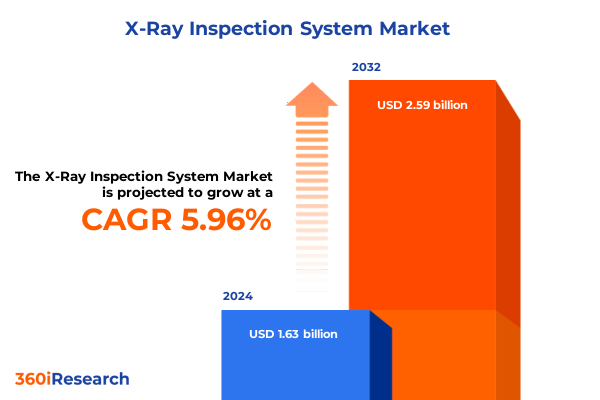

The X-Ray Inspection System Market size was estimated at USD 1.72 billion in 2025 and expected to reach USD 1.82 billion in 2026, at a CAGR of 6.01% to reach USD 2.59 billion by 2032.

Unveiling the Strategic Significance and Evolving Capabilities of X-Ray Inspection Systems in Ensuring Product Integrity and Safety

X-Ray inspection systems have emerged as indispensable tools across industries where precision and reliability are paramount. From safeguarding the integrity of critical aerospace components to verifying the purity of pharmaceutical consignments, these systems offer unparalleled accuracy in detecting structural anomalies, contaminants, and dimensional deviations. As manufacturing and quality assurance standards tighten globally, the reliance on non-destructive testing solutions has intensified, positioning X-Ray inspection as a strategic enabler for operational excellence.

Over the past decade, advancements in detector sensitivity, image processing algorithms, and automation capabilities have redefined the boundaries of what is achievable with X-Ray technology. Modern inspection platforms not only deliver high-resolution imaging but also integrate seamlessly with data management frameworks, empowering real-time analytics and predictive maintenance strategies. This confluence of hardware innovation and software intelligence has accelerated inspection throughput while minimizing false positives, thereby fostering both cost efficiency and product safety.

Moreover, evolving regulatory landscapes and escalating consumer expectations around product quality continue to underscore the critical role of X-Ray inspection solutions. As organizations confront intensified scrutiny-from regulatory audits to end-customer demands for traceability-the ability to demonstrate rigorous inspection protocols becomes a competitive differentiator. This introduction lays the groundwork for exploring the dynamic shifts, strategic impacts, and targeted insights that define today’s X-Ray inspection ecosystem.

Exploring the Technological Breakthroughs and Regulatory Dynamics Driving Disruptive Transformations in X-Ray Inspection Landscape

The landscape of X-Ray inspection has undergone transformative shifts, driven by a convergence of technological breakthroughs and regulatory imperatives. On the technology front, the transition from film-based radiography to digital radiography has accelerated, enabling instantaneous image acquisition and analysis. This leap has not only reduced operational bottlenecks but has also paved the way for AI-powered defect recognition, where algorithms learn from vast datasets to identify even the most subtle anomalies with remarkable consistency.

Simultaneously, the integration of automation and robotics into inspection workflows has elevated throughput benchmarks, particularly in high-volume industries like automotive and electronics. Automated inspection stations now operate continuously, adapting imaging parameters on the fly and routing suspect parts for further analysis, thereby minimizing manual intervention and human error. This shift towards automation is complemented by a growing emphasis on modular, portable systems that support flexible manufacturing paradigms and rapid on-site deployment.

Regulatory environments, too, have evolved in response to emerging risks and heightened safety standards. New directives around traceability, risk assessment, and quality management have spurred organizations to adopt more rigorous inspection protocols. In turn, inspection system manufacturers are incorporating traceability features-such as blockchain-backed audit trails-to provide immutable records of component integrity. Together, these forces-digitalization, AI, automation, and regulatory rigor-are reshaping the X-Ray inspection landscape, setting the stage for sustained innovation and adoption.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Supply Chain Dynamics and Cost Structures in X-Ray Inspection Market

In 2025, the United States government introduced a series of tariffs targeting imported X-Ray inspection components and finished systems, marking a significant inflection point for the industry. These measures, intended to bolster domestic manufacturing and protect critical supply chains, have led to a tangible recalibration of procurement strategies. Importers have faced elevated costs on essential hardware components such as detectors and X-Ray tubes, compelling organizations to revisit supplier portfolios and evaluate near-shoring options.

