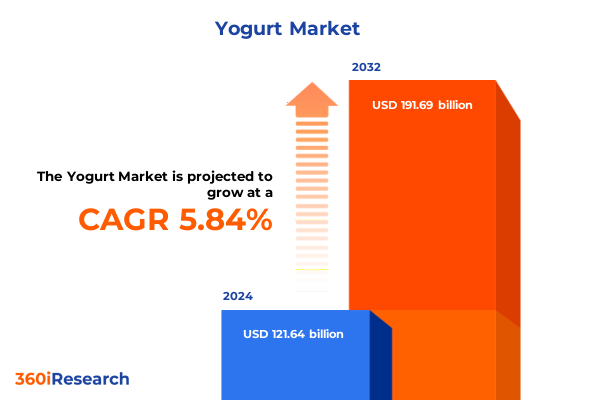

The Yogurt Market size was estimated at USD 120.99 billion in 2025 and expected to reach USD 127.96 billion in 2026, at a CAGR of 5.89% to reach USD 180.69 billion by 2032.

A focused, action‑oriented executive introduction that explains the current market role of yogurt across occasions and the strategic implications for manufacturers and retailers

This executive summary synthesizes the most relevant market dynamics shaping the yogurt category today and highlights the commercial choices that matter for leaders across manufacturing, retailing, and distribution. The category has transitioned from a breakfast staple to a multi‑occasion platform where nutrition, convenience, and functional benefits determine consumer preference. Across refrigerated shelves and e‑commerce carts, product form, flavor architecture, and targeted nutrition claims now govern consumer entry points and loyalty pathways.

Understanding these forces requires both a granular read of segmentation behaviors and a situational appreciation for emergent macro risks that can quickly reshape pricing, supply and distribution. This document draws from point‑of‑sale trends, trade and industry commentary, company investments, and policy developments to present a concise set of insights and actionable recommendations. Where relevant, the narrative highlights observable shifts in consumer purchase patterns and manufacturing choices that are already influencing assortment, promotional plans, and go‑to‑market priorities; these observations are grounded in recent category performance and industry reporting that indicate notable resilience and format growth for yogurt.

How health‑first nutrition preferences, appetite‑modulating medical trends, and format innovation are jointly remaking yogurt as a multi‑occasion functional platform

A set of transformative shifts is redefining how the yogurt category creates value for consumers and for commercial stakeholders. Health and functional nutrition have moved from niche positioning to mainstream product attributes; consumers now evaluate yogurt through the lens of protein density, sugar management and digestive health, which has created room for reformulation and benefit‑led messaging. Concurrently, a wave of consumer behavioral change-driven in part by appetite‑modulating medications-has encouraged product strategies that emphasize nutrient density and portion control as central value propositions.

Format innovation is another structural shift reshaping the category economics and route‑to‑market dynamics. Single‑serve and on‑the‑go formats have broadened usage occasions beyond breakfast to snacking and meal replacement moments, while drinkable formats have expanded the category’s share of active, convenience‑seeking households. Plant‑based alternatives continue to push manufacturers to rethink ingredient and processing platforms, even as traditional dairy segments demonstrate renewed strength. Together, these forces demand that brands invest selectively in product platforms that can be scaled across packaging formats and distribution channels to maximize shelf density and consumer relevance; this repositioning is already visible in recent company investments and product launches that prioritize protein, low sugar, and portable formats.

An evidence‑based assessment of how the 2025 tariff environment is disrupting trade flows, ingredient sourcing, and margin dynamics across the yogurt value chain

The policy environment in 2025 introduced new trade‑policy uncertainty that has direct consequences for ingredient sourcing, export channels and input costs across the dairy and cultured products value chain. Recent tariff actions and the threat of reciprocal measures among major trading partners have interrupted some established trade flows and raised short‑term risk premia for exporters and processors that rely on cross‑border supply and scale economies. As a result, companies with export exposure or those sourcing specialized ingredients from challenged markets must reassess both sourcing strategies and contractual protections to limit margin erosion.

Operationally, the tariffs episode has sharpened attention on three pragmatic areas: inventory and sourcing flexibility, near‑term margin management, and market prioritization. Manufacturers are increasingly triangulating between local sourcing, longer‑dated procurement contracts, and tactical inventory build‑outs where logistics and storage economics permit. At the same time, trade associations and industry groups have urged rapid resolution and targeted mitigation measures to protect agricultural communities and processors, reflecting the systemic importance of dairy exports to producer incomes and processing utilization. For commercial leaders, scenario planning that models a range of tariff outcomes and retaliatory responses is now a baseline requirement to preserve supply continuity and manage pricing actions with retail partners.

A strategic segmentation synthesis that links product form, flavor, fat profile, and channel behavior to profitable assortment and go‑to‑market choices

Segmentation behaviors provide the clearest route to profitable assortment and innovation choices, because they reveal how product attributes map to distinct consumer needs and distribution economics. Based on product type, the distinction between flavoured and non‑flavoured offerings remains a key determinant of repeat purchase patterns; flavoured goods drive trial and impulse, while non‑flavoured formats often anchor multifunctional, culinary and wellness use cases. Based on packaging, the availability and growth of cup, drinkable, multipack, and pouch formats explain how convenience and shareability influence retail fixture decisions and pricing tiers; cup formats satisfy in‑home, multi‑serving behavior, drinkable formats capture on‑the‑go and impulse purchases, multipacks combine value and variety, and pouches target portability and kid‑centric usage.

Based on flavor, consumer preference lines-fruit, plain, strawberry and vanilla-remain durable anchors for both core SKUs and promotional rotations, with derivative and limited‑edition flavors layered on top to stimulate trial. Based on fat content, the choice architecture between low fat, non‑fat and whole fat reflects both health positioning and taste expectations, and it interacts with protein and sugar claims to create differentiated nutritional profiles. Based on distribution channel, offline and online channels require different packaging investments, promotional mechanics and assortment density; offline channels prioritize shelf presence and effective unit economics, whereas online channels prize pack formats that optimize shipping weight, shelf life and add‑on purchase potential. Translating these segmentation truths into commercial playbooks requires matching product form, flavor and nutrition to the right channel and price architecture to achieve both penetration and margin objectives.

This comprehensive research report categorizes the Yogurt market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Flavor Profile

- Fat Content

- Source

- Application

- Distribution Channel

A regionally differentiated perspective on demand behavior, supply resilience, and product strategies across Americas, EMEA, and Asia‑Pacific markets

Regional dynamics continue to shape demand drivers and structural risk, and each major region presents distinct implications for product strategy, supply resilience and competitive positioning. In the Americas, strong domestic consumption and integrated North American supply chains support rapid scaling of successful product platforms, but trade measures in 2025 have heightened the imperative to manage cross‑border flows and bilateral market access. Regional purchasing behavior emphasizes multi‑occasion convenience and protein‑led nutrition, which favors formats that can be deployed at scale in both retail and foodservice channels.

Europe, the Middle East and Africa present a segmented opportunity set where premiumization, clean‑label preferences and regulatory scrutiny over claims coexist with local dairy traditions. Brand strategies that combine provenance storytelling with clinically supported functional claims perform particularly well across European grocery corridors. The Asia‑Pacific region, by contrast, is characterized by rapid innovation cycles and strong local competition in both dairy and plant‑based alternatives, with consumers demonstrating high receptivity to flavored and drinkable formats. Across all regions, resilience in supply chains and the ability to pivot quickly between local and global sourcing underpin competitive advantage in an environment where trade policy and logistics volatility can shift the cost base rapidly.

This comprehensive research report examines key regions that drive the evolution of the Yogurt market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A competitive analysis showing how capacity investments, acquisition strategies, and nutrition‑first portfolios are reshaping which companies will lead the next phase of category growth

The competitive field is dynamic and increasingly defined by firms that can combine scale manufacturing with rapid product and packaging innovation. Leading manufacturers are investing in both capacity expansion and process flexibility to serve multiple formats and ingredient platforms simultaneously, because the ability to shift production between dairy and plant‑based lines reduces unit risk and accelerates time to shelf. Strategic acquisitions and targeted capital projects underscore a broader industry posture toward capturing incremental usage occasions while defending core white‑space positions in mainstream refrigerated dairy.

Company moves also reflect a pivot toward nutrition‑oriented messaging and channel diversification. Some manufacturers are prioritizing higher‑protein SKUs, low‑sugar formulations and ready‑to‑consume drinkable offerings to meet shifting consumer demands and emerging clinical nutrition use cases. Investments in new or expanded processing sites have been announced that materially increase domestic capacity and support regional supply security, while others are leveraging partnerships and acquisitions to broaden their direct‑to‑consumer and convenience channel footprints. These corporate actions create a competitive landscape where scale, agility and portfolio breadth determine which companies can both innovate and maintain cost discipline in an unsettled policy environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Yogurt market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Danone S.A.

- Groupe Lactalis S.A.

- Inner Mongolia Yili Industrial Group Co., Ltd

- China Mengniu Dairy Company Limited.

- Müller Holding GmbH & Co. KG

- Nestlé S.A.

- Chobani LLC

- Arla Foods AMBA

- General Mills, Inc.

- Royal FrieslandCampina N.V.

- Meiji Holdings Co., Ltd.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Unilever PLC

- Yakult Honsha Co., Ltd.

- FAGE International S.A

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Valio Ltd

- Hain Celestial Group, Inc.

- Yeo Valley Organic Limited

- GRAHAMS THE FAMILY DAIRY GROUP LIMITED

- Yogurtland Franchising, Inc.

- Milky Mist Dairy Food Pvt. Ltd.

- Agapi by Delna Artisanal Foods Pvt Ltd.

- AS FARMI Piimatööstus

- Epigamia by Drums Food International Private Limited

- Fonterra Co-operative Group Limited

- Grupo Lala, S.A.B. de C.V.

- Pinkberry by Kahala Franchising, LLC

- Sugar Creek Foods International, Inc.

- Zoh Farms Private Limited.

Practical, priority‑level recommendations that balance near‑term margin protection with strategic portfolio moves to capture nutrition‑led demand opportunities

Industry leaders should pursue an integrated set of actions that protect short‑term margins while positioning portfolios for sustained relevance. First, prioritize reformulation efforts that increase protein density and reduce added sugar without sacrificing mouthfeel, because such SKUs appeal both to mainstream consumers and medically influenced cohorts who require nutrient‑dense, portion‑controlled foods. Next, accelerate packaging investments that reduce unit logistics costs and improve portability for drinkable and pouch formats, enabling more effective placement in online fulfillment and impulse channels.

Operationally, hedge input risk by diversifying ingredient supply, negotiating longer‑dated contracts where practical, and building contingency inventories aligned to near‑term promotional calendars. Commercially, strengthen retailer partnerships through joint demand planning and margin‑protecting promotional mechanics that recognize rising input cost pressures. Finally, allocate R&D budget to platform technologies that allow a single line to produce dairy and plant‑based yogurts, because multifaceted capacity reduces the drag of demand swings and protects utilization across economic cycles.

A concise explanation of the mixed‑methods research approach that blends primary interviews, POS analytics, retailer audits, and scenario planning to deliver actionable insights

The research behind these insights combined qualitative industry interviews, retailer assortment analysis and point‑of‑sale patterning with trade and policy monitoring to create an integrated view of the category. Primary inputs included structured interviews with supply chain and category managers, confidential retailer shelf audits and executive briefings with product leaders; these were supplemented by POS and channel analytics to observe how formats and flavors perform across distinct store footprints and online assortments.

Secondary research synthesized regulatory filings, industry statements and press coverage to map policy risks and capital investments, while scenario planning techniques were used to stress‑test supply and pricing outcomes under alternative tariff and trade‑disruption pathways. The resulting methodology is intentionally practice‑oriented: it privileges replicable observations about consumer behavior and channel economics while layering on scenario analysis to support robust commercial decision‑making under uncertainty.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Yogurt market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Yogurt Market, by Product Type

- Yogurt Market, by Packaging Type

- Yogurt Market, by Flavor Profile

- Yogurt Market, by Fat Content

- Yogurt Market, by Source

- Yogurt Market, by Application

- Yogurt Market, by Distribution Channel

- Yogurt Market, by Region

- Yogurt Market, by Group

- Yogurt Market, by Country

- United States Yogurt Market

- China Yogurt Market

- Iraq Yogurt Market

- Egypt Yogurt Market

- South Africa Yogurt Market

- Syria Yogurt Market

- Competitive Landscape

- List of Figures [Total: 23]

- List of Tables [Total: 2608 ]

A forward‑looking conclusion emphasizing decisive portfolio action, supply hedging, and channel investment to convert disruption into competitive advantage

For executive teams, the operating lesson is clear: yogurt is no longer a single‑dimension commodity but a platform that monetizes convenience, nutrition and occasion‑driven innovation. The commercial winners will be those that translate segmentation intelligence into tightly targeted SKUs, preserve supply flexibility amid trade uncertainty, and invest in packaging and manufacturing platforms that enable rapid response to consumer shifts. Leadership choices made now-around product architecture, channel investments and sourcing strategy-will determine which firms preserve margin and which will be forced into defensive price competition.

The combination of resilient category demand, evolving health narratives and episodic policy risk creates both upside for well‑positioned brands and downside for actors that neglect structural change. Executives should therefore treat the next 12 to 24 months as a period for decisive portfolio rationalization, channel experimentation and operational hedging rather than incremental adjustments. Those who act with clarity and speed will convert disruption into differentiated competitive advantage.

Choose an accelerated path to purchase expert yogurt market intelligence and tailored briefing sessions with the Associate Director of Sales & Marketing

For board members, category leaders, and retail partners ready to convert insight into action, this research report is the most efficient way to gain an authoritative, scenario‑tested view of the evolving yogurt market and the strategic options that protect margin and accelerate growth. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure purchase details, scope customization, and expedited access options for enterprise licensing or single‑user access. Ketan can help match the report’s modules to your immediate business needs-whether you require deeper segmentation analysis, customized regional briefings, or a bespoke workshop for your executive and commercial teams.

Contacting Ketan will initiate a short scoping call to align the report deliverables to your time horizon, risk appetite, and deployment channels. Following that call, purchasers can request add‑ons such as retailer shelf audits, branded product benchmarking, and an executive briefing tailored to C‑suite priorities. Purchasing arrangements include standard report delivery, secure data extracts for internal modeling, and optional follow‑up consulting to translate findings into a six‑month operational plan.

- How big is the Yogurt Market?

- What is the Yogurt Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?