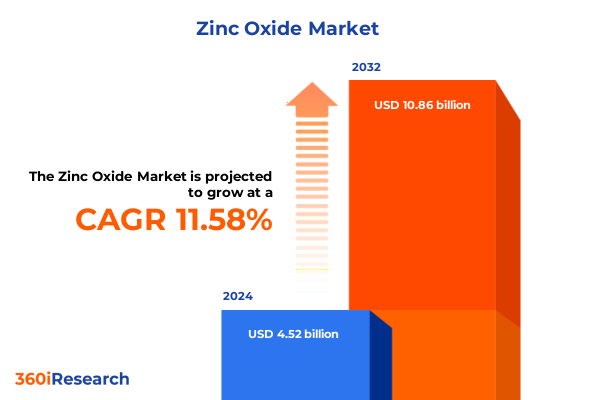

The Zinc Oxide Market size was estimated at USD 5.04 billion in 2025 and expected to reach USD 5.64 billion in 2026, at a CAGR of 11.57% to reach USD 10.86 billion by 2032.

Emerging Applications and Market Forces Shaping Zinc Oxide’s Pivotal Role Across Rapidly Evolving Industrial Value Chains and Sustainability Trends

Zinc oxide stands at the crossroads of traditional manufacturing and emerging technological frontiers, driven by its versatile functional properties and broad applicability. Over the past decade, evolving environmental regulations have elevated its profile as a key ingredient in environmentally responsible formulations, while breakthroughs in material science have unlocked novel performance enhancements across sectors such as electronics, pharmaceuticals, and advanced ceramics. As a resilient UV absorber, a reinforcing filler, and a pigment, zinc oxide’s multifaceted utility has generated sustained interest from R&D teams seeking to optimize product performance and cost efficiency.

Today’s market is characterized by a convergence of innovation and sustainability imperatives. Manufacturers are refining production processes to reduce energy consumption, minimize waste, and leverage renewable feedstocks. Concurrently, end users are demanding higher purity grades and specialized particle morphologies, driven by the imperative to integrate precisely engineered additives into sophisticated formulations. This introduction frames zinc oxide not merely as a commodity but as a dynamic enabler of performance and compliance in a rapidly changing regulatory and technological environment. Emphasizing its central role in enabling next-generation applications, this section sets the stage for a deeper exploration of market transformations and strategic considerations.

Key Innovations and Sustainability Imperatives Redefining Zinc Oxide Production and Application Across Multiple High-Growth Industry Verticals

The zinc oxide landscape is undergoing transformative shifts fueled by advances in process innovation and evolving stakeholder expectations. On the production side, the adoption of continuous processes such as spray pyrolysis and plasma flame synthesis has gained traction, enabling tighter control of particle size distribution and morphology while reducing energy intensity. These technical refinements are complemented by growing investments in circular economy initiatives, where closed-loop recovery of zinc from spent materials and by-products is progressively integrated into supply chains.

Meanwhile, end-use industries are realigning their specifications to address sustainability agendas and performance benchmarks. Within coatings, formulators are substituting traditional pigments with engineered zinc oxide variants to enhance UV protection and corrosion resistance, thereby extending asset longevity and reducing maintenance costs. In personal care, the push for mineral-based UV filters has stimulated demand for highly dispersed, transparent zinc oxide grades that satisfy both efficacy and aesthetic requirements.

This transformative period is also marked by the convergence of digital manufacturing platforms and advanced analytics, allowing producers and users to co-develop tailored solutions, monitor quality in real time, and optimize run-rates. Taken together, these shifts underscore a transition from bulk commodity trading to a more nuanced value proposition centered on customized performance, environmental stewardship, and integrated supply chain visibility.