The tariff regime’s ripple effects extend beyond immediate cost pressures. As hardware prices escalated, software and service providers repositioned their offerings to emphasize value-added capabilities, such as remote diagnostics and subscription-based analytics, in an effort to offset hardware cost inflation. Concurrently, this environment has incentivized domestic OEMs to ramp up production capacity, with several manufacturers investing in localized assembly lines and strategic partnerships to mitigate import dependencies.

Supply chain resilience has emerged as a paramount concern, as stakeholders seek to insulate operations from further trade volatility. Companies are diversifying their sourcing strategies, incorporating multiple geographic suppliers for critical components and exploring alternative technologies less susceptible to tariff constraints. While end users may experience modest price adjustments, these strategic shifts are fostering a more robust, agile ecosystem that is better equipped to navigate future policy uncertainties.

Leveraging Comprehensive Segment Perspectives to Uncover How Component, Technology, Application, Industry, and Distribution Factors Shape Market Dynamics

A nuanced understanding of the X-Ray inspection domain emerges through the prism of multiple segmentation lenses, each revealing distinct value drivers and adoption barriers. When viewing the market by component, it becomes evident that hardware-encompassing detectors and X-Ray tubes-anchors the ecosystem’s performance, driving innovation in sensitivity and throughput. Complementing this core equipment, installation, maintenance, and training services ensure systems operate at optimal capacity, while control, data management, and image processing software layers facilitate seamless integration and actionable insights.

Examining technology type highlights the ongoing shift towards digital radiography, as organizations increasingly favor digital imaging for its superior resolution and versatility compared to traditional film-based methods. This move has been particularly pronounced in sectors with stringent defect detection requirements, where digital systems deliver both speed and accuracy. System type further differentiates the market, with portable inspection units gaining traction for field-based applications while stationary platforms remain the backbone of high-volume production lines.

The mode of operation segmentation underscores the bifurcation between automated inspection ecosystems-characterized by robotic handling, automated defect classification, and networked data flows-and manual systems that continue to serve low-volume or specialized use cases. Application-centric segmentation illustrates the expansive utility of X-Ray inspection, from identifying structural defects to detecting contaminants and verifying critical measurements. Finally, end-use industry and distribution channel insights demonstrate that aerospace, automotive, electronics, food & beverages, and pharmaceutical sectors each demand tailored solutions, delivered through a balanced mix of direct sales, distributors, and online platforms.

This comprehensive research report categorizes the X-Ray Inspection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Technology Type

- Mode of Operation

- Application

- End-Use Industry

- Distribution Channel

Comparing Regional Adoption Patterns and Regulatory Landscapes to Reveal Distinct Growth Drivers and Challenges Across Americas, EMEA, and Asia-Pacific

Regional dynamics in the X-Ray inspection ecosystem reflect a convergence of economic maturity, regulatory frameworks, and industry concentration. In the Americas, a robust manufacturing base in aerospace, automotive, and pharmaceutical sectors drives steady demand for both stationary and portable inspection solutions. Stringent safety and quality mandates from regulatory bodies reinforce adoption, while a well-established network of service providers and OEMs facilitates rapid deployment and localized support.

Across Europe, the Middle East & Africa, regulatory harmonization within the European Union has standardized inspection protocols, boosting cross-border equipment utilization. Germany and France serve as innovation hubs for advanced digital radiography and AI-enhanced inspection platforms, whereas emerging markets in the Middle East are increasingly leveraging portable systems to bolster infrastructure and ensure food safety. Africa’s nascent manufacturing capabilities present growth opportunities, particularly where regulatory agencies seek to strengthen quality assurance frameworks.

Asia-Pacific stands out for its dynamic electronics and automotive production corridors, where high volume and intricate component geometries demand rapid, high-precision inspection workflows. China, South Korea, and Japan lead in domestic production of core hardware components, while service providers in India are expanding maintenance and training offerings to meet surging adoption rates. Across the region, investments in smart factories and Industry 4.0 initiatives continue to elevate demand for integrated X-Ray inspection solutions that align with digital manufacturing ecosystems.

