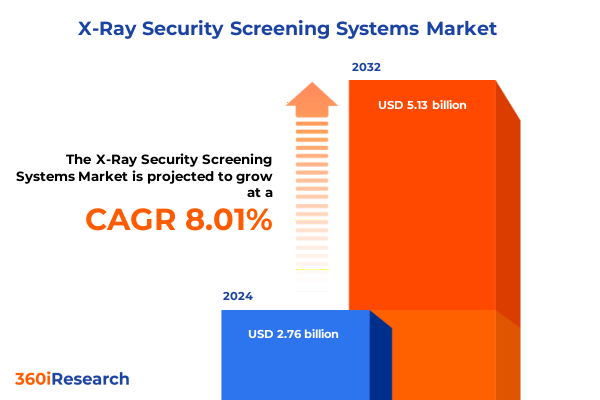

The X-Ray Security Screening Systems Market size was estimated at USD 2.97 billion in 2025 and expected to reach USD 3.21 billion in 2026, at a CAGR of 8.07% to reach USD 5.13 billion by 2032.

Exploring the transformative role of X-ray security screening in safeguarding critical infrastructure and passenger safety amidst evolving global threats

X-ray security screening systems have become an indispensable pillar in the architecture of modern security operations, serving as the first line of defense against a spectrum of evolving threats. As public safety concerns intensify across transportation hubs, critical infrastructure sites, and high-profile events, stakeholders are under mounting pressure to adopt solutions that reliably differentiate between benign items and potential hazards. In response, technology developers and security operators have pursued continuous refinement of imaging algorithms, hardware capabilities, and user interfaces to ensure rapid throughput without compromising detection accuracy.

Over the past decade, the convergence of higher resolution detectors, smarter analytics, and user-centric design has transformed the capabilities and expectations associated with X-ray screening. Today’s systems are not only tasked with identifying metallic weapons but also discerning complex organic and inorganic threats hidden within densely packed containers or carry-on belongings. Furthermore, integration with broader security ecosystems-ranging from biometric authentication platforms to automated analytics suites-has reshaped the role of X-ray screening from a stand-alone checkpoint to a critical node in an end-to-end security workflow.

As we look ahead, the imperative for operational agility and resiliency continues to grow. Security managers are seeking platforms that can adapt to volume fluctuations, seamlessly incorporate threat updates, and interface with emerging technologies such as robotics and cloud-based monitoring services. Understanding this dynamic landscape is essential for decision-makers who must balance performance, cost, and regulatory compliance in an environment where security challenges are becoming increasingly sophisticated and global in scope.

Analyzing the seismic shifts in X-ray security technology adoption driven by artificial intelligence, regulatory changes, and escalating threat complexity

The landscape of X-ray security screening is experiencing a wave of transformative shifts fueled by advancements in imaging technology, heightened regulatory demands, and the proliferation of more sophisticated threats. Artificial intelligence and machine-learning capabilities have become core differentiators, enabling systems to automatically analyze three-dimensional scans and identify anomalies with far greater precision than traditional two-dimensional imagery. Moreover, the integration of automatic threat recognition tools is streamlining operations by reducing reliance on operator judgment and minimizing false alarms.

Beyond purely technological drivers, evolving regulations have compelled operators to elevate screening standards across multiple contexts. In many jurisdictions, updated aviation security directives now mandate the deployment of computed tomography systems capable of generating volumetric images, reflecting a shift toward regulations that prioritize both thoroughness and throughput. Concurrently, the rise of non-aviation applications-such as mailroom inspection and border security checkpoints-has broadened the competitive landscape, encouraging vendors to tailor their offerings toward specific screening scenarios and throughput requirements.

At the same time, the threat environment is growing more complex. Emerging risks such as 3D-printed contraband, improvised explosive devices concealed within dense composites, and attempts to exploit system blind spots require screening platforms to evolve in lockstep. Consequently, vendors and end users are increasingly investing in modular architectures that enable field-upgradable hardware and software patches, ensuring that security deployments remain resilient and adaptable in the face of unanticipated challenges.

Assessing the compounded effects of the 2025 United States tariffs on global supply chains, manufacturing costs, and procurement strategies in X-ray security

The introduction of a revised tariff schedule by the United States in early 2025 has reverberated through the global supply chains that underpin X-ray security screening systems. With duties imposed on key electronic components, including advanced semiconductor detectors and specialized X-ray tubes, the cost basis for assembly has risen notably. Suppliers who previously optimized production across multiple low-cost jurisdictions have been forced to reassess their sourcing strategies, leading to increased lead times as manufacturers identify alternative component streams or negotiate new trade agreements.

Furthermore, the relocation of certain manufacturing processes back to North America, while beneficial for reducing logistical complexity and improving supply chain transparency, has introduced capital expenditures that many smaller vendors find difficult to absorb. As a result, some have consolidated operations or pursued strategic partnerships with larger original equipment manufacturers to share production resources. This consolidation trend has not only impacted vendor diversity but has also influenced innovation cycles, as research and development efforts become more centralized within a handful of key players.