Comprehensive Analysis of 2025 U.S. Tariff Policies and Their Ripple Effects on Zinc Oxide Supply Chains Cost Structures and Strategic Sourcing Decisions

In 2025, U.S. trade policy introduced a series of tariff adjustments that have had a cumulative effect on zinc oxide procurement and distribution, reshaping cost structures and strategic sourcing decisions. Beginning February 4, an additional 10 percent tariff on goods imported from China and Hong Kong was enacted, followed by a subsequent increase to 20 percent on March 4. These measures sit atop existing Section 301 duties and antidumping assessments, amplifying landed cost pressures for supply chains reliant on lower-cost imports. Furthermore, the de minimis exemption for shipments valued under $800 was revoked on May 2, 2025, subjecting all consignments from these regions to standard duties and intensifying administrative burdens for small-volume purchases.

However, certain end-use segments benefit from targeted exemptions. Mineral sunscreen filters such as zinc oxide have been explicitly excluded from the new tariffs on cosmetic ingredients, reflecting policy recognition of domestic dependency on these raw materials for sun care formulations. While this carve-out provides some relief for personal care applications, downstream users in coatings, ceramics, and electronics continue to grapple with elevated input costs, prompting shifts toward near-shoring and supplier diversification.

Overall, these layered tariff adjustments have catalyzed strategic responses across the value chain. Importers are renegotiating contracts to include duty-landed pricing clauses, establishing domestic inventory hubs to mitigate cross-border complexity, and exploring alternative sourcing from EMEA and Asia-Pacific suppliers with comparatively stable trade arrangements. The net effect underscores the centrality of agile trade management and proactive policy monitoring in navigating the evolving tariff environment.

In-Depth Exploration of Zinc Oxide Market Dynamics Through Form Distribution Channel and Application Segmentation Framework to Identify Growth Drivers

Dissecting the zinc oxide market through a segmentation lens reveals critical insights into demand patterns and competitive dynamics. When analyzed by form, the dispersion segment encompasses aqueous systems favored for high-clarity formulations and solvent-based options preferred in specialized coatings. Granular zinc oxide is produced in coarse and fine grades, serving as durable fillers in plastics and reinforcing agents in rubber compounding. Paste variants range from oil-based pastes utilized in heat-dissipating adhesives to water-based pastes engineered for ease of handling in textile coating processes. Powder products include coated grades that enhance dispersion stability and micronized powders that deliver optimized UV attenuation in personal care applications.

Distribution channels shape market reach and customer engagement strategies. Direct sales models cater to large-volume end users requiring tailored logistics and technical support, while distributor networks extend market access to regional formulators and smaller producers. Each channel demands distinct inventory management approaches and value-added services ranging from just-in-time delivery to custom blending.

Application segmentation further refines competitive landscapes. Within ceramics, zinc oxide plays a pivotal role in refractories, sanitaryware, and tile glazing, imparting improved thermal stability and color uniformity. Electronics applications leverage varistor and LED formulations that depend on precise particle engineering to regulate voltage and control light diffusion. In glass manufacturing, container, fiberglass, and float glass producers integrate zinc oxide to enhance durability and optical clarity. Architectural and industrial coatings segments exploit zinc oxide’s anticorrosion and UV-blocking capabilities, while pharmaceutical use spans oral and topical formulations, leveraging its antimicrobial and sun protection attributes. Plastics processors incorporate zinc oxide into PE, PP, and PVC resins to achieve flame retardancy and pigmentation, and rubber manufacturers rely on it in belts, hoses, and tires to enhance wear resistance and heat dissipation.

This comprehensive research report categorizes the Zinc Oxide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Distribution Channel

- Application

Comparative Examination of Regional Demand Drivers and Policy Influences Shaping Zinc Oxide Markets in the Americas EMEA and Asia-Pacific Regions

Regional dynamics in the zinc oxide industry reflect a confluence of resource endowments, regulatory frameworks, and downstream demand centers. In the Americas, North America’s robust coatings, pharmaceutical, and plastics sectors drive consistent consumption, supported by localized production facilities that mitigate import exposure. Latin American markets, while smaller in scale, exhibit growing interest in ceramic and glass applications as infrastructure investments accelerate.