This comprehensive research report examines key regions that drive the evolution of the X-Ray Inspection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players to Highlight Innovative Strategies, Collaborative Ventures, and Portfolio Diversification Efforts in X-Ray Inspection Sphere

Leading players in the X-Ray inspection arena distinguish themselves through a blend of technological prowess, strategic alliances, and customer-centric services. Several multinational equipment manufacturers have fortified their portfolios by acquiring specialized image processing startups, thereby integrating AI-driven analytics directly into their platforms. This vertical consolidation enhances end-to-end solutions, positioning these companies as one-stop partners for complex inspection needs.

Collaboration between hardware vendors and software developers is another hallmark strategy, enabling the co-development of intuitive control interfaces and cloud-based data management frameworks. These partnerships accelerate time to market for advanced features such as remote defect analysis and predictive maintenance dashboards, which have become key differentiators in service contracts. Moreover, select service providers have launched subscription-based models, bundling software updates, calibration services, and real-time support under flexible pricing structures that cater to evolving customer requirements.

Forward-thinking firms are also exploring cross-industry synergies, applying learnings from pharmaceutical X-Ray screening to bolster contaminant detection in food processing lines, or adapting aerospace-grade inspection algorithms to semiconductor quality control. These cross-pollination efforts underscore a broader shift towards modular, interoperable solutions that transcend traditional industry boundaries, while ensuring continued innovation and resilience in an increasingly competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the X-Ray Inspection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DX-RAY Ltd. by Image Scan Holdings plc

- A&D Co,.Ltd.

- ABB Ltd.

- Ametek, Inc.

- ANRITSU CORPORATION

- Baker Hughes Company

- Bruker Corporation

- Carl Zeiss AG

- CASSEL Messtechnik GmbH BY TASI Group

- Comet Yxlon GmbH

- GÖPEL electronic GmbH

- Hitachi, Ltd.

- ISHIDA CO.,LTD

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Loma Systems by Illinois Tool Works Inc.

- Maha X-ray Equipment Private Limited

- MATSUSADA PRECISION, Inc.

- Metrix NDT Ltd. Acquired by Fairley Gunn Group Ltd

- Mettler-Toledo International Inc.

- Minebea Intec GmbH

- MULTIVAC Sepp Haggenmüller SE & Co. KG

- Nikon Corporation

- Nordson Corporation

- North Star Imaging Inc. by Illinois Tool Works Inc.

- OMRON Corporation

- Rad Source Technologies, Inc.

- Saki Corporation

- Sapphire Inspection Systems

- Sesotec GmbH

- Shanghai Eastimage Equipment Co., Ltd

- Shimadzu Corporation

- Smiths Detection Group Ltd. by Smiths Group PLC

- System Square Inc.

- TDI Packsys

- Techik Instrument (Shanghai)Co., Ltd

- Teledyne Technologies Incorporated

- Thermo Fisher Scientific Inc.

- Toshiba Corporation

- Viscom AG

- VisiConsult X-ray Systems & Solutions GmbH

- VISION MEDICAID EQUIPMENTS PVT. LTD

- VJElectronix, Inc.

- Wellman X-ray Solution Co., Ltd.

Formulating Strategic Imperatives and Investment Pathways to Enhance Competitive Positioning and Operational Excellence in the X-Ray Inspection Ecosystem

In the face of rapid technological evolution and shifting market pressures, industry leaders must adopt a proactive posture to sustain competitive advantage. Prioritizing investments in AI-augmented image analysis and predictive maintenance capabilities can significantly reduce downtime and elevate inspection accuracy. By integrating machine learning models that continuously refine defect classification based on real-world data, organizations can minimize false positives while accelerating throughput.

Establishing strategic partnerships across the supply chain is equally critical. Collaborations with detector manufacturers, software innovators, and system integrators enable the creation of cohesive solutions that address end-to-end inspection challenges. Additionally, forging alliances with academic and research institutions can unlock early access to breakthrough imaging technologies and foster joint development efforts that differentiate offerings.

To navigate tariff-induced cost fluctuations, companies should explore localized assembly and component sourcing, reducing exposure to import duties and enhancing supply chain agility. Concurrently, adopting flexible pricing and service agreements-such as outcome-based contracts and software-as-a-service models-can help absorb cost pressures and align vendor incentives with customer success metrics. Through these measures, industry participants can chart a course toward sustainable growth amid a complex and evolving environment.

