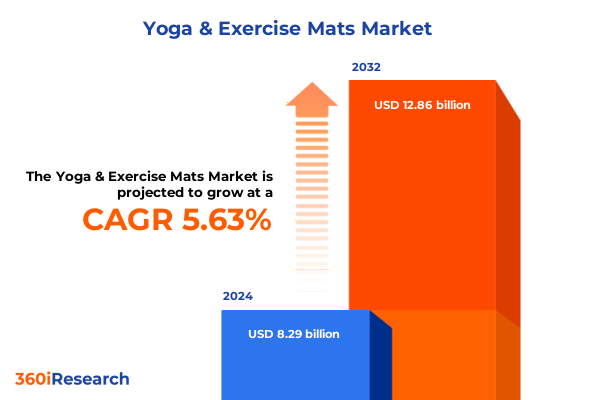

The Yoga & Exercise Mats Market size was estimated at USD 8.64 billion in 2025 and expected to reach USD 9.01 billion in 2026, at a CAGR of 5.84% to reach USD 12.86 billion by 2032.

Unveiling the Pivotal Role of Yoga and Exercise Mats in Shaping Modern Wellness Practices and Consumer Engagement Across Diverse Environments

The yoga and exercise mat sector has evolved into far more than a simple accessory for fitness enthusiasts. Once viewed merely as protective padding, these mats now represent an intersection of wellness, sustainability, and technological innovation that resonates across consumer lifestyles and professional environments. As consumers increasingly prioritize holistic health, manufacturers respond by elevating materials, ergonomic design, and eco-friendly production methods. Consequently, what began as a utilitarian product has become a strategic touchpoint for brands seeking to deepen engagement with a health-conscious audience.

Transitioning into this landscape requires a nuanced understanding of both consumer demands and industry dynamics. With yoga studios and fitness centers catering to a more diverse clientele, and home workouts gaining traction, the mat’s role stretches from a foundational surface to a personal statement of values. Meanwhile, rising outdoor fitness trends have introduced new performance criteria, compelling stakeholders to rethink durability, portability, and environmental impact. This introduction sets the stage for an in-depth exploration of the forces shaping this market at a pivotal moment of transformation.

Exploring the Revolutionary Transformations in Material Innovation Consumer Preferences and Retail Dynamics Redefining the Yoga and Exercise Mat Industry

Over the past five years, the yoga and exercise mat industry has undergone several transformative shifts that have upended conventional supply chains and consumer expectations. Foremost among these is the surge in sustainable material innovation. Cork and jute have emerged as credible alternatives to synthetic polymers, driven by consumer demand for eco-friendly products and heightened regulatory scrutiny around plastic usage. This material renaissance underscores a broader pivot toward circularity, where manufacturers integrate recycled inputs and design for end-of-life recyclability.

Concurrently, digital retail ecosystems have redefined distribution channel dynamics. While traditional specialty stores and sports goods retailers continue to play an essential role, online platforms have matured into omnichannel experiences that combine direct-to-consumer websites with third-party marketplaces. These platforms leverage data analytics to personalize offerings, optimize inventory, and facilitate seamless purchasing journeys. At the same time, rising consumer sophistication has heightened expectations around performance features such as non-slip textures, moisture management, and ergonomic support.

Further compounding these shifts, application-focused differentiation has become a key strategic lever. Fitness centers and yoga studios now partner with manufacturers to co-develop mats that reflect brand identity and training modalities. Home users, ranging from individual consumers to luxury hotels and resorts, seek products that balance aesthetics with functionality, while outdoor adventurers demand lightweight, quick-drying mats tailored for travel and rugged terrains. These converging trends highlight the necessity for industry players to adopt agile innovation and collaborative approaches to stay ahead.