In response to these tariff-induced pressures, security operators and procurement teams have adopted several mitigation measures. Multi-tiered sourcing agreements, inventory buffering strategies, and long-term fixed-price contracts have become more prevalent. At the same time, there is growing interest in localizing certain preemptive maintenance functions and spare-parts supply to minimize the impacts of future trade disruptions, ensuring that critical screening infrastructure remains operational even during periods of heightened geopolitical uncertainty.

Revealing segmentation dynamics shaping demand across product types, technologies, applications, end-users, and sales channels in the X-ray security space

Throughout the X-ray security screening ecosystem, distinct segmentation dimensions reveal crucial insights into how demand is shaping technology roadmaps and deployment strategies. Based on product type, the market is delineated into cargo screening, checkpoint screening, explosive trace detection, and hold baggage scanners, with trace detection further classified into benchtop and portable units. This granularity underscores how different operational environments-from large freight terminals to smaller border crossings-necessitate tailored hardware capabilities.

In terms of core technology, backscatter X-ray, dual-energy X-ray, and single-energy systems continue to coexist alongside computed tomography platforms. Within CT systems specifically, the evolution toward automatic threat recognition has gained momentum, complementing manual threat recognition workflows where operator expertise remains critical. These variations in technology choice reflect trade-offs between throughput, image resolution, and budgetary constraints.

Application-driven segmentation highlights how airport security, border security, mail screening, and transportation security contexts each impose unique requirements on scanner performance, form factor, and integration capabilities. End-user profiles-spanning airports, customs agencies, government security bureaus, and seaports-further influence procurement cycles and support agreements based on the scale of operations and regulatory obligations. Meanwhile, the persistence of both offline and online sales channels indicates that while traditional direct-sales relationships remain vital for high-value installations, digital platforms are increasingly leveraged for standardized or lower-cost screening solutions.

This comprehensive research report categorizes the X-Ray Security Screening Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Technology

- Application

- End User

- Sales Channel

Evaluating regional variations in adoption, regulatory frameworks, and emerging opportunities across Americas, EMEA, and APAC in X-ray security screening

Regional analysis reveals divergent adoption patterns across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific, each driven by distinct regulatory frameworks, security priorities, and economic conditions. In the Americas, established aviation infrastructure and substantial budgets have fueled early adoption of next-generation computed tomography systems and backscatter X-ray units, particularly in the United States and Canada where integrated security protocols continue to evolve.

Transitioning to EMEA, stringent regulatory standards imposed by the European Union and key Middle Eastern gateways have compelled stakeholders to prioritize high-throughput checkpoint solutions and advanced trace detection capabilities. Moreover, collaborative investments in joint security operations across national borders have accelerated the standardization of screening processes, benefiting vendor ecosystems that can support multi-nation rollouts.

In contrast, Asia-Pacific is characterized by rapid growth in emerging markets, where infrastructure expansion projects necessitate flexible screening platforms that balance cost efficiency with performance. Governments in the region are increasingly partnering with global technology providers to deploy modular screening architectures that can scale in tandem with passenger and cargo traffic growth projections. Across all regions, the interplay of regulatory mandates, budgetary considerations, and threat evolution continues to shape procurement strategies and deployment timelines.

This comprehensive research report examines key regions that drive the evolution of the X-Ray Security Screening Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading manufacturers and technology innovators driving competitive differentiation and strategic partnerships in the X-ray security screening domain

The competitive landscape in X-ray security screening is dominated by a mix of established manufacturers and nimble innovators, each leveraging distinct capabilities to differentiate their offerings. Leading global equipment suppliers have invested heavily in research collaborations with universities and national laboratories to refine detector materials, improve image reconstruction algorithms, and enhance system reliability under continuous operation.

At the same time, specialized technology firms are focusing on niche capabilities such as portable trace detection and advanced backscatter imaging for crowded checkpoints. Their agile development cycles and targeted product roadmaps allow them to address emerging use cases-such as remote border posts or temporary event screenings-more rapidly than larger incumbents can pivot.

Strategic partnerships between system integrators and software analytics providers have become increasingly common, enabling vendors to bundle X-ray hardware with subscription-based analytics services. This shift toward as-a-service models is reconfiguring traditional revenue streams, with after-market support and software upgrades becoming critical levers for recurring income and customer retention. Collectively, these competitive dynamics underscore the importance of technological differentiation, service excellence, and strategic alliances in sustaining long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the X-Ray Security Screening Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DX‑Ray Ltd.

- A&D Co,.Ltd.

- Adani Systems Inc.

- ANRITSU CORPORATION

- Astrophysics, Inc.

- Autoclear, LLC

- CEIA SpA

- Gilardoni S.p.A.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hi-TECH DETECTION SYSTEMS

- Hitachi, Ltd.

- ISHIDA CO.,LTD

- Leidos Holdings, Inc.