Detailing a Rigorous Multi-Pronged Approach Incorporating Expert Interviews, Secondary Research, and Triangulation for Robust Market Intelligence

This research employs a multi-layered methodology to ensure comprehensiveness and credibility. The process commenced with an extensive secondary research phase, drawing on peer-reviewed journals, industry standards, and regulatory documentation to map the technological landscape and identify prevailing trends. Concurrently, company literature and patent filings were analyzed to ascertain innovation trajectories and competitive dynamics.

Building on these insights, primary research was conducted through structured interviews with senior executives, quality managers, and technical specialists across hardware, software, and service domains. These discussions provided first-hand perspectives on adoption drivers, operational challenges, and strategic priorities. The qualitative findings were then validated through a triangulation framework, cross-referencing data points with end-user surveys and third-party whitepapers to reconcile discrepancies and reinforce accuracy.

Finally, the synthesis phase focused on contextualizing the intelligence within prevailing economic and regulatory frameworks, facilitating the translation of raw data into actionable insights. Throughout the research lifecycle, rigorous data governance protocols were upheld to maintain transparency, traceability, and reproducibility of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our X-Ray Inspection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- X-Ray Inspection System Market, by Component

- X-Ray Inspection System Market, by System Type

- X-Ray Inspection System Market, by Technology Type

- X-Ray Inspection System Market, by Mode of Operation

- X-Ray Inspection System Market, by Application

- X-Ray Inspection System Market, by End-Use Industry

- X-Ray Inspection System Market, by Distribution Channel

- X-Ray Inspection System Market, by Region

- X-Ray Inspection System Market, by Group

- X-Ray Inspection System Market, by Country

- United States X-Ray Inspection System Market

- China X-Ray Inspection System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

Synthesizing Core Insights and Overarching Themes to Consolidate Understanding and Guide Future Decision-Making in X-Ray Inspection Sector

The evolving landscape of X-Ray inspection systems is defined by relentless technological advancement, shifting regulatory demands, and the emergence of innovative business models. The synthesis of component, technology, operational, and application-based segments reveals a market that is both complex and dynamic, with distinct regional and industry-specific nuances guiding adoption patterns.

Tariff policies introduced in 2025 have catalyzed supply chain realignment, prompting organizations to diversify sourcing strategies and explore localized manufacturing pathways. This strategic recalibration, coupled with the integration of AI-driven analytics and automation, underscores a broader trend toward resilience and efficiency. Leading companies are leveraging cross-industry collaborations and modular solution architectures to deliver comprehensive, high-value offerings that address evolving quality assurance imperatives.

Looking ahead, the capacity to harness data-driven insights, navigate regulatory shifts, and align with end-user priorities will determine winners and laggards in the X-Ray inspection domain. By internalizing the research’s core themes-technological innovation, strategic agility, and partnership-driven growth-stakeholders can position themselves for sustained success in a market characterized by constant evolution.

Engaging with Ketan Rohom to Unlock Comprehensive Market Insights and Equip Your Organization with Actionable Intelligence for X-Ray Inspection Excellence

For organizations seeking to elevate their operational efficiency and quality control protocols, engaging directly with Ketan Rohom offers a clear pathway to unlocking the full potential of X-Ray inspection systems. With extensive expertise in translating complex market dynamics into strategic roadmaps, Ketan provides a tailored consultation that aligns cutting-edge technological insights with specific business objectives.

By partnering with Ketan, decision-makers gain access to in-depth analyses that pinpoint critical adoption hurdles, optimize procurement strategies, and identify high-value investment areas. His hands-on guidance ensures that your organization can navigate regulatory complexities and integrate advanced inspection capabilities seamlessly into existing workflows.

Securing the comprehensive market research report through this direct engagement not only delivers detailed segment breakdowns and regional outlooks but also supplies actionable recommendations designed to drive measurable performance improvements. Contacting Ketan today is the essential first step toward transforming uncertainty into strategic advantage and ensuring that your company remains at the forefront of innovation in the X-Ray inspection domain.

- How big is the X-Ray Inspection System Market?

- What is the X-Ray Inspection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?