by Portability

- X-Ray Detectors Market, by Panel Size

- X-Ray Detectors Market, by Application

- X-Ray Detectors Market, by End-User

- X-Ray Detectors Market, by Region

- X-Ray Detectors Market, by Group

- X-Ray Detectors Market, by Country

- United States X-Ray Detectors Market

- China X-Ray Detectors Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Summarizing the Pivotal Insights and Strategic Imperatives Shaping the Future Trajectory of X-Ray Detector Technologies Across Key Sectors

In synthesizing the insights from technological breakthroughs, policy shifts, segmentation dynamics, regional variances, and competitive strategies, one theme emerges: the X-ray detector market is at an inflection point. Sensor innovations and digital integrations are unlocking new dimensions of diagnostic clarity, while geopolitical and tariff considerations are reshaping supply chain paradigms. A nuanced segmentation framework highlights that tailored solutions-whether fixed or portable, analog or digital, large-area or small-area-are imperative to meet the distinct needs of diverse applications and end-users.

Regional developments underscore that strategic agility is crucial. Mature markets continue to demand feature-rich, AI-enabled detectors, whereas emerging regions prioritize cost-effective scalability and regulatory compliance. Competitive landscapes reveal that value-added services, lifecycle management, and strategic partnerships are becoming as pivotal as core product advancements. These strategic imperatives collectively define a path forward: embracing modularity, investing in intelligent imaging, and aligning go-to-market approaches with evolving stakeholder expectations.

As the future trajectory of X-ray detector technologies unfolds, organizations that harness data-driven insights, reinforce supply chain resilience, and continuously innovate will be best positioned to capture emerging opportunities. This executive summary lays the groundwork for strategic decision-making that can drive sustainable growth and technological leadership in the rapidly evolving world of X-ray imaging.

Engage with Ketan Rohom to Unlock Tailored Market Intelligence and Accelerate Strategic Decision-Making in X-Ray Detector Innovations

To explore the comprehensive insights, in-depth analysis, and strategic recommendations laid out in this executive summary, engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in X-ray detector technologies and market dynamics, and he can tailor a solution-driven discussion to address your organization’s unique challenges. Reach out to Ketan to unlock tailored market intelligence, refine your growth strategies, and gain a competitive edge in the evolving landscape of X-ray detectors. Secure your full market research report today and empower your decision-making with data-driven clarity and actionable foresight.

- How big is the X-Ray Detectors Market?

- What is the X-Ray Detectors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?