Analyzing the Comprehensive Effects of 2025 United States Tariff Measures on Manufacturing Sourcing Strategies and Global Supply Chain Resilience

In 2025, the United States government implemented targeted tariff measures on imported fitness accessories, including yoga and exercise mats, in an effort to protect domestic manufacturing and address trade imbalances. These levies have compelled sourcing teams to re-evaluate established procurement strategies, weighing the cost advantages of offshore production against the increased landed expense created by tariffs. While some brands have absorbed these additional charges to maintain price parity, others have engaged in dual-sourcing models that blend domestic and international suppliers to mitigate exposure.

Beyond reshaping procurement, these tariffs have had a cascading effect on the global supply chain architecture. Logistics partners recalibrated their networks to optimize trade lanes, reducing reliance on high-tariff import corridors and exploring nearshore manufacturing in North America and Latin America. As a consequence, manufacturers have accelerated investments in automated production technologies to bolster domestic output and preserve margin structures. These strategic responses mark a significant departure from previous economies of scale arguments that favored low-cost jurisdictions.

Despite initial cost pressures, the tariff framework has stimulated collaboration among industry stakeholders to drive efficiency improvements. Shared warehousing, consolidated freight arrangements, and supply chain visibility platforms have gained traction as brands and service providers seek to offset tariff-induced inflation. Ultimately, this period of adjustment may yield a more resilient and diversified supply chain ecosystem that balances competitive pricing with supply continuity.

Illuminating Market Differentiation Through Material Application Distribution Channel End User and Thickness Parameters That Guide Strategic Positioning

Understanding the competitive landscape begins with dissecting the market through material composition parameters. Cork has gained prominence for its natural antimicrobial properties and biodegradability, while jute offers a cost-effective, textured surface prized by traditionalists. PVC remains a staple for its affordability and durability, even as rubber and thermoplastic elastomer (TPE) attract premium segments seeking superior grip and eco-certifications. These material distinctions inform branding, pricing, and channel strategies, shaping how products resonate with different consumer cohorts.

Equally important is the differentiation by application context. In fitness centers and yoga studios, mat performance is judged by its capacity to withstand daily high-intensity use, necessitating thicker profiles and reinforced edges. In home settings, whether in a five-star resort or an individual residence, aesthetics and compact storage dominate purchase criteria, prompting manufacturers to craft visually appealing designs with moderate thickness levels. Outdoors, the beach, travel, camping, and hiking segments demand ultralight, quick-dry constructions that can endure variable terrain and exposure to the elements.

Distribution channels further segment competitive positioning. Offline outlets like hypermarkets, specialty stores, and sports goods retailers facilitate tactile evaluation and immediate purchase, while online channels-including manufacturer websites and popular third-party platforms-enable curated assortments and subscription models. End-user segmentation also drives bespoke innovations: household and individual consumers seek ease of use and affordability, whereas professional fitness trainers and yoga instructors prioritize advanced features, personalized branding opportunities, and bulk procurement options.

Lastly, thickness specifications ranging from ultra-thin 1–2 millimeter travel mats to 7 millimeter-plus performance mats allow stakeholders to tailor offerings for targeted use cases. By integrating these five segmentation lenses-material, application, distribution channel, end user, and thickness-leaders can craft nuanced product portfolios and messaging that align precisely with evolving consumer demands.

This comprehensive research report categorizes the Yoga & Exercise Mats market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Thickness

- Application

- End User

- Distribution Channel

Decoding Regional Demand Patterns Across Americas Europe Middle East Africa and Asia Pacific to Uncover Growth Hubs and Emerging Opportunities

Regional dynamics in the yoga and exercise mat sector reflect diverse consumer preferences and regulatory landscapes. In the Americas, a strong emphasis on sustainable sourcing and domestic manufacturing has driven adoption of cork and TPE products, supported by a robust network of specialty retailers and e-commerce platforms. Cultural fitness trends, from boutique studios to community wellness events, continue to fuel demand in both urban and suburban markets.