Turning to Europe, Middle East, and Africa, stringent environmental regulations in the European Union have catalyzed the adoption of high-performance, low-impurity zinc oxide grades for sustainable coatings and advanced electronics. The Middle East region’s expanding petrochemical complexes present long-term growth avenues for zinc oxide in polymer stabilization, whereas African markets are emerging adopters in rubber compounding and construction ceramics, spurred by urbanization and industrial diversification strategies.

In Asia-Pacific, a mature manufacturing ecosystem underpins significant zinc oxide consumption across electronics, glass, and coatings applications. China remains a dominant producer and exporter, but rising domestic demand for premium grades and regulatory scrutiny of emissions are shifting production toward Japan, South Korea, and Southeast Asia. India’s accelerating pharmaceutical and rubber sectors also contribute to heightened zinc oxide uptake, reflecting the region’s multifaceted growth trajectory.

This comprehensive research report examines key regions that drive the evolution of the Zinc Oxide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Differentiation Among Leading Zinc Oxide Manufacturers Driving Innovation Operational Excellence and Market Leadership

Leading zinc oxide producers have distinguished themselves through strategic investments in capacity expansion, product innovation, and sustainability. Several global chemical companies have modernized reactor technologies to reduce carbon intensity, while also integrating real-time analytics for enhanced process control and quality assurance. These initiatives have enabled them to deliver a diverse portfolio of standard and specialty grades, catering to stringent specifications in sectors such as electronics, personal care, and high-performance coatings.

A subset of players has prioritized backward integration, securing access to zinc concentrate supplies and leveraging by-product streams from galvanizing operations to fortify their raw material base. This vertical integration strategy has proven instrumental in managing feedstock volatility and ensuring continuity of supply, particularly in volatile geopolitical environments.

In parallel, nimble mid-tier producers have carved out niches by focusing on rapid technical support, customized blending services, and regional distribution networks. By aligning closely with formulators and manufacturers, these companies can co-develop application-specific solutions and accelerate time-to-market for innovative products. Collectively, these strategic postures underscore a competitive landscape defined by efficiency, differentiation, and customer intimacy.

This comprehensive research report delivers an in-depth overview of the principal market players in the Zinc Oxide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advance ZincTek Limited

- Akrochem Corporation

- American Zinc Products

- BASF SE

- Everzinc Group SA

- Global Chemical Co., Ltd.

- GRILLO-Werke AG

- INTERMEDIATE CHEMICALS CO. LTD.

- J. G. Chemicals Pvt. Ltd.

- Jiangsu ShenLong Zinc Industry Co., Ltd.

- L. Brüggemann GmbH & Co. KG

- Lanxess AG

- Merck KGaA

- MLA Group

- Nahar Granites Pvt. Ltd.

- Neo Zinc Oxide Pvt Ltd.

- New Directions Australia Pty Ltd.

- Nordmann, Rassmann GmbH

- Pan-Continental Chemical Co., Ltd.

- Rubamin Private Limited

- Silox, S.A.

- Suraj Udyog

- Tokyo Chemical Industry Co., Ltd.

- Upper India

- Uttam Industries

- Vedanta Limited

- Weifang Longda Zinc Industry Co., Ltd.

- Zochem by Zinc Oxide LLC

Strategic Imperatives and Best Practices for Industry Leaders Navigating Disruption and Seizing Growth Opportunities in the Zinc Oxide Sector

Industry leaders should prioritize a holistic approach that balances cost efficiency with innovation and sustainability. Strengthening supplier relationships through long-term agreements and collaborative R&D partnerships can secure access to high-quality zinc feedstock and accelerate new grade development. Furthermore, adopting circular economy principles-such as recycling zinc-bearing by-products and deploying closed-loop manufacturing-can mitigate raw material risks and enhance environmental credentials.