- LINEV SYSTEMS

- Lockheed Martin Corporation

- Mitsubishi Chemical Corporation

- North Star Imaging Inc. by Illinois Tool Works Inc.

- Nuctech

- OSI Systems, Inc.

- Smiths Detection Group Ltd. by Smiths Group PLC

- Techik Instrument (Shanghai)Co., Ltd

- Teledyne Technologies Incorporated

- Vehant Technologies

- Vidisco Ltd.

- Viscom AG

- Westminster International Limited

Delivering targeted strategic imperatives and operational best practices to maximize performance, resilience, and innovation in X-ray security screening projects

To thrive in the rapidly evolving X-ray security screening market, industry leaders should first prioritize the integration of artificial intelligence and advanced analytics across their equipment portfolios. Investing in modular architectures that support field-based software updates and scalable compute resources will enable deployments to adapt quickly to newly identified threats without necessitating full equipment replacements.

Moreover, organizations can enhance supply chain resilience by diversifying component sourcing through multi-tiered agreements and exploring regional manufacturing partnerships. By establishing localized support centers and critical spare-parts depots, they can minimize downtime risks associated with geopolitical shifts or tariff fluctuations.

Collaborating proactively with regulatory bodies and industry consortia is also essential. Joint efforts to define performance benchmarks, threat libraries, and certification pathways can streamline product approvals and foster greater interoperability across different screening solutions. Finally, developing comprehensive training programs for operators and maintenance personnel will ensure that advanced capabilities are fully leveraged, maximizing throughput while sustaining high detection accuracy.

Outlining the robust research framework integrating primary interviews, secondary data analysis, and rigorous validation to ensure credible industry insights

This research leverages a multi-method approach to deliver robust and credible insights. Primary data collection involved structured interviews with security directors, government procurement officials, and leading technology vendors to capture firsthand perspectives on deployment challenges, technology preferences, and regulatory compliance dynamics. These qualitative inputs were complemented by a systematic review of relevant technical standards, certification guidelines, and policy whitepapers issued by civil aviation authorities and international security organizations.

Secondary research encompassed an extensive analysis of industry whitepapers, academic journals on imaging physics, and proprietary databases tracking procurement awards and capital expenditure trends. All data points were triangulated through cross-validation to ensure consistency and accuracy. In addition, expert panels comprising former airport security chiefs and forensic detection specialists were convened to vet key assumptions and refine threat scenario modeling.

Supplementary quantitative analyses-such as comparative performance assessments of different imaging modalities and cost-benefit evaluations of maintenance models-were conducted using standardized metrics. Quality control protocols included iterative peer reviews and fact checks to validate the integrity of data interpretations and ensure the final deliverable meets rigorous industry standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our X-Ray Security Screening Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- X-Ray Security Screening Systems Market, by Component

- X-Ray Security Screening Systems Market, by System Type

- X-Ray Security Screening Systems Market, by Technology

- X-Ray Security Screening Systems Market, by Application

- X-Ray Security Screening Systems Market, by End User

- X-Ray Security Screening Systems Market, by Sales Channel

- X-Ray Security Screening Systems Market, by Region

- X-Ray Security Screening Systems Market, by Group

- X-Ray Security Screening Systems Market, by Country

- United States X-Ray Security Screening Systems Market

- China X-Ray Security Screening Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing key findings and reinforcing the strategic importance of advanced X-ray security screening technologies in addressing evolving security challenges

In conclusion, the X-ray security screening landscape continues to evolve in response to technological breakthroughs, shifting regulatory imperatives, and the relentless ingenuity of malicious actors. Advanced imaging modalities, bolstered by artificial intelligence and cloud-enabled analytics, are redefining the scope and efficiency of threat detection across diverse security contexts. At the same time, supply chain complexities and trade policy shifts underscore the necessity for strategic agility and collaborative ecosystem engagement.

Moving forward, stakeholders must balance demands for higher throughput with the uncompromising requirement for detection accuracy, all while navigating a complex web of regional regulations and procurement frameworks. Fashioning resilient procurement models, embracing modular system architectures, and fostering cross-industry partnerships will be key to sustaining innovation and operational readiness.

Ultimately, decision-makers who proactively align their technology roadmaps with emerging threat profiles and regulatory trajectories will secure a critical competitive advantage. By leveraging the insights and recommendations presented herein, organizations can chart a course toward more secure, efficient, and future-proof screening operations.

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to access comprehensive insights and secure your X-ray screening market intelligence today

To acquire the most comprehensive and forward-looking analysis of X-ray security screening systems, engage with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. With a deep understanding of market dynamics and emerging technology trends, Ketan can guide you through the report’s key findings, tailor additional data modules to your organization’s needs, and facilitate a personalized walkthrough of strategic insights. Connecting with him ensures that you receive expert counsel on leveraging this intelligence to optimize procurement strategies and enhance operational readiness. Reach out today to secure your copy and transform your security screening roadmap with the latest market intelligence.

- How big is the X-Ray Security Screening Systems Market?

- What is the X-Ray Security Screening Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?