Europe, Middle East & Africa exhibit a multifaceted profile where Western Europe leads with high-end mat innovations, driven by stringent environmental regulations and a culture of design excellence. In contrast, markets in the Middle East and Africa demonstrate growing interest in cost-effective yet durable options as fitness awareness expands. Distribution remains a blend of brick-and-mortar specialty outlets and high-potential online channels that leverage regional payment and logistics infrastructures.

Asia-Pacific stands out as both a manufacturing hub and a rapidly expanding consumer market. Southeast Asian nations supply a significant portion of PVC and rubber mats, while countries such as Australia and Japan manifest sophisticated end-user demand for premium, eco-certified products. The proliferation of fitness chains, lifestyle influencers, and outdoor recreation has fostered a vibrant market that rewards agility in product customization and channel partnerships.

Across these regions, differences in tariff policies, consumer purchasing power, and regulatory frameworks inform tailored go-to-market approaches. By dissecting these geographic nuances, stakeholders can pinpoint growth corridors and allocate resources to regions where product attributes resonate most effectively with local preferences.

This comprehensive research report examines key regions that drive the evolution of the Yoga & Exercise Mats market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Industry Leaders Driving Innovation Sustainability and Competitive Advantage Within the Yoga and Exercise Mat Market

Leading enterprises in the yoga and exercise mat domain differentiate themselves through a blend of innovation, sustainability, and strategic partnerships. Some manufacturers have made early investments in closed-loop recycling systems that reclaim end-of-life mats for new product lines, demonstrating a commitment to circular economy principles. Others have secured exclusive collaborations with fitness instructors and yoga studios to develop co-branded mats that reinforce brand identity at point of use.

In parallel, distribution-focused companies have optimized omnichannel ecosystems, integrating flagship brick-and-mortar showrooms with virtual try-on tools and subscription-based replenishment services. This hybrid model accommodates traditional retail preferences while capturing digital-savvy consumers who value convenience and personalization. Moreover, several players have forged alliances with logistics and technology providers to implement real-time inventory management and predictive replenishment algorithms, ensuring high service levels without overstock risk.

On the professional services side, fitness training conglomerates and boutique studio operators have exhibited leadership by standardizing mat specifications across franchises, streamlining procurement, and negotiating volume discounts. This sector-driven approach has elevated quality benchmarks and accelerated the adoption of performance-driven features. Collectively, these corporate strategies underscore the multifaceted pathways through which companies can secure competitive advantage in a maturing yet innovating market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Yoga & Exercise Mats market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Amazon.com, Inc.

- Aurorae, LLC

- B Yoga Ltd

- Ecoyoga Ltd

- Gaiam, Inc.

- Hugger Mugger Yoga Products, Inc.

- JadeYoga, LLC

- Liforme Limited

- Lululemon Athletica Inc.

- Manduka LLC

- Merrithew Corporation

- prAna, LLC

- Reebok International Limited

- Yoga Design Lab, LLC

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Capitalize on Trends Enhance Resilience and Maximize Competitive Performance

Industry leaders seeking to capitalize on emergent trends should prioritize integrating sustainable materials into their core portfolios while communicating the environmental and health benefits to consumers. Establishing transparent supply chain practices and securing ecolabel certifications will not only mitigate regulatory risks but also enhance brand differentiation in increasingly eco-conscious markets. Simultaneously, stakeholders must invest in modular product lines that address distinct application scenarios-from high-performance gym mats to lightweight travel solutions-thereby maximizing relevance across customer segments.

Operationally, companies should develop agile sourcing frameworks that incorporate multiple suppliers and nearshoring options to cushion against future trade disruptions. Digital transformation of distribution channels is equally critical, requiring robust e-commerce infrastructures and data-driven personalization engines to capture and retain online shoppers. Collaborations with fitness influencers, studio chains, and professional associations can amplify reach and credibility, especially when paired with targeted content marketing strategies.