In parallel, companies must invest in digital platforms that integrate supply chain visibility with performance analytics, enabling proactive risk management and demand forecasting. This capability will prove crucial in navigating policy shifts, trade disruptions, and evolving customer requirements. Additionally, aligning product portfolios with end-market sustainability mandates, such as low-VOC coatings and clean-label personal care formulations, will be imperative for maintaining competitive relevance.

Finally, leaders should cultivate agility through decentralized decision-making structures and empowered cross-functional teams. By fostering a culture of continuous improvement and knowledge sharing, organizations can respond more rapidly to emerging opportunities and pivot strategically in the face of market turbulence.

Rigorous Multi-Source Research Methodology Combining Qualitative and Quantitative Analyses to Ensure Robust and Actionable Zinc Oxide Market Insights

This analysis synthesizes insights derived from a comprehensive research framework integrating primary and secondary methodologies. Primary research involved in-depth interviews with key stakeholders across the zinc oxide value chain, including production executives, R&D leaders, and procurement specialists. These discussions provided qualitative perspectives on technological trends, regulatory impacts, and strategic priorities.

Complementary secondary research encompassed a thorough review of patents, industry publications, academic journals, and trade association reports to contextualize market dynamics and validate emerging developments. Proprietary databases were leveraged to analyze historical and current trade flows, while public customs data informed evaluations of regional supply shifts and the impact of trade measures.

Quantitative analyses were conducted to map production capacities, assess capacity utilization rates, and evaluate comparative cost positions, though proprietary numerical estimates have been excluded from this summary. Triangulation of multiple data sources ensured robust cross-verification of findings, while continuous expert validation maintained the integrity of interpretations and conclusions. This methodological rigor underpins the credibility and relevance of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Zinc Oxide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Zinc Oxide Market, by Form

- Zinc Oxide Market, by Distribution Channel

- Zinc Oxide Market, by Application

- Zinc Oxide Market, by Region

- Zinc Oxide Market, by Group

- Zinc Oxide Market, by Country

- United States Zinc Oxide Market

- China Zinc Oxide Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2385 ]

Synthesizing Critical Insights and Forward-Looking Perspectives on Zinc Oxide Market Evolution to Inform Strategic Decision-Making and Drive Sustainable Growth

Throughout this executive summary, we have traced the intersection of innovation, policy, and market dynamics shaping the zinc oxide landscape. From production advancements that enhance performance and reduce environmental impact to the strategic responses prompted by shifting tariffs and trade policies, zinc oxide’s trajectory is defined by adaptability and technical evolution. Segmentation insights reveal nuanced demand profiles across forms, channels, and applications, highlighting avenues for targeted value creation.

Regional analysis underscores the importance of geographic diversification and regulatory alignment in safeguarding supply chains and capturing growth pockets. Meanwhile, company profiles illustrate how operational excellence, integration strategies, and customer-centric innovation distinguish market leaders. By synthesizing these critical insights, decision-makers can craft informed strategies that account for cost pressures, regulatory imperatives, and the accelerating pace of technological change.

As the market advances, continued vigilance, collaborative partnerships, and investment in sustainable practices will be pivotal. The path forward requires a delicate balance between driving efficiency and fostering innovation, ensuring that zinc oxide remains a cornerstone of performance and compliance across diverse industrial landscapes.

Unlock In-Depth Zinc Oxide Market Intelligence and Collaborate with Ketan Rohom to Access Comprehensive Research for Strategic Competitive Advantage

I invite you to connect with Ketan Rohom, whose deep expertise in market intelligence and client engagement will ensure you gain immediate access to the comprehensive zinc oxide research report. His nuanced understanding of industry trends and commitment to delivering tailored insights can guide your strategic planning and sharpen your competitive edge. Reach out to explore how this definitive analysis can address your organization’s unique challenges and empower data-driven decisions. Secure your copy today and leverage the full breadth of this in-depth study to anticipate market shifts, optimize your supply chain, and uncover new growth avenues in the zinc oxide landscape.

- How big is the Zinc Oxide Market?

- What is the Zinc Oxide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?