Finally, an emphasis on continuous feedback loops-leveraging consumer reviews, studio partnerships, and in-field trials-will uncover insights for iterative product enhancements. By aligning research and development roadmaps with authentic user experiences, organizations can sustain innovation pipelines and accelerate time-to-market. These strategic and tactical imperatives will equip industry leaders to navigate a competitive landscape defined by evolving consumer expectations and regulatory shifts.

Transparent Research Methodology Integrating Comprehensive Data Collection Rigorous Analysis and Stakeholder Validation to Ensure Robustness and Credibility

This study employs a rigorous mixed-methods approach that integrates both qualitative and quantitative data sources. Primary research consisted of in-depth interviews with material scientists, product designers, and procurement executives, complemented by field visits to manufacturing facilities and fitness studios across key regions. These engagements yielded firsthand insights into production processes, material selection criteria, and end-user preferences.

Secondary research drew upon a curated collection of industry reports, sustainability frameworks, and trade publications, ensuring a broad perspective on regulatory developments and technological advancements. To enhance data validity, information was cross-referenced against customs databases, logistics reports, and retail audit statistics. A triangulation process reconciled disparate data points, reconciled inconsistencies, and reinforced the robustness of the findings.

For analytical rigor, the report applied segmentation modeling across material, application, distribution channel, end user, and thickness lenses. Scenario analysis assessed the impact of tariff changes and supply chain disruptions under multiple trade-policy environments. Throughout the research lifecycle, periodic validation workshops were conducted with select industry stakeholders to verify assumptions and refine interpretive frameworks, culminating in a methodology that balances depth, accuracy, and actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Yoga & Exercise Mats market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Yoga & Exercise Mats Market, by Material

- Yoga & Exercise Mats Market, by Thickness

- Yoga & Exercise Mats Market, by Application

- Yoga & Exercise Mats Market, by End User

- Yoga & Exercise Mats Market, by Distribution Channel

- Yoga & Exercise Mats Market, by Region

- Yoga & Exercise Mats Market, by Group

- Yoga & Exercise Mats Market, by Country

- United States Yoga & Exercise Mats Market

- China Yoga & Exercise Mats Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Perspectives on Innovation Sustainability and Market Responsiveness Shaping the Future Trajectory of Yoga and Exercise Mats

The narrative of the yoga and exercise mat landscape is one of continuous evolution driven by material innovation, shifting consumption patterns, and complex trade dynamics. Sustainability has transitioned from a peripheral consideration to a core strategic imperative, influencing everything from raw material sourcing to end-of-life disposal. Concurrently, digital and omnichannel retail models have elevated consumer expectations for personalized, performance-driven offerings.

Tariff-induced recalibrations of global supply chains have catalyzed investments in automation and nearshoring, ultimately reinforcing resilience and operational agility. Meanwhile, nuanced segmentation by application context, distribution channel, and end-user profile has enabled companies to tailor portfolios that resonate with distinct market niches. Regional diversity further underscores the importance of localized strategies that reflect cultural preferences and regulatory environments.

Looking ahead, the confluence of sustainable materials research, digital innovation, and collaborative partnerships will define the competitive battleground. By embracing these imperatives, industry participants can deliver differentiated products that meet evolving consumer demands while fortifying their strategic positioning in a dynamic global market environment.

Engage with Associate Director Sales and Marketing to Secure Detailed Yoga and Exercise Mat Market Insights Propel Strategic Decisions and Drive Business Growth

To explore the most comprehensive insights and detailed analyses that can guide your strategic initiatives in the yoga and exercise mat sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to acquire your full market research report. His expertise in aligning industry data with actionable business strategies ensures you gain the competitive intelligence necessary to optimize sourcing, product innovation, and distribution plans.

Whether you are a manufacturer aiming to refine your material portfolio, a distributor seeking to bolster your channel performance, or an end-user focused on emerging applications, Ketan can provide tailored solutions that address your unique challenges. Engage with him today to transform data into decisions, elevate your market positioning, and unlock new growth opportunities in this dynamic industry.

- How big is the Yoga & Exercise Mats Market?

- What is the Yoga & Exercise Mats